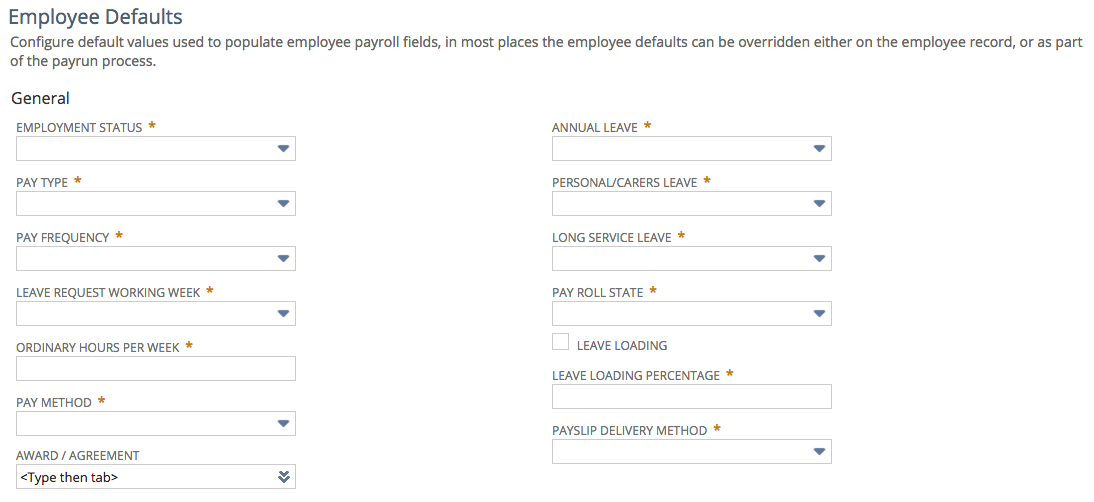

3. Employee Defaults

Superannuation Global Defaults

- Select the Default Super Fund

- The Lower Super Threshold determines the minimum salary per month that an employee must earn before the employer must pay Employer Super

- The Upper Super Threshold determines the maximum salary per quarter that an employee can earn before the employer does not need to pay Employer Super

- Enter the default Employer Super Contribution

- Select the Default Super Expense Account

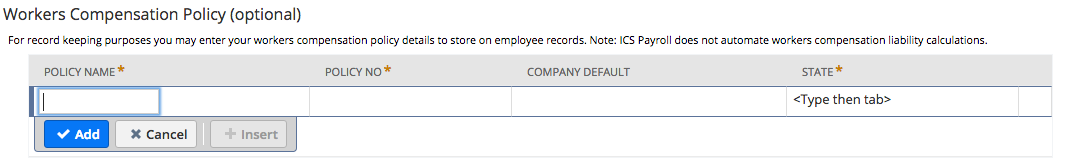

Work Cover

- Policy Name - Enter the Work Cover policy name

- Policy No - Enter the Work Cover policy number

- Company Default - Mark the checkbox if this is the company default

- State - Select the state for the Work Cover policy

Click on Next