AU JobKeeper Automation Update

1. Request Update:

- Email support@infinetcloud.com and request update "20.1.03" either immediately or specify a desired time during the working day or overnight. You will need to be out of payroll when the update is running.

- This is full bundle update and will take approx 15-30 minutes. We will notify you when the update is complete.

- Usual bundle update actions apply.

- There is now a new menu option at the bottom of the list that should assist you in managing this requirement

2. Decide if you will pay Super on the top-up:

First you need to decide if you will pay Super on the top-up amounts. It will be up to the employer if they want to pay superannuation on any additional wage paid because of the JobKeeper Payment. For employees who are paid normally (over $1,500 per fortnight equivalent) you must continue to pay Super as normal even if you are claiming the JobKeeper subsidy for them.

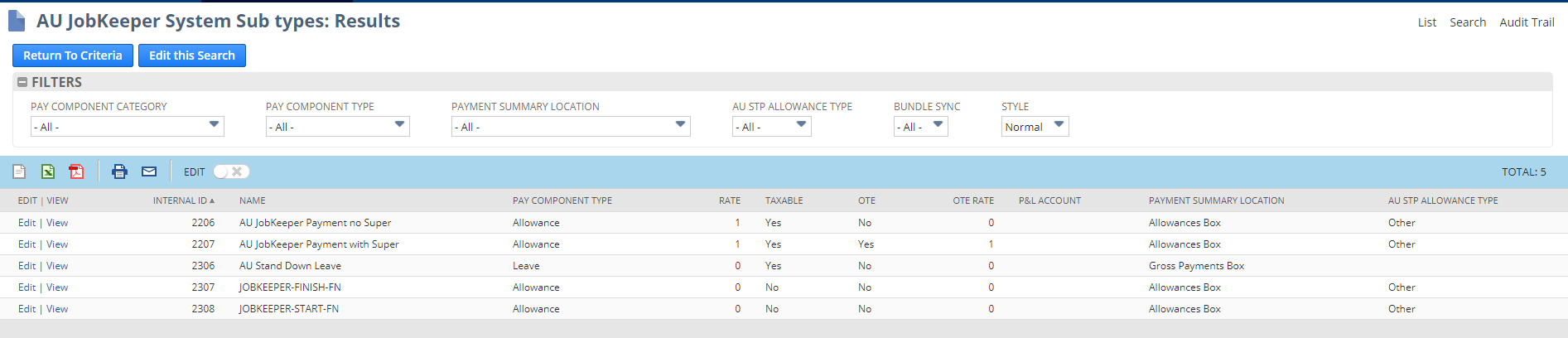

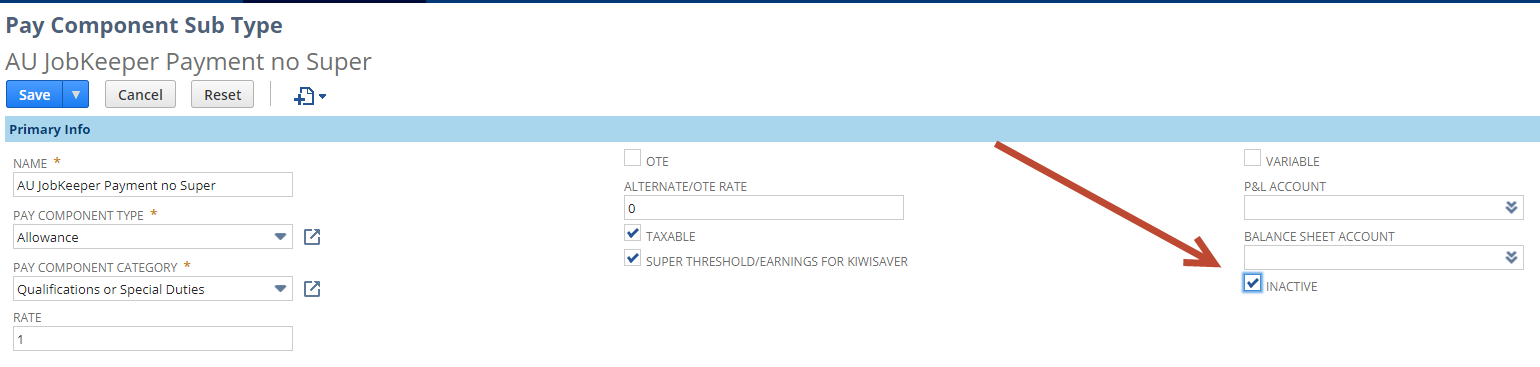

- Navigate to Payroll Administration > JobKeeper (AU) > AU JobKeeper System Sub types: Results : This is the list of system created sub types for this measure.

