Paying Employees in a Foreign Currency

1. NetSuite Settings:

- Setup>Company>Enable Features>Company Tab : Under the "International" heading ensure "MULTIPLE CURRENCIES" is ticked and save.

- Lists>Accounting>Currencies : Ensure the foreign currency has been created. NB: Infinet does not interact with NetSuite exchange rates or exchange rate settings. See "Exchange Rate Tables" section below.

2a. Payroll Country

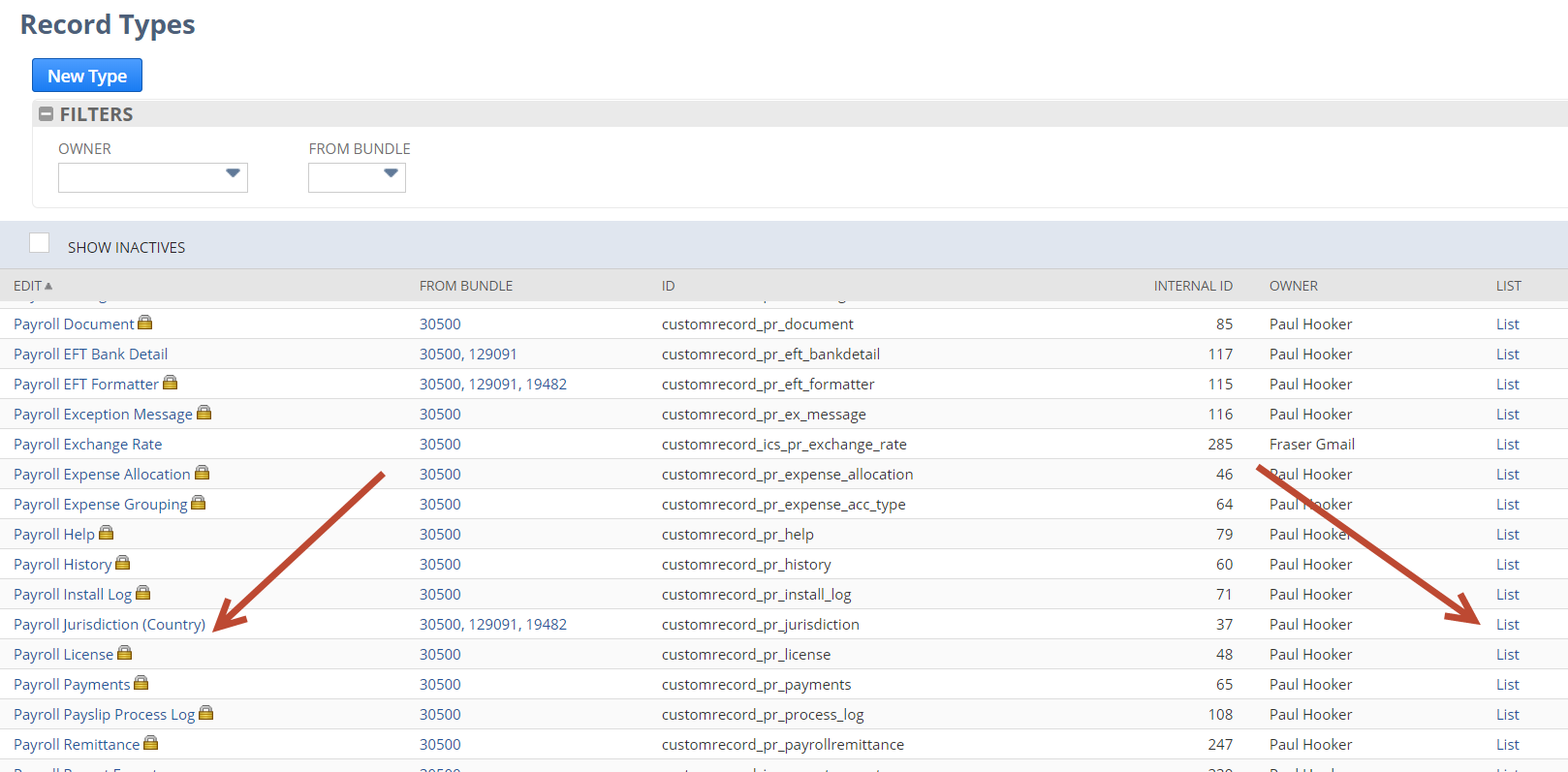

- Navigate to Customisation>Lists/Records/Fields>Record Types : Find the record type "Payroll Jurisdiction (Country)" and click the List. Ensure the country is not inactive. Click "show inactives" if you do not see the country in the list.

- Payroll Country : Edit the country and complete the highlighted fields below. Save

