Setting up a Manual Tax Pay Component

To follow are the instructions for each of these scenarios

Creating a Manual Tax Pay Component to deduct an Additional amount of tax from the Employees pay

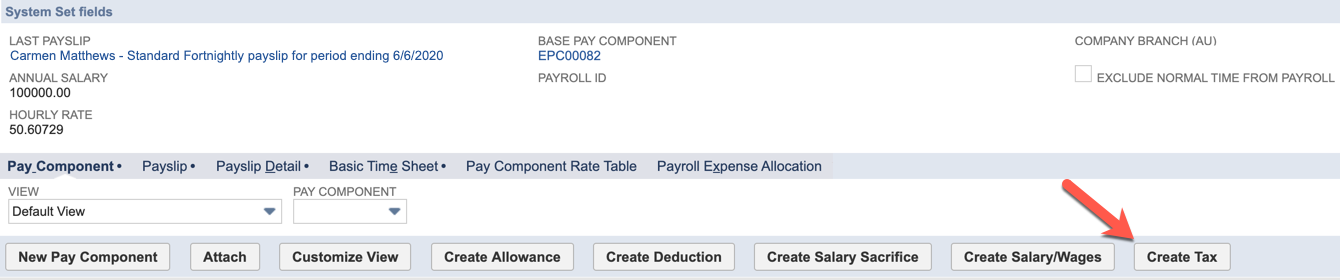

- Navigate to the employees record in VIEW MODE, scroll to the bottom of the page and click on the "Create Tax" Button

