AU JobKeeper Start and Finish Fortnight corrections

If the incorrect data has not been sent to the ATO via STP then you can simply change the existing data before you submit your pay run for STP or do an update event. Please take care to ensure you understand how Start and Finish fortnights are reported before making any changes. AU JobKeeper Start and Finish Fortnights

ATO says: "This design does not support multiple corrections, so extreme caution should be taken to ensure accuracy of originally reported JobKeeper data. This critical detail is used to determine reimbursement to the employer"

So take your time and don't send an update event unless you are sure the solution is correct.

1. Start Fortnight Corrections:

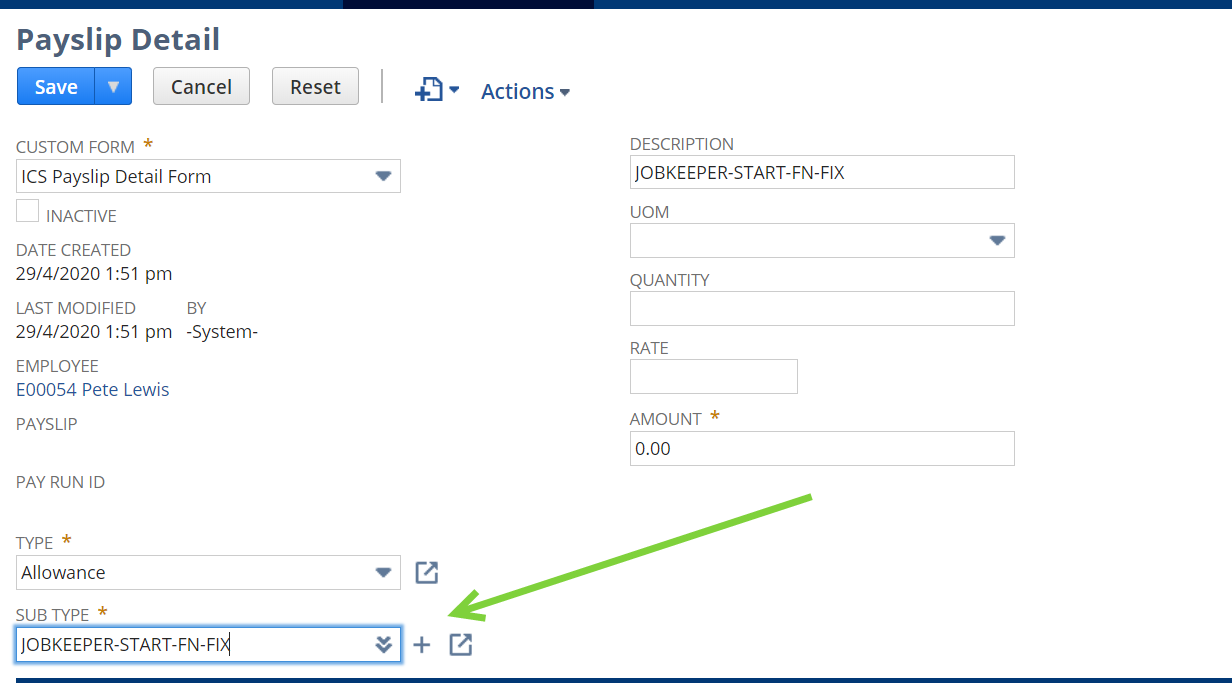

All accounts have now been updated with additional sub types that may be used in some of the situations below. The sub type that may need to be used for some of the corrections to start fortnights is JOBKEEPER-START-FN-FIX

1a. Wrong Employee:

- ATO says: "If the wrong employee was reported as eligible via the use of the JOBKEEPER-START-FNXX, then cancel this employee from eligibility via the use of matching JOBKEEPER-FINISH-FNXX where the “XX” fortnights are the same (cancellation via matching start/finish fortnights). "

- Our solution: Find the incorrect JOBKEEPER-START-FN payslip detail and change the sub type only from JOBKEEPER-START-FN to JOBKEEPER-START-FN-FIX. save and send an Update event. In the STP submission we will recognise this and send a matching JOBKEEPER-FINISH-FN. The ATO already has the incorrect JOBKEEPER-START-FN so the JOBKEEPER-START-FN-FIX tells us the start was incorrect so we send a JOBKEEPER-FINISH-FN to match and cancel it at the ATO end. Our solution saves you from having to create another payslip detail for the JOBKEEPER-FINISH-FN.