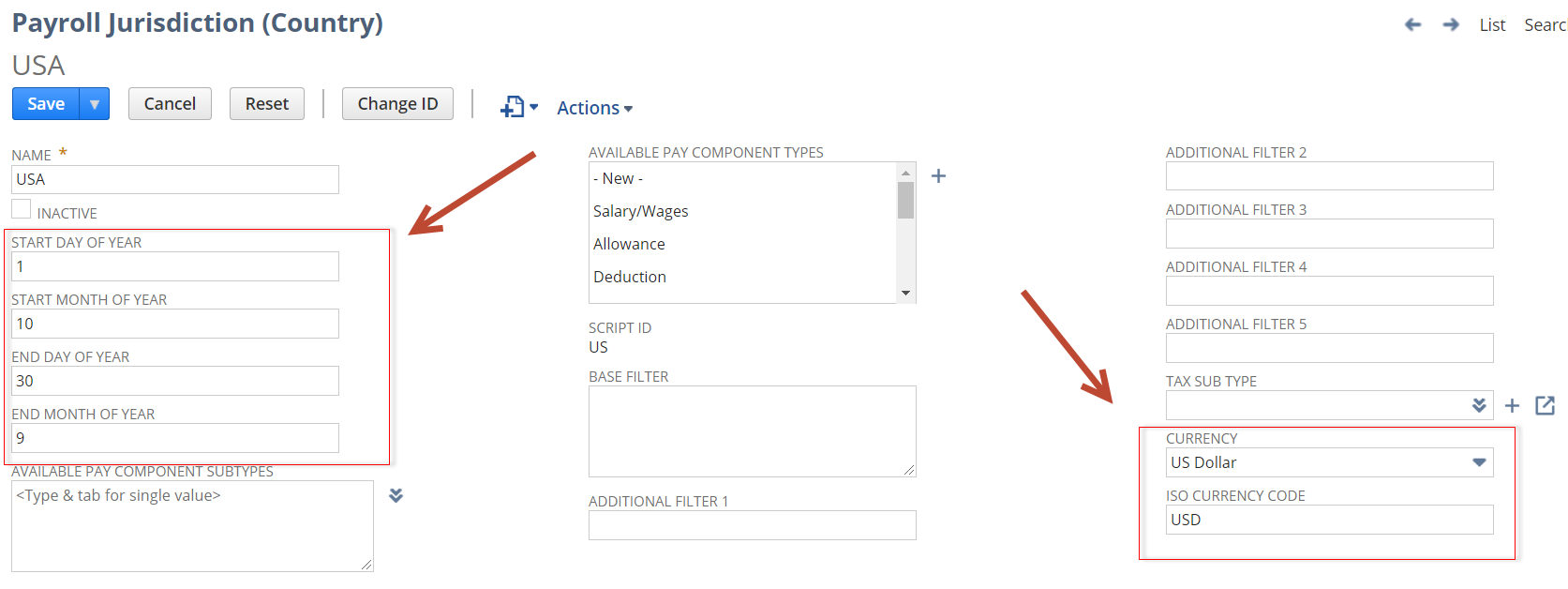

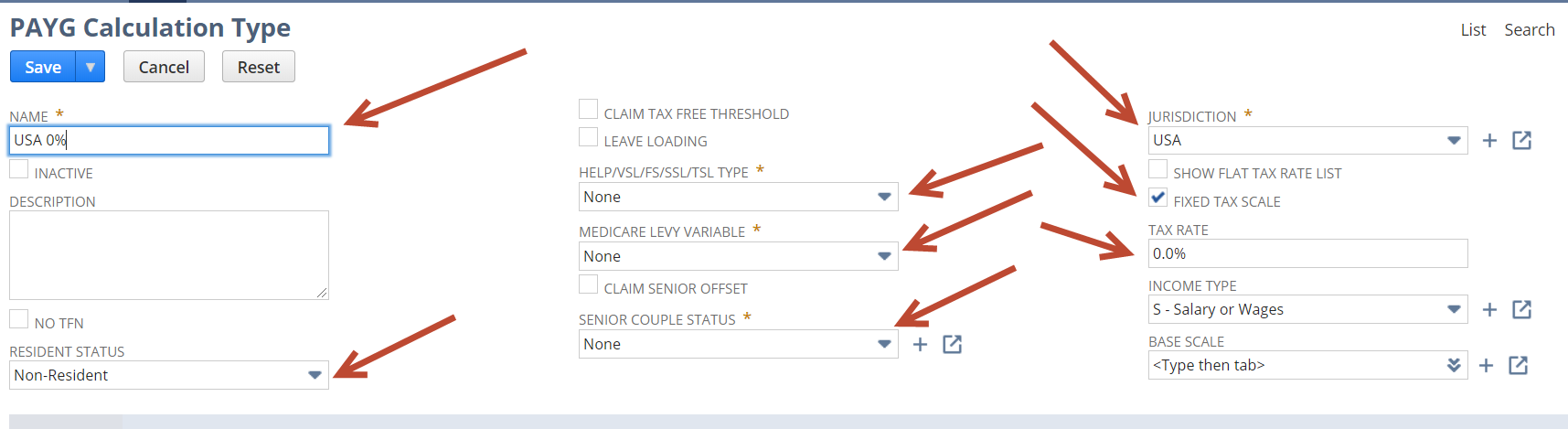

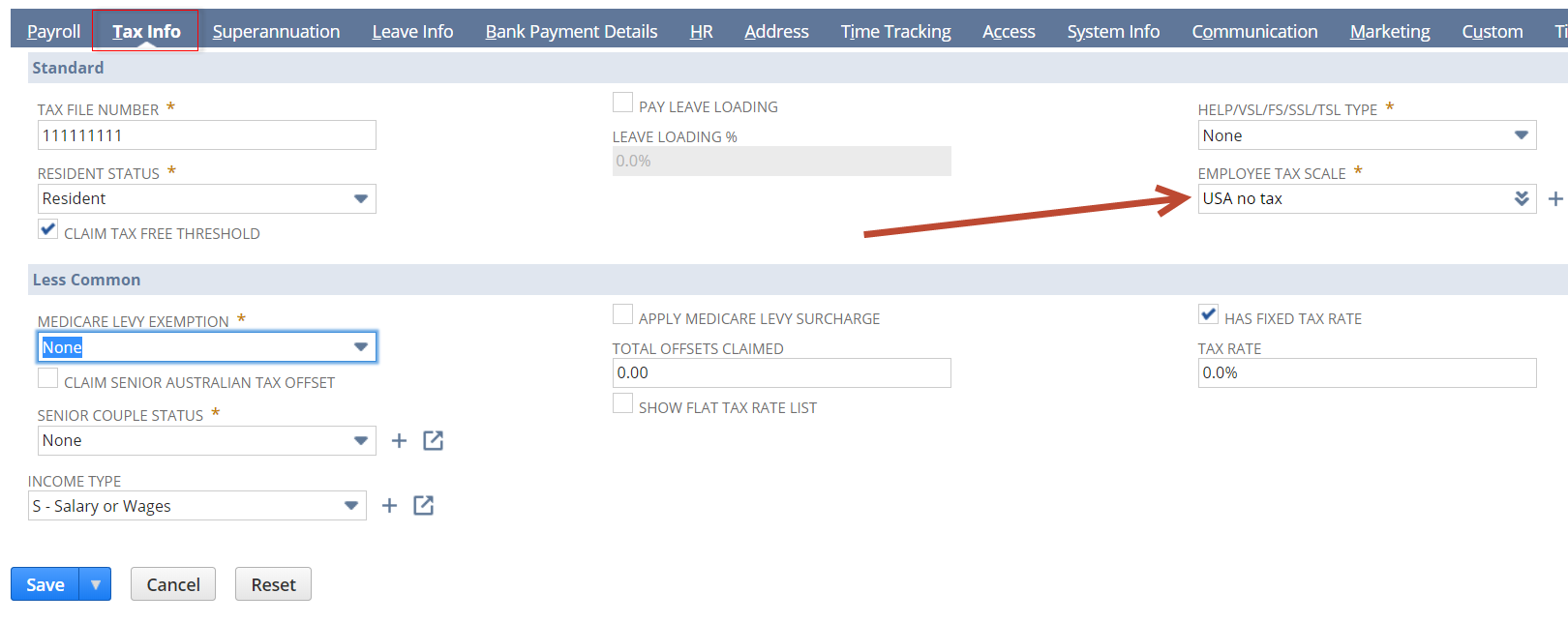

2b. PAYG Calculation Type

We need to create a tax scale to apply to the employee record, even if it is 0% tax.

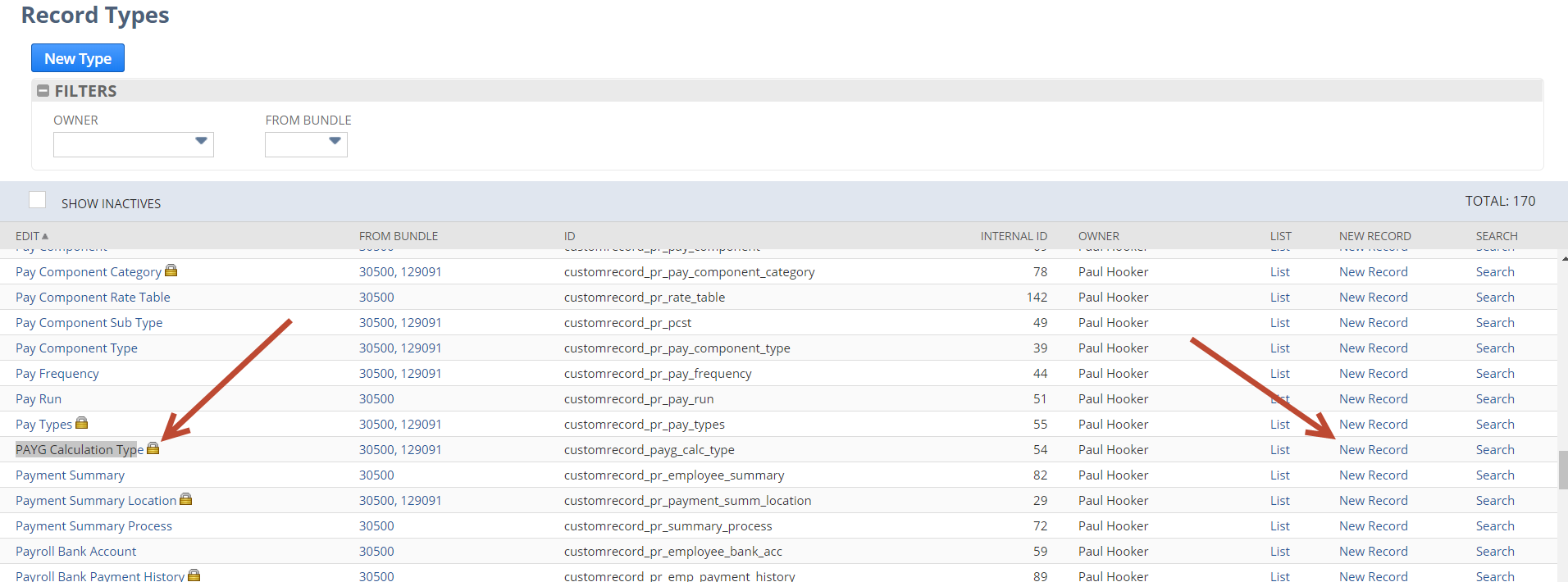

- Navigate to Customisation>Lists/Records/Fields>Record Types : Find the record type "PAYG Calculation Type" and click "New Record"

- PAYG Calculation Type : Complete the highlighted fields below. Save.

2c. Payroll States and Public Holidays for Leave Management

- Navigate to Customisation>Lists/Records/Fields>Record Types : Find the record type "Payroll States" and click the List : Ensure the Payroll state/s you require is in the list. Check "show inactives" if you don't see them. Create as needed.

- Navigate to Customisation>Lists/Records/Fields>Record Types : Find the record type "Payroll Statutory Holiday" and click the List : You will need to create and maintain Public Holidays outside of AU, NZ, UK, USA, SG.

