AU JobKeeper Additional Automation for Weekly Pay Frequency

1. Processing Back Pays for April:

- The system will now apply additional logic to back pays for April for weekly pay frequencies. You should have already completed steps 1-6 from our original JK automation article. AU JobKeeper Automation Update

- You should include ALL nominated employees who earned under $1500 for each fortnight in your back pay adjustments. Even if they were not paid in all the weeks that require back pay. This is because they should have been included and we need to review each week and top-up accordingly so their pay is minimally $1,500 per fortnight and they are taxed on a weekly basis.

- If you have already completed back pays for April for weeklies then you don't need to apply step 1 in this guide.

- If you want to work out your own top-ups and do in a single pay run then that is up to you. You may need to use our "IGNORE JOBKEEPER" checkbox when recalculating and also manually adjust an employees tax if you pay this in a lump sum. Check with the ATO for guidance https://www.ato.gov.au/

1a. Initiate Pay run:

The system should now automatically include any employees who are nominated in the pay run initiate screen even if they don't have timesheets to process. E.g. Casuals who are set as "Pay from NetSuite time" wouldn't normally show. All nominated weekly employees need to be processed in payroll for all weeks of the JobKeeper payment. If the employee has already received over $1500 per fortnight then there is no need to include them in an adjustment pay run. You can check this first with the employee pay summary report as below.

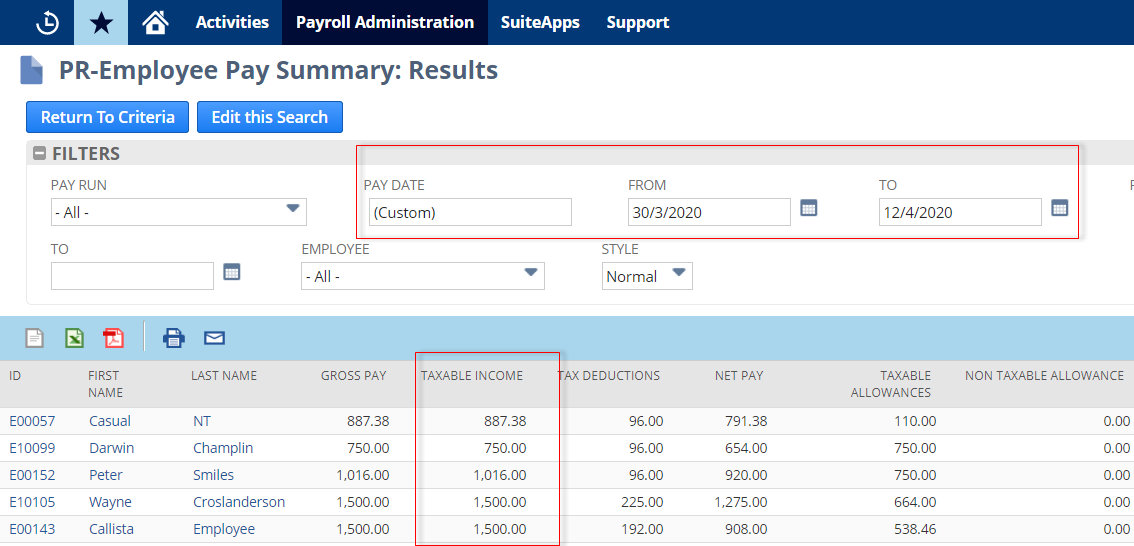

Employee Pay Summary

To review an employees taxable income in a defined period you can use the "Employee pay Summary" report from the Pay Reports menu. Set the "Pay Date" filter to match one of the ATO defined fortnights. Eg. 30/3/2020 - 12/4/2020 would be fortnight 01

