Calculating the Reference Rate for Annual Leave in the UK

Configuration required to support the Reference Rate

Payroll Configuration Record

- Ensure that "Use Reference Rate" is ticked.

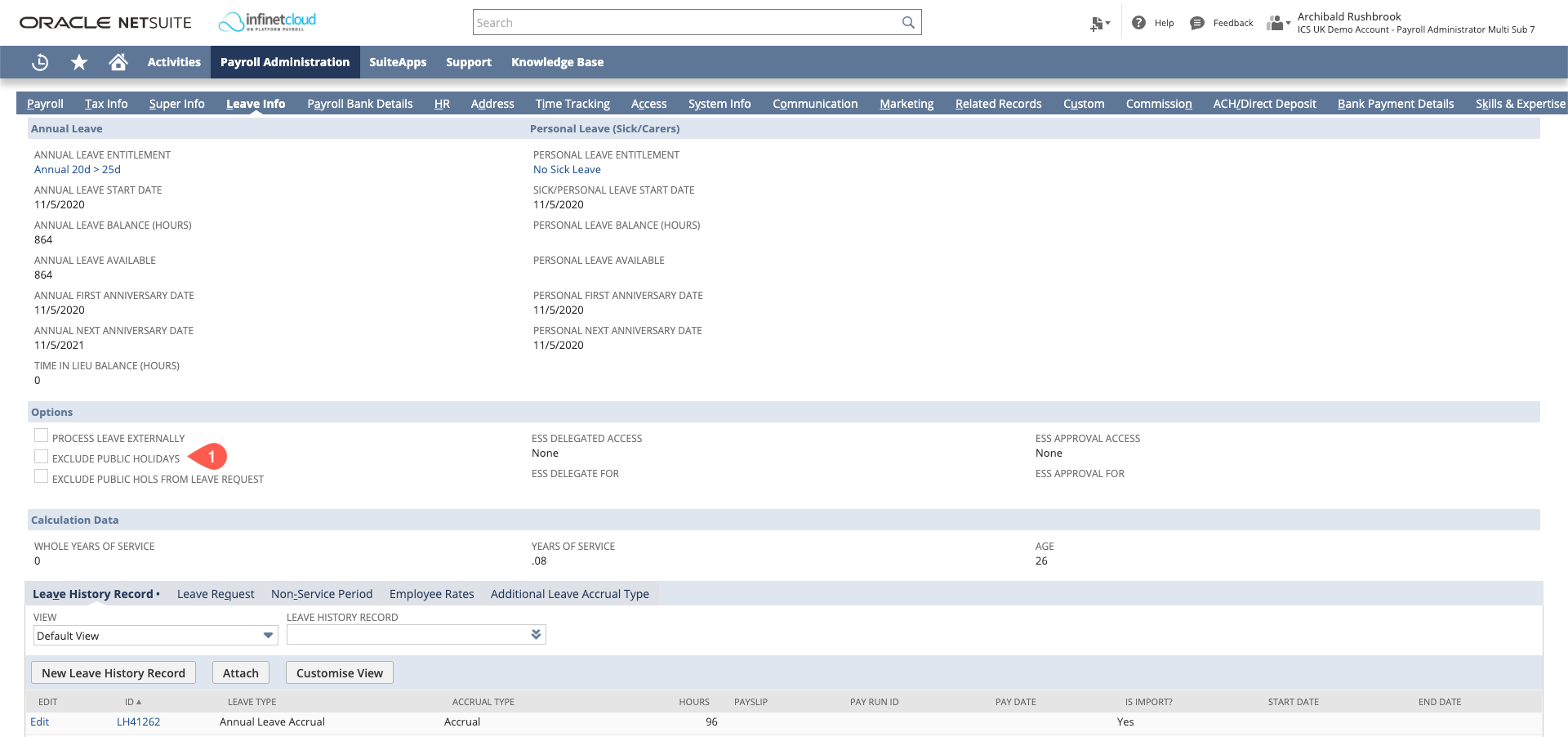

Employee Record

- Ensure that the Leave Info > "Exclude Public Holidays" checkbox is unticked.

