Integrations : Deputy Custom Field : Tax Scale Update

Overview

This article outlines the actions necessary to update the Deputy Custom Field > Employee Tax Scale to match the recently updated Tax Scale names in Infinet Cloud Payroll. This field is used to set the Employee Tax Scale, and the name is used to map to the internal reference in Infinet Cloud Payroll when the employee is added / updated using the REST interface.

This article is only relevant to customers who use Deputy to sync Employee information to Netsuite / Infinet Cloud Payroll using the payroll REST interface, and include an Employee Tax Scale. If you are unsure please contact Infinet Cloud Payroll Support.

Tax Scale Name Change

The following table outlines the recent tax scale name changes that need to be made. The values in the New Value column need to replace the values in the Old Value column in the same order they are currently specified.

Order Is Important

When updating the multi options you must ensure that the order of the options remains the same.

| Old Value | New Value |

|---|---|

Half Medicare exemption (6a) with HELP debt | Half Medicare exemption (6a) with STSL debt |

Full Medicare exemption (5a) with HELP debt | Full Medicare exemption (5a) with STSL debt |

Tax-free threshold claimed (2.a) with HELP debt | Tax-free threshold claimed (2.a) with STSL debt |

Tax-free threshold claimed (2a) with HELP debt | Tax-free threshold claimed (2a) with STSL debt |

Foreign resident (3c) with HELP and SFSS debt | Foreign resident (3c) with STSL debt |

Full Medicare exemption (5c) with HELP and SFSS debt | Full Medicare exemption (5c) with STSL debt |

Half Medicare exemption (6c) with HELP and SFSS debt | Half Medicare exemption (6c) with STSL debt |

No tax-free threshold (1c) with HELP and SFSS debt | No tax-free threshold (1c) with STSL debt |

Tax-free threshold claimed (2.c) with HELP and SFSS debt | Tax-free threshold claimed (2.c) with STSL debt |

Tax-free threshold claimed (2c) with HELP and SFSS debt | Tax-free threshold claimed (2c) with STSL debt |

Foreign resident (3b) with SFSS debt | Foreign resident (3b) with STSL debt |

Full Medicare exemption (5b) with SFSS debt | Full Medicare exemption (5b) with STSL debt |

Half Medicare exemption (6b) with SFSS debt | Half Medicare exemption (6b) with STSL debt |

No tax-free threshold (1b) with SFSS debt | No tax-free threshold (1b) with STSL debt |

Tax-free threshold claimed (2.b) with SFSS debt | Tax-free threshold claimed (2.b) with STSL debt |

Tax-free threshold claimed (2b) with SFSS debt | Tax-free threshold claimed (2b) with STSL debt |

H - Working Holiday Maker < $37,000 | H - Working Holiday Maker to 37000 (WHM1) |

H - Working Holiday Maker $37,001 - $87,000 | H - Working Holiday Maker 37001 to 87000 (WHM2) |

H - Working Holiday Maker $87,001 - $180,000 | H - Working Holiday Maker 87001 to 180000 (WHM3) |

H - Working Holiday Maker > $180,000 | H - Working Holiday Maker over 180000 (WHM4) |

Foreign resident (3a) with HELP debt | Foreign resident (3a) with STSL debt |

No tax-free threshold (1a) with HELP debt | No tax-free threshold (1a) with STSL debt |

H - Working Holiday Maker < $37,000 | H - Working Holiday Maker to 37000 |

H - Working Holiday Maker > $180,000 | H - Working Holiday Maker over 180000 |

H - Working Holiday Maker $87,001 - $180,000 | H - Working Holiday Maker 87001 to 180000 |

H - Working Holiday Maker $37,001 - $87,000 | H - Working Holiday Maker 37000 to 87000 |

