Changing a Tax Code

If you have received a P45 or a tax code notice for a new starter please go to the UK Enrolment Guide and review the section on updating an enrolment record.

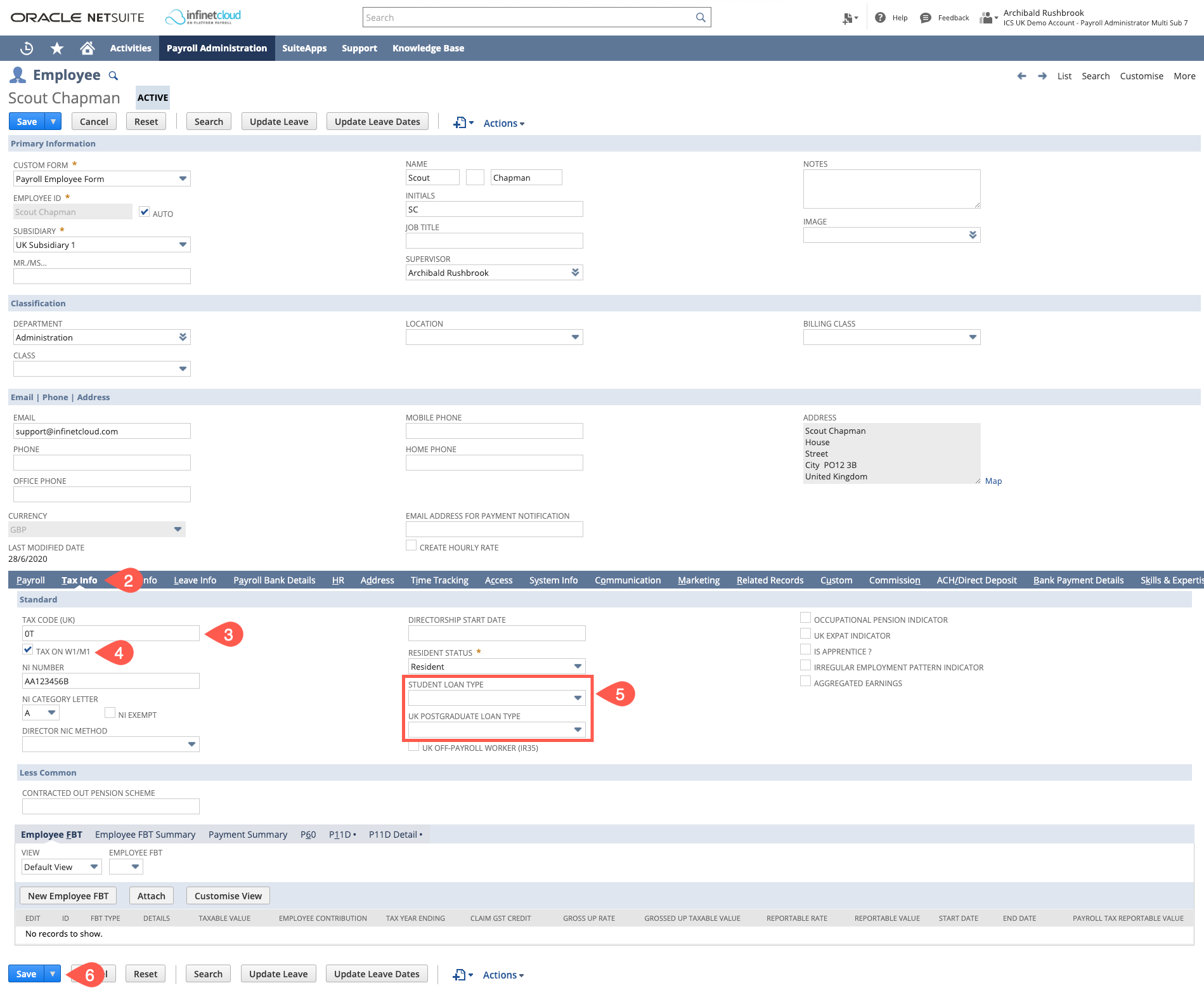

For any other changes to a tax code or student loan during a tax year you will need to follow the instructions below:

Logged in as a Payroll Administrator

Administrator

If you are amending an Administrator's record you will need to be logged in as Administrator and once in edit you will need to change the form to the Payroll Employee Form

- Navigate to the employee's record and open in edit mode

- Go to the Tax Info Tab

- Edit the Tax Code Field

- Tick the W1/M1 flag if necessary

- If required - edit the Student and Postgraduate loans sections

- Save the record

, multiple selections available,