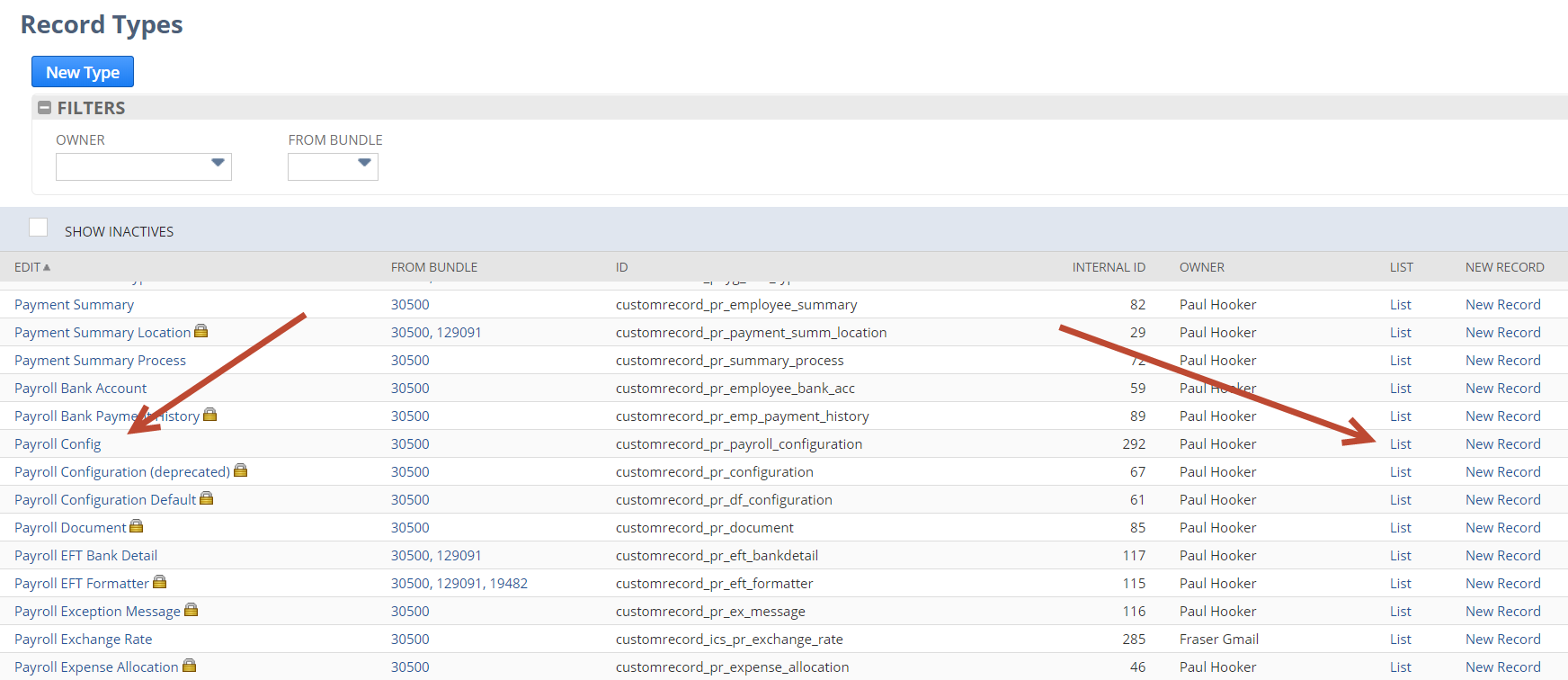

3. Payroll Config

- Navigate to Customisation>Lists/Records/Fields>Record Types : FInd the record type "Payroll Config" and click the List.

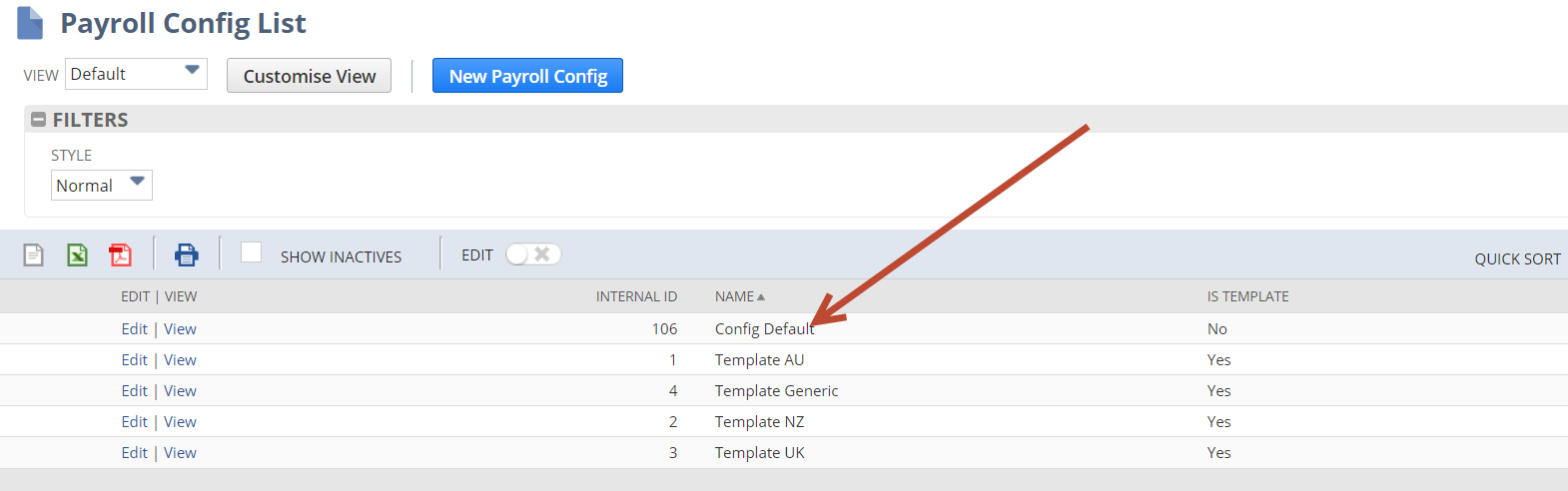

- Payroll Config : Find and edit the "Config Default" record or the employee subsidiary config if you have multiple subsidiaries.