This may mean that Public Holidays start to show on payslips

Some customers have previously elected to tick this box to prevent Public Holidays being displayed on the payslip. Please review your configuration to ensure compliance.

Similarly, some have elected to leave this unticked but to combine the Public Holiday on the pdf template. This will correctly calculate the pay, but will not display separately on the Payslip. This setting can also be found on the Payroll Configuration Record.

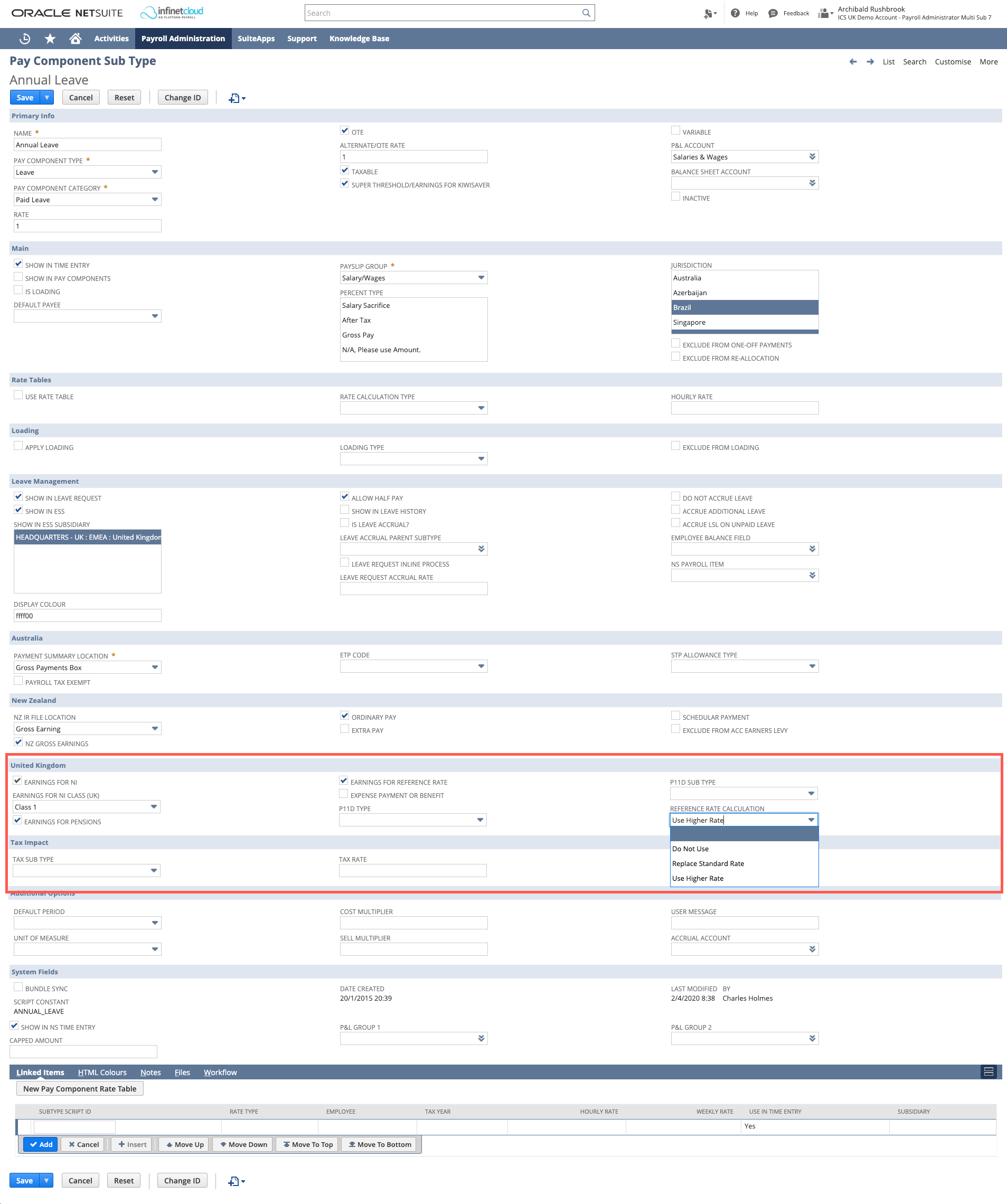

Pay Component Subtype

- Earnings for Reference Rate: This box is ticked by default on all standard overtime, normal time, base salary, commission, etc and ensures all pay associated to it is considered for earnings under the Reference Rate.

