AU JobKeeper Extension

If you are NOT eligible or are NOT enrolling for the JobKeeper Extension (phase 2) then you do not need to do anything and can continue processing payroll without following the instructions below.

Overview

The Job Keeper Extension changes the original scheme by:

- Changing company eligibility

- Payment Rate is now based on a per Employee (Tier) which also changes between Q3 and Q4

- The new Tier is reported to the ATO using Single Touch Payroll.

To continue to receive job keeper payments for employees (if your company is eligible), and for the appropriate Top up Payment Rates to be used during payroll processing you MUST set the new Employee Tier Field.

If you are eligible to continue claiming the JobKeeper Extension, please review and follow these steps in order to identify the correct Tier for your employees and then update their employee record (either manually if you don't have many employees or using the Mass Update we have created to assist with bulk updates).

ATO Documentation

These instructions detail the steps required in Infinet Cloud Payroll for the JobKeeper Extensions (phase 2). Please ensure that you are also familiar with the ATO's information and guidelines, we recommend you start here: JobKeeper extension - what you need to do as a business.

JobKeeper Extension fortnights

The Job Keeper extension covers the following fortnights:

Fortnight # | QTR | Period relating to each JobKeeper Fortnight | Employees are paid on or before |

|---|---|---|---|

14 | Q3 | 28th September 2020 – 11th October 2020 | 11th October 2020 |

15 | Q3 | 12th October – 25th October 2020 | 25th October 2020 |

16 | Q3 | 26th October – 8th November 2020 | 8th November 2020 |

17 | Q3 | 9th November – 22nd November 2020 | 22nd November 2020 |

18 | Q3 | 23rd November – 6th December 2020 | 6th December 2020 |

19 | Q3 | 7th December – 20th December 2020 | 20th December 2020 |

20 | Q3 | 21st December 2021 – 3rd January 2021 | 3rd January 2021 |

| 21 | Q4 | 4th January 2021 - 17th January 2021 | 17th January 2021 |

| 22 | Q4 | 18th January 2021 - 31st January 2021 | 31st January 2021 |

| 23 | Q4 | 1st February 2021 - 14th February 2021 | 14th February 2021 |

| 24 | Q4 | 15th February 2021 - 28th February 2021 | 28th February 2021 |

| 25 | Q4 | 1st March 2021 - 14th March 2021 | 14th March 2021 |

| 26 | Q4 | 14th March 2021 - 28th March 2021 | 28th March 2021 |

| 29th March Scheme Ends |

The payment rate is dependent on the extension Quarter, and the employees Tier.

| Type | Period | Fortnights | Tier 1 rate | Tier 2 rate |

| Job Keeper | start of scheme - 27th September 2020 | 1-13 | Single Rate of $1,500 | |

| Job Keeper Extension Q3 | 28 September 2020 – 3 January 2021 | 14-20 | $1,200 | $750 |

| Job Keeper Extension Q4 | 4 January 2021 – 28 March 2021 | 21-26 | $1,000 | $650 |

The next sections will explain how a Tier 1 / Tier 2 is determined and the steps that need to be taken to update the employee records.

1. Identify Nominated Employees Tier Status

Run the search PR- AU JobKeeper Extension Employee Tier Lookup from the JobKeeper (AU) menu. This search shows you the hours employees have worked in Feb 2020 and June 2020 and will assist you to determine their Tier Status as below.

Tier 1 rate: | Tier 2 rate: |

|---|---|

This rate applies to:

| This rate applies to:

|

If you have employees that are not meant to be there then you need to ensure they are not updated in Step 2. Or, you can update the employee first...maybe they need a termination date or should be inactive?If you don't see employees in this search that you expect to nominate then you may need to update them as below. Please note, that this search should serve as a guide only as it displays the full hours worked in each period. You should verify the hours displayed for each employee.

If someone is not on the list and you want to nominate them, then you can either review the employee record to see what is different from the others and update accordingly or you can manually set the field in Step 2 on the tax info tab.

NB

It is entirely your responsibility to ensure the criteria you use is correct for your organisation. You may have custom employment statuses or variations such as contractors who are employees, you will need to update the criteria accordingly to ensure your nominated employees are updated. Contact support with full details if you need assistance with this.

You may need to update any employees you have nominated so they can be processed in payroll. This step only applies to employees who are no longer processed in payroll. E.g. You may have employees who are inactive or terminated but are eligible for this measure and you have chosen to re-hire them.