- Payroll Config : Edit the config record and check the box below in the "General Options" section (Payroll Multi-Currency) . Save.

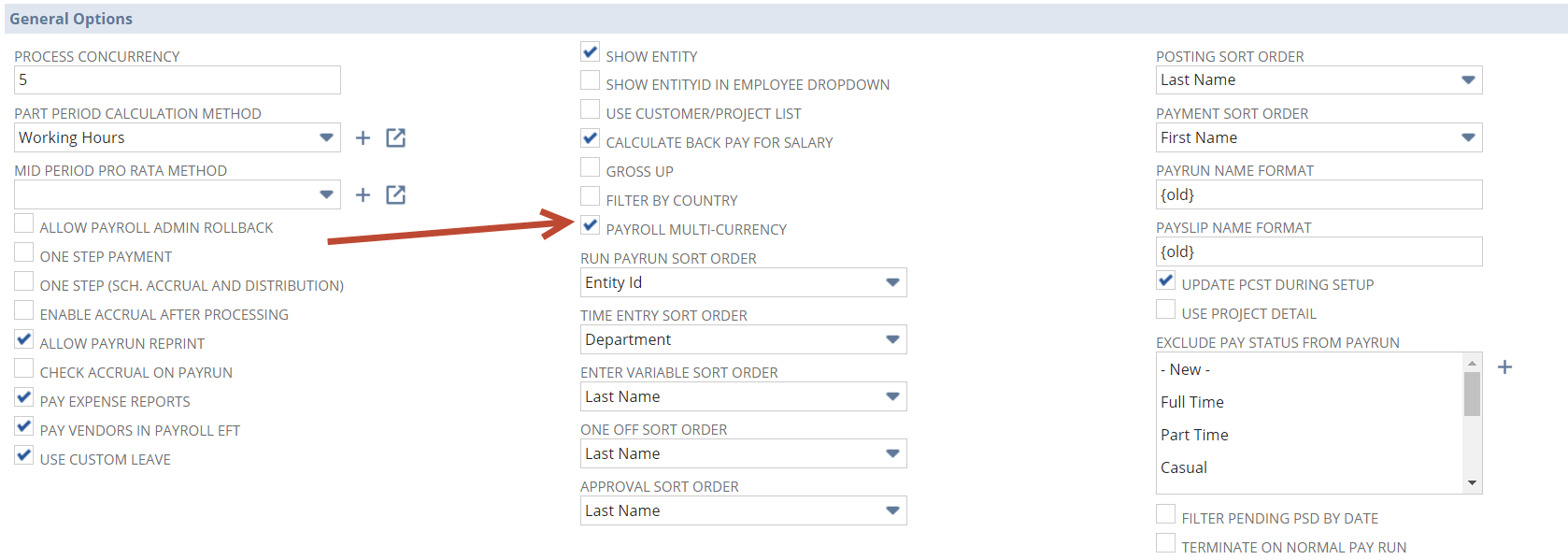

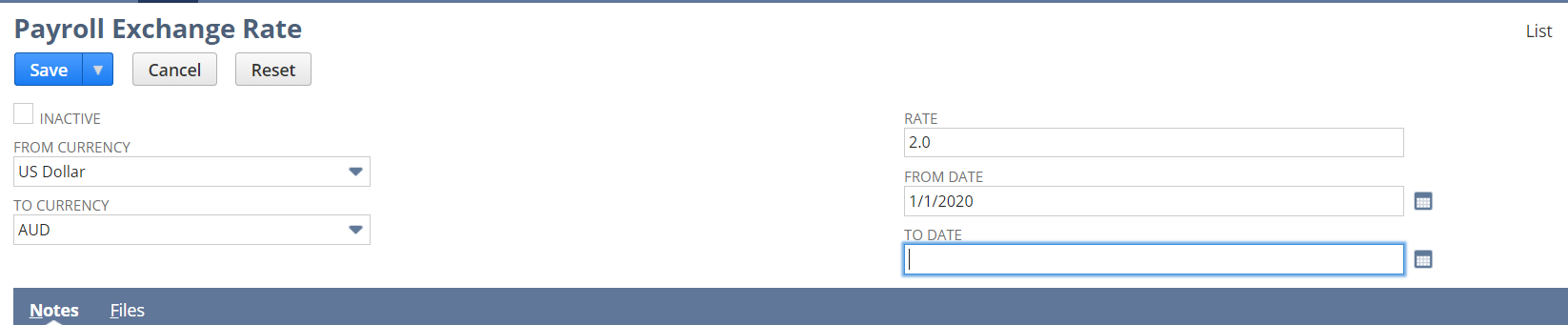

4. Exchange Rate Tables

- Navigate to Customisation>Lists/Records/Fields>Record Types : Find the record type "Payroll Exchange Rate" and click "New Record"

- Payroll Exchange Rate: Enter the relevant fields. A "from date" is required but a "to date" is not. NB: When you create a new exchange rate record you must ensure that any existing records have an "to date" set prior to the new "from date" The pay run "Pay date" is used to find the appropriate exchange rate record.

Overlapping dates on exchange rate records will cause an error in payroll processing. Only the current record can have an empty "to date".

- Shortcuts : As you will need to maintain the exchange rates we suggest you save the list to your shortcuts.

Step 6 onwards can be completed using your Payroll Admin role.

