/

Update of Pay Component forms

Update of Pay Component forms

Dec 16, 2019

Overview

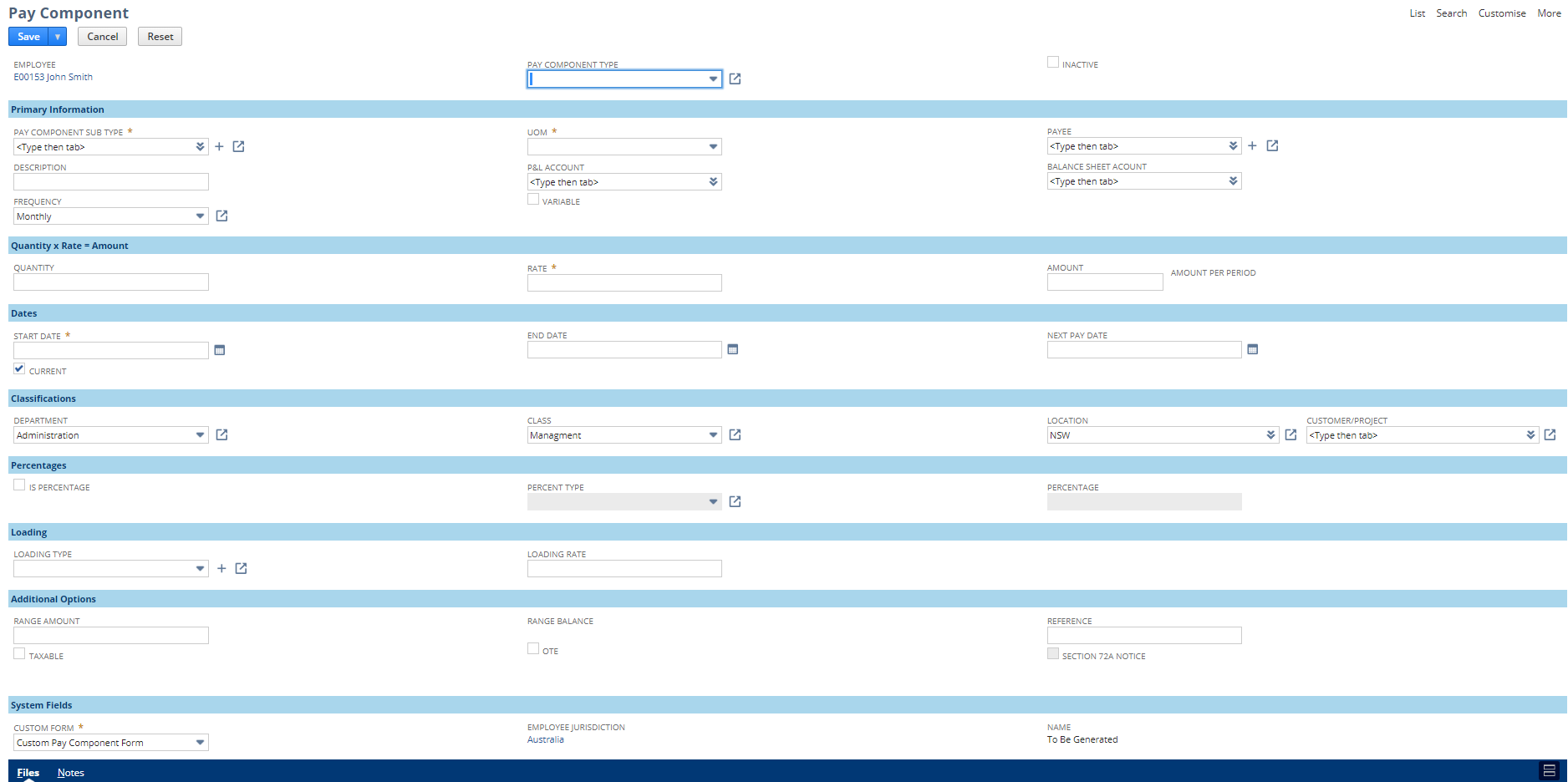

In Infinet Cloud Payroll Bundle 30500 Version 19.3.00 we have updated Employee Pay Component forms to include field groups. Hopefully this makes it easier to read and enter information. See the description of the field groups and fields below.