- Find the employee record and reverse the changes that would prevent the employee from being processed in payroll.

- Ensure they are not "Inactive" (System info tab of the employee record)

- Ensure they have the correct "Payroll employment status" (Payroll tab of the employee record)

- Ensure they have the correct "Pay Frequency" (Payroll tab of the employee record)

- Ensure their "termination date" has been removed. (HR tab of the employee record)

2. Update nominated employees via mass update or Manually on employee record

Overview

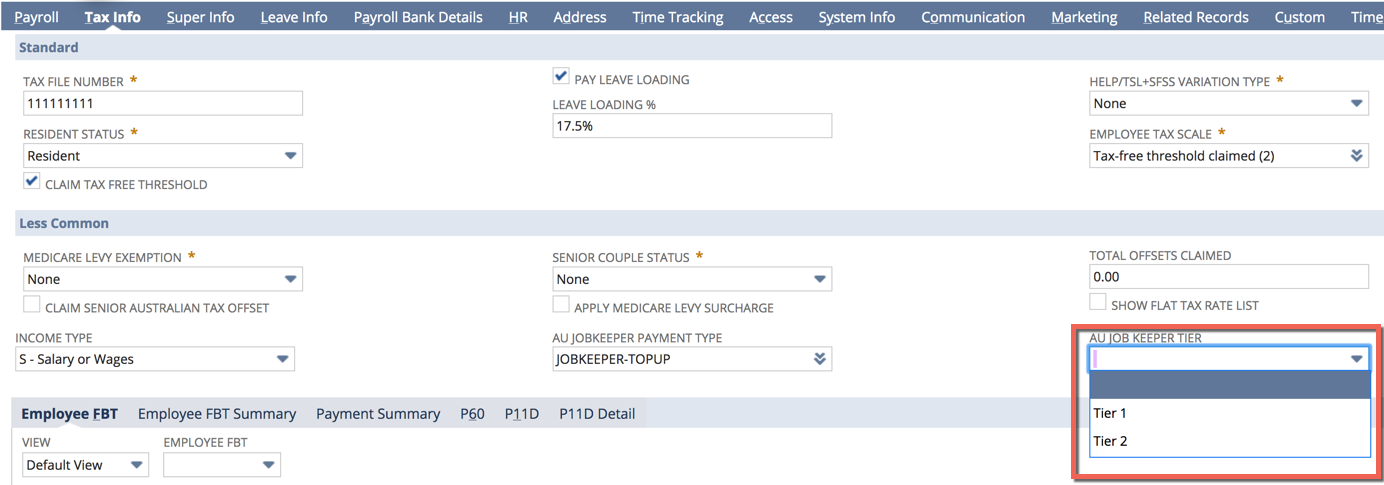

Now we need to update all nominated employees by using a mass update to set either Tier 1 or Tier 2. on the tax info tab of the employee record. This tells the system you intend to claim the JobKeeper payment subsidy for this employee and allows us to automate the STP reporting and top-up payment. This is the most important step in identifying who you are claiming the subsidy for. We have created a new field on the tax info tab of the employee record. You can set this manually for nominated employees if you don't have that many or you can run a mass update as below.

- Employees earning over $1200 per fortnight equivalent are paid normally so there is no top-up payment required. However we still need to update them to identify them as nominated employees and select a Tier in case their pay drops below $1,200 or $750 per fortnight equivalent. This ensures any changes that may occur in their pay over the next 8 fortnights of the JobKeeper payment are catered for in advance.

- To clarify, ALL NOMINATED EMPLOYEES you wish to claim the subsidy for must have a top-up sub type set and either Tier 1 or Tier 2 set on the tax info tab to identify them as one of your nominated employees. This is our primary identification mechanism for STP reporting. This is regardless of if they will need a top-up payment currently or not.

