Finding Out of Balance Payslips

A pay run may say that it is out of balance, this is due to the total amount debited and credited not matching. You will not be able to continue the pay run until this has been balanced.

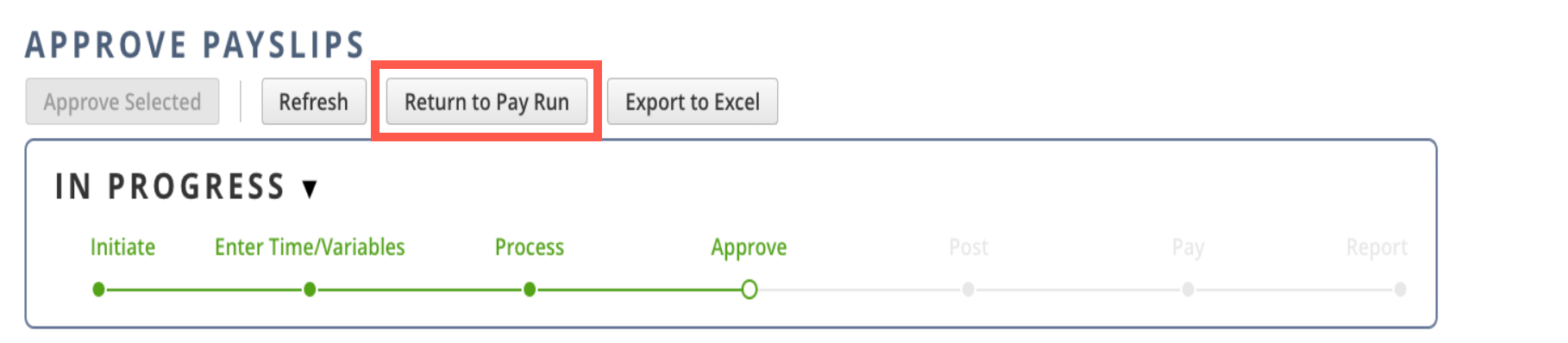

You will need to ensure you are on the Pay Run page (not the Approve Payslips page) to review the list of out of balance payslips. If you are on the Approve Payslips page, click "Return to Pay Run".