1b. Incorrect Start FN (Later):

- ATO says: "If a later start fortnight is incorrectly reported, report an additional earlier start fortnight. ATO will assume the earliest start fortnight is relevant where no unmatched finish fortnight is reported. For example: reported JOBKEEPER-START-FN02 but should have been JOBKEEPER-START-FN01"

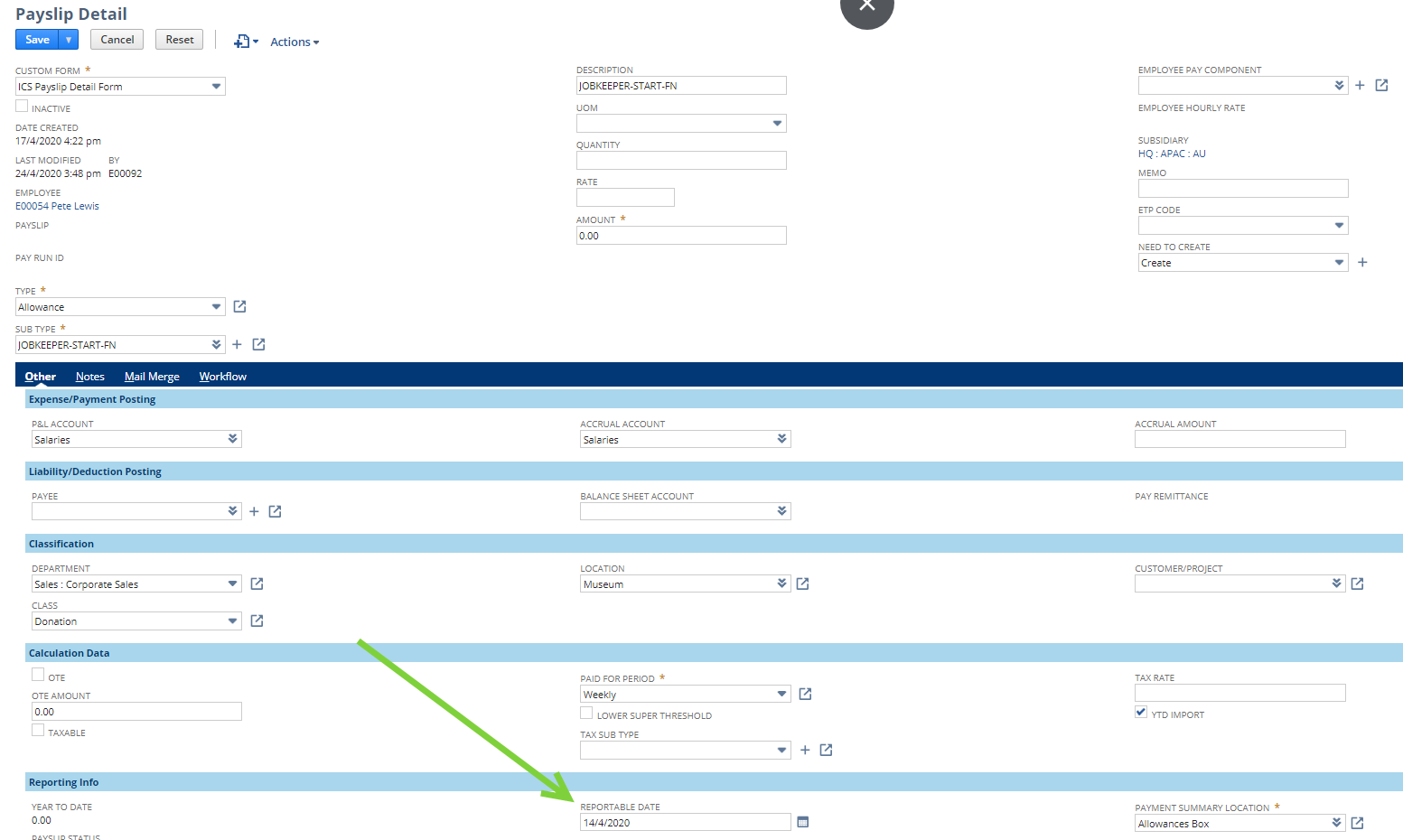

- Our solution: Simply edit and change the reportable date on the existing JOBKEEPER-START-FN payslip detail to a date within the earlier fortnight, save and send an Update event. The ATO already has the incorrect fortnight already so by updating the payslip detail and sending an update event the ATO will now have earlier JOBKEEPER-START-FN and will use that.

1c. Incorrect Start FN (Earlier):