Steps

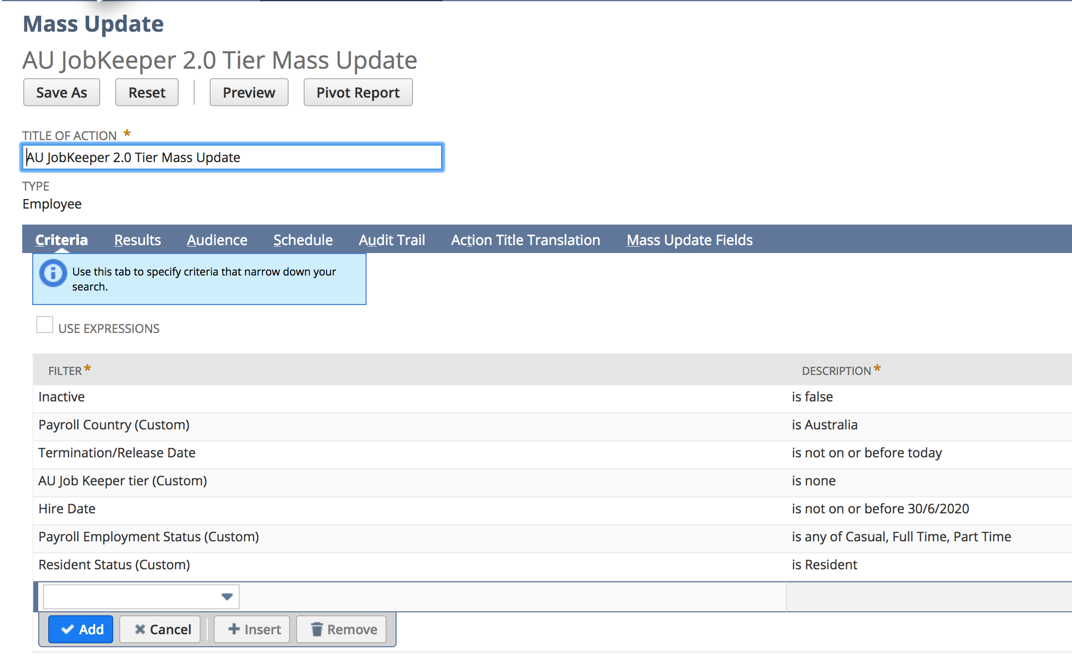

- Navigate to Payroll Administration > JobKeeper (AU) > AU JobKeeper 2.0 Tier Mass Update. This mass update template replicates the employee eligibility criteria as closely as we can currently. https://www.ato.gov.au/General/JobKeeper-Payment/Employers/Your-eligible-employees/

- Rename the mass update for your organisation.

- Update the Criteria as required.

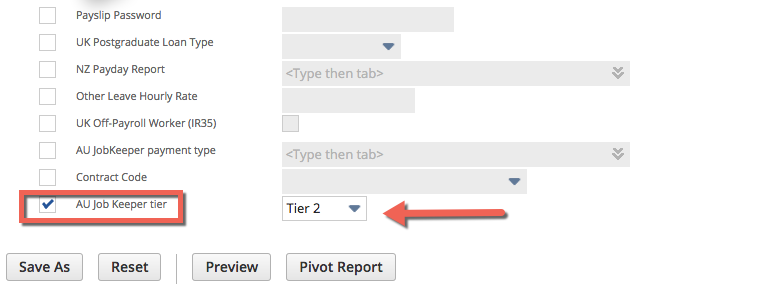

- On the Mass Update Fields tab, at the very bottom of the page select your chosen Tier 1 or Tier 2.

- Click Save As

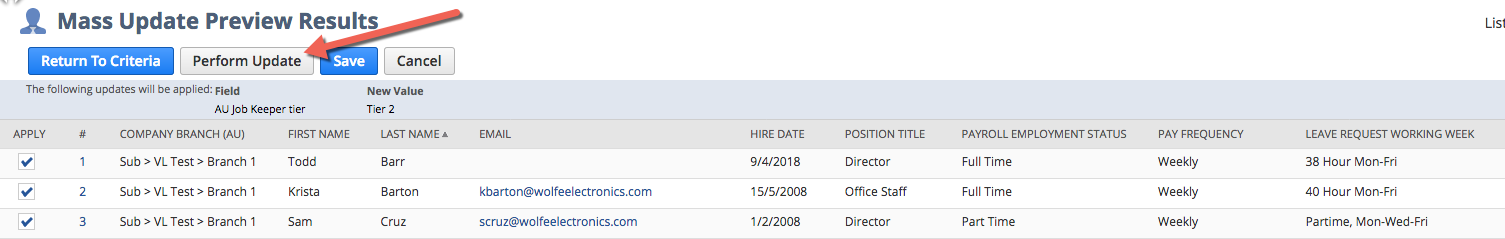

- On the Saved Mass Updates page, find your company mass update (the one you just saved) and click Preview

- Review the list of Employees and ensure this matches your expectation for your nominated employees. Unselect any Employees you do not wish to claim the subsidy for.