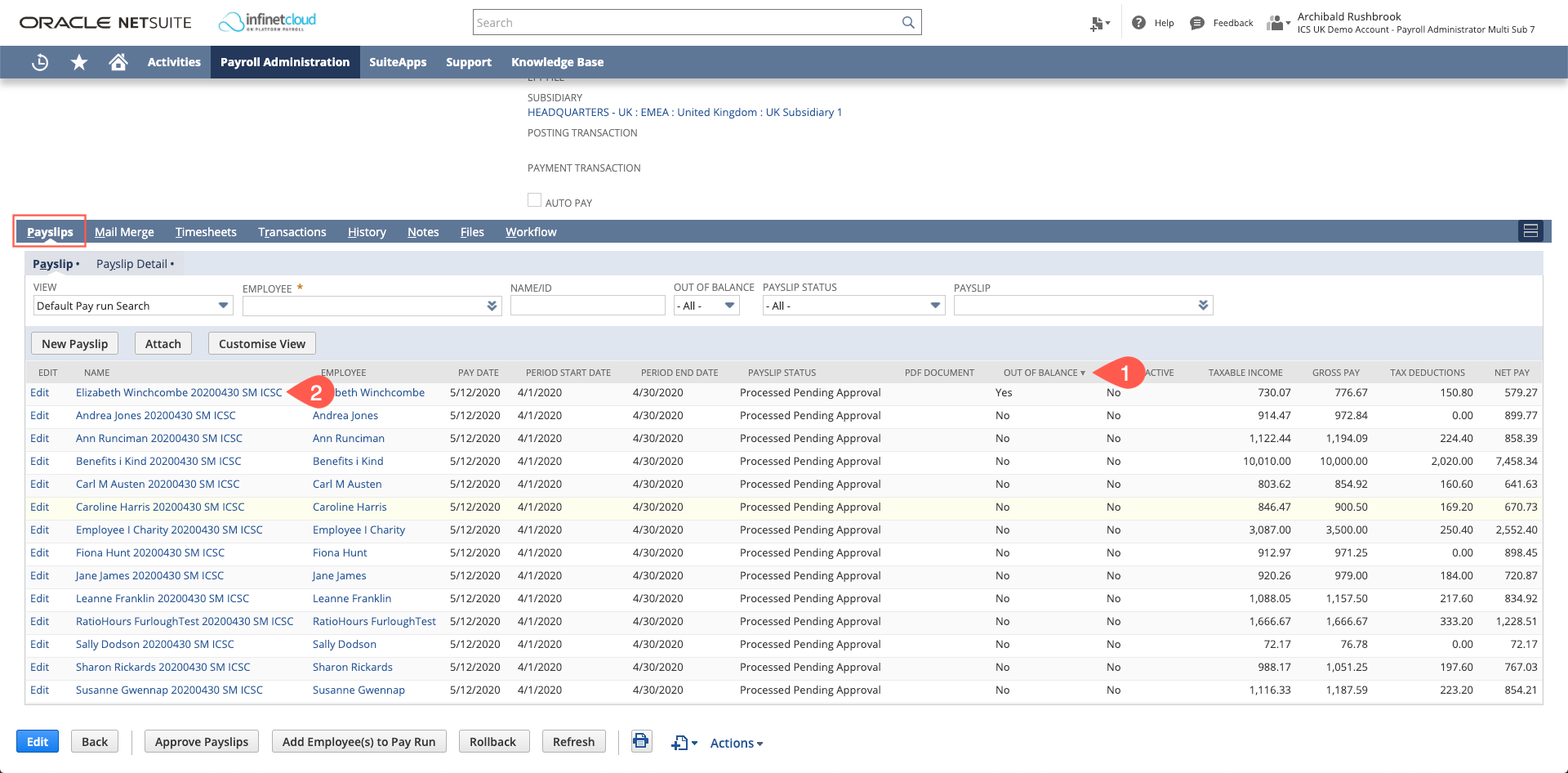

- To find the out of balance payslip scroll down to the Payslips tab and sort the payslips by the Out of Balance column - arrow pointing down to show "Yes" at the top

- To fix this issue - open up the out of balance payslip/s and recalculate (instructions on recalculating a payslip linked here).

If there is no payslip showing as out of balance on the payrun:

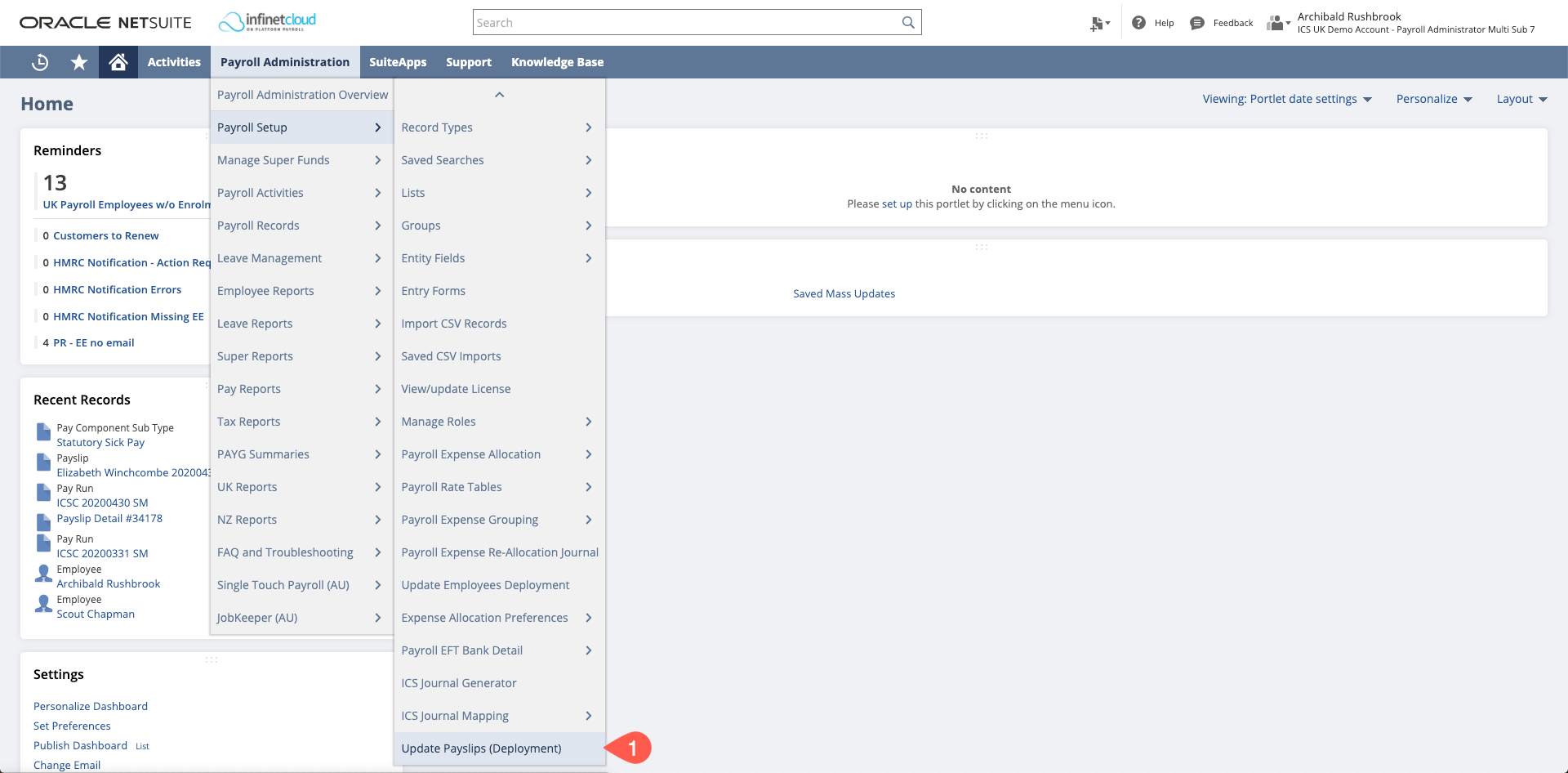

- Navigate to Payroll Administration > Payroll Setup > Update Payslips (Deployment)

