UK Auto-Enrolment Pension Contribution Rates Uplift

Pensions Regulator Guidance: Tax Year Ending 2020 Rates

This guide outlines the process and considerations for uplifting auto-enrolment contribution rates in the UK.

| Do not initiate this process until after the final pay run of the Tax Year |

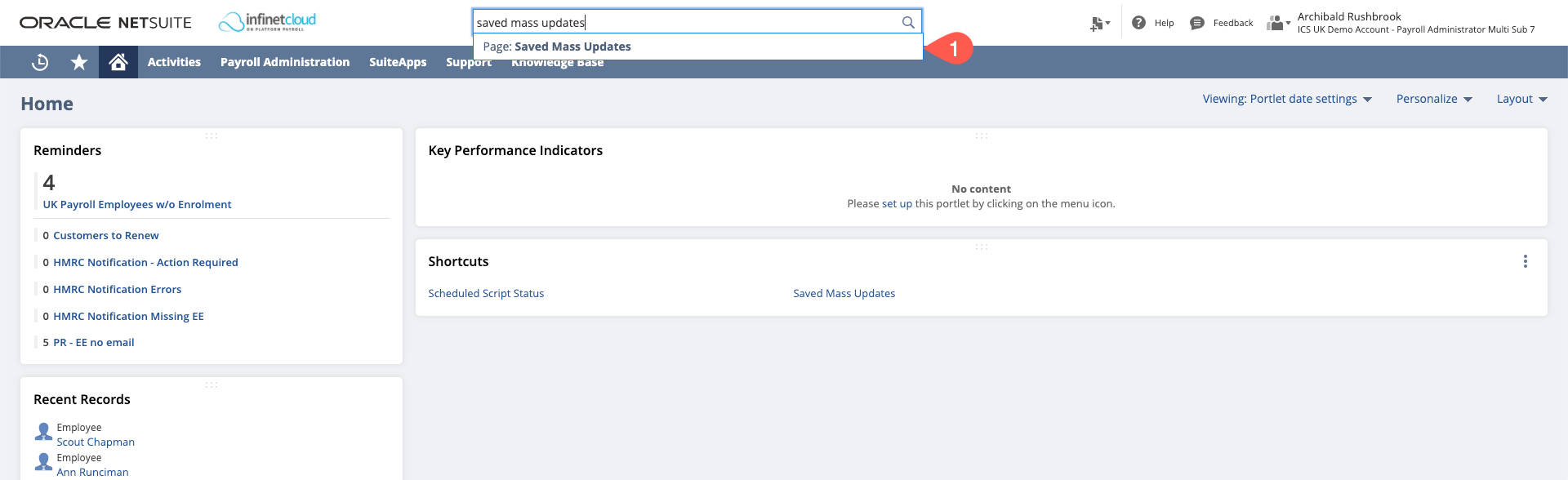

- Global search for “Saved Mass Updates”