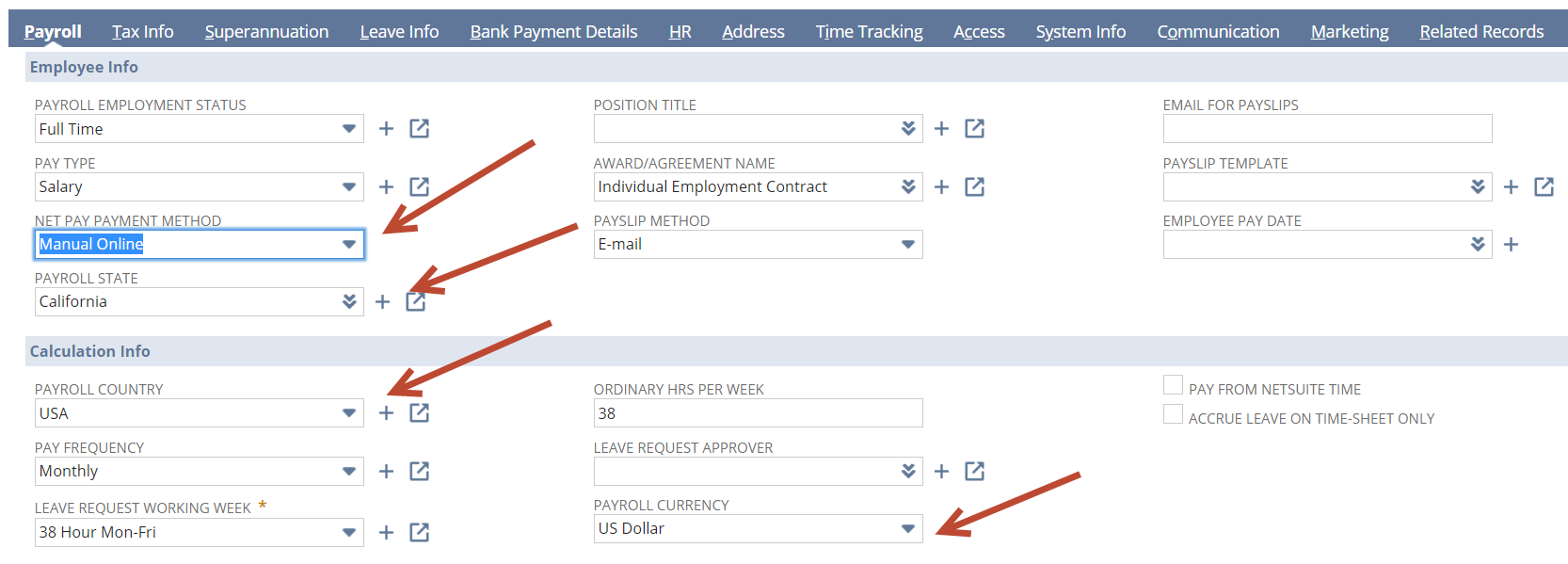

5. Employee Record

Create the employee record as normal paying particular attention to the tabs and settings below. Save.

- Payroll Tab : Select the "Payroll Country" first and then "Payroll State" and "Payroll Currency". Set the "Net Pay Payment Method" to "manual online"

- Tax Info : Select the Employee tax scale. Set any other fields as required or add placeholders if mandatory but not relevant.

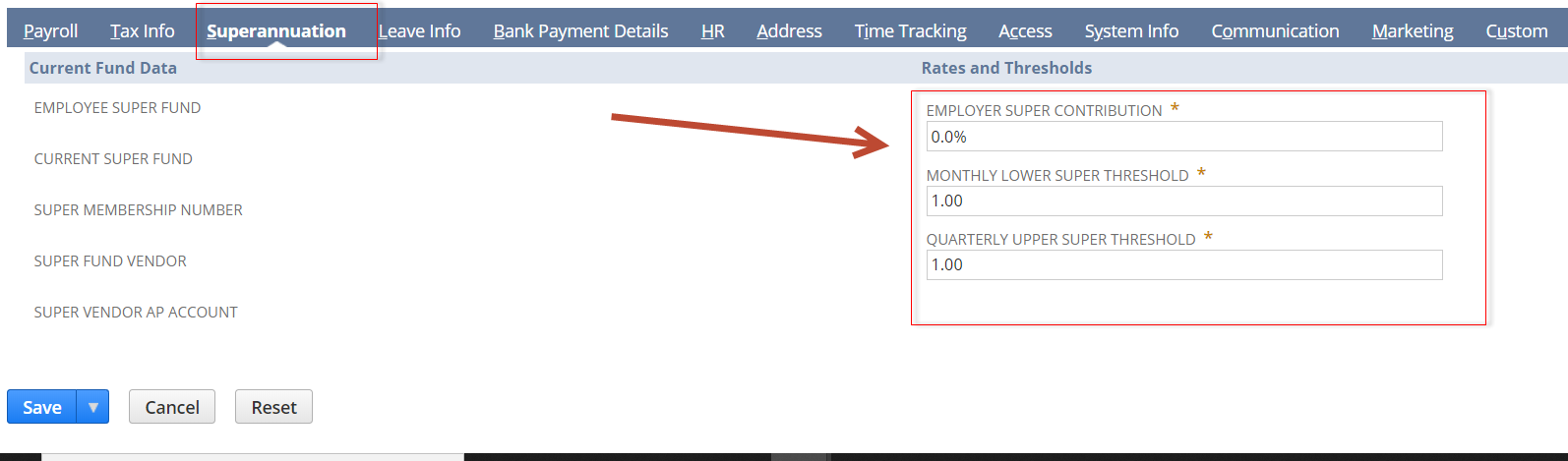

- Superannuation : Set any other fields as required or add placeholders if mandatory but not relevant.