- Reference Rate Calculation

- "Do Not Use", this subtype is unaffected by Reference rate (this applies to most subtypes).

- Replace Standard Rate, use the Reference Rate in all cases (this is not appropriate for current UK legislation as it could cause the rate to be lower than the Employee's hourly rate)

- "Use Higher Rate", means that the system will take the higher of the employees current hourly rate, or the Reference Rate. This is the default for Annual Leave and Publid Holiday related subtypes in the UK.

Infinet Cloud calculates the "Reference Rate" on all Annual Leave

You may need to seek legal advice as to what entitlement must be paid on the Reference Rate as there are differences between UK and EU Legislation that are impactful. Please note that Infinet Cloud Payroll treats all Annual Leave that is correctly configured as payable under the Reference Rate.

How the Reference Rate is calculated

Reference rate my be lower than the Hourly Rate

Remember, the reference rate only kicks in if it is higher than the Employees current Hourly Rate. For example, if the employee has had a pay increase recently their current hourly rate may be higher than their reference rate.

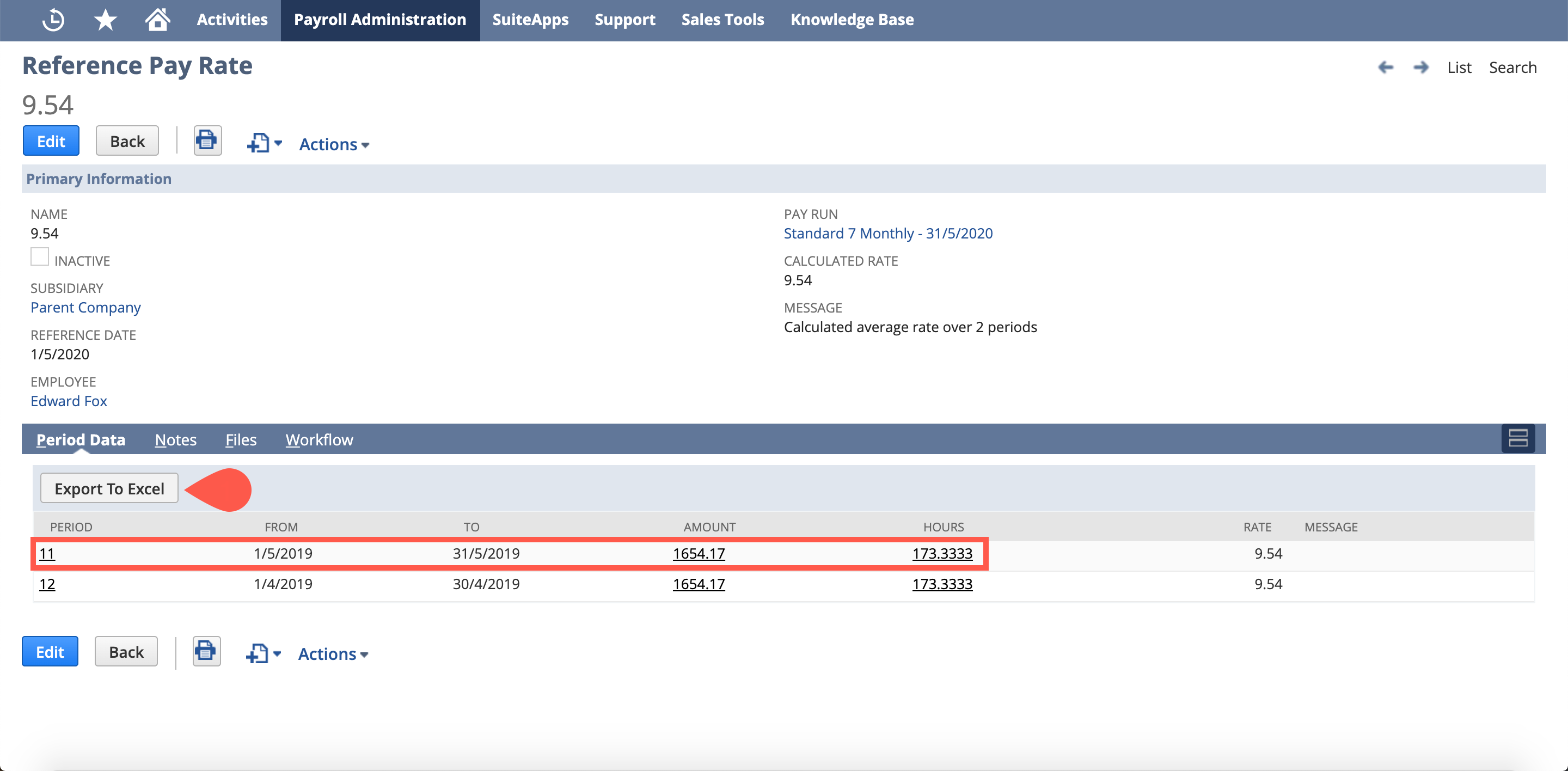

The Reference Rate is calculated after Initiate Pay Run.

- It is calculated by calculating the average rate for each period by summing the relevant amounts and dividing against the number of hours on the associated "Basic Time Sheet".

- This is then averaged by the number of periods to give the "Calculated Rate".

Once the payrun is at the stage "Processed Pending Approval", you can review the relevant Payslip Detail(s) or Basic Time Sheets. The Payslip Detail is the key record, however.

Reference Rate only works on "Time"

Currently we only support calculating the Reference Rate where Annual Leave is being processed via a "Time" (timebill) record. We do not support calculating it on Payslip Details "for processing".

