Initiate Pay Run

Former user (Deleted)

Infinet Support (Unlicensed)

Lisa Morris (Unlicensed)

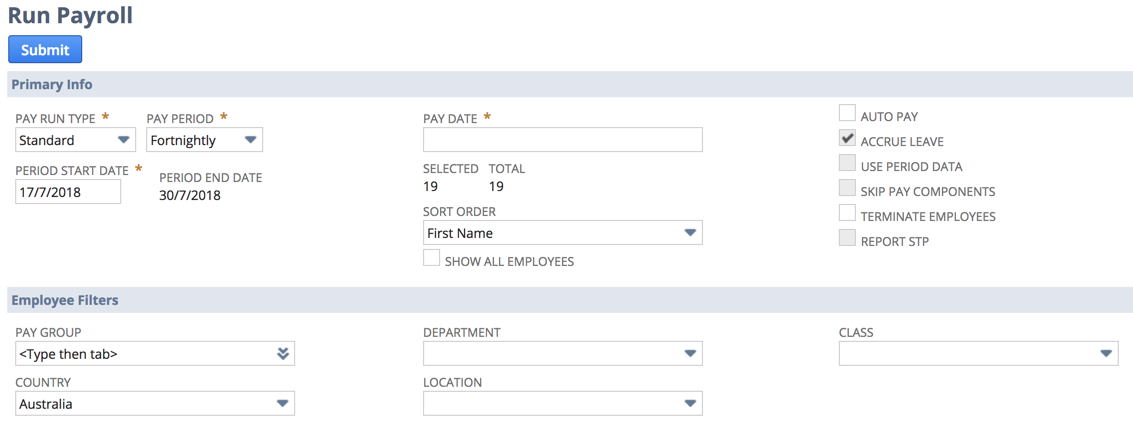

To start a payrun navigate to Payroll Administration > Payroll Activities > Start New Pay Run, the screen will refresh displaying a selection form as shown below.

Primary Info

- Subsidiary - Select Subsidiary if OneWorld account.

- Pay Run Type - Select Standard or Adjustment. Adjustment is for when you may have completed a standard pay run but may need to do an additional pay run for some reason, such as an out of cycle bonus.

- Pay Period – Select the pay frequency.

- Period Start Date – This will default to the next one for the pay frequency selected. You will need to manually select this for the first time you run it.

**NOTE: if you need to run multiple 'Standard type' pay runs for the same period date range you can override the Period Start Date field to what you need it to be. A message will appear highlighting that a pay run for period date range already exists, but it is absolutely fine to click OK and continue with the pay run. - Period End Date – This will calculate based on start date and pay period. This date determines the date the posting journal will be created.

- Pay Date – The date you want to go on the ABA file and payment journal.

- Selected / Total - shows how many employees are selected of the total number of employees with this pay frequency and filter criteria

- Sort Order - Select how you would like to sort the employees on this screen.

- Autopay – if selected you can choose a start and end step for the pay run.

- Accrue Leave – available on adjustment runs. This will ensure leave history accruals are calculated if marked. It would be unmarked if the adjustment run is just for a bonus or commission.

- Use Period Data – available on adjustment runs. This ensures that tax is calculated based on any other standard pay run for the same period. The period start and end date must be the same as the standard run if you use this checkbox.

- Skip Pay Components – available on adjustment runs. The pay run will not create the basic timesheets from the employees pay components if this is marked.

- Terminate Employees – Select if you would like to terminate any employees during this pay run.

- Report STP – Should be marked if you have set up Single Touch Payroll.

Employee Filters

- Pay Group - used to restrict the employees by Pay Date.or employees being paid on different day but same pay frequency.

- Country - used to restrict the employees in each pay run by Country.

- Department – used to restrict the employees in each pay run by Department.

- Location – used to restrict the employees in each pay run by Location.

- Class – used to restrict the employees in each pay run by Class.

Apply Filters

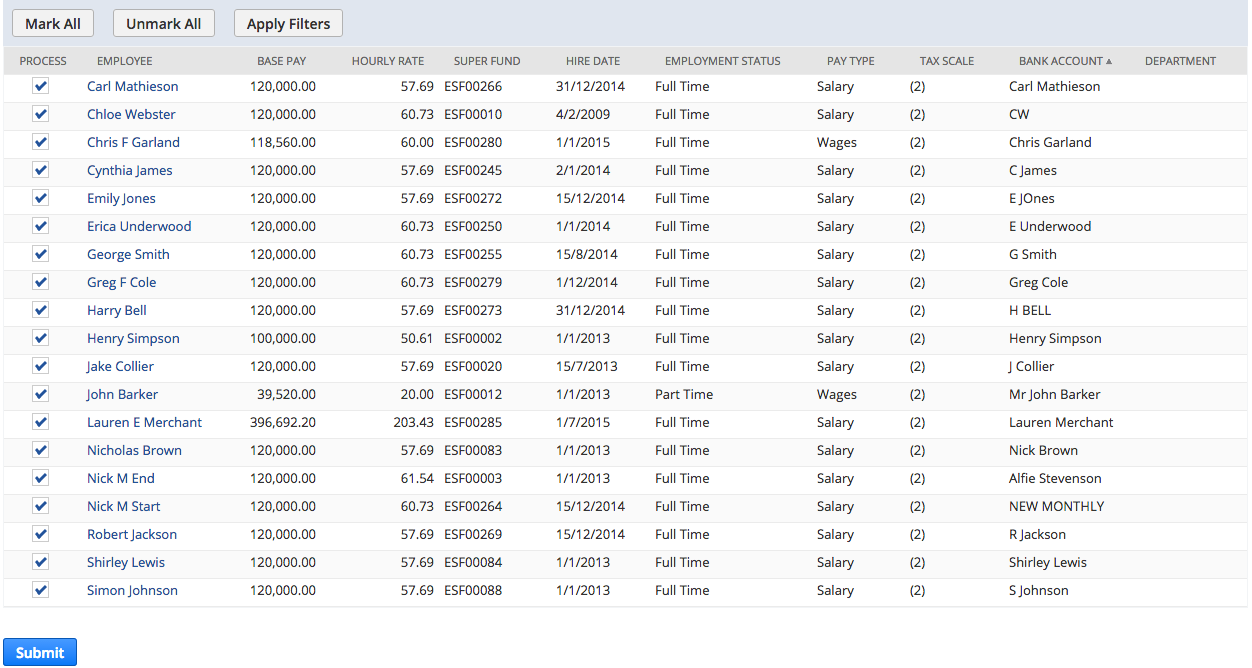

If you have selected one of the employee filters you can then click on 'Apply Filters' to refresh the page

The bottom part of this screen shows a list of employees and their basic employee information including base salary, tax scale etc. It is recommended that this is reviewed to ensure that this level of information is correct. You can click on the employee name, which opens the employee record in a new tab and you can make any required changes before continuing.

Unmark the employees you want to exclude from your pay run.

Click on Submit – this creates the pay run record and empty payslip records and loads basic timesheets based on the pay components set up on the employees selected.