Inland Revenue File Processing

Review IRD requirements reporting via IR File

Prior to processing IR files you should review the Employer Responsibilities pages on the IRD website, particularly:

You need to:

- Check the frequency of reporting requirement. Depending on how much PAYE and ESCT you need to pay per year you may be required to report on a monthly or bi-monthly basis.

- Register for electronic lodgement of the IR File.

The following reports can be run through ICS Payroll:

Employer Deductions form

The IR345 is used to record and pay the deductions made from employees pay. This form should correspond to a payment made to Inland Revenue (either directly, electronically or via a Westpac Branch).

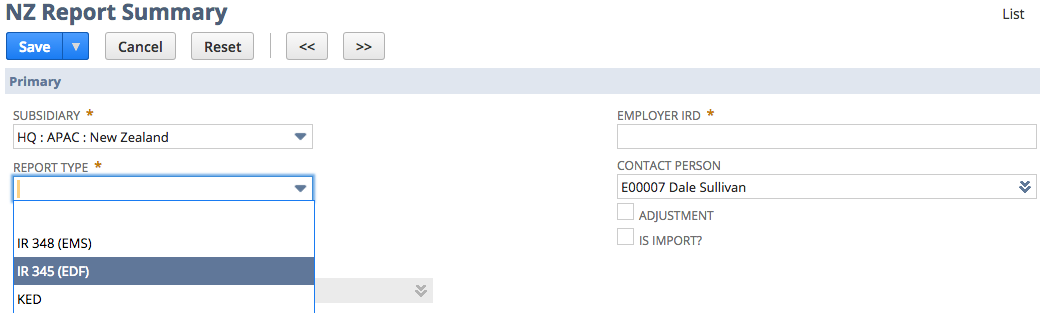

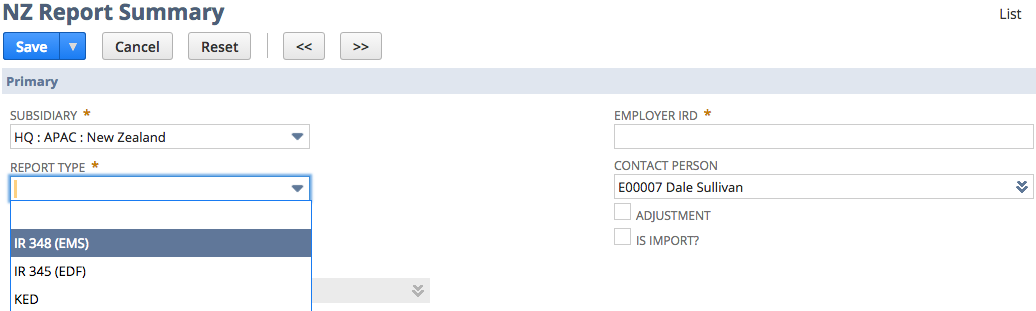

From the menu, navigate to Payroll Administration > NZ Reports > IRD Reports > New

- Select the correct Subsidiary, then select Report Type of IR 345 (EDF). The page will refresh once the report type is selected so selecting the subsidiary first ensures the data returned is filtered properly.

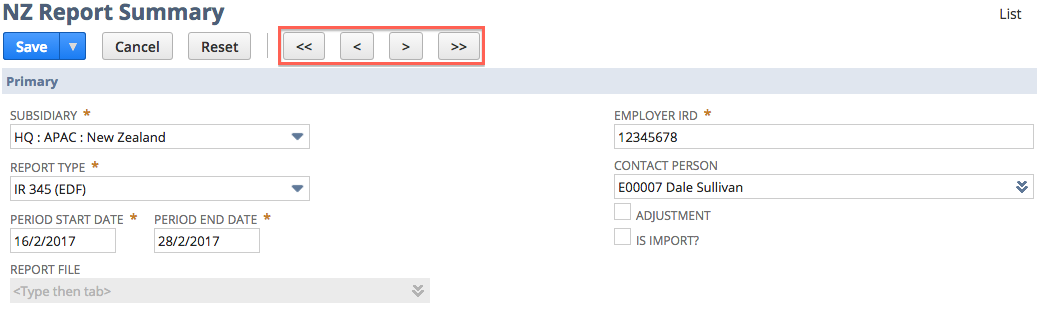

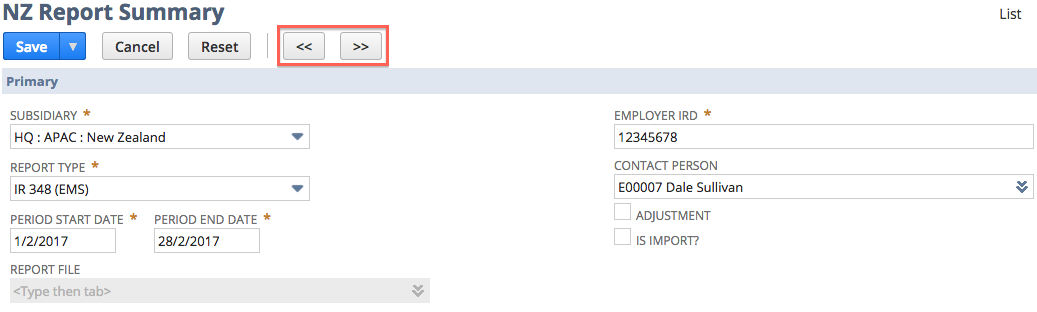

- There is no preview for IR345, dates are defaulted for Reporting Period Start Date and Period End Date. For larger employees the IR345 is submitted twice a month so the dates will default based on 15 days prior to the current period. Dates can be adjusted up and down using the arrow buttons:

- Double arrows move the dates forward or back one month;

- Single arrows move the dates forward or back 15 days.

- To create the IR file click the Save button.

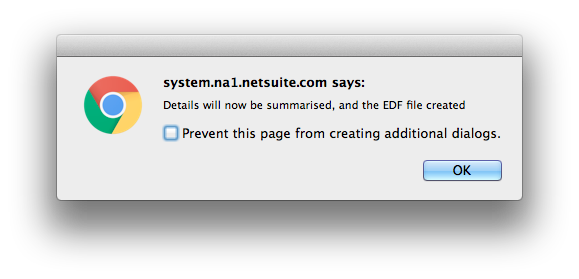

- The following message should appear - click OK.

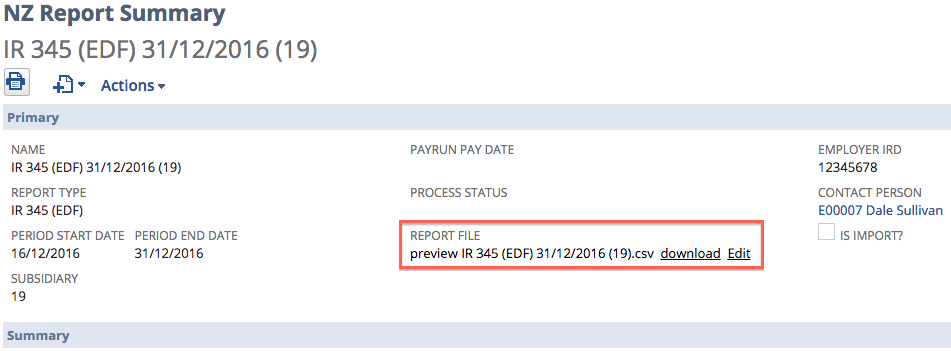

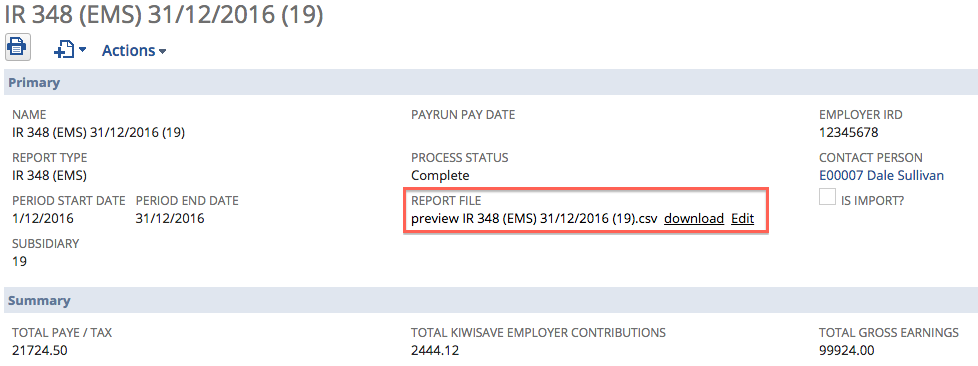

- The file and summary should be generated immediately. Review the IR file and upload via the IRD portal.

- You should see the download and Edit links for the file.

- You should see the download and Edit links for the file.

Employer Monthly Schedule form

The IR348 is the Employer Monthly Schedule (EMS). As the names suggests, this schedule is filed monthly. The due dates for the EMS vary depending on the size of the employer.

| Employer Size | Due Date |

|---|---|

| Large | 5th of the month following the month PAYE was deducted, OR |

| Small | 20th of the month following the month PAYE was deducted |

To generate the IR348, follow these steps:

- From the menu, navigate to Payroll Administration > NZ Reports > IRD Reports > New

- Select the correct Subsidiary, then select Report Type of IR 348 (EMS). The page will refresh once the report type is selected so selecting the subsidiary first ensures the data returned is filtered properly.

- A preview of the employee data will be shown and dates defaulted for Reporting Period Start Date and Period End Date. As reporting is generally done for last month the dates default to the month prior to the current date. To change the date ranges click on the arrows at the top of the page.