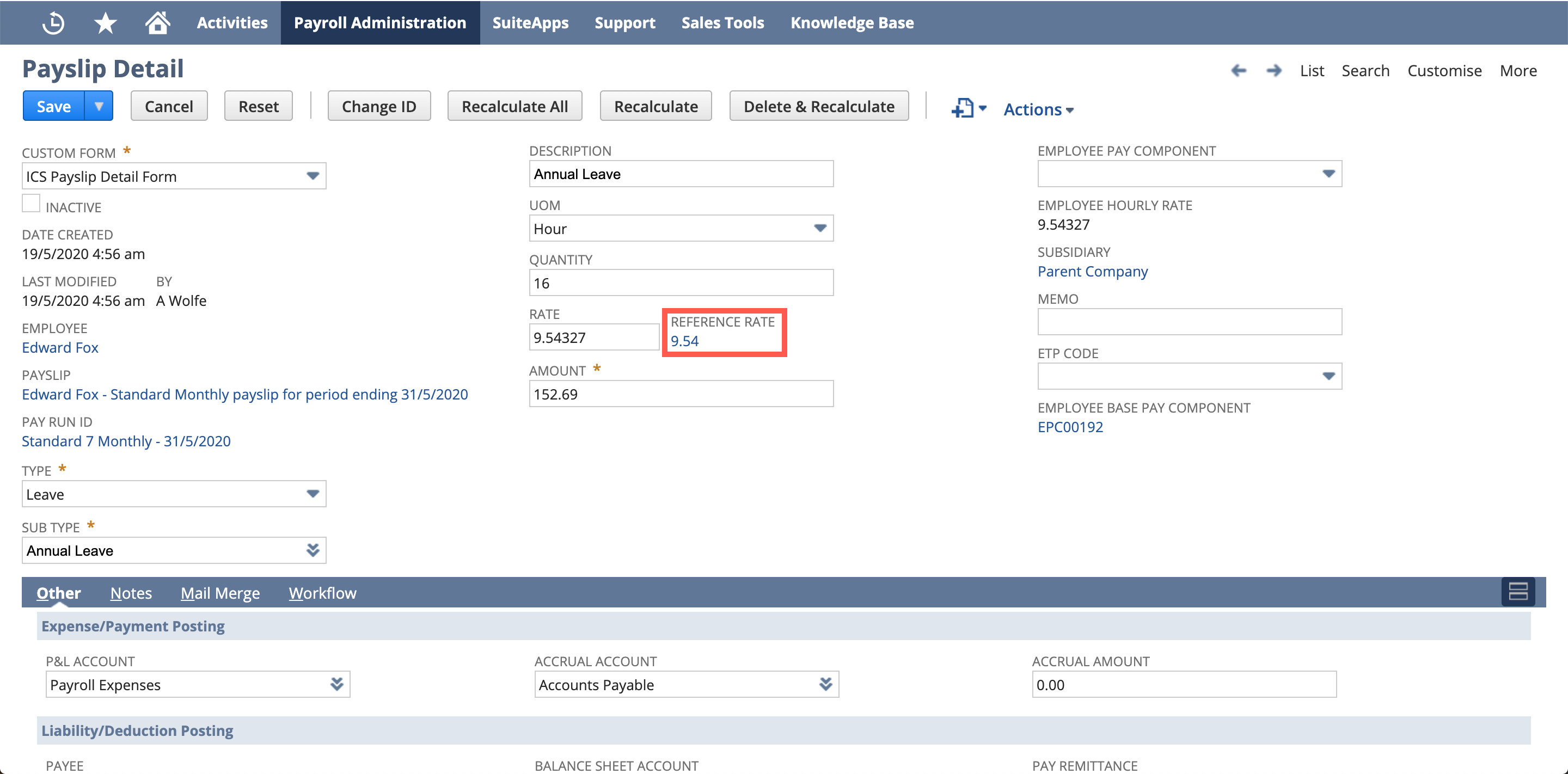

Reviewing the Reference Rate on a Payslip Detail

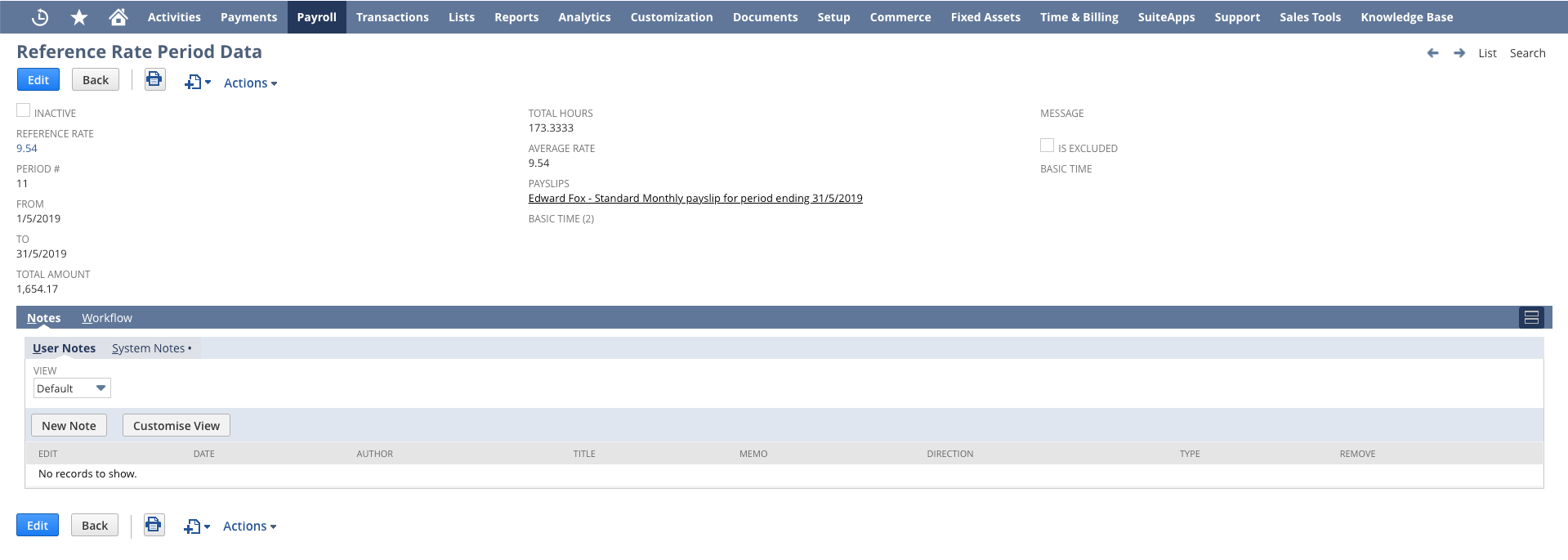

The Reference Rate will be displayed next to the "Rate" field if it is being considered for this Payslip Detail. You can drill in to the calculations by clicking it to review the Reference Pay