- ATO says: "If an earlier start fortnight is incorrectly reported, cancel this entry via a matching finish fortnight (cancellation via matching start/finish fortnights) and report an additional later start fortnight "

- Our solution: 1. Find the incorrect JOBKEEPER-START-FN payslip detail and change the sub type only from JOBKEEPER-START-FN to JOBKEEPER-START-FN-FIX. Save. In the STP submission we will recognise this and send a matching JOBKEEPER-FINISH-FN. The ATO already has the incorrect earlier JOBKEEPER-START-FN so the JOBKEEPER-START-FN-FIX tells us the start was incorrect so we send a JOBKEEPER-FINISH-FN to match and cancel it at the ATO end.

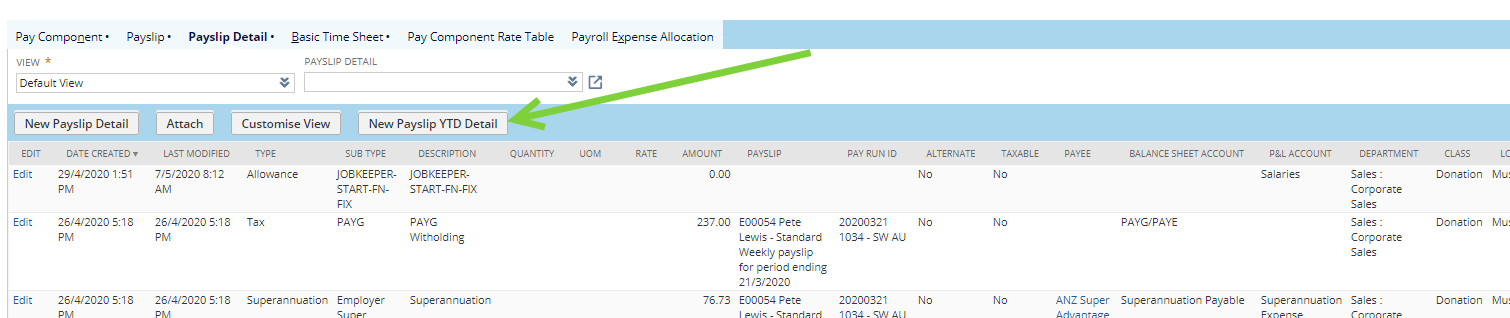

2. Now we need to create a new JOBKEEPER-START-FN payslip detail for the correct fortnight. Navigate to the Employee record>Payroll tab>Payslip Detail subtab in View mode. Click "New Payslip YTD detail"