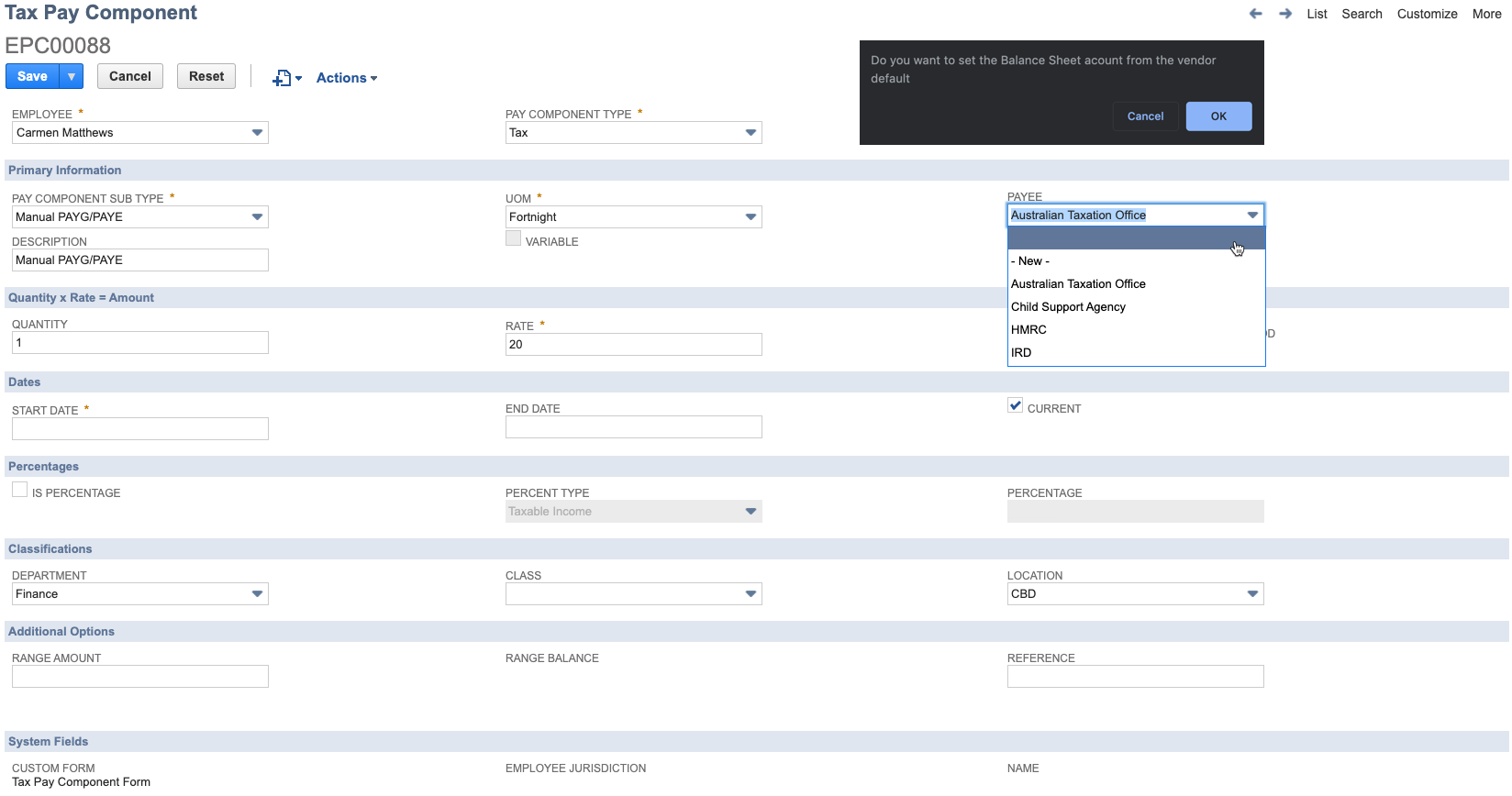

2. Work through all fields, from left to right, top to bottom. Select Manual PAYG/PAYE, Enter the amount in the amount field and also ensure you set the Payee field if you are using NetSuite vendors like the ATO, IRD or HMRC. When you set the Payee you will receive a "popup up" asking you to confirm if you want to set the Balance Sheet account to be the vendor default - you would normally say OK to this unless you wish this amount to go to a different account in your GL.

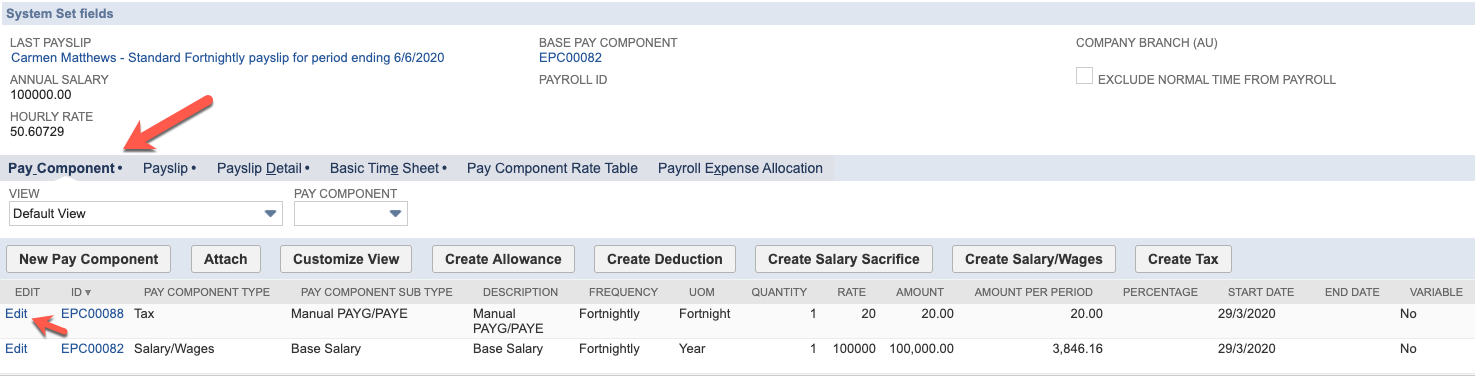

3. Finally Set your Start date and then Save. This record is now attached to the employees record like any other pay component and can be edited again if required.

Setting up a Manual PAYG Pay Component to deduct a Fixed Rate %age from the Employees Pay