6. Pay Components

Create Pay components as normal in the foreign currency amount.

7. Payroll Processing

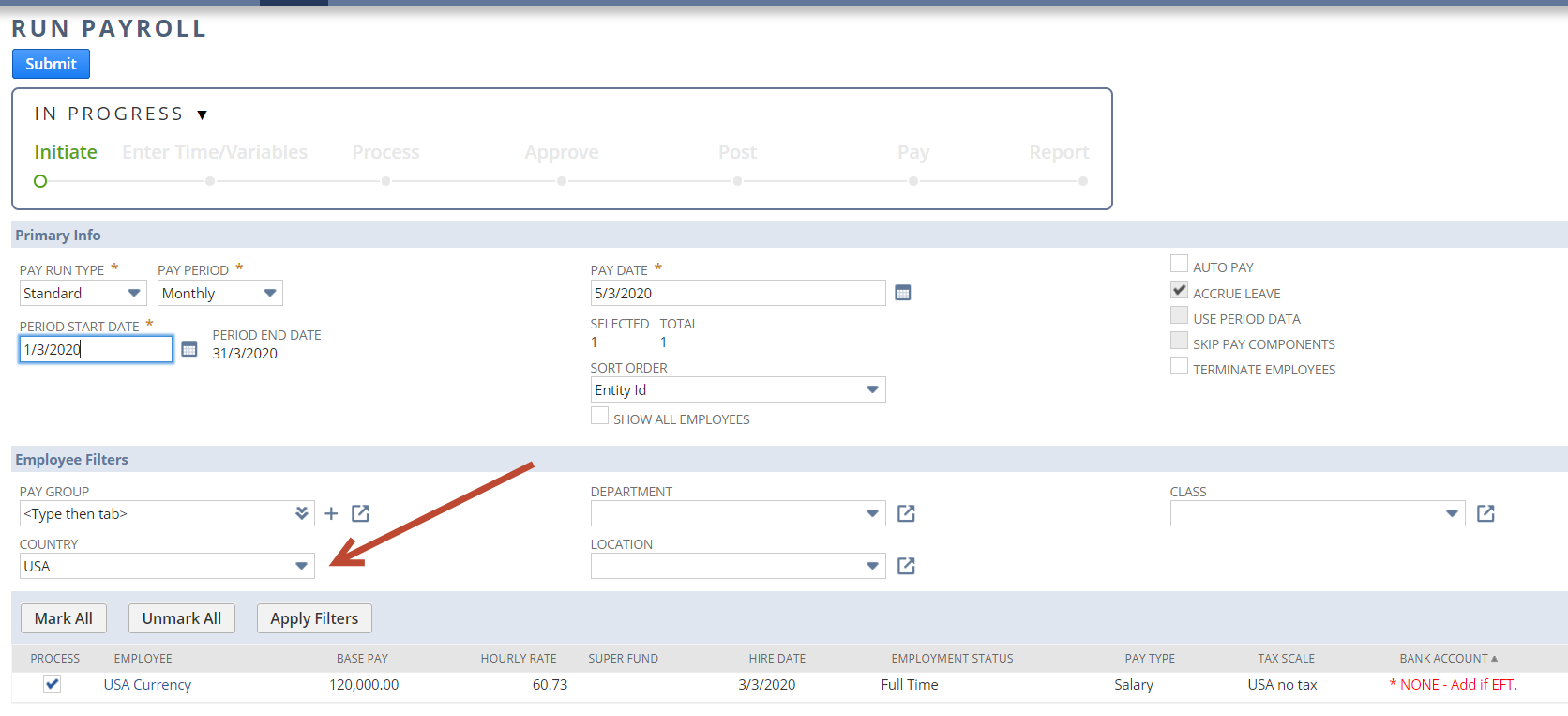

Initiate a new pay run as normal.

- Initiate : Change the payroll country to the desired and let page reload. Complete period and pay dates as required. Submit. Ensure you have a valid exchange rate record ( step 4 above) that encompasses the pay date)