- Click Perform Update when satisfied and allow the mass update to run. Your employees should now be updated and you can review nominated employees via the JobKeeper (AU) menu option PR - AU JobKeeper 2.0 Tier Lookup or create your own search.

- You can manually update anyone who does not appear in your "PR - AU JobKeeper 2.0 Tier Lookup" or create your own search.

- If you have payroll employee's who are NetSuite Administrator's then ideally this update should be run by a NetSuite Administrator. If you are unable to do this then those employees will need to be manually updated by someone with the NetSuite Administrator role.

3. Process Payroll

Process payroll as normal with the following understandings:

- Initiate Pay run : The system should now automatically include any employees who are nominated in the pay run initiate screen even if they don't have timesheets to process. E.g. Casuals who are set as "Pay from NetSuite time" wouldn't normally show. All nominated employees need to be processed in payroll for all periods of the JobKeeper payment.

- Process Payslips : When payslips are processed, the system will automatically create a top-up payslip detail for those employees with a taxable income below $1,200 (Tier 1) or $750 (Tier 2) per fortnight equivalent. The top-up will be reported via STP as "JOBKEEPER-TOPUP" and the relevant YTD amount. NB: The system will apply this on a per pay run basis. There is no comparison to see if the payment has already been applied in a period. This would complicate things significantly and would delay this automation. It is your responsibility to ensure the top-up has been applied correctly for your employees.

In addition the employee's Tier will be reported as a 0.00 amount allowance via STP as "JK-TIER1" or "JK-TIER2". This information is sourced directly from the employee field set during mass update or manually.

- Recalculate : If for any reason including multiple pay runs in a period where the top up has already been applied, you can delete or adjust the top-up line created and then recalculate with "IGNORE JOBKEEPER" ticked. This will prevent any further automation and preserve your changes.

Prior Page Updates

Update 21/09/2020 am

JobKeeper 2.0 Release

We will be updating all Customers commencing Friday 25th of September 2020 to version 20.3.02 For those customers that are eligible for Phase 2 this release will include reports to help you identify your eligible employees and also a new field on your employee records to set the applicable Tier 1 or Tier 2 level required for the new JobKeeper identification and reporting. There will also be mass updates available for those customers who have large volumes of employees that they need to update. NB. there is no requirement to send Start Fortnights again for those employees you are continuing to claim for.

For those Customers that are no longer eligible to claim JobKeeper after Fortnight 13, the good news is that you DO NOT NEED TO SEND FINISH FORTNIGHTS to notify the ATO that you are no longer claiming and there is no action required within Infinet Cloud to stop the JobKeeper Topup automation. Provided there has not been any Tier 1 or Tier 2 field set then this will all cease automatically after the last pay dates of Fortnight 13.

This page will be updated again with further instructions for eligible customers after the release so please check back here on Monday 28th September 2020.

Last week the ATO released the new rules for employers. CLICK HERE

Getting ready for JobKeeper 2.0

Assuming you meet the eligibility criteria, there will now be two JobKeeper payment rates. Your company accountant will normally be responsible for determining if you are eligible for JobKeeper 2.0

| JobKeeper fortnights | Tier 1 rate | Tier 2 rate |

| 28 September 2020 – 3 January 2021 | $1,200 | $750 |

| 4 January 2021 – 28 March 2021 | $1,000 | $650 |

Employers will need to do the following:

- Review the number of hours worked during the 28 days before the end of the last full pay periods that finished immediately before 1 March 2020 or 1 July 2020.

- When calculating the number of hours include actual hours worked (including overtime hours), and any hours for which the employee received paid leave (including annual, long service, personal carers and other forms of employer paid leave), and any paid absence for public holidays.

- Employees who worked 80 hours or more (in either period) are entitled to Tier 1 payments, all other employees are entitled to Tier 2 payments.

- Special rules apply that allow employers to use an alternative reference period if the 1 March or 1 July period is not representative of the employee's typical work hours.

- Start paying the appropriate rate from 28 September and advise the ATO via STP which tier each employee belongs in.