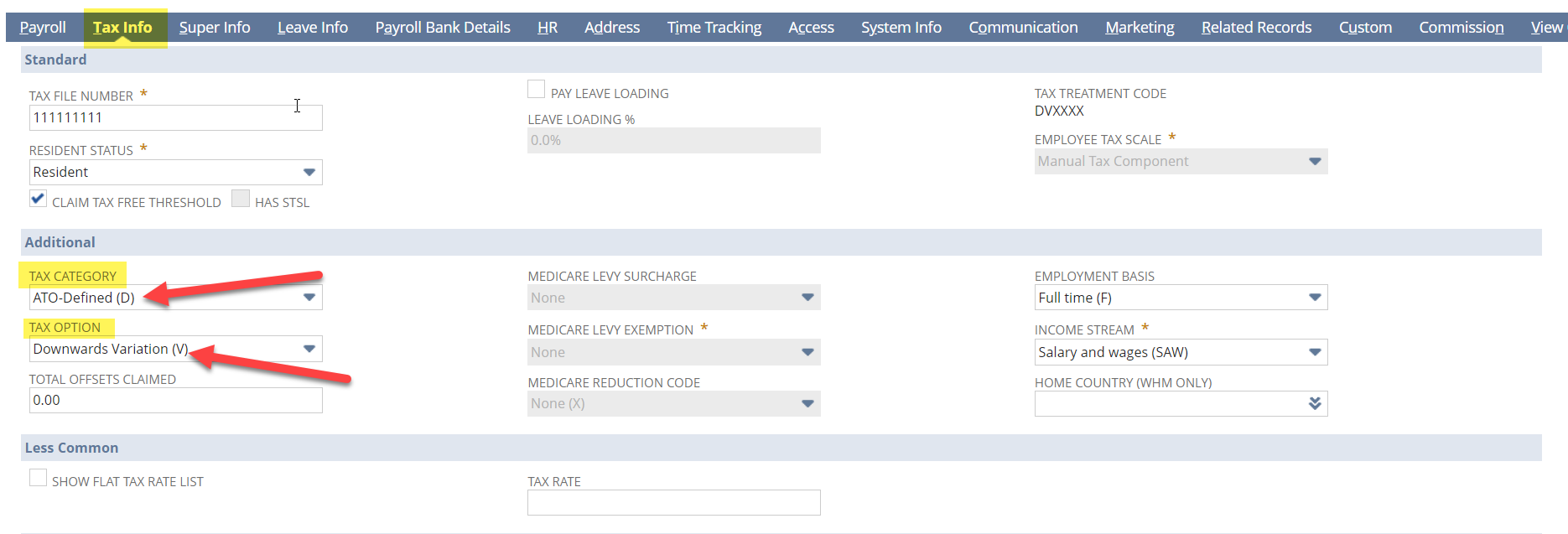

- Navigate to the employees record in EDIT MODE, click on the Tax Info tab, set the highlighted fields as per below, then Save.

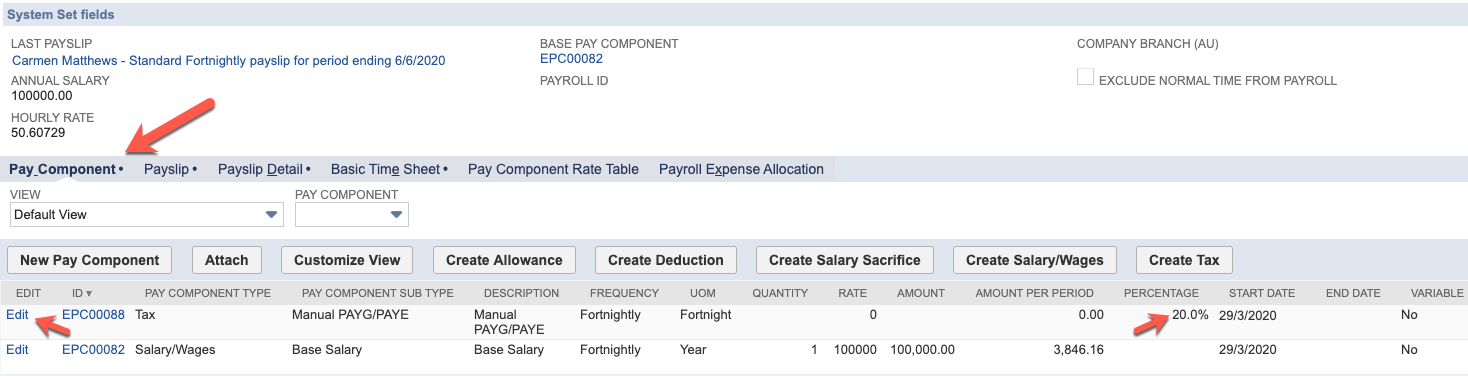

- Navigate to the employees record > Payroll Tab > Pay Component sub tab in VEW MODE, scroll to the bottom of the page and click on the "Create Tax" Button.