- Process Payroll : Process Payroll steps as normal

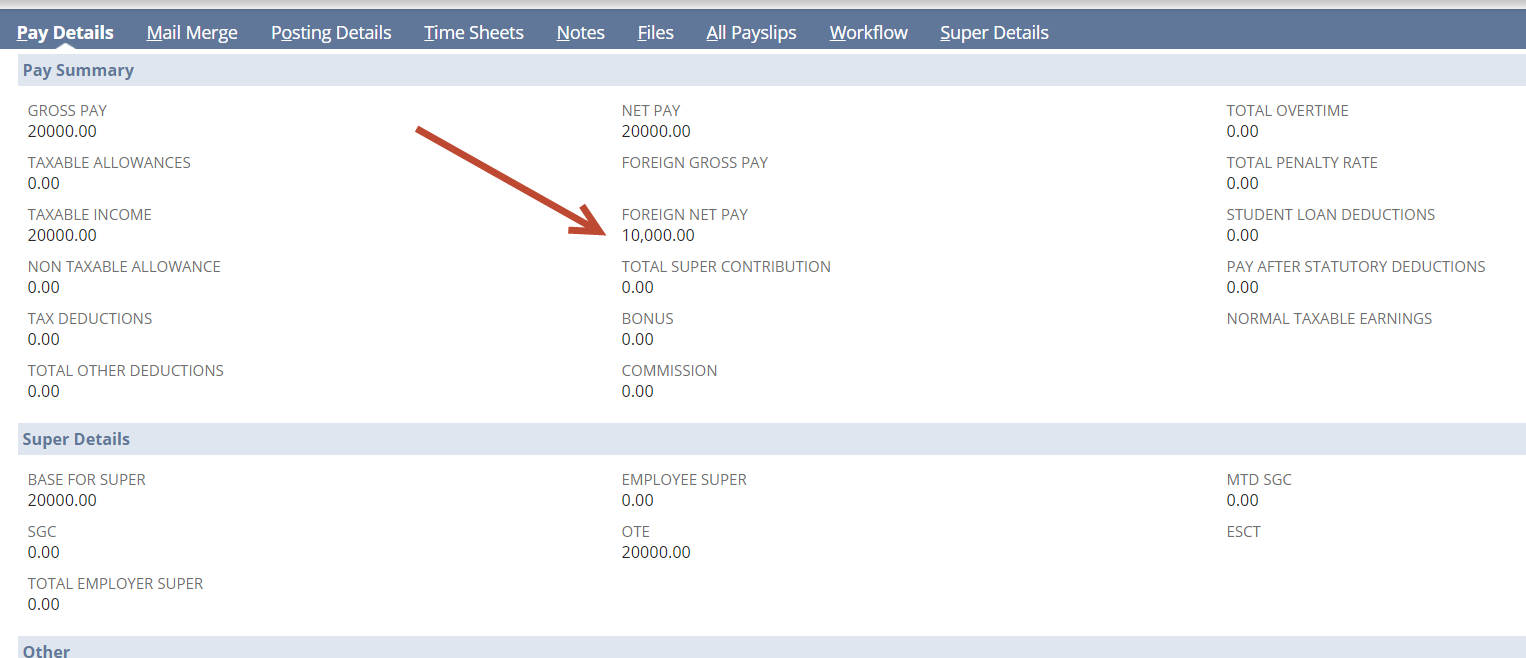

- Approve Payslips : Click "current" to view the payslip record. You will note that the summary fields and payslip detail are in the local currency amount. A field exists on the payslip for "Foreign Net Pay" amount.

- Proceed as normal if correct. Any manual adjustments to payslip detail should reflect the local currency amount.

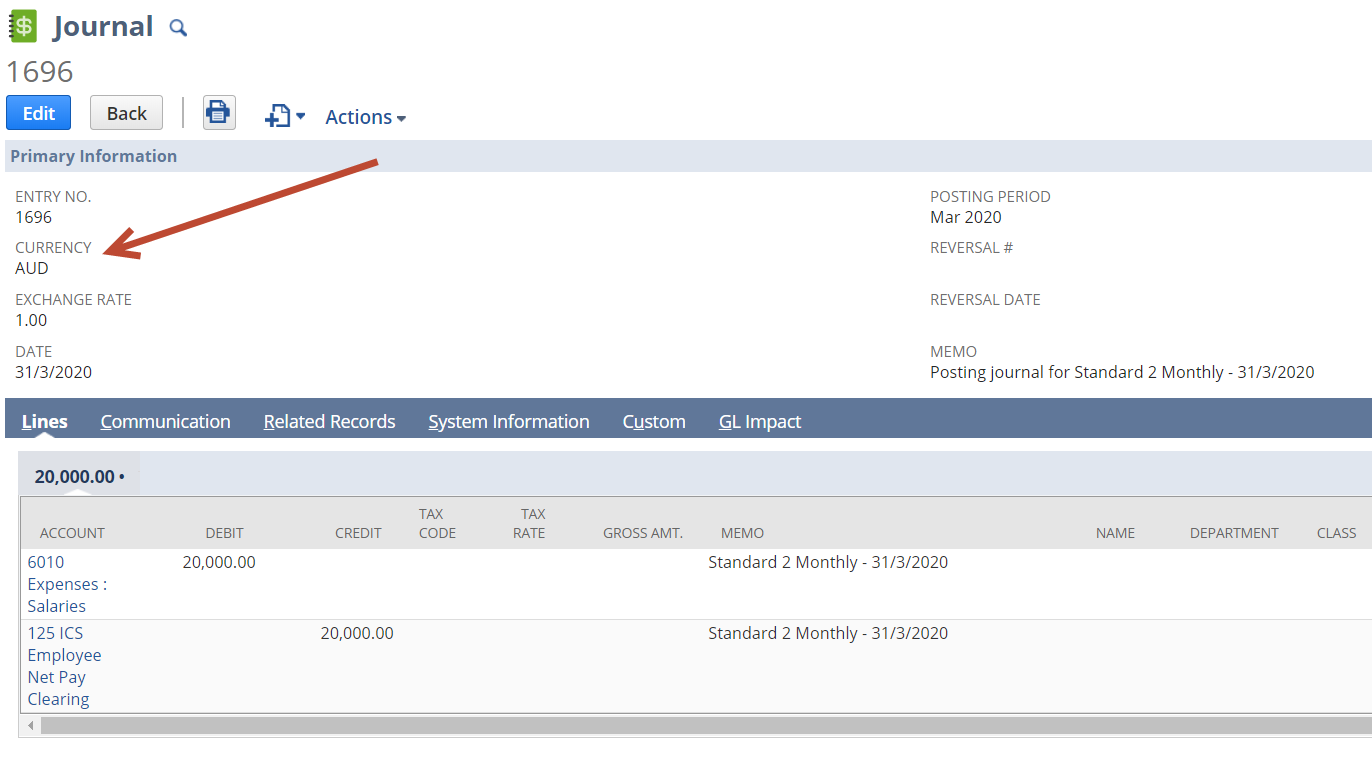

8. GL Impact

- Payroll Journals : Journals will be created using the local currency amounts based on the payslip detail.

9. Paying your employees

Infinet does not offer to to automate overseas EFT or bank transfer. It is your responsibility to ensure the employee is paid using your preferred method.

10. Reporting

Contact support or your Infinet consultant to discuss reporting options.

, multiple selections available, Use left or right arrow keys to navigate selected items