2018/2019 AU Working Holiday Maker (WHM) Employee Updates Required

Important

Please Note: Changes to this functionality apply from 25/6/2018. We have automated this functionality so all you need to do is select the correct "Resident Status" on the Tax Info Tab of the employee record. After you have selected the resident status "Working Holiday Maker" the system will automate and update the employee tax scale as needed and also if the employee changes earnings threshold.

What you need to do

Please read the following links to understand your obligations as an Employer

First, to employ a working holiday maker in Australia on a visa subclass 417 or 462, you:

- should check your worker has the correct visa using the Visa Entitlement Verification OnlineExternal Link service

- must register with the ATO to withhold tax at the working holiday maker tax rate before making your first payment to them. Penalties may apply if you fail to register.

Once you've registered with the ATO - you will need to setup any Holiday Makers accordingly in ICS Payroll. See steps below.

How to register with the ATO

Only employers of working holiday makers need to register by using the registration tool.

Before you register, you must be registered for pay as you go (PAYG) withholding or a withholding payer number.

You should print a copy of the registration confirmation screen for your records or phone 13 28 66 to confirm your registration.

See also:

How to tax a working holiday maker

Once you register, you withhold 15% from every dollar earned up to $37,000 with foreign resident withholding rates applying to income over $37,000.

If you don't register, you must withhold tax at 32.5% from every dollar earned up to $87,000 and foreign resident withholding rates apply to income over $87,000.

You can use the Employee/contractor decision tool to work out if your worker is an employee or contractor for tax and super purposes. If the tool shows they are an employee you must tax them at working holiday maker tax rates even if they provide you an ABN.

Penalties apply if you employ someone with visa subclass 417 or 462 but don't register as an employer of working holiday makers.

Working holiday makers can't claim the tax-free threshold and must provide you with their tax file number (TFN).

Setting up Employees as Working Holiday Makers

Use the following steps to update employees who are eligible Working holiday Makers from 1/1/2017