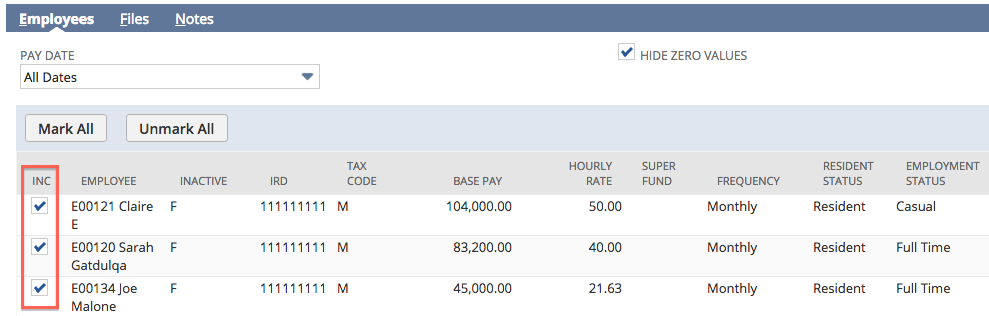

- Employees can be deselected from the IR file by unmarking the checkbox on the left hand side of the list of the Employees list.

To create the IR file click the Save button. Depending on the number of employees that are included on the submission the process will generate the file immediately or schedule.

Scheduled info

If the process schedules then click the Refresh button periodically until the process is complete. It should not take more than 5 minutes. Any error messages will appear in user notes section and you should Contact Support for assistance.

The Report File is available inline. Review the IR file and upload via the IRD portal.

KiwiSaver Employment Details form

The KiwiSaver employment details (KED) form allows employers to electronically notify Inland Revenue of:

- New employees, who meet KiwiSaver automatic enrolment eligibility criteria (KS1);

- Existing employees, who are not subject to the automatic enrolment rules but decide to join KiwiSaver without actively choosing a KiwiSaver provider (also treated as a „default enrolment‟); and

- Employees who have been automatically enrolled, but have opted out of KiwiSaver (KS10).

To generate the KED report file follow these steps:

- From the menu, navigate to Payroll Administration > NZ Reports > IRD Reports > New

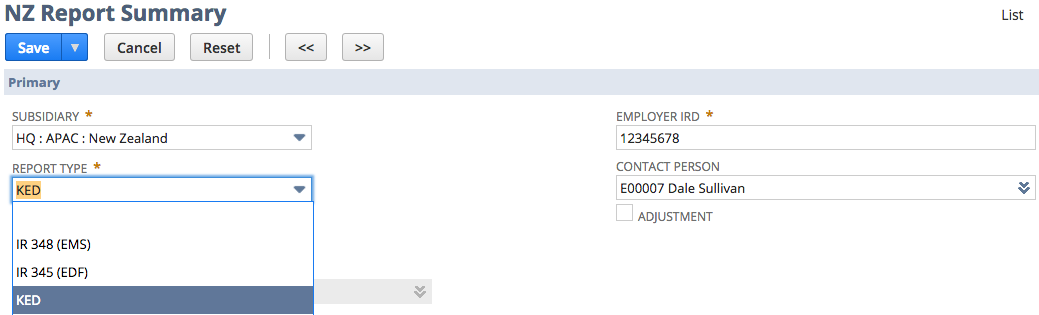

- Select the correct Subsidiary then select Report Type of KED. The page will refresh once the report type is selected so selecting the subsidiary first ensures the data returned is filtered properly.

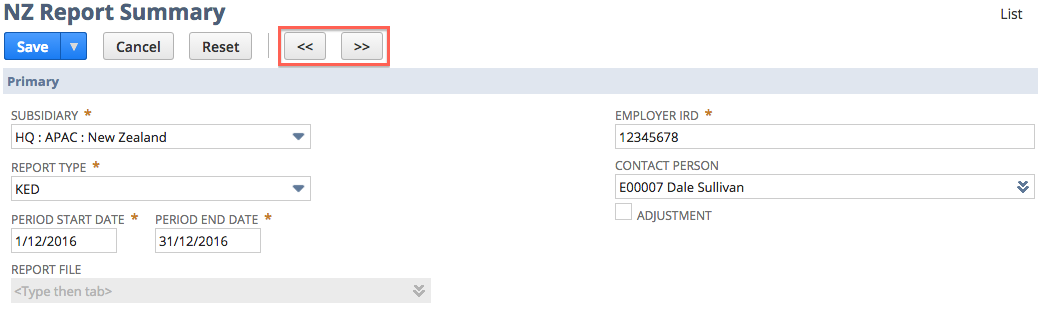

- A preview of the employee data will be shown and dates defaulted for Reporting Period Start Date and Period End Date. As reporting is generally done for last month the dates default to the month prior to the current date. To change the date ranges click on the arrows at the top of the page.

- To create the IR file click the Save button. Depending on the number of employees that are included on the submission the process will generate the file immediately or schedule. If the process schedules click the refresh button periodically until the process is complete. It should not take more than 5 minutes. Any error messages will appear in user notes section and you should Contact Support for assistance.

- The Report File will be available inline. Review the IR file and upload via the IRD portal.