Paying Out Annual or Holiday Leave

This article explains how to pay out Annual, LSL or Holiday leave for an employee if they request it. There are two methods for processing this leave - either in your standard pay run, or via adjustment run. Both methods are outlined below.

You should check with your governing tax authority on any rules or regulations pertaining to paying out Annual Leave, LSL, Holiday Entitlements or Holiday Pay.

Annual Leave Payout in Standard Payrun

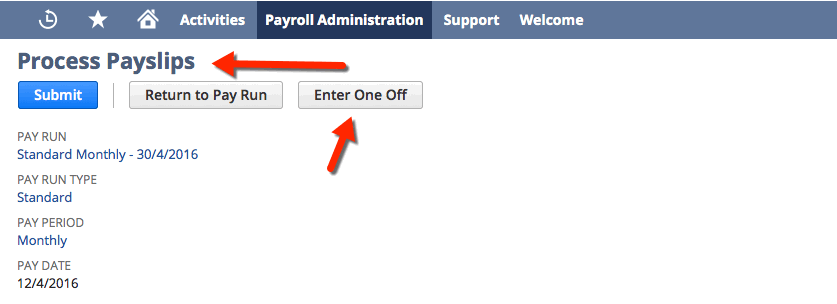

- At the Process Payslips stage of your payrun, click on the Enter One Off button

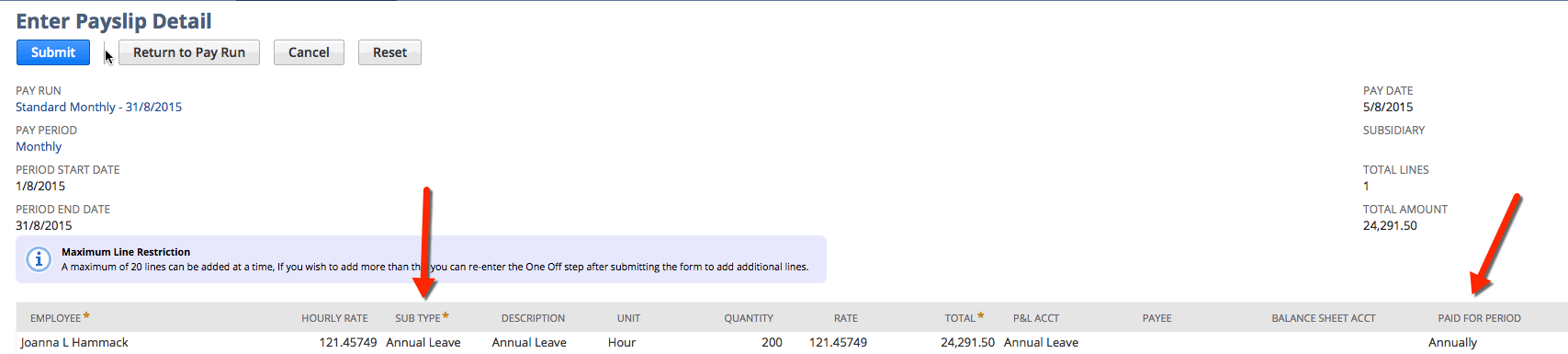

- You can now enter a line using the correct Sub Type (e.g. For AUS Payroll you must use Annual Leave Cash Out in Service or Long Service Leave Cash Out in Service - take care not to use other 'leave pay out' type codes). Here you can also set the Paid for Period field to show as Annually so that the system taxes the leave at the employees marginal rate of tax.

- If the person is entitled to Leave Loading or anything else, then you will also need to add in a line for this at this stage.

- If the person is entitled to Leave Loading or anything else, then you will also need to add in a line for this at this stage.

- Click Submit to go back to the Process Payslips stage, and continue with the payrun.