Rate Record, this data is available to be exported as an excel file.

You can click into the period information to review the figures included in the period calculation.

If you click the Period Number this will give you a summary including a link to the payslip in question:

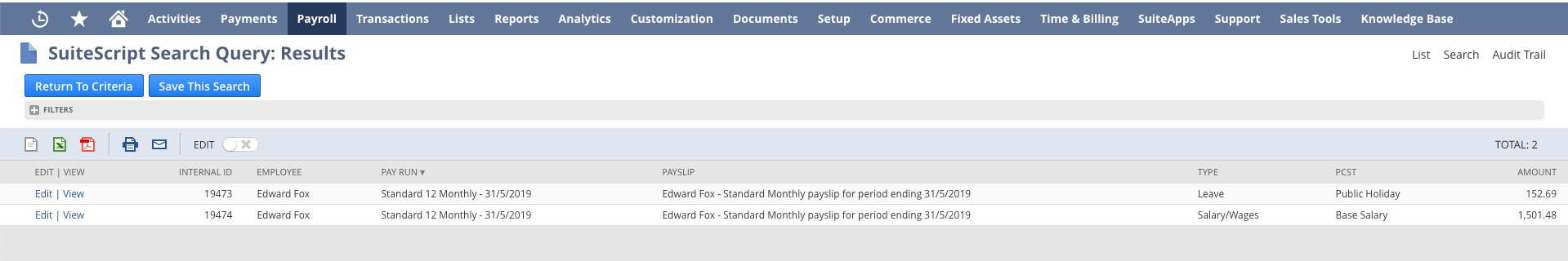