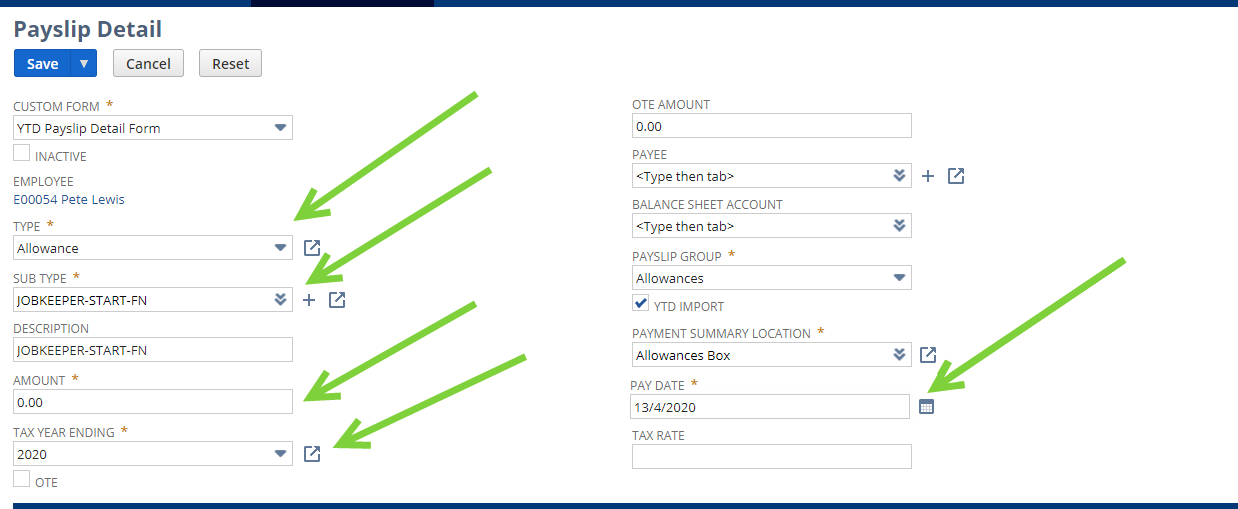

3. Enter the relevant details as below and ensure your "Tax year ending" and "Pay date" are in the relevant fortnight you wish to claim from. In the example below 13/4/2020 is in Fortnight 02. Save and send an update event.

2. Finish Fortnight Corrections:

All accounts have now been updated with additional sub types that may be used in some of the situations below. The sub type that may need to be used for some of the corrections to finish fortnights is JOBKEEPER-FINISH-FN-FIX

2a. Wrong Employee:

- ATO says: "If the wrong employee was reported as becoming ineligible via the use of the JOBKEEPER-FINISH- FNXX, then cancel this ineligibility via the use of matching JOBKEEPER-START-FNXX where the “XX” fortnights are the same (cancellation via matching start/finish fortnights)"

- Our solution: Find the incorrect JOBKEEPER-FINISH-FN payslip detail and change the sub type only from JOBKEEPER-FINISH-FN to JOBKEEPER-FINISH-FN-FIX. save and send an Update event. In the STP submission we will recognise this and send a matching JOBKEEPER-START-FN. The ATO already has the incorrect JOBKEEPER-FINISH-FN so the JOBKEEPER-FINISH-FN-FIX tells us the finish was incorrect so we send a JOBKEEPER-START-FN to match and cancel it at the ATO end. Our solution saves you from having to create another payslip detail for the JOBKEEPER-START-FN.

2b. Incorrect Finish FN (Later):

- ATO says: "If a later finish fortnight is incorrectly reported, report an additional earlier finish fortnight. ATO will assume the earliest finish fortnight is relevant where no unmatched start fortnight is reported. For example: reported JOBKEEPER-FINISH-FN06 but should have been JOBKEEPER-FINISH-FN05 "

- Our solution: "Simply edit and change the reportable date on the existing JOBKEEPER-FINISH-FN payslip detail to a date within the earlier fortnight, save and send an Update event. The ATO already has the incorrect fortnight already so by updating the payslip detail and sending an update event the ATO will now have earlier JOBKEEPER-FINISH-FN and will use that.