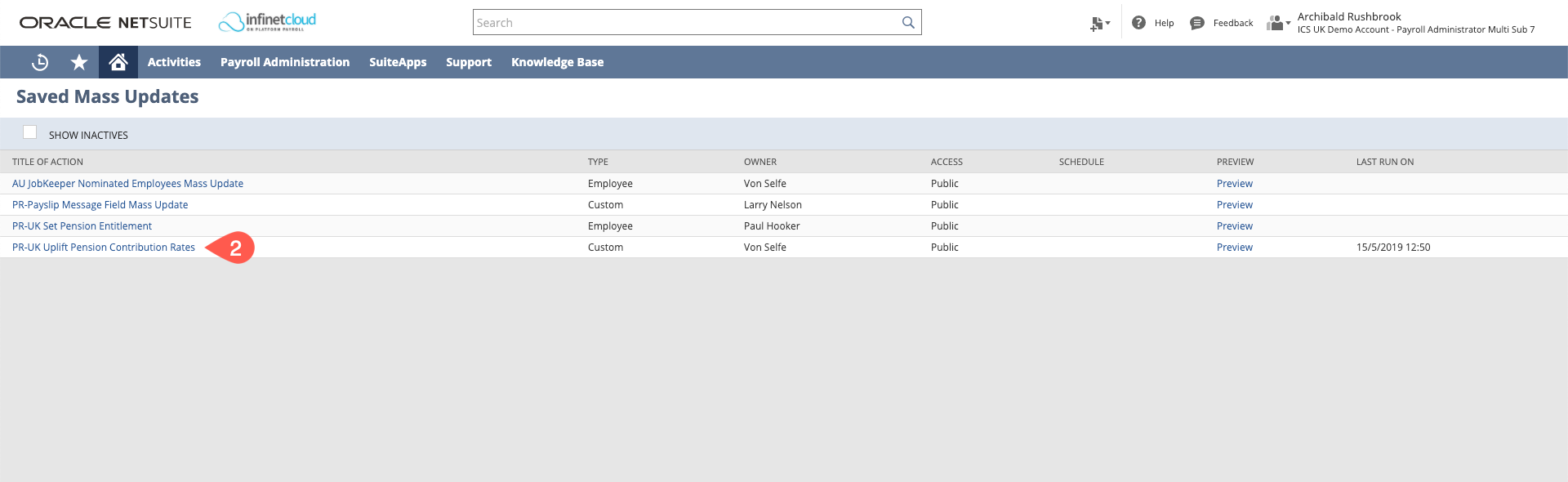

- Select “PR-UK Uplift Pension Contribution Rates”