If you are eligible for JobKeeper 2.0, you will be automatically transferred to the new rules as soon as you report employee tiers to the ATO via STP

- Employers don’t need to re-enrol for the JobKeeper extension if they are already enrolled for JobKeeper for fortnights before 28 September.

- Employers don’t need to reassess employee eligibility or ask employees to agree to be nominated by them as their eligible employer if they’re already claiming for the employees before 28 September.

If you are not eligible for JobKeeper 2.0, stop paying employees JobKeeper payments from 27 September

- Employers don’t need to notify the ATO. You do not need to send a finish code via STP

- The ATO will automatically assume you have left the scheme if you do not advise them of employee tier levels via STP.

If you were not eligible for Jobkeeper 1.0 but are now eligible for Jobkeeper 2.0 you will have to:

- Obtain nomination forms from your eligible employees

- Send start codes via STP for your eligible employees

- Send the ATO the correct tier code for your eligible employees.

Update 18/9/2020 pm

ATO have provided additional information on various aspects of the reporting requirements, and the development team are now hard at work to deliver the changes ready for fortnight 14 (the start of phase 2).

Update 17/09/2020 pm

ATO have finally provided the JobKeeper Extension Fact sheet. Our developers have been reviewing the changes and new STP reporting requirements; and will be validating some of the use cases with the ATO Friday afternoon. Once confirmed work will begin on implementing the new reporting requirements.

Update 02/09/2020 pm

We are still waiting on the ATO Specification to be released to developers so that we can plan any required development and update our customers on required processes. We will let you know as soon as we do!

Latest ATO information is on these links which they continuously update:

https://www.ato.gov.au/General/JobKeeper-Payment/

https://www.ato.gov.au/General/JobKeeper-Payment/JobKeeper-extension-announcement/

Update 25/08/2020 pm

Please see this link for the latest ATO information in relation to the JobKeeper Extension & Eligibility https://www.ato.gov.au/General/JobKeeper-Payment/In-detail/Extension-of-the-JobKeeper-Payment/

Update 27/07/2020 pm

On 21 July 2020, the Australian Government announced their intention to extend the JobKeeper scheme until 28 March 2021. The current scheme will remain in place until 27 September 2020, i.e. FN13. Whilst officially called the “JobKeeper extension” it was almost immediately labelled “JobKeeper 2.0”.

What’s new in JobKeeper 2.0?

Businesses that are currently eligible for the JobKeeper scheme will need to requalify to continue receiving JobKeeper from 28 September 2020 and again in early January 2021. Obviously, if the employer is no longer eligible neither are their employees.

The eligibility criteria for employees remains the same, however there are now two tiers of payment determined by the average hours worked per week in February 2020. Employees who worked less than 20 hours a week on average in the four weekly pay periods ending before 1 March 2020 will receive the lower payment rate.

The rates are:

Date | Full rate per fortnight | Less than 20hrs worked per fortnight rate |

28 September 2020 | $1,200 | $750 |

4 January 2021 | $1,000 | $650 |

Whilst not the domain of Payroll, it’s worth outlining the primary eligibility criteria for business. In order to be eligible for the JobKeeper Payment after 27 September 2020, businesses and not-for-profits will have to meet a further decline in turnover test for each of the two periods extension, as well as meeting the existing eligibility requirements for the JobKeeper Payment.

- From 28 September 2020, businesses and not-for-profits will be required to reassess their eligibility with reference to their actual GST turnover in the June and September quarters 2020. They will need to demonstrate that they have met the relevant decline in turnover test in both of those quarters to be eligible for the JobKeeper Payment from 28 September 2020 to 3 January 2021.

- From 4 January 2021, businesses and not-for-profits will need to further reassess their turnover to be eligible for the JobKeeper Payment. They will need to demonstrate that they have met the relevant decline in turnover test with reference to their actual GST turnover in each of the June, September and December quarters 2020 to remain eligible for the JobKeeper Payment from 4 January 2021 to 28 March 2021.

What has remained the same?

- The eligibility rules for employees remain unchanged and will be the same as the current JobKeeper scheme.

- Employers are still required to make payments to employees equal to, or greater than, the amount of the JobKeeper Payment (before tax), based on the payment rate that applies to each employee. Also known as the ‘wage condition’, the JobKeeper Payment will continue to be made by the ATO to employers in arrears.

CLICK HERE for more details of the government’s extension to JobKeeper.