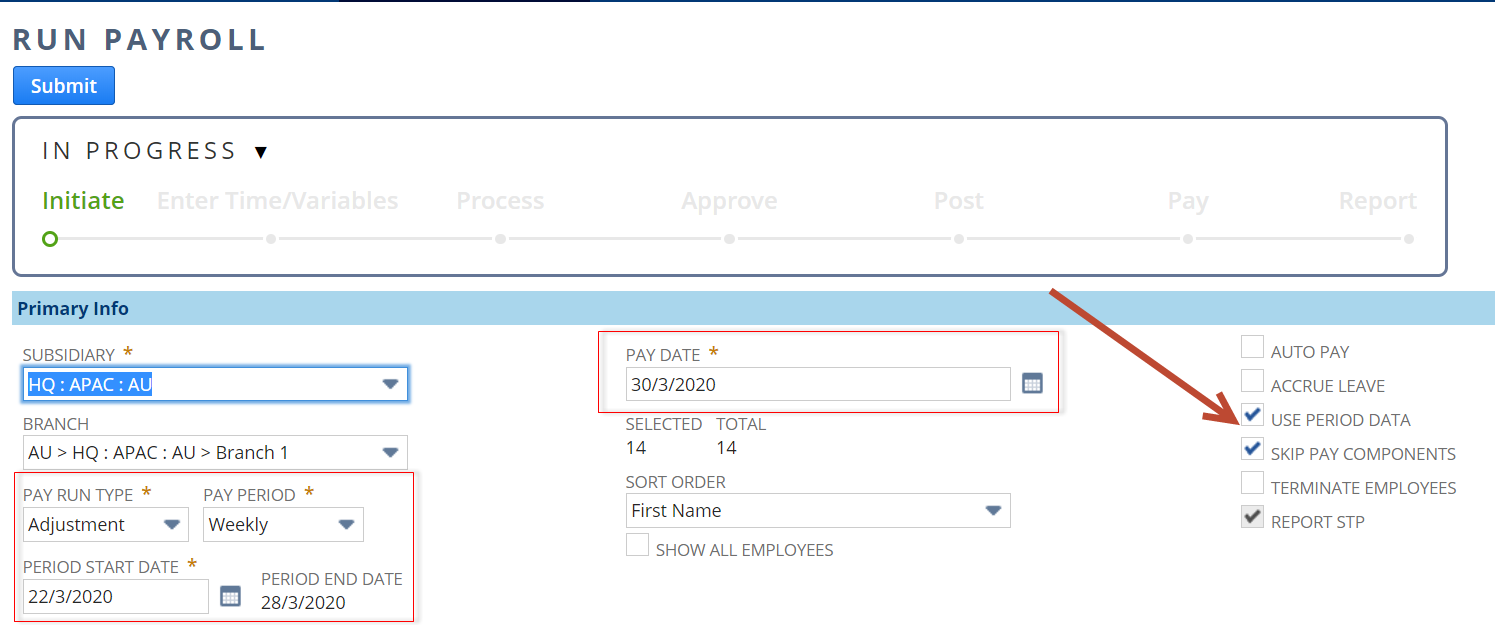

- Start Pay run as normal for the first week of the JobKeeper defined fortnights. IE. Any pay run with a pay date of 30/3/2020 to 5/4/2020. Pay particular attention to the following.

- Pay run type should be "Adjustment"

- The period start and end dates and pay date should exactly match the prior period already processed. (The period start and end date need to match so we do the incremental tax and super calcs correctly. The pay date needs to match so we can compare the pay to the ATO defined fortnights and top up accordingly. You will override the bank file date before you pay the pay run after the calculations occur)

- Untick "Accrue leave"

- Tick "Use period data" (This will ensure Tax and Super calcs are incremental)

- Tick "Skip Pay components"

- Check the list of employees and make sure you have everyone who needs a top up.

- Submit.