A Pay Component is a record assigned to an employee that determines what will appear in the pay run and on the payslip for that employee.

Best Practice

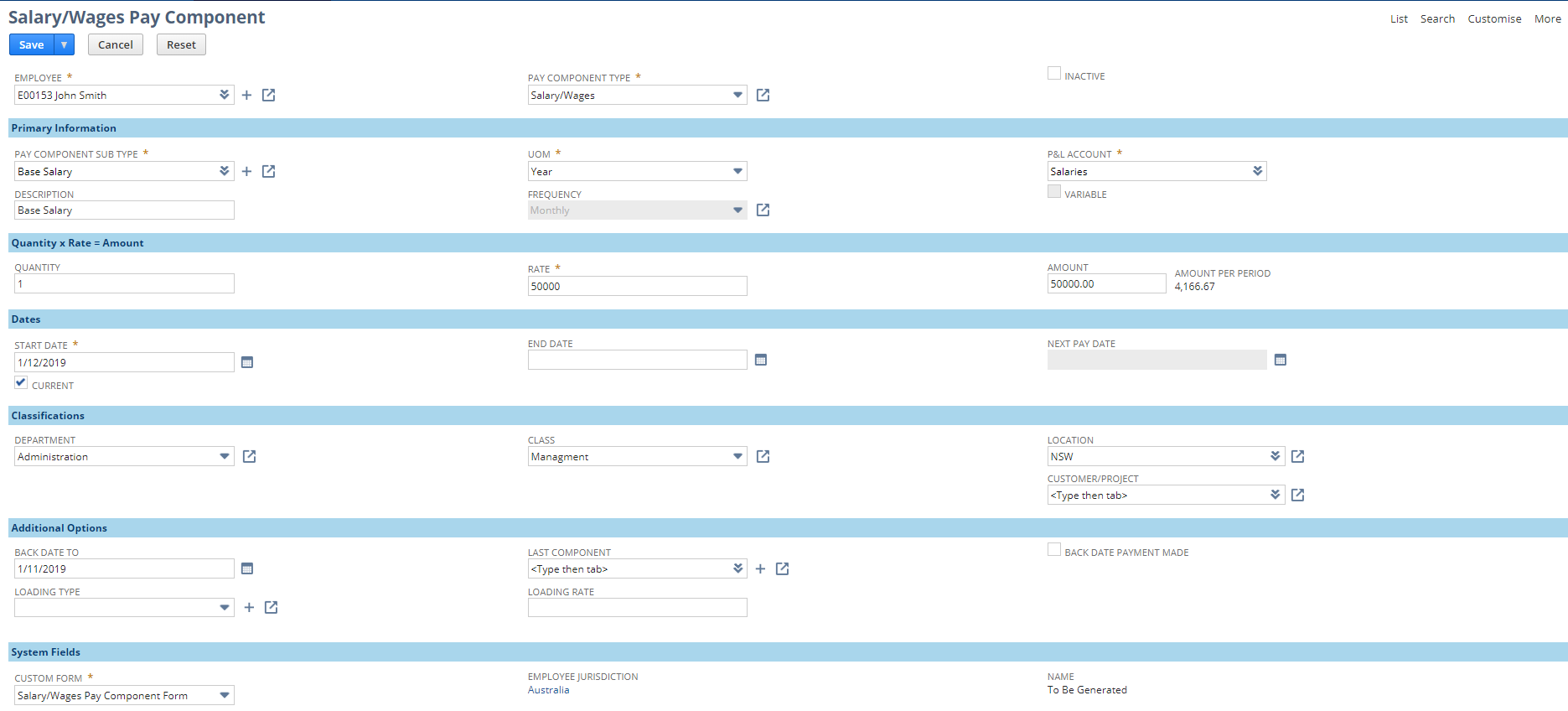

Always use the matching buttons on the payroll tab of the employee record. Eg. "Create Salary/Wages" for Base Salary or Normal time.