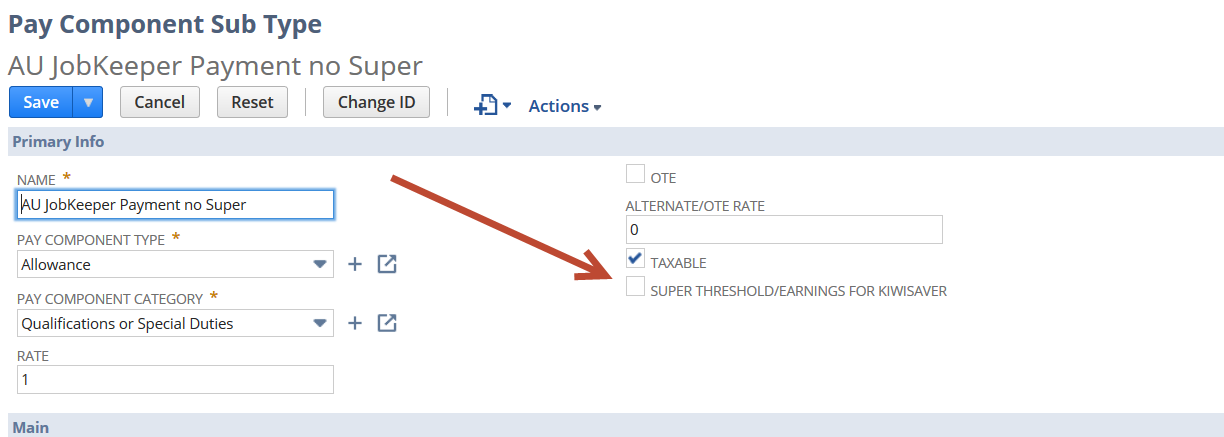

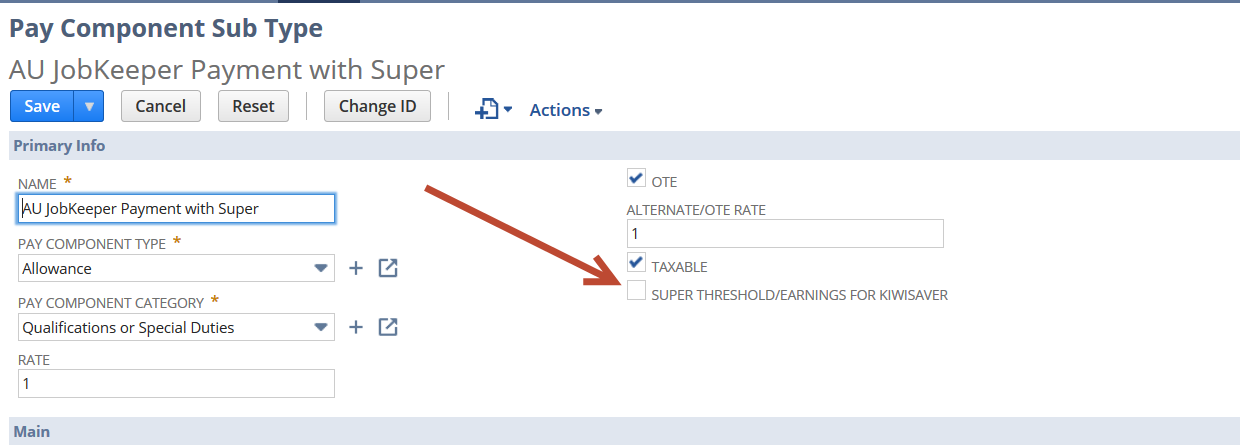

- Select and edit the subtype you wish to use. (Either "AU JobKeeper Payment no Super" or "AU JobKeeper Payment with Super")