2c. Incorrect Finish FN (Earlier):

- ATO says: "If an earlier finish fortnight is incorrectly reported, cancel this entry via a matching start fortnight (cancellation via matching start/finish fortnights) and report an additional later finish fortnight"

- Our solution:

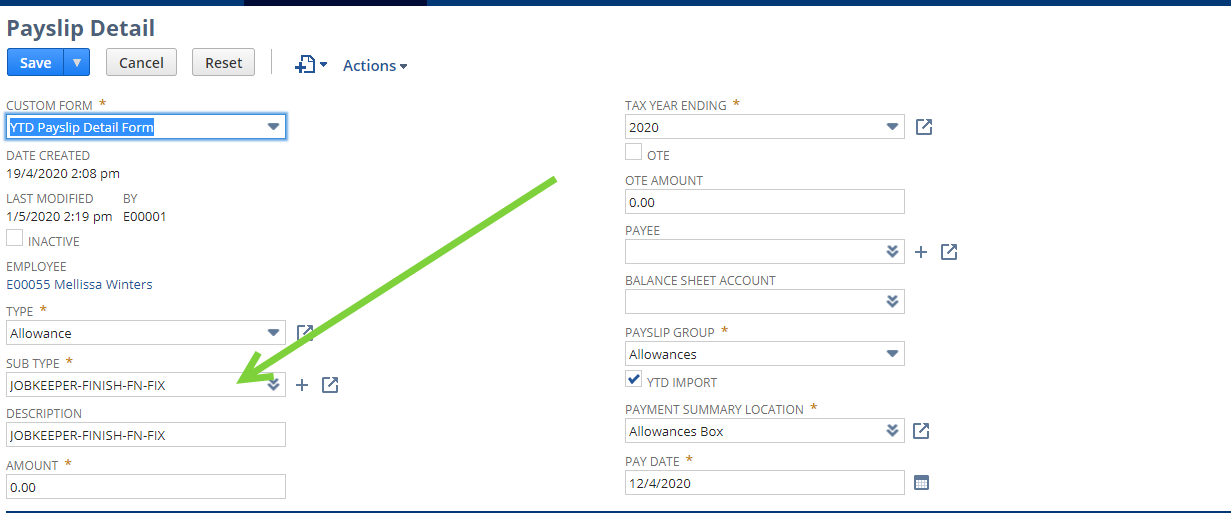

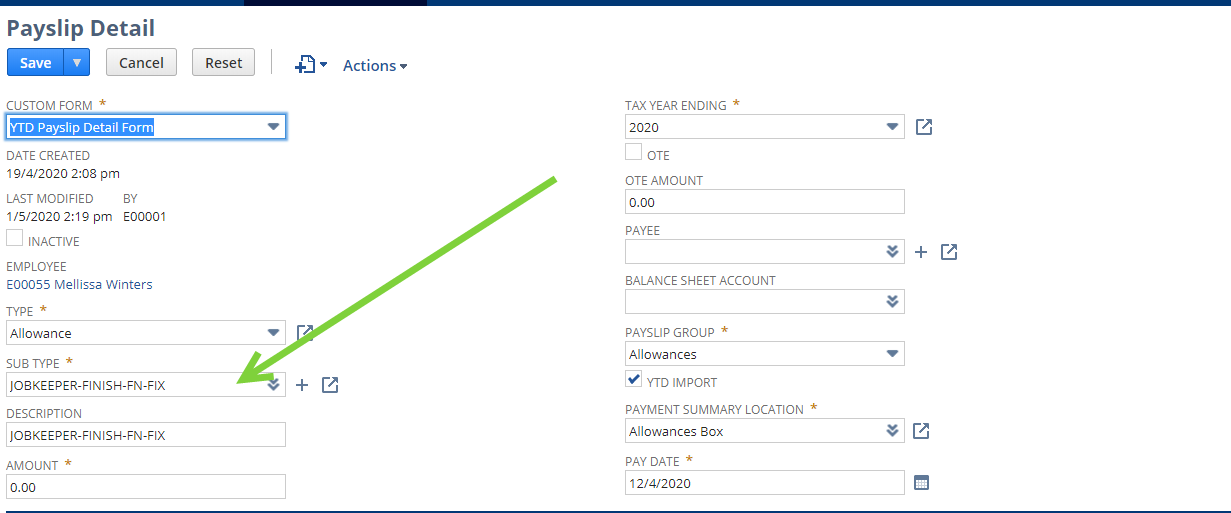

- 1. Find the incorrect JOBKEEPER-FINISH-FN payslip detail and change the sub type only from JOBKEEPER-FINSH-FN to JOBKEEPER-FINISH-FN-FIX. Save. In the STP submission we will recognise this and send a matching JOBKEEPER-START-FN. The ATO already has the incorrect earlier JOBKEEPER-FINSH-FN so the JOBKEEPER-FINISH-FN-FIX tells us the finish was incorrect so we send a JOBKEEPER-START-FN to match and cancel it at the ATO end.

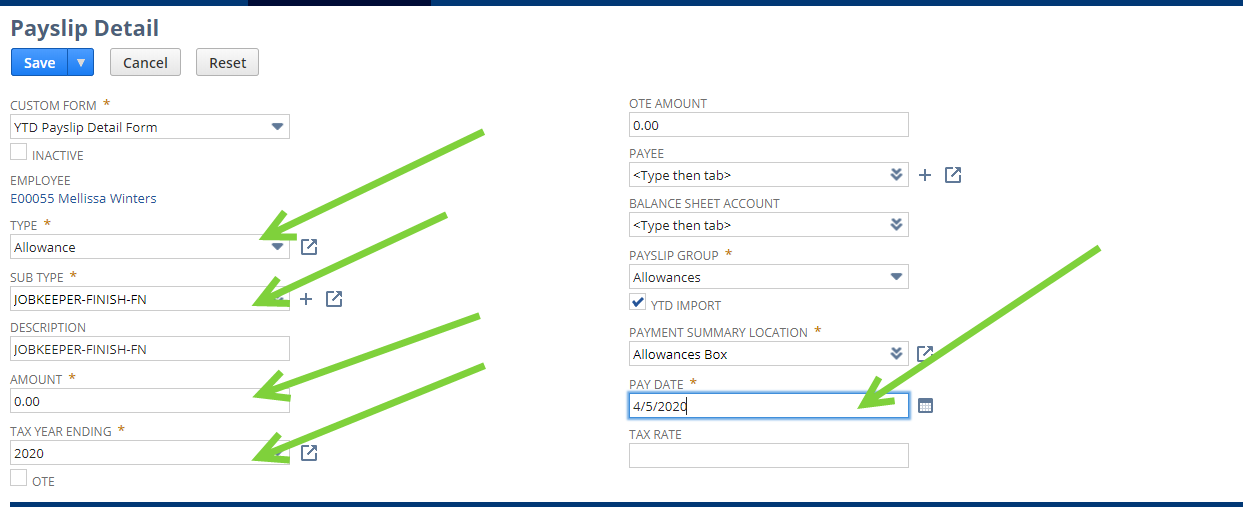

2. Now we need to create a new JOBKEEPER-FINISH-FN payslip detail for the correct fortnight. Navigate to the Employee record>Payroll tab>Payslip Detail subtab in View mode. Click "New Payslip YTD detail"

3. Enter the relevant details as below and ensure your "Tax year ending" and "Pay date" are in the relevant fortnight you wish to claim to. In the example below 4/5/2020 is in Fortnight 03. This means you are claiming up to and including fortnight 03. Save and send an update event. Remember that the STP submission will show as JOBKEEPER-FINISH-FN04

3. Contact support before you do any corrections:

If you are not sure what to do and you have read this article fully, then please contact support with information regarding your employees and the relevant dates.

ATO says : "The correction options for the JobKeeper payment are limited. Extreme caution should be taken by employers to ensure that validation and reconciliation processes are strong enough to warrant confidence in the initially reported data."