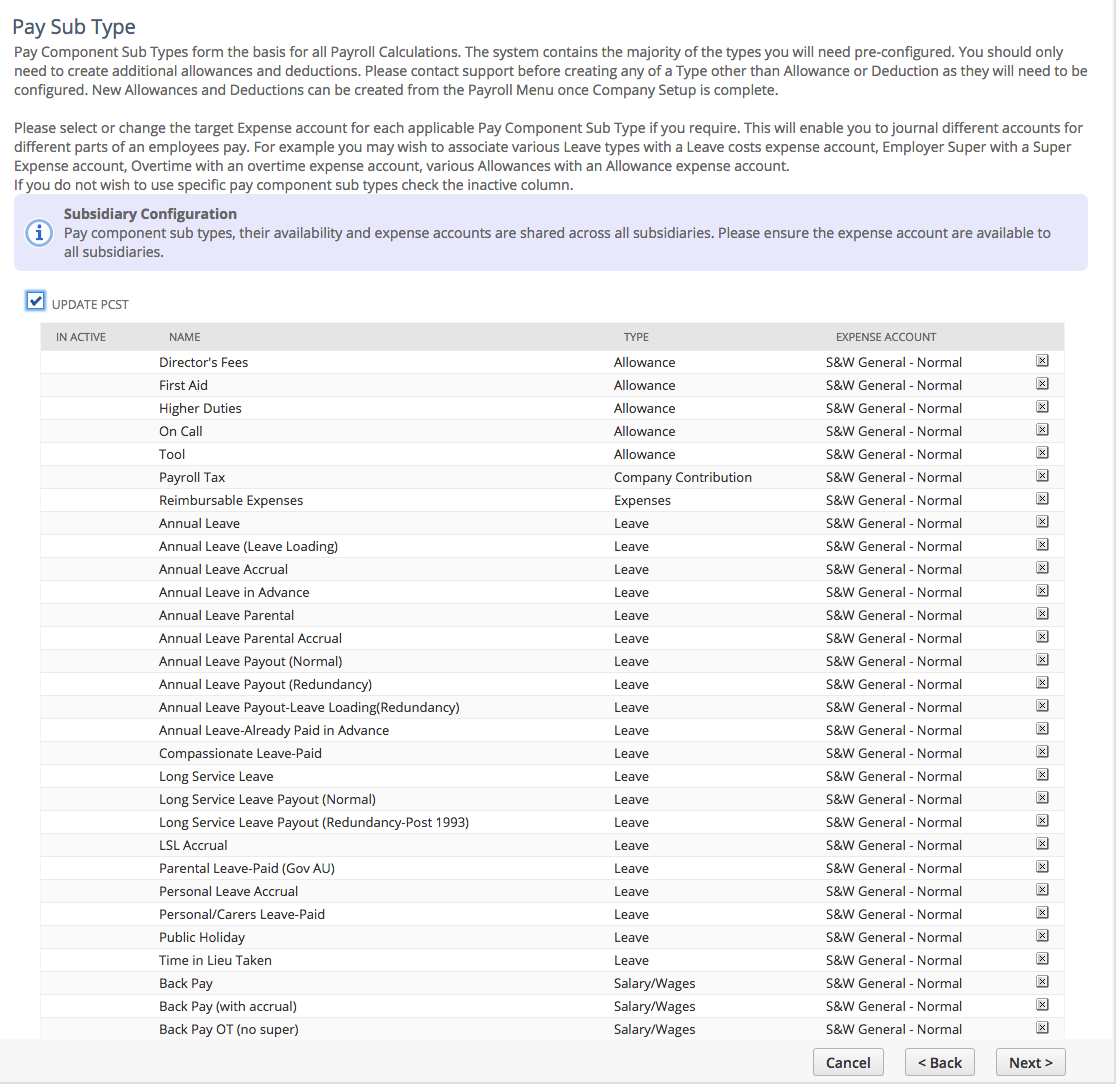

8. Pay Component Sub Type

Update the Expense Account for any Pay Component Sub Type where the Expense Account is not correct. ICS provides a list of the most popular salary and allowance pay components.

Do not add or delete any pay component sub types in this screen.

Pay Component Sub Types are used across all subsidiaries in a OneWorld account.

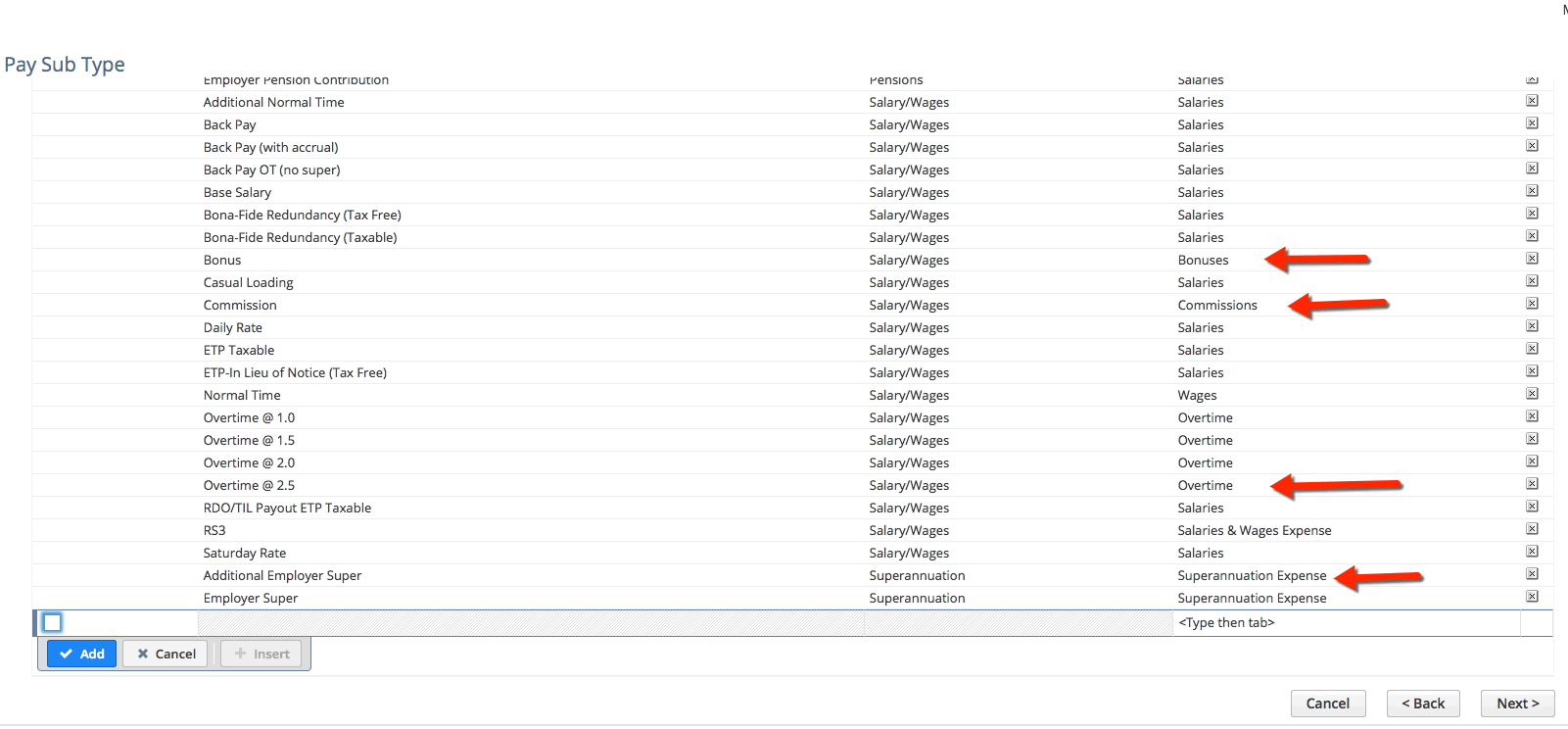

If you elected to follow ICS recommendations for more detailed reporting, then Select

- Salary & Wages : Allowances expense account for Allowance Pay Types

- Salary & Wages : Overtime expense account for Overtime Pay Types

- Superannuation Expense account for Superannuation Pay Types

If there are Pay Components that are not relevant to your organisation, simply mark as inactive (or ignore)

- Inactive Pay Components will not display when setting up employees. However at a future date these Pay Components can be made active.

- Ignoring irrelevant Pay Components simply means that the Payroll Officer will see them when setting up employees.

- Any action taken here can be subsequently reversed / amended once Configuration is complete.

Click on Next