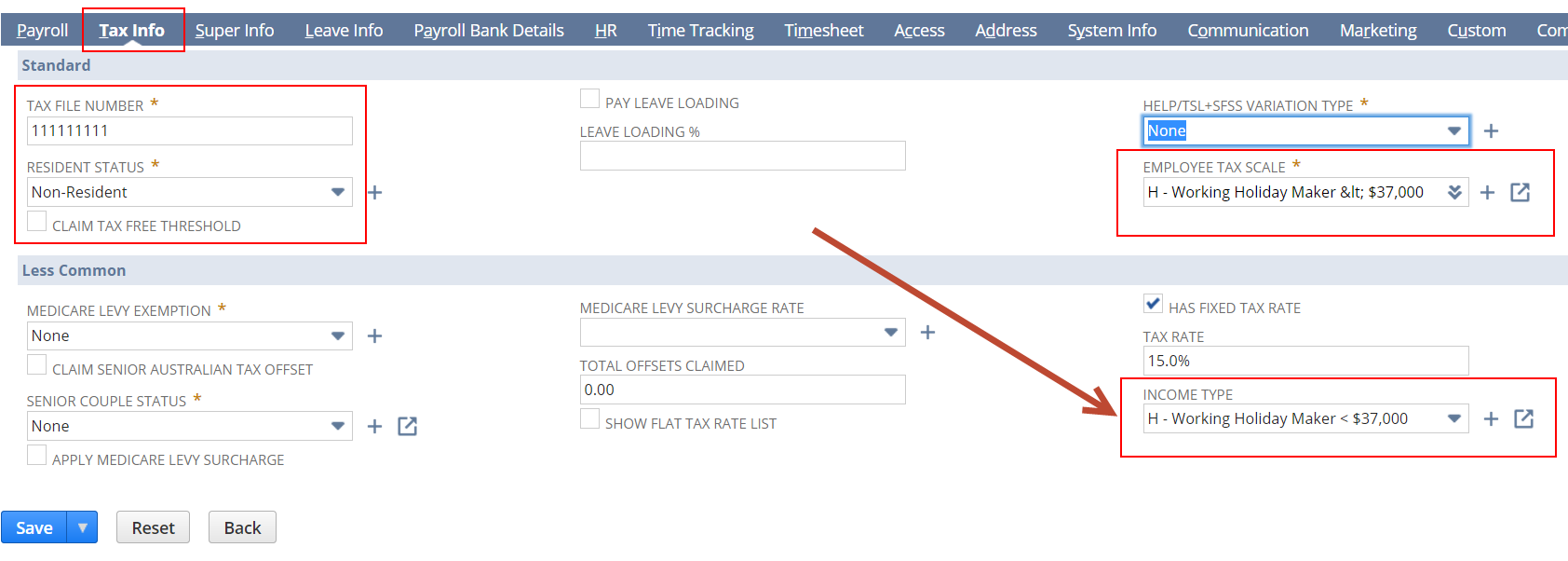

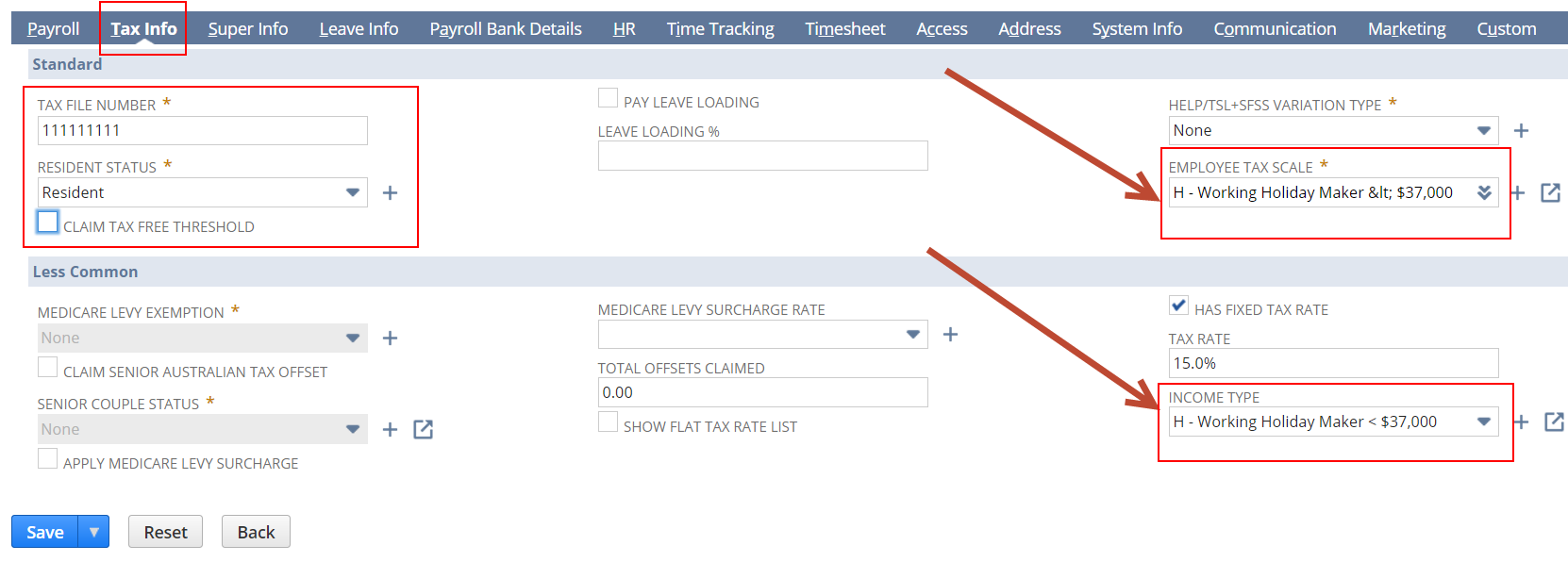

- Navigate to the Employee record in Edit mode

- Go to the Tax Info tab

- Ensure you have entered a valid Tax File Number (TFN) and set the Resident Status field to Working Holiday Maker

- This should automatically set the Income type and Employee Tax scale.

- Click Save

In future a daily update will run that will update the tax scale should the employee change their earnings threshold.

Set the Residents - set Income Type & Employee Tax Scale fields

PAYG summaries

To make sure working holiday makers are taxed correctly, a payment summary must identify income earned by a working holiday maker from 1 January 2017.

Working holiday makers who worked for you both before and after 1 January 2017 will need two payment summaries as these periods are taxed differently. The two payment summaries cover the following periods:

- 1 July to 31 December 2016

- 1 January to 30 June 2017.

ICS Payroll Generated

ICS Payroll supports creating both PAYG Summaries - including the correct 'H' Income Type - provided you've setup your employees correctly. Follow the steps above to setup your Working Holiday Makers correctly (prior to the EOY).

When going through the EOY process, 2 PAYG Summaries will be automatically generated for these employees based on appropriate payslip details with pay dates as below when you process your payment summaries.

See the /wiki/spaces/SUP/pages/32767971 for detailed instructions.

Manual (paper) process

For payments to a working holiday maker, you need to indicate 'H' on the payment summary in the 'gross payment type' box. If your payment summary doesn't have this box, then just put the letter 'H' next to the income earned by the working holiday maker. This is to help your worker to prepare their income tax return.