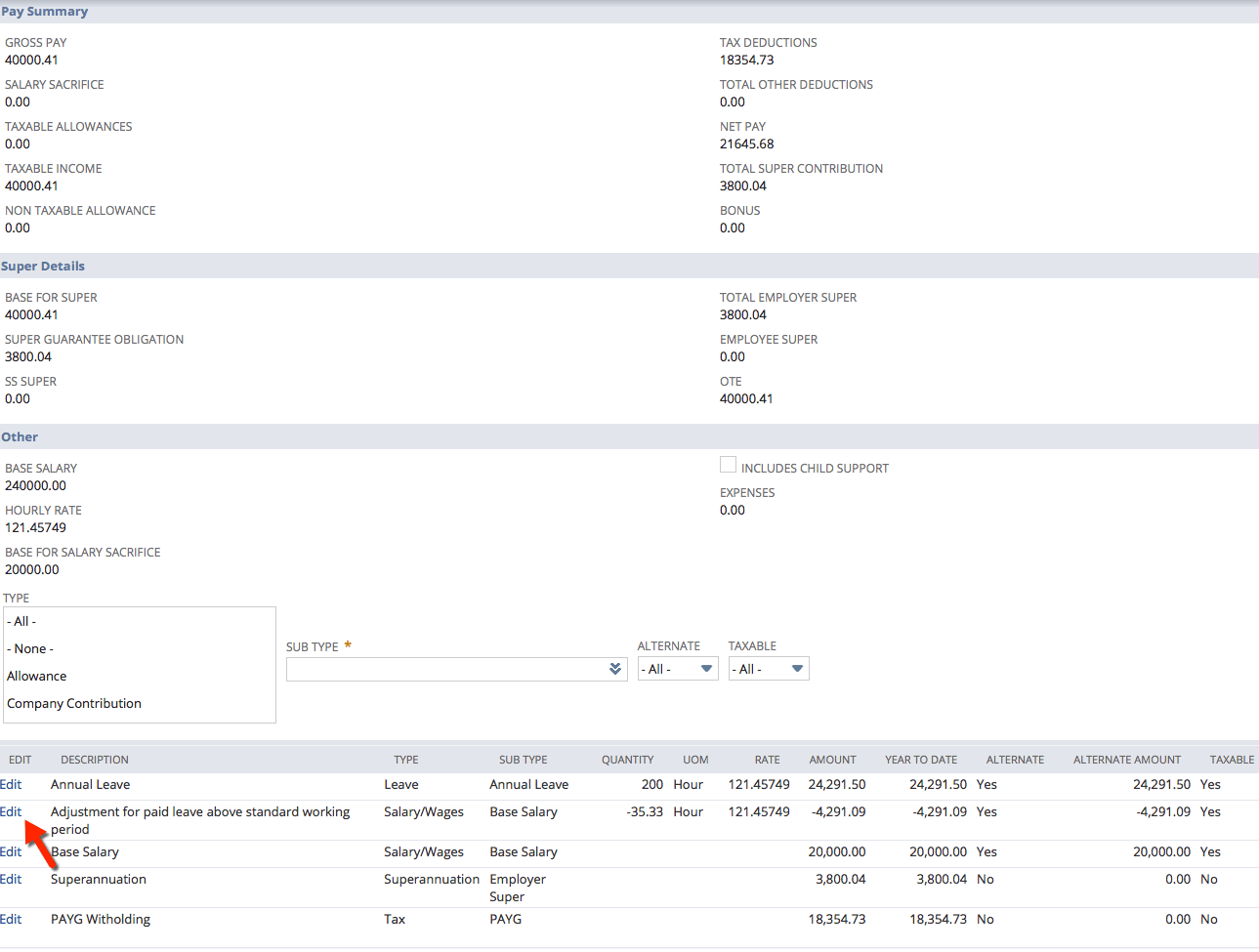

- Once you process the payslip you will need to review the payslip detail screen at the Approve Payslips stage as the system is likely to generate an auto adjustment line to reduce the persons overall hours for the pay run.

- In the example below the person normally gets paid 164.67 hours a month and you are paying out 200 hours of annual leave then the system will generate a negative hours line to bring the overall hours for the pay period down to 164.67 so it still allows you to process the leave but the person doesn't get any extra pay. This is useful for when you need to process back dated leave that has been taken however in this instance you actually want the person to get paid these hours. So you need to click Edit against that Adjustment line and the go to Actions > Delete and then Re-Calculate the payslip.

- Once you are happy with the Payslip then you can Approve, Post and Pay as normal.