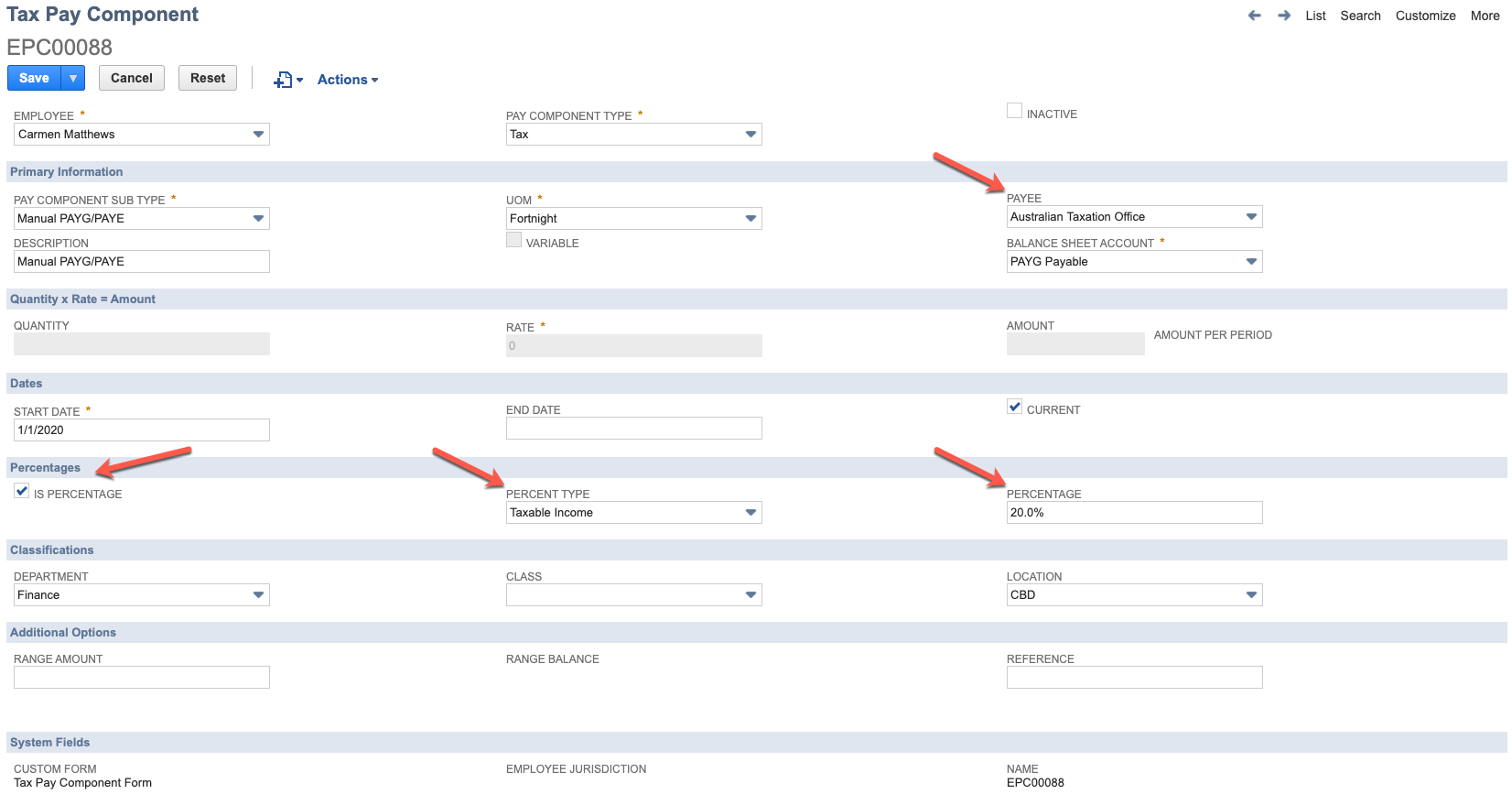

2. Work through all fields, from left to right, top to bottom. Select Manual PAYG/PAYE, Ignore the Rate & Amount fields and Tick the Box for "Is Percentage" Then select the Percent Type as "Taxable Income" and enter the %age in the Percentage field. Also ensure you set the Payee field if you are using NetSuite vendors like the ATO, IRD or HMRC. When you set the Payee you will receive a "popup up" asking you to confirm if you want to set the Balance Sheet account to be the vendor default - you would normally say OK to this unless you wish this amount to go to a different account in your GL.

3. Finally Set your Start date and then Save. This record is now attached to the employees record like any other pay component and can be edited again if required.