Pay Payroll Vendors : Superfunds and ATO using Liability Accounts from Journals

There are many different ways to pay your Payroll Vendors out of NetSuite. This page provides instructions for paying the ATO and and Superfund vendors using Bill Payments in NetSuite. The same principal can be applied for any other payroll vendor.

The liabilities needed to use this method are created during the Pay Run process.

- Depending on whether you want to pay the ATO or a Superfund then you will need to run a different report.

- For Superfunds, navigate to Payroll Administration > Australia > Super : Reconcile Payslip Details

- For the ATO, navigate to Payroll Administration > Pay Reports > PR-Employee Pay Summary Results

- For Superfunds, navigate to Payroll Administration > Australia > Super : Reconcile Payslip Details

- You will need to recall the figures presented later, so either make sure you leave the report (browser tab) open or record the figures

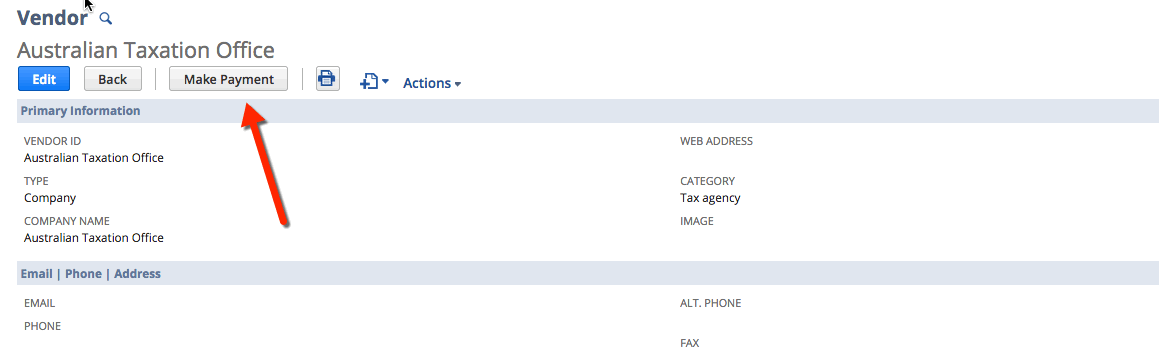

- In a new tab, go to the ATO or the Superfund vendor record you'd like to pay

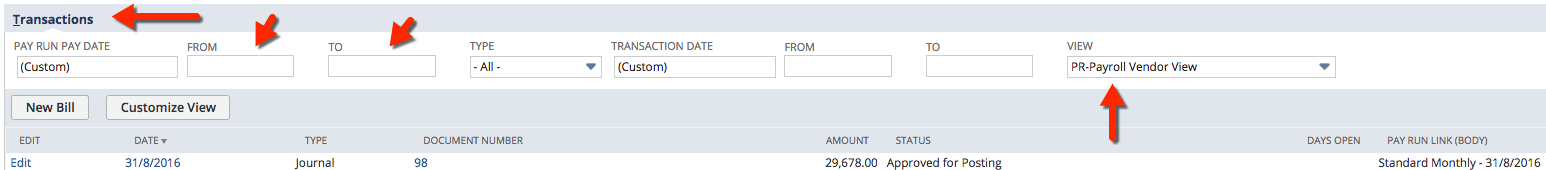

- Click on the Financials tab and scroll down to look at Transactions sublist

- Change the View dropdown to PR-Payroll Vendor View

- You may then need to refresh your page and go back to the Financials tab and Transactions sublist to display the date range fields

- You may then need to refresh your page and go back to the Financials tab and Transactions sublist to display the date range fields

- Change the Pay Run Pay Date dropdown (and From and To dates) to the period you wish to display the journals for. E.g. last fiscal quarter, or enter a specific date range.

- This should display all the journals created for that period and the amount that you will need to pay to ATO in PAYG or the Superfund. Cross reference this to the report you ran earlier - the amounts should match.

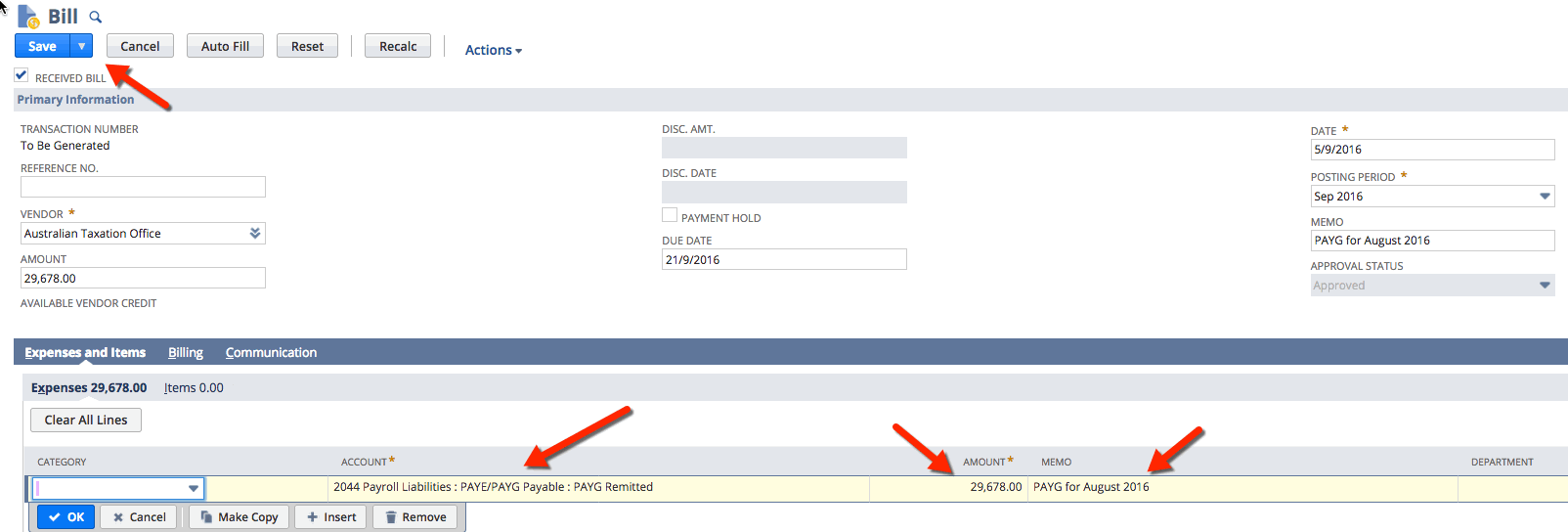

- Select Create New Bill and complete the Bill details, including:

- Account - choose the Superannuation/PAYG (remitted) Liability Account (this account is reduced with the bill creation)

- Amount - to be paid to the ATO or Superfund

- Also enter a Memo for your reference. E.g. PAYG/Super July-Sept Quarter,

- Save the bill

- You can now select Make Payment and enter the payment date and company bank account