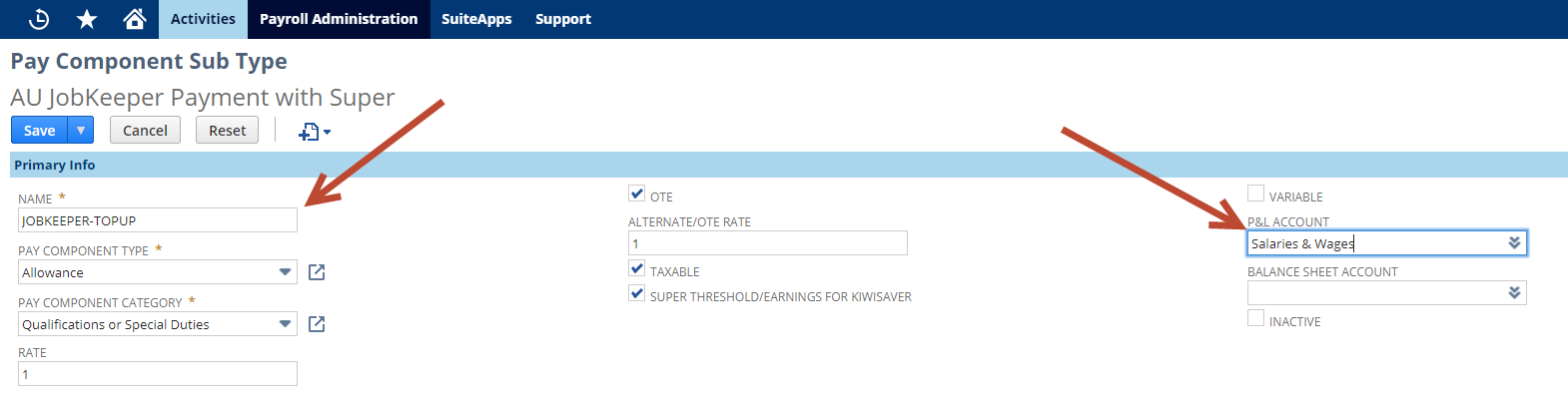

- Change the name to JOBKEEPER-TOPUP and select your preferred "P&L account". Save.

- Make the OTHER subtype inactive so as not to cause confusion and save. DO NOT MAKE THE SUB TYPE YOU HAVE RENAMED INACTIVE

If for some reason you are paying Super on the top-up for some employees but not others, please contact support@infinetcloud.com with details to discuss best solution.

3. Update Nominated employees:

You can run the search "AU JobKeeper Employee Eligibility Review: Results" from the JobKeeper (AU) menu. If you don't see employees in this search that you expect to nominate then you may need to update them as below.

The search is just a guide based on our best understanding of the criteria.

If you have employees that are not meant to be there then you need to ensure they are not updated in Step 4. Or you can update the employee first...maybe they need a termination date or should be inactive?

If someone is not on the list and you want to nominate them then you can either review the employee record to see what is different from the others and update accordingly or you can manually set the field in Step 4 on the tax info tab.

NB: It is entirely your responsibility to ensure the criteria you use is correct for your organisation. You may have custom employment statuses or variations such as contractors who are employees, you will need to update the criteria accordingly to ensure your nominated employees are updated. Contact support with full details if you need assistance with this.

The system is currently unable to determine this requirement for casuals.

"Casual employees are not eligible unless they were employed by you on a regular and systematic basis for at least 12 months as at 1 March 2020."

To assist you with this criteria we have added a search to the JobKeeper (AU) menu called "AU JobKeeper Casual Payslip Review: Results" This search shows the number of payslips and total taxable income for your eligible casuals since 1/3/2019.

You may need to update any employees you have nominated so they can be processed in payroll. This step only applies to employees who are no longer processed in payroll. E.g. You may have employees who are inactive or terminated but are eligible for this measure and you have chosen to re-hire them.

- Find the employee record and reverse the changes that would prevent the employee from being processed in payroll.

- Ensure they are not "Inactive" (System info tab of the employee record)

- Ensure they have the correct "Payroll employment status" (Payroll tab of the employee record)

- Ensure they have the correct "Pay Frequency" (Payroll tab of the employee record)

- Ensure their "termination date" has been removed. (HR tab of the employee record)

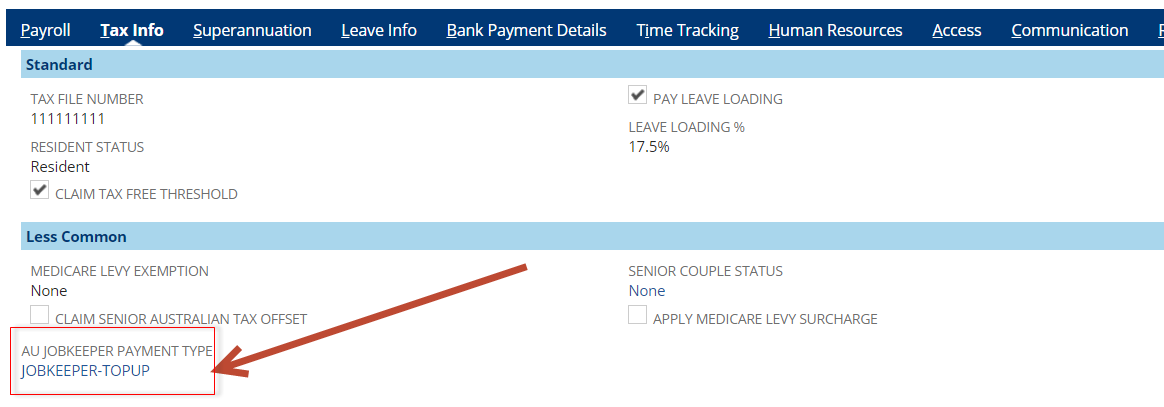

4. Identify Nominated employees via mass update:

Now we need to identify all nominated employees by using a mass update to set the sub type from Step 2. above on the tax info tab of the employee record. This tells the system you intend to claim the JobKeeper payment subsidy for this employee and allows us to automate the STP reporting and top-up payment. This is the most important step in identifying who you are claiming the subsidy for. We have created a new field on the tax info tab of the employee record. You can set this manually for nominated employees or run a mass update as below.