If you click the Amount, this will give you a breakdown of the payslip details included in this calculation and their amounts.

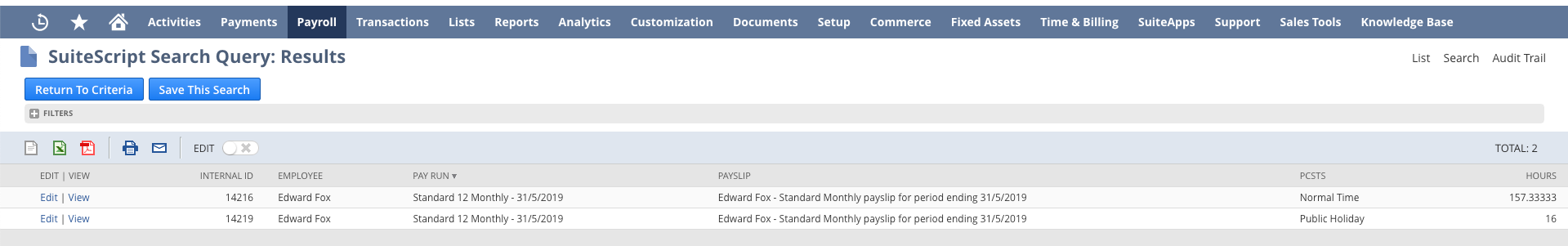

If you click into the Hours, this will give you a breakdown of the payslip details included in this calculation and the number of hours they reflect (if any).