"New Pay Component" should only be used in rare circumstances or if you have been instructed to.

- Body

- Employee

- Pay Component Type

- Inactive

- Primary Info

- Pay Component Sub Type

- Description

- UOM

- Frequency

- Variable

- P&L Account

- Payee

- Balance Sheet Account

- Quantity x Rate = Amount

- Quantity

- Rate

- Amount

- Amount Per Period

- Dates

- Start Date

- End Date

- Current

- Next Pay Date

- Percentages

- Is Percentage

- Percent type

- Percentage

- Classification

- Department

- Class

- Location

- Customer/Project

- Additional Options

- Back Date to

- Last Component

- Back Payment Made

- Loading Type

- Loading Rate

- Range Amount

- Range Balance

- Reference

- Section 72a Notice

- Taxable

- OTE

- System Fields

- Custom Form

- Employee Jurisdiction

- Name

- NZ

- Ordinary Pay

- NZ IR File Location

- NZ Gross Earnings

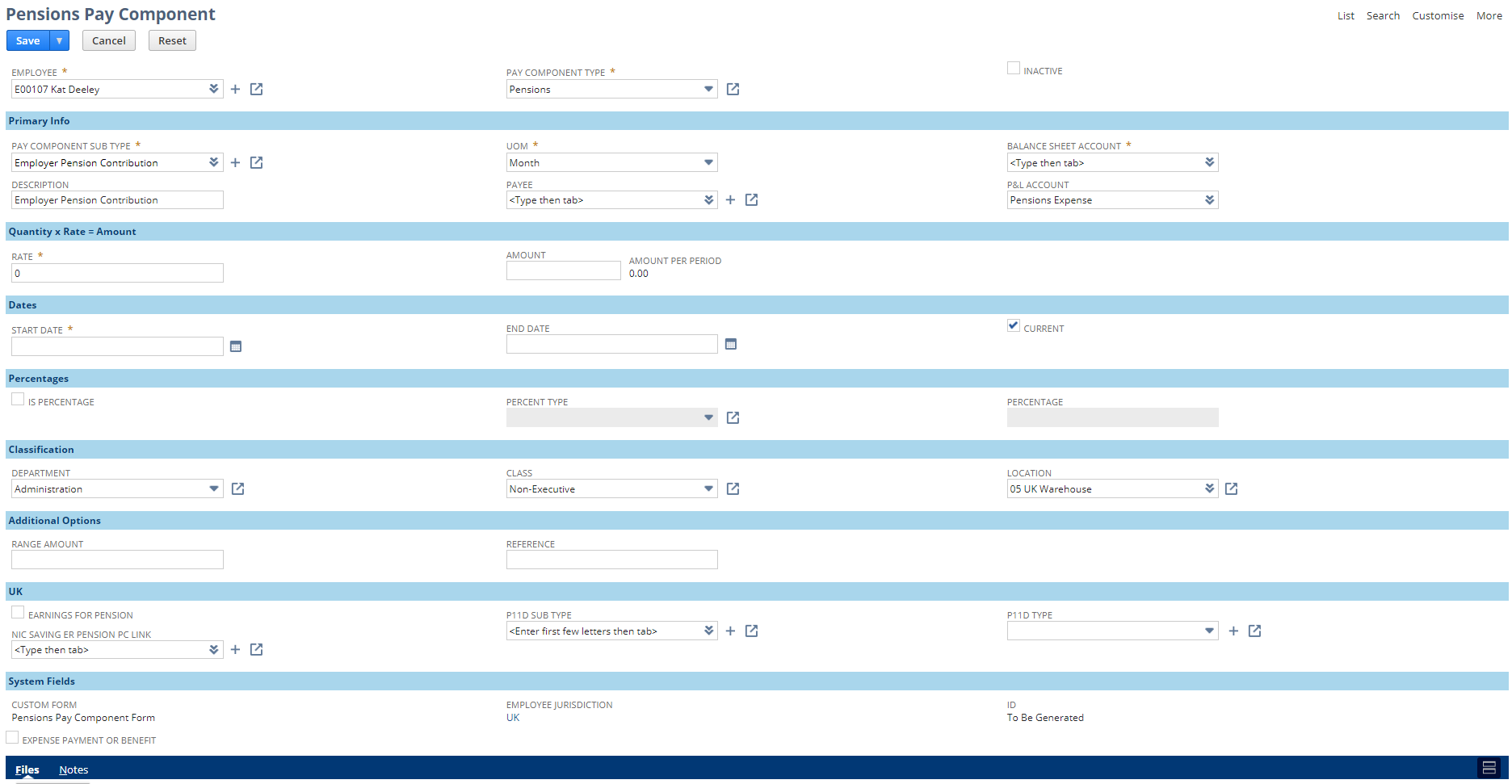

- UK

- P11D Type

- P11D Sub Type

- NIC Saving ER Pension PC Link

- Salary Sacrifice Cap

- Earnings for Pension

- Files/Notes Sublists

- Files

- Notes

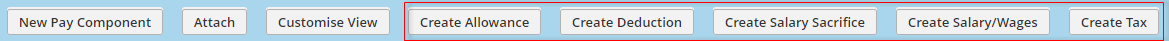

Salary/Wages Form