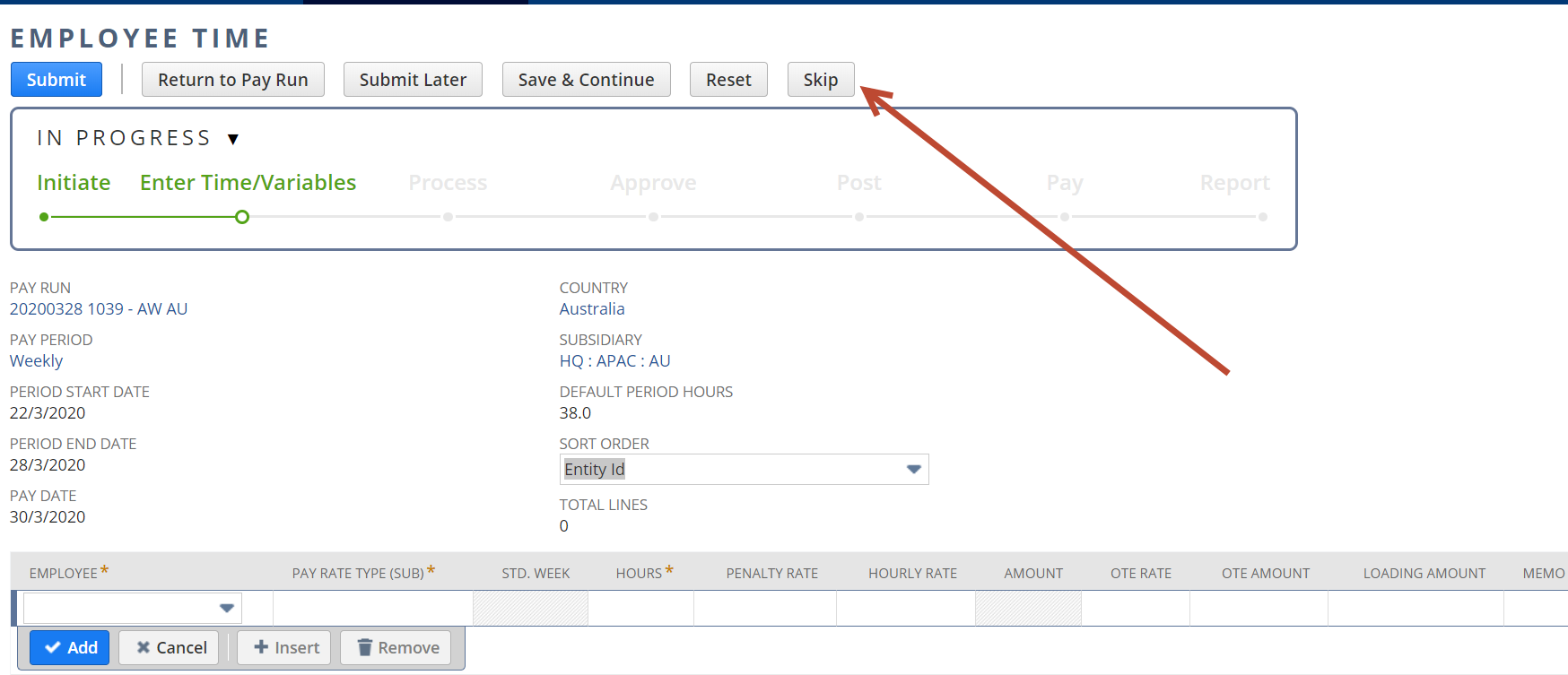

1b. Enter Employee time:

"Skip" this step....the employees Top-up will occur at "Process Payslips"

1c. Process Payslips:

Process payslips as normal for each period in the original order. The additional logic should create top-up's where required for each week of the fortnight. Please note the following.

- Any top-up that occurs in the first week of a fortnight will ensure the total fortnight pay is not over $1,500 already and the taxable income does not exceed $750 if a top-up is required. This ensures the weekly tax is as correct as possible.

| Week 1 Pay | Week 1 top-up adjustment | Week 2 pay | Week 2 top-up Adjustment | Comment | |

|---|---|---|---|---|---|

| Pay Date Range | 30/3/2020 - 5/4/2020 | 30/3/2020 - 5/4/2020 | 6/4/2020 - 12/04/2020 | 6/4/2020 - 12/04/2020 | ATO defined pay date ranges for Fortnight 01 |

Employee 1 | $0.00 | $750 | $0.00 | $750 | Employee not paid should get $750 per week |

| Employee 2 | $200 | $550 | $200 | $550 | Employee part paid under $750 per week so top-up occurs each week |

| Employee 3 | $900 | $0.00 | $500 | $100 | Employee part paid but under $1,500 for fortnight. |

| Employee 4 | $600 | $0.00 | $1,000 | $0.00 | Employee pay is already over $1,500 for period so not top-up occurs |

| Employee 5 | $0.00 | $0.00 | $1,600 | $0.00 | Employee pay is already over $1,500 for period so not top-up occurs |

- Review the payslips at "Approve Payslips" and proceed as normal with Posting Stage.

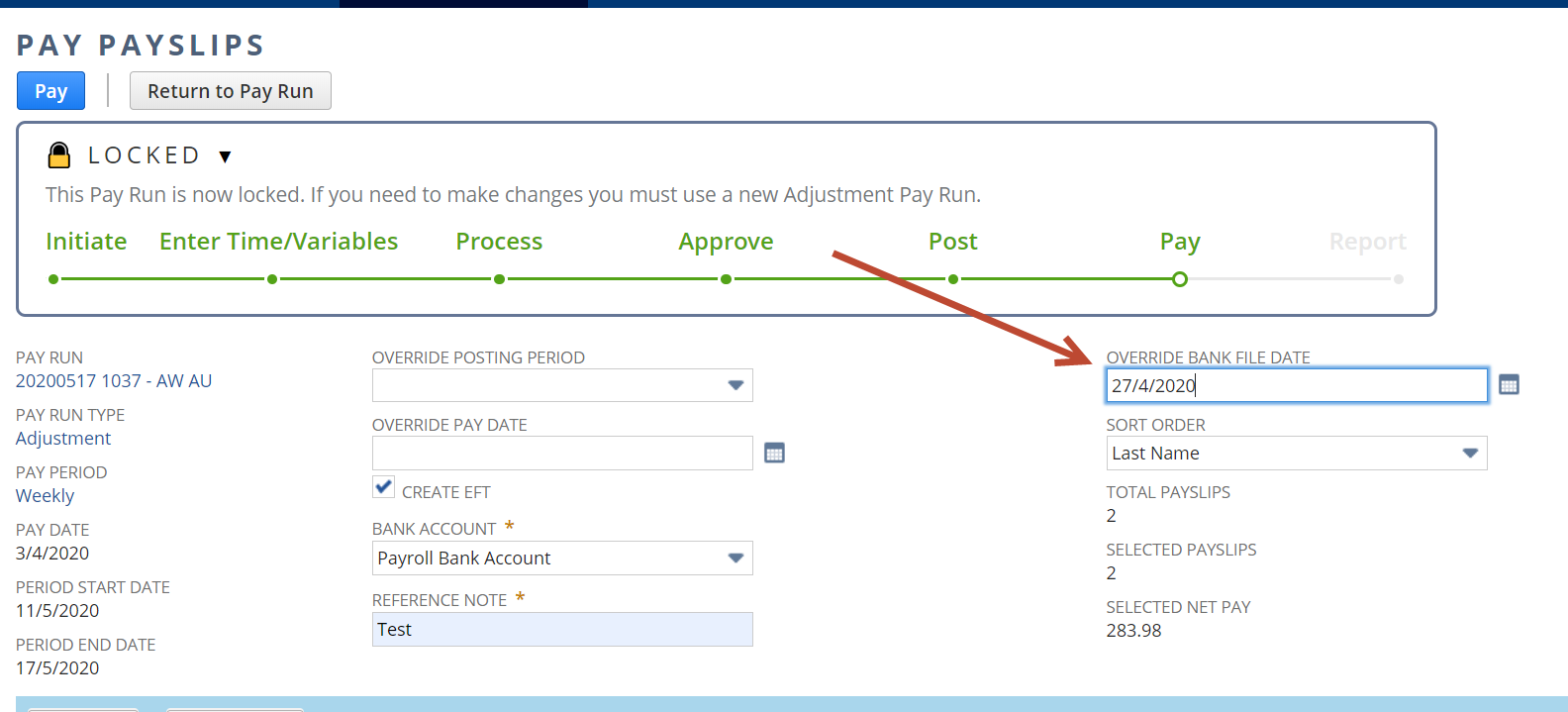

1d. Pay Pay run:

Because we set the pay date to match the original pay run (for calculation purposes) we now need to override that so we get the correct ABA. file and update the records to the correct pay date.

You need to:

- "Override Bank file Date" to the date you are actually paying (DO NOT OVERRIDE PAY DATE, this will cause issues with your future pay runs)

- Select Bank Account and reference note as normal

- "Pay"

- Compete pay run as normal including "Email payslips" as required.

1e. Repeat for each weekly pay run in April that requires back pay:

2. Normal Weekly Processing

- You should ensure you have completed any back pays for April as per step 1. above.

- The system will now apply additional comparative logic to processing for weekly pay frequencies. You should have already completed steps 1-6 from our original JK automation article. AU JobKeeper Automation Update

- You should include ALL nominated weekly employees in ALL your weekly pay runs. Even if they have no normal pay. This is because we need to review each week and top-up accordingly so their pay is minimally $1,500 per fortnight and they are taxed on a weekly basis.

2a. Initiate Pay run:

Ensure you include all nominated employees in each weekly pay run regardless if they have normal pay or not. Standard settings should apply.

2b. Enter Employee time:

Complete this step as normal. NB: Top-up will be added when processing payslips.

2c. Process Payslips:

Process payslips as normal for each period in the original order. The additional logic should create top-up's where required for each week of the fortnight. Please note the following.

- Any top-up that occurs in the first week of a fortnight will ensure the total fortnight pay is not over $1,500 already and the taxable income does not exceed $750 if a top-up is required. This ensures the weekly tax is as correct as possible.

Example below.

| Week 5 Pay | Week 5 top-up | Week 6 pay | Week 6 top-up | Comment | |

|---|---|---|---|---|---|

| Pay Date Range | 27/04/2020 - 03/05/2020 | 27/04/2020 - 03/05/2020 | 04/05/2020 - 10/05/2020 | 04/05/2020 - 10/05/2020 | ATO defined pay date ranges for Fortnight 03 |

Employee 1 | $0.00 | $750 | $0.00 | $750 | Employee not paid should get $750 per week |

| Employee 2 | $200 | $550 | $200 | $550 | Employee part paid under $750 per week so top-up occurs each week |

| Employee 3 | $900 | $0.00 | $500 | $100 | Employee part paid but under $1,500 for fortnight. |

| Employee 4 | $1600 | $0.00 | $0.00 | $0.00 | Employee pay is already over $1,500 for period so not top-up occurs |

| Employee 5 | $600 | $150 | $1,000 | -$150 | Employee pay goes over $1,500 for period so top-up from first week is reversed in second week |

- Review the payslips at "Approve Payslips" and proceed as normal with all other stages.