- Employees earning over $1500 per fortnight equivalent are paid normally so there is no top-up payment required. However we still need to update them to identify them as nominated employees and select a top-up sub type in case their pay drops below $1,500 per fortnight equivalent. This ensures any changes that may occur in their pay over the 13 fortnights of the JobKeeper payment are catered for in advance.

- To clarify, ALL NOMINATED EMPLOYEES you wish to claim the subsidy for must have a top-up sub type set on the tax info tab to identify them as one of your nominated employees. This is our primary identification mechanism for STP reporting. This is regardless of if they will need a top-up payment currently or not.

NB: It is entirely your responsibility to ensure the criteria you use is correct for your organisation. You may have custom employment statuses or variations such as contractors who are employees, you will need to update the criteria accordingly to ensure your nominated employees are updated. Contact support with full details if you need assistance with this.

The system is currently unable to determine this requirement for casuals.

"Casual employees are not eligible unless they were employed by you on a regular and systematic basis for at least 12 months as at 1 March 2020."

To assist you with this criteria we have added a search to the JobKeeper (AU) menu called "AU JobKeeper Casual Payslip Review: Results" This search shows the number of payslips and total taxable income for your eligible casuals since 1/3/2019.

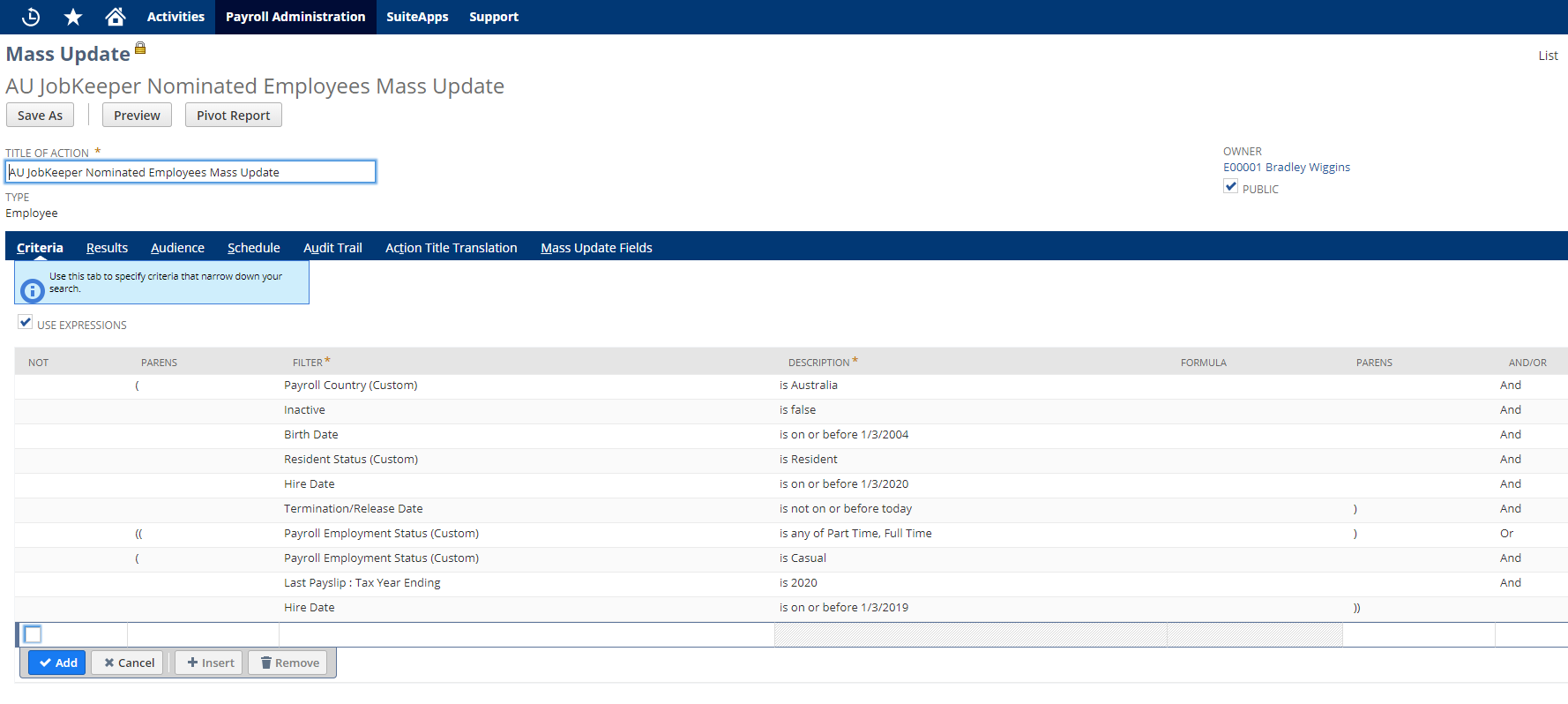

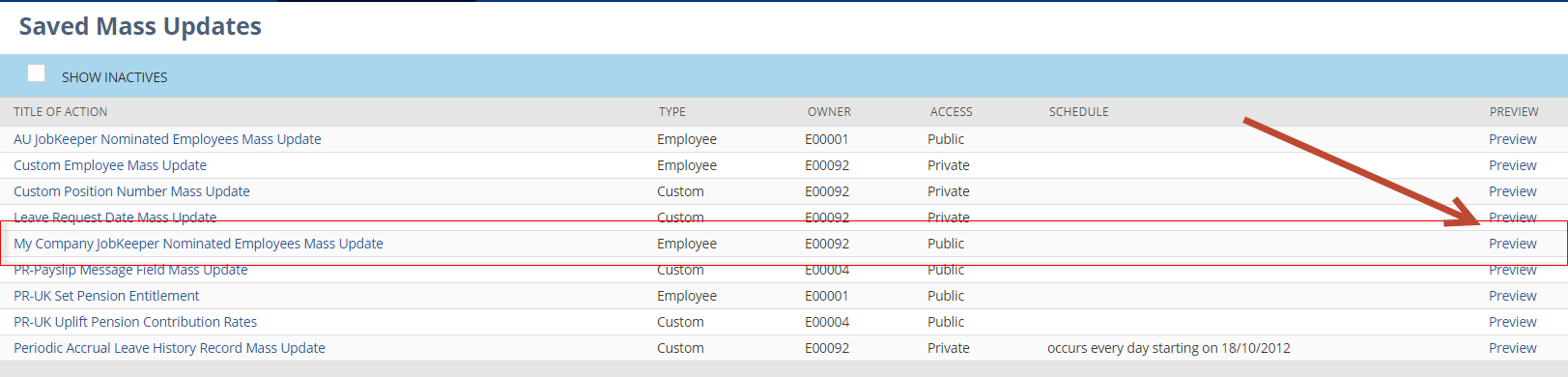

- Navigate to Payroll Administration > JobKeeper (AU) > AU JobKeeper Nominated Employees Mass Update: This mass update template replicates the employee eligibility criteria as closely as we can currently. https://www.ato.gov.au/General/JobKeeper-Payment/Employers/Your-eligible-employees/

- Rename the mass update for your organisation.

- Update criteria as required.

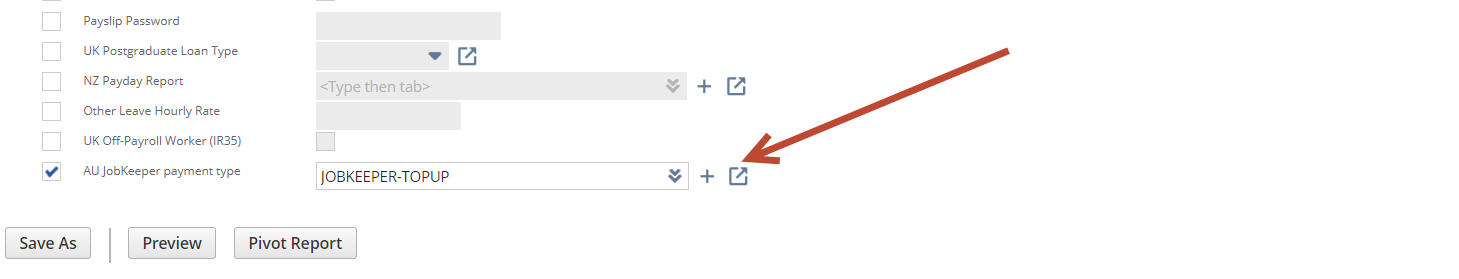

- On the "mass update fields" tab, select your JOBKEEPER-TOPUP sub type.

- "Save As"