On this page

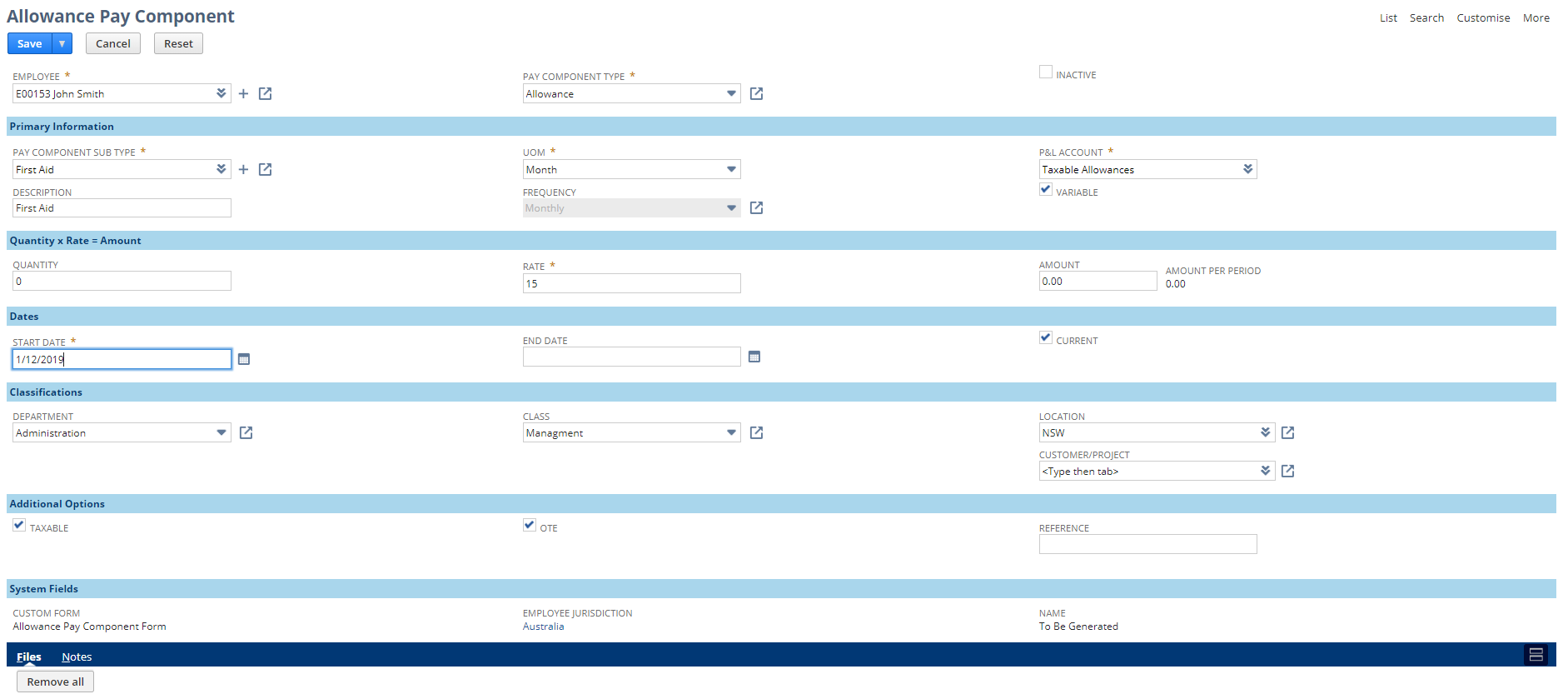

Allowance Form

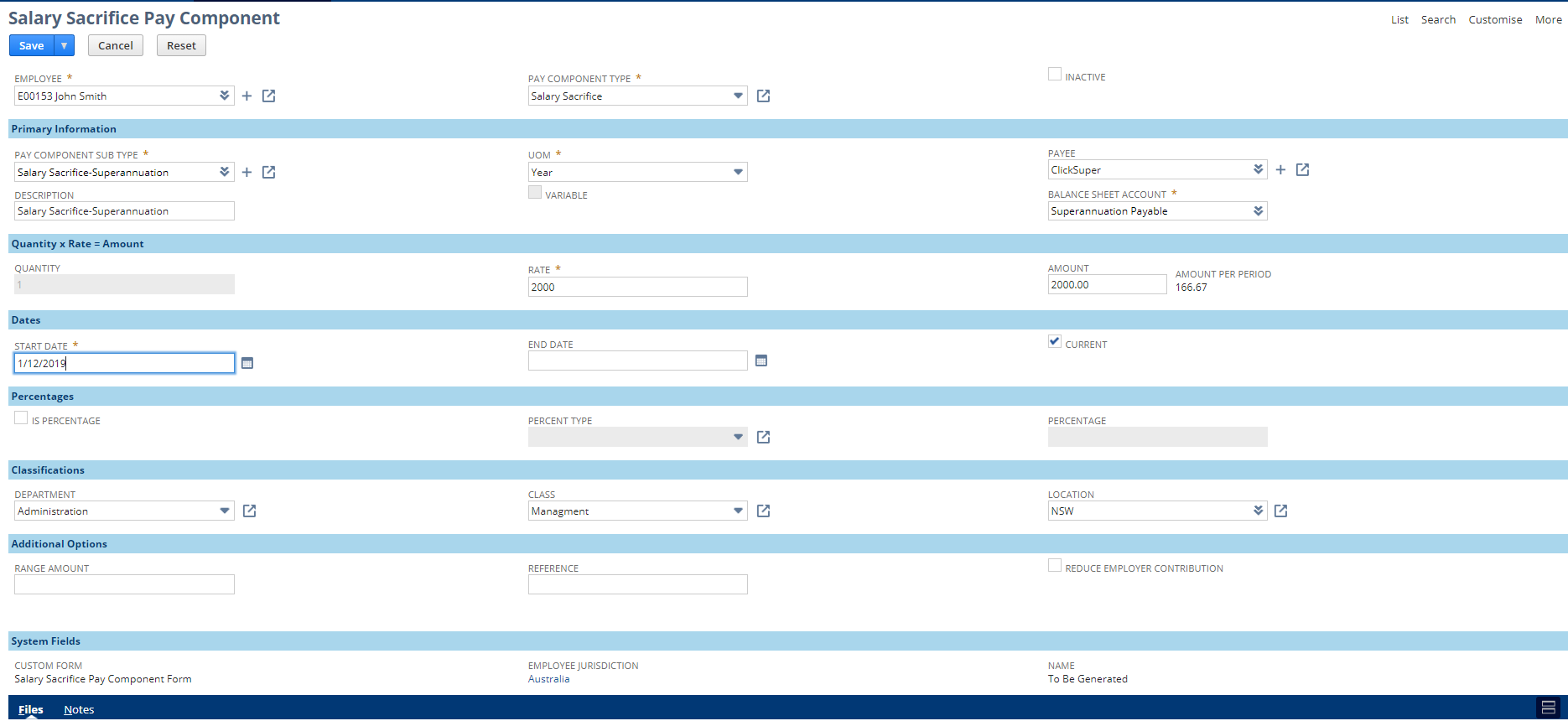

Salary Sacrifice Form

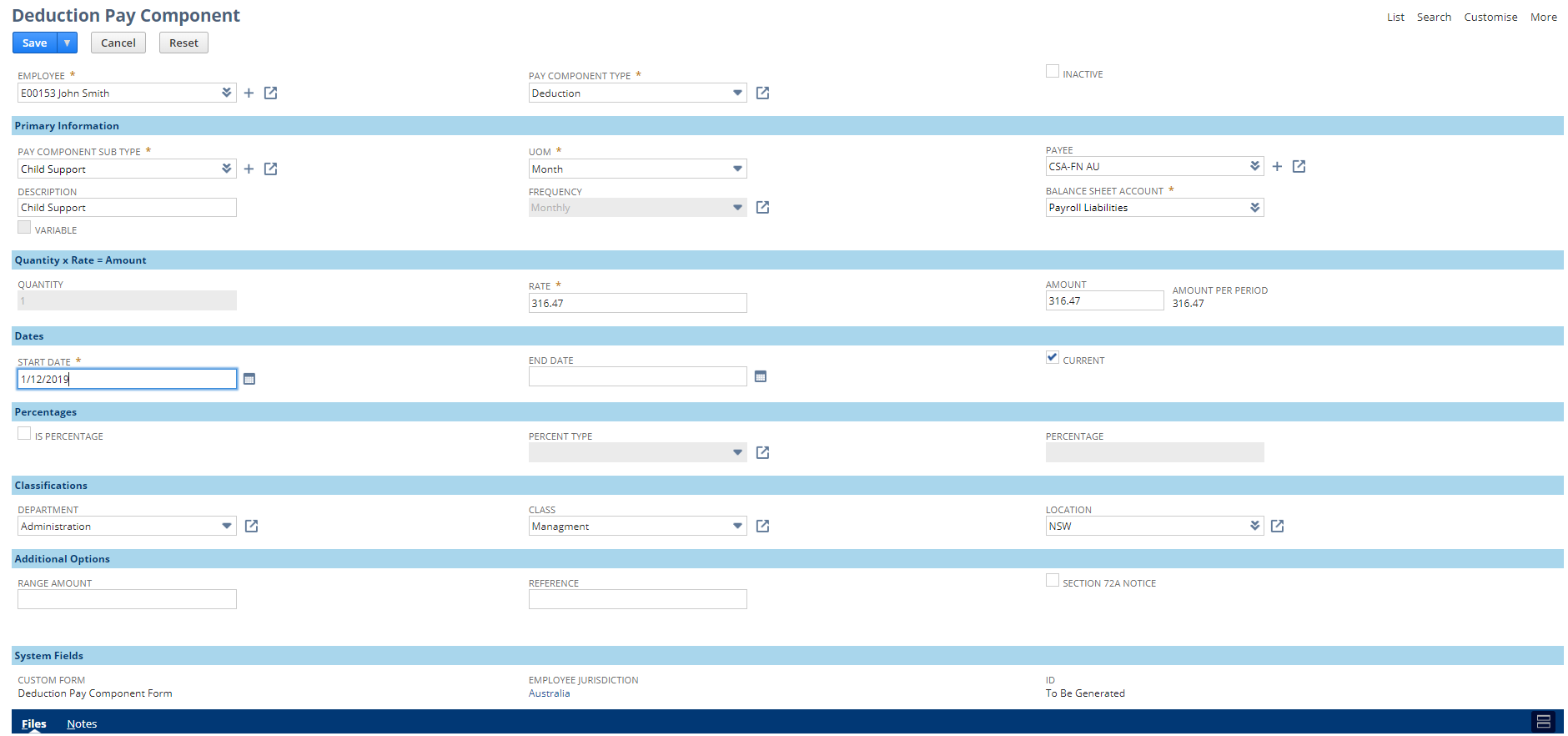

Deduction Form

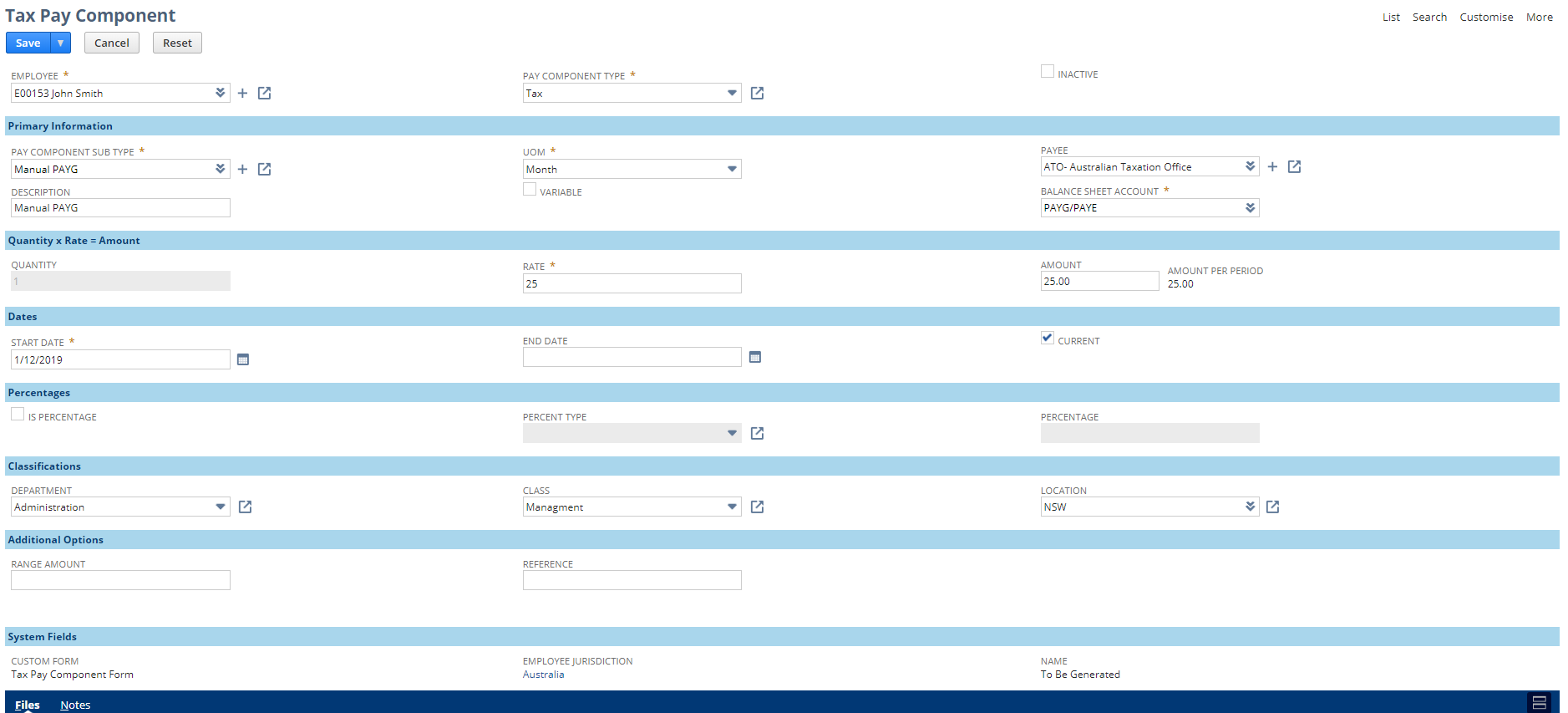

Tax Form

Pensions Form

New Pay Component Form