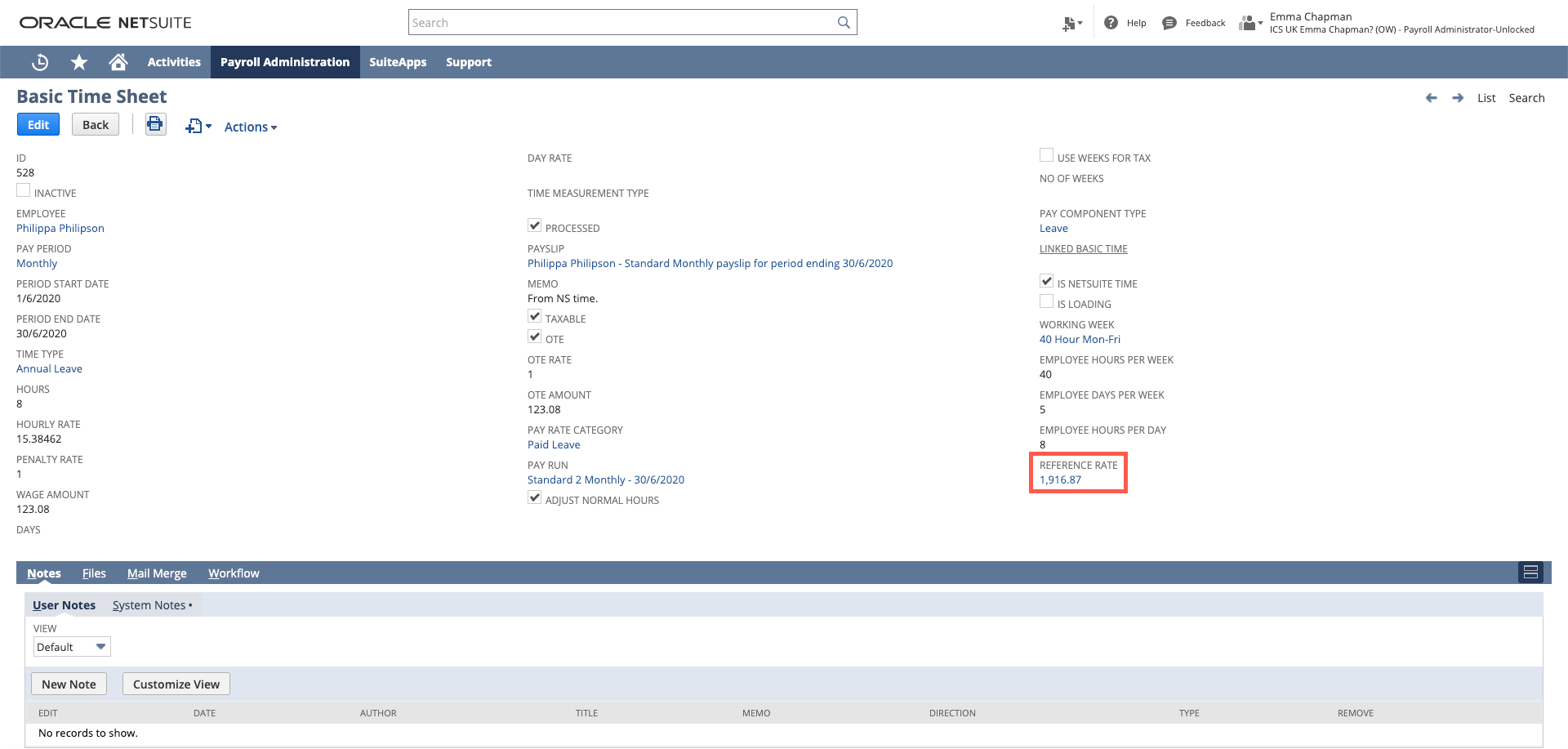

Reviewing the Reference Rate on a Basic Time Sheet

The Reference Rate will be linked in the "Reference Rate". You can drill in to the calculations by clicking it to review the Reference Rate Record and reviewing as above.