Annual Leave Payout in an Adjustment Payrun

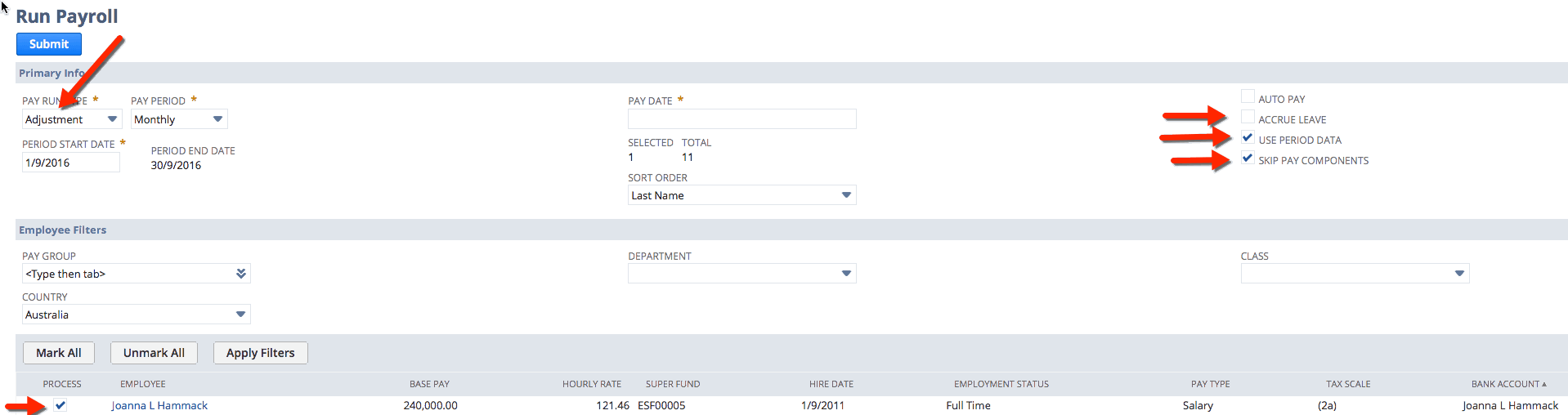

- From the menu, select Payroll Administration > Payroll Activities > Start New Pay Run

- Select the type as Adjustment (rather than Standard)

- Tick the box on right hand side for Skip Pay components

- Tick the box for Use period data

- Tick or untick the the box for Accrue leave depending on whether the employee should also accrue leave on this leave payment

- Enter the Pay period date range to be the same as the last standard pay run that you have run so that the system can use that salary data to work out the tax on this payment you are making

- Change the Pay date to the date you are paying it.

- Tick those employees that you need to pay

- Submit this

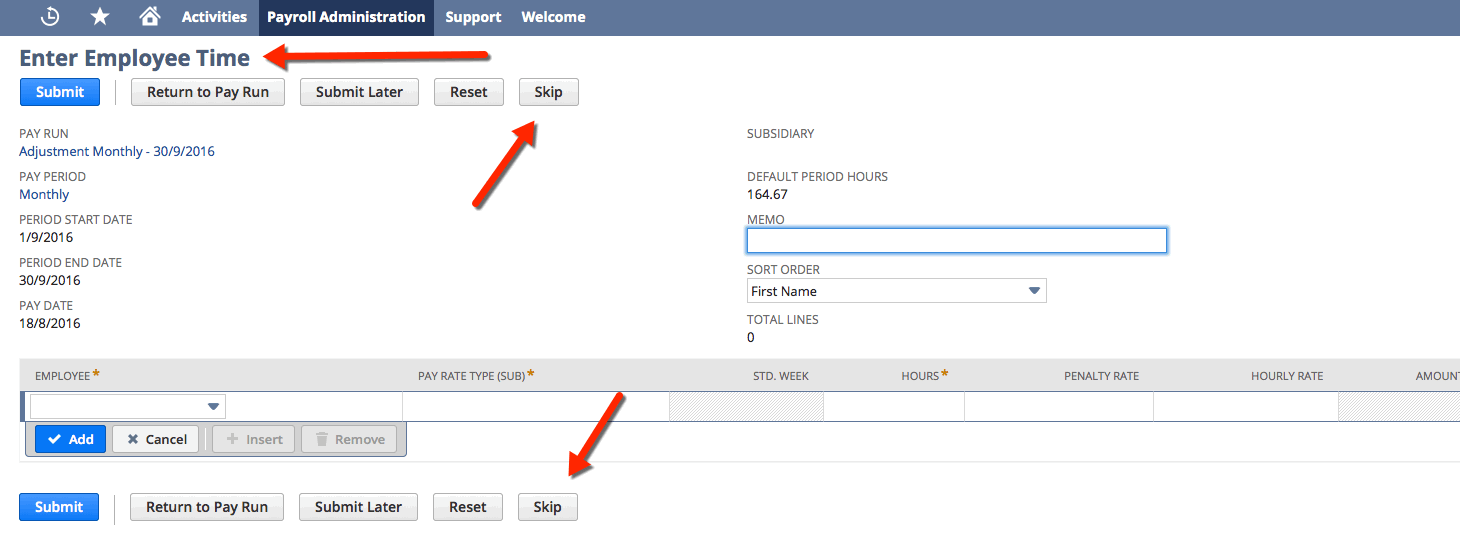

10. At enter time Stage - Click on the Skip button

You can now follow the same steps detailed above for paying in a Standard Pay run.

, multiple selections available, Use left or right arrow keys to navigate selected items