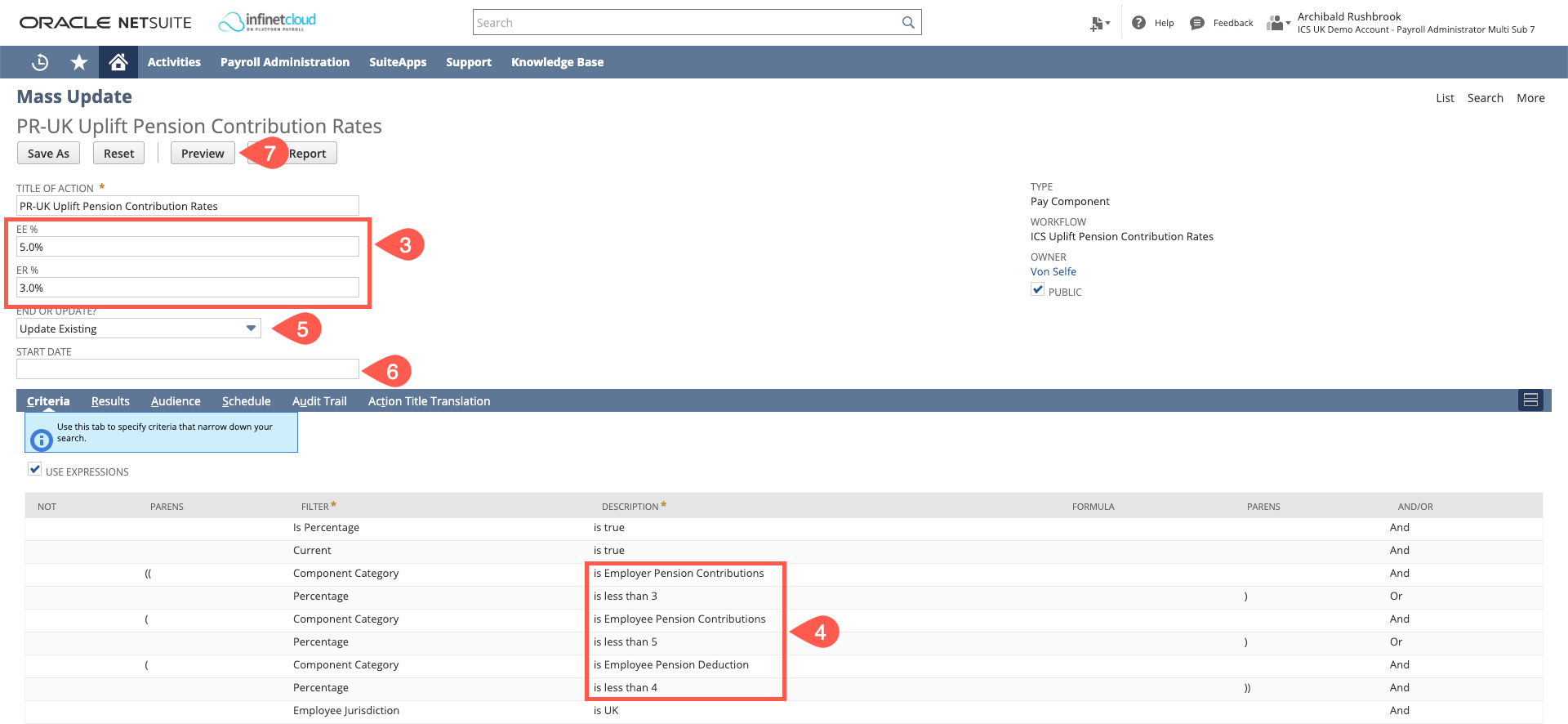

- Review and ensure the percentages are as you want

If you change the ER or EE percentages on the left – you will need to change the criteria in the middle to reflect this

For relief at source pension please use the full pension percentage the process will adjust for the 20% tax relief

select if you want to update the current pay components or end date current ones and set up new ones

If you select that you are setting up new pay components you will need to put a start date (this will end date the previous pay components the day before the date you put in)

Once you are happy that the percentages are correct select Preview

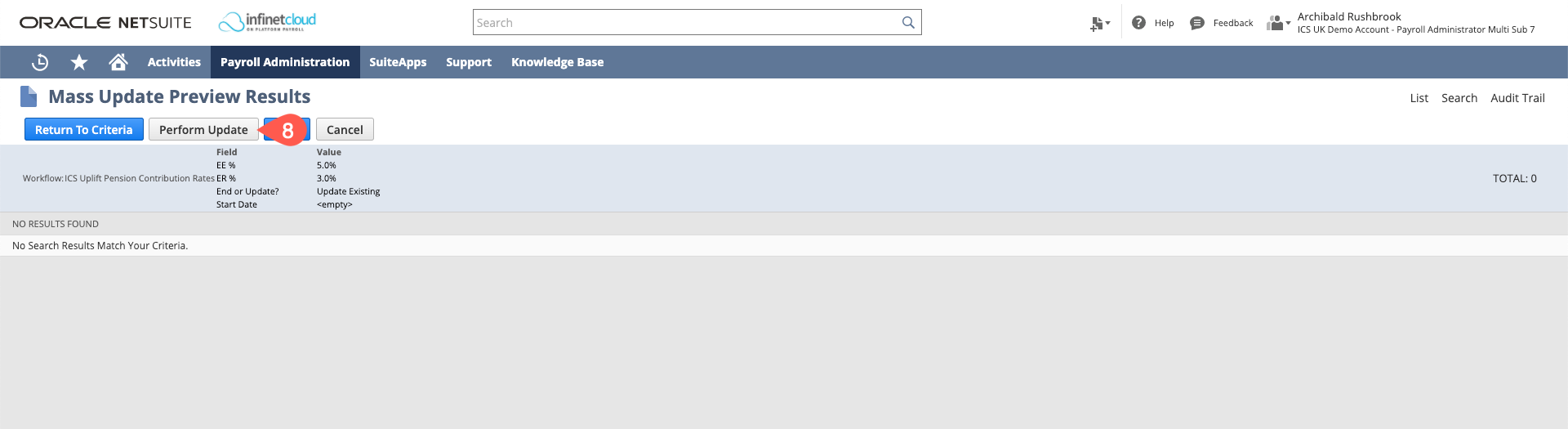

- Review from the list the changes the mass update is going to make (you can untick employees you don’t want to update) when you have reviewed and you are happy with the changes please select Perform Update.

, multiple selections available,