Update Deputy Custom Field Settings

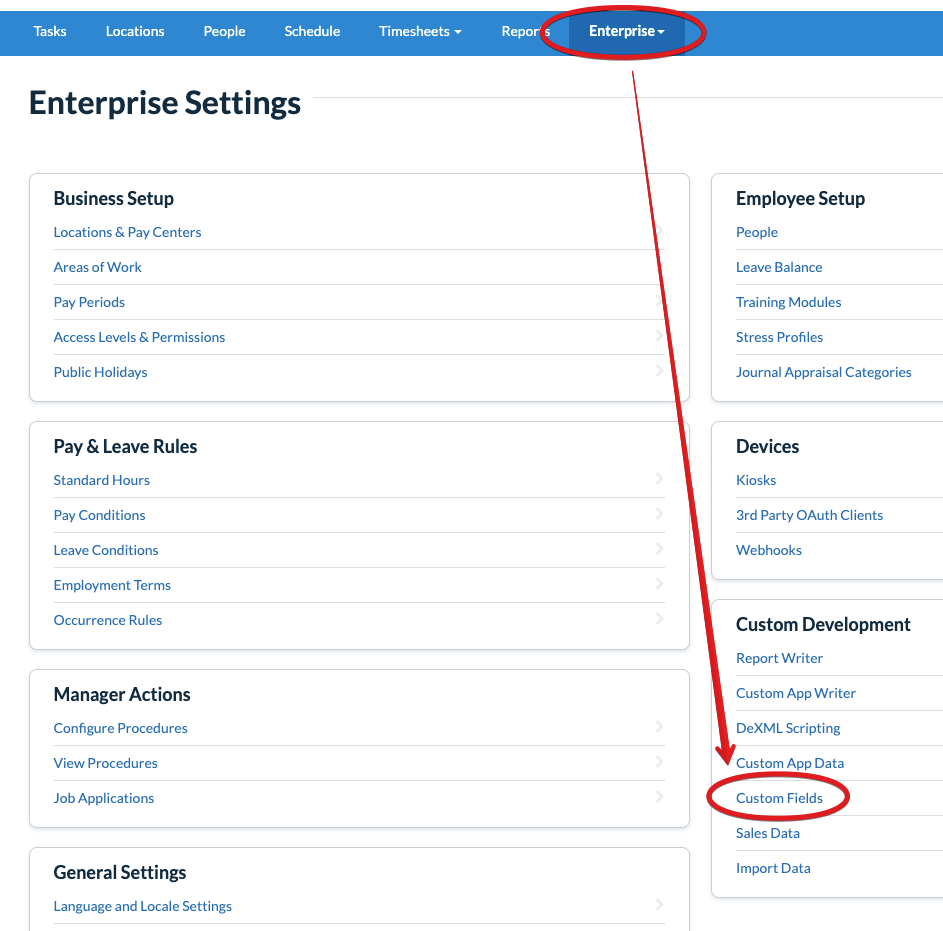

Navigate to the Custom Fields in the Custom Development Section:

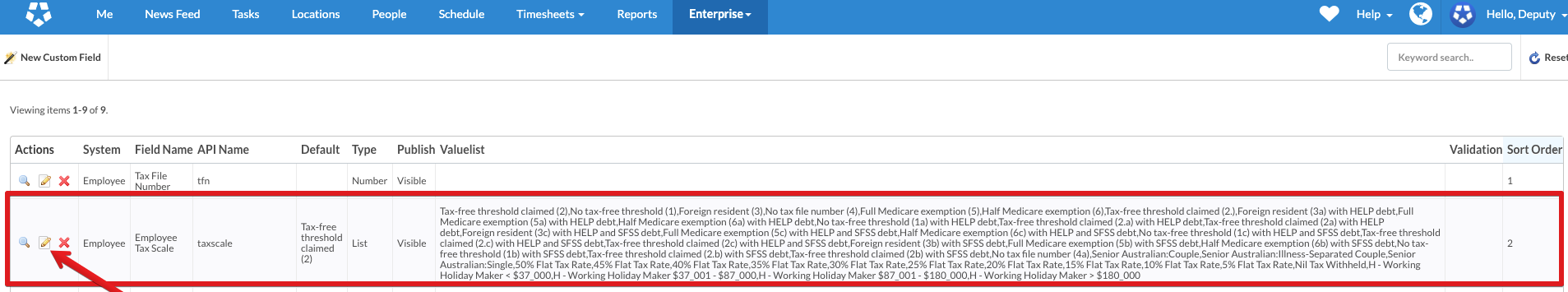

Click on the Edit Button for Employee Tax Scale Custom Field.

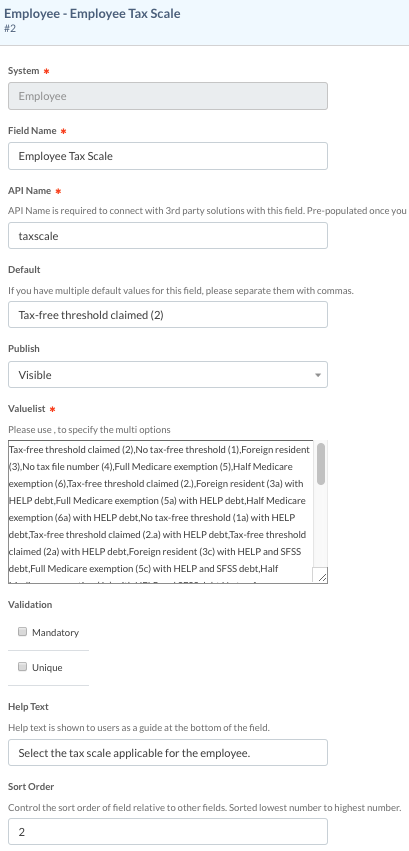

Take a copy of the text in the Valuelist entry box (just in case you need to refer back to it). Replace the Valuelist text with the updated names comma delimited.