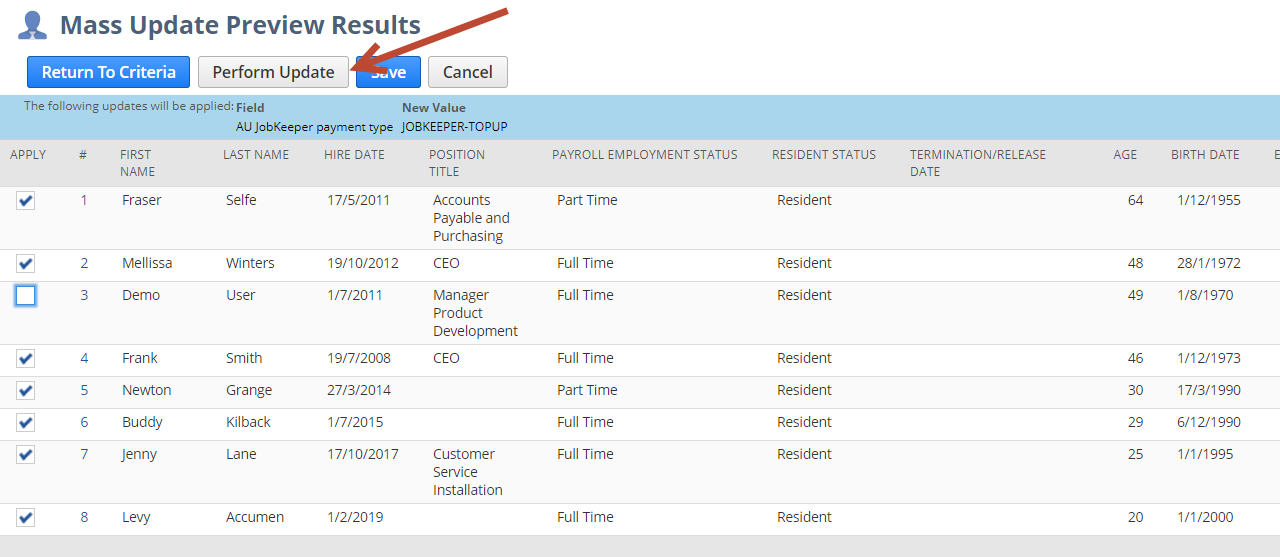

- On the "Saved mass updates" page. Find your company mass update and Click "Preview'

- Review the list and ensure this matches your expectation for your nominated employees. Unselect any employees you do not wish to claim the subsidy for.

- Click "perform update" when satisfied and allow the mass update to run. Your employees should now be updated and you can review nominated employees via the JobKeeper (AU) menu option. "AU JobKeeper Nominated Employees: Results "

- You can manually update anyone who does not appear in your "AU JobKeeper Nominated Employees: Results "

- If you have payroll employee's who are NetSuite Administrator's then ideally this update should be run by a NetSuite Administrator. If you are unable to do this then those employees will need to be manually updated by someone with the NetSuite Administrator role.

5. Review Salary Sacrifice:

You may need to review and remove any Salary Sacrifice from any employee whose taxable income may be impacted by any top-up payment. This would be anyone getting a top-up or whose Salary Sacrifice could cause the Taxable income to fall below $1,500 per fortnight equivalent. Contact ATO for guidance if you are unsure how this may impact top-up processing.

Updated 22/04/2020

To clarify the point above. Currently the system is unable to factor in Salary Sacrifice so it could result in an employee being paid twice for the top up IF the Salary Sacrifice reduced the taxable income below $1500 equivalent. If you are not happy with any of our calculations or results then you are able to make manual adjustments and recalculate with "IGNORE JOBKEEPER" ticked. We may add additional automation on this point in the future.

https://treasury.gov.au/sites/default/files/2020-04/JobKeeper_frequently_asked_questions_2.pdf

I CURRENTLY HAVE A SALARY SACRIFICE ARRANGEMENT WITH MY EMPLOYER. CAN IT CONTINUE?

Yes. The JobKeeper Payment may be paid to an employee in cash or as a fringe benefit or an extra superannuation contribution where the employee and employer agree.

6. Stand Down Leave:

Ensure any employees are on Stand down leave requests if appropriate. Stand Down Leave Setup

7. Process Payroll:

WEEKLY PAY FREQUENCIES

Process payroll as normal with the following understandings:

- Initiate Pay run : The system should now automatically include any employees who are nominated in the pay run initiate screen even if they don't have timesheets to process. E.g. Casuals who are set as "Pay from NetSuite time" wouldn't normally show. All nominated employees need to be processed in payroll for all periods of the JobKeeper payment.

- Process Payslips : When payslips are processed, the system will automatically create a top-up payslip detail for those employees with a taxable income below $1,500 per fortnight equivalent. IE $750 weekly and $3,250 Monthly. The top-up will be reported via STP as "JOBKEEPER-TOPUP" and the relevant YTD amount. NB: The system will apply this on a per pay run basis. There is no comparison to see if the payment has already been applied in a period. This would complicate things significantly and would delay this automation. It is your responsibility to ensure the top-up has been applied correctly for your employees.

- Recalculate : If for any reason including multiple pay runs in a period where the top up has already been applied, you can delete or adjust the top-up line created and then recalculate with "IGNORE JOBKEEPER" ticked. This will prevent any further automation and preserve your changes.

- JOBKEEPER-START-FN : When payslips are processed for the first time after the automation and you have updated your employees, the system will also create the JOBKEEPER-START-FN payslip detail. This is the key STP reporting requirement for you to notify ATO you are claiming the subsidy for each employee. It will only be created once.

NB: By default we will set the JobKeeper Start fortnight to "01" for all employees. (This is not visible on the Payslip detail itself other than the reportable date falling within the defined periods below) If you are NOT claiming for an employee from the first fortnight onwards then you can update the relevant STP reporting by changing the "reportable date" on the payslip detail to a date within the applicable fortnight as per the table below.

If you want to adjust the JOBKEEPER START FN for any employee you should do so before the STP for that pay run is submitted.

You can find a list of all employees Start fortnight payslip details and their reportable dates in the JobKeeper (AU) Menu . "AU JobKeeper Start Fortnight Payslip Details: Results"

So, you should review the JobKeeper (AU) Menu > "AU JobKeeper Start Fortnight Payslip Details: Results" after you have processed payslips and before you approve the pay run. Edit and adjust the reportable date to the relevant FN you wish to claim for. Then proceed as normal.

The Start Fortnight is the fortnight from which you wish to claim the subsidy. Not the first fortnight you paid the employees in. Most people will claim from the first fortnight even if they didn't get to pay their employees till a later fortnight. But you still need to pay your employees for every fortnight you are claiming.

Eg. You may not be able to pay your employees for the first fortnight until later in April. This is ok for April payments. ATO says:

- For the transition into the JobKeeper payment, the employer can retrospectively apply this payment for paydays on or after 30 March by the end of April (NB now extended to 8th of May 2020)

M | T | W | T | F | S | S | |

April | Fortnight 01 (30 March – 12 April) | ||||||

30 | 31 | 1 | 2 | 3 | 4 | 5 | |

6 | 7 | 8 | 9 | 10 | 11 | 12 | |

Fortnight 02 (13 April – 26 April) | |||||||

13 | 14 | 15 | 16 | 17 | 18 | 19 | |

20 | 21 | 22 | 23 | 24 | 25 | 26 | |

Fortnight 03 (27 April – 10 May) | |||||||

27 | 28 | 29 | 30 | 1 | 2 | 3 | |

May | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

Fortnight 04 (11 May – 24 May) | |||||||

11 | 12 | 13 | 14 | 15 | 16 | 17 | |

18 | 19 | 20 | 21 | 22 | 23 | 24 | |

Fortnight 05 (25 May to 7 June) | |||||||

25 | 26 | 27 | 28 | 29 | 30 | 31 | |

June | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

Fortnight 06 (8 June to 21 June) | |||||||

8 | 9 | 10 | 11 | 12 | 13 | 14 | |

15 | 16 | 17 | 18 | 19 | 20 | 21 | |

Fortnight 07 (22 June to 5 July) | |||||||

22 | 23 | 24 | 25 | 26 | 27 | 28 | |

29 | 30 | 1 | 2 | 3 | 4 | 5 | |

July | Fortnight 08 (6 July to 19 July) | ||||||

6 | 7 | 8 | 9 | 10 | 11 | 12 | |

13 | 14 | 15 | 16 | 17 | 18 | 19 | |

Fortnight 09 (20 July to 2 August) | |||||||

20 | 21 | 22 | 23 | 24 | 25 | 26 | |

27 | 28 | 29 | 30 | 31 | 1 | 2 | |

August | Fortnight 10 (3 August to 16 August) | ||||||

3 | 4 | 5 | 6 | 7 | 8 | 9 | |

10 | 11 | 12 | 13 | 14 | 15 | 16 | |

Fortnight 11 (17 August to 30 August) | |||||||

17 | 18 | 19 | 20 | 21 | 22 | 23 | |

24 | 25 | 26 | 27 | 28 | 29 | 30 | |

Fortnight 12 (31 August to 13 September) | |||||||

Sept | 31 | 1 | 2 | 3 | 4 | 5 | 6 |

7 | 8 | 9 | 10 | 11 | 12 | 13 | |

Fortnight 13 (14 September to 27 September) | |||||||

14 | 15 | 16 | 17 | 18 | 19 | 20 | |

21 | 22 | 23 | 24 | 25 | 26 | 27 | |

End of Subsidy | |||||||

28 | 29 | 30 | 1 | 2 | 3 | 4 | |

8. Manually Top-Up for Terminations:

Termination payslips will not be adjusted automatically for the top-up. The system will not check if the employee has already received the top-up in another pay run so you must manually add any top-up amount to a termination payslip using your JOBKEEPER-TOPUP sub type if applicable.

9. Manually add Finish Fortnight to Terminations:

When an employee terminates you will also need to add a payslip detail to the termination payslip to notify the ATO via STP of the final fortnight that you are claiming the JobKeeper subsidy for them. The sub type you need to use is JOBKEEPER-FINISH-FN.

You DO NOT need to change the description to include the fortnight number, the reportable date determines that. The amount should be 0.00. You can select this Allowance and add to any termination payslip.

By default the JOBKEEPER-FINISH-FN payslip detail will be created with the same reportable date as the pay date of the pay run.

If you DO NOT wish to claim the JobKeeper for the fortnight in which you are terminating the employee then you can review and edit the reportable date to be in the relevant fortnight. So if you wish to claim up to fortnight 03 your reportable date should be within fortnight 03 eg. (27 April – 10 May)

If you did not add it to the actual termination you processed then you will need to create it manually from the employee record as follows

Navigate to the employee record > payroll tab > payslip detail sub tab

New YTD Payslip Detail button. Click on this button and set the following:

Type is Allowance

Sub Type is JOBKEEPER-FINISH-FN

Amount is $0

Tax Year Ending is 2020

Reportable Date is a date within the ATO's Fortnights that reflects the LAST fortnight you are claiming for this employee

Make sure the Branch field is populated

Then Save.

Then you need to send an Update Event for this employee.

https://support.infinetcloud.com/pages/viewpage.action?pageId=8716411

You can then view and access these payslip detail in the JobKeeper (AU) menu, "AU JobKeeper Finish Fortnight Payslip Details: Results"

Fortnight 01 (30 March – 12 April) | ||||||

30 | 31 | 1 | 2 | 3 | 4 | 5 |

6 | 7 | 8 | 9 | 10 | 11 | 12 |

Fortnight 02 (13 April – 26 April) | ||||||

13 | 14 | 15 | 16 | 17 | 18 | 19 |

20 | 21 | 22 | 23 | 24 | 25 | 26 |

Fortnight 03 (27 April – 10 May) | ||||||

27 | 28 | 29 | 30 | 1 | 2 | 3 |

4 | 5 | 6 | 7 | 8 | 9 | 10 |

Fortnight 04 (11 May – 24 May) | ||||||

11 | 12 | 13 | 14 | 15 | 16 | 17 |

18 | 19 | 20 | 21 | 22 | 23 | 24 |

We will then report this to the ATO including the fortnight number based on the reportable date of the pay run + 1 fortnight. The ATO require we report it this way.

So if you are claiming for fortnight 01, 02, 03 and the employee terminates in fortnight 03 (based on reportable date/pay date of the termination payslip) we will report fortnight 04. In the STP submission it will be reported as JOBKEEPER-FINISH-FN04. Remember that the fortnights are based on the ATO defined periods displayed above in section 7 of this guide.

10. Manually adjust for multiple pay runs in a period:

The system will not compare existing pay runs in a fortnightly period. Each pay run will be treated as a standalone and the top-up added automatically if the taxable income is below $1,500 per fortnight equivalent. So if the employee has already received a top-up in a prior pay run within the ATO defined fortnights as per the table above, then you will need to delete the line created and recalculate with "IGNORE JOBKEEPER" ticked.

WEEKLY PAY FREQUENCIES

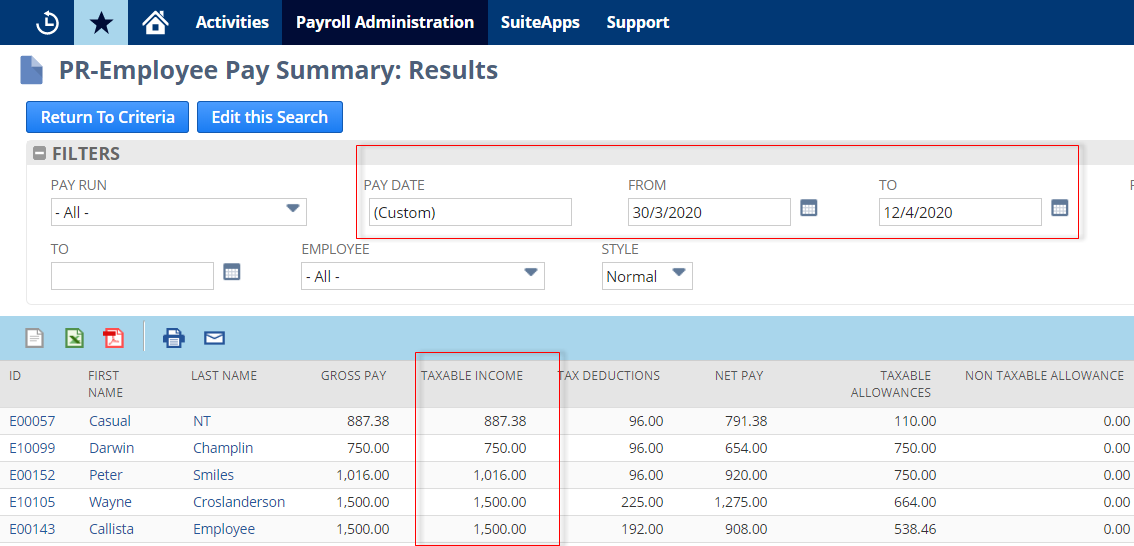

Employee Pay Summary

To review an employees taxable income in a defined period you can use the "Employee pay Summary" report from the Pay Reports menu. Set the "Pay Date" filter to match one of the ATO defined fortnights. Eg. 30/3/2020 - 12/4/2020 would be fortnight 01

11. Contact support if you have attempted your own solution:

Please contact support@infinetcloud.com and fully explain your situation if you have already paid your employees using your own sub types prior to this update or have attempted to add Start/Finish fortnights manually. We should be able to guide you on the best resolution.