5. Tax Info tab

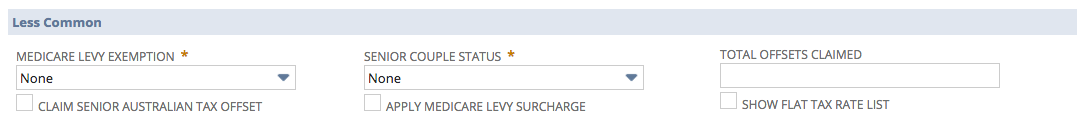

Less Common Fields

- Medicare Levy Exemption - select the exemption level (Half, Full or no Medicare Levy Exemption) the employee is claiming.

- Claim Senior Australian Tax Offset - check if the employee wishes to claim the Senior Australian Tax Offset.

- Senior Couple Status - if the employee is claiming the Senior Australian Tax Offset then select the option which describes this employee's Senior Couple Status.

- Apply Medicare Surcharge Levy - check if the employee has answered yes to Q4 of Medicare Levy Variation Declaration and wishes to have additional tax withheld for Medicare Levy Surcharge.

- Total Offsets Claimed - enter total amount of Tax Offsets claimed by the employee at Q9 of their ATO withholding declaration.

- Show Flat Rate Tax List - check to show the Flat Rate Tax List.

Go to step 6. Superannuation tab

, multiple selections available, Use left or right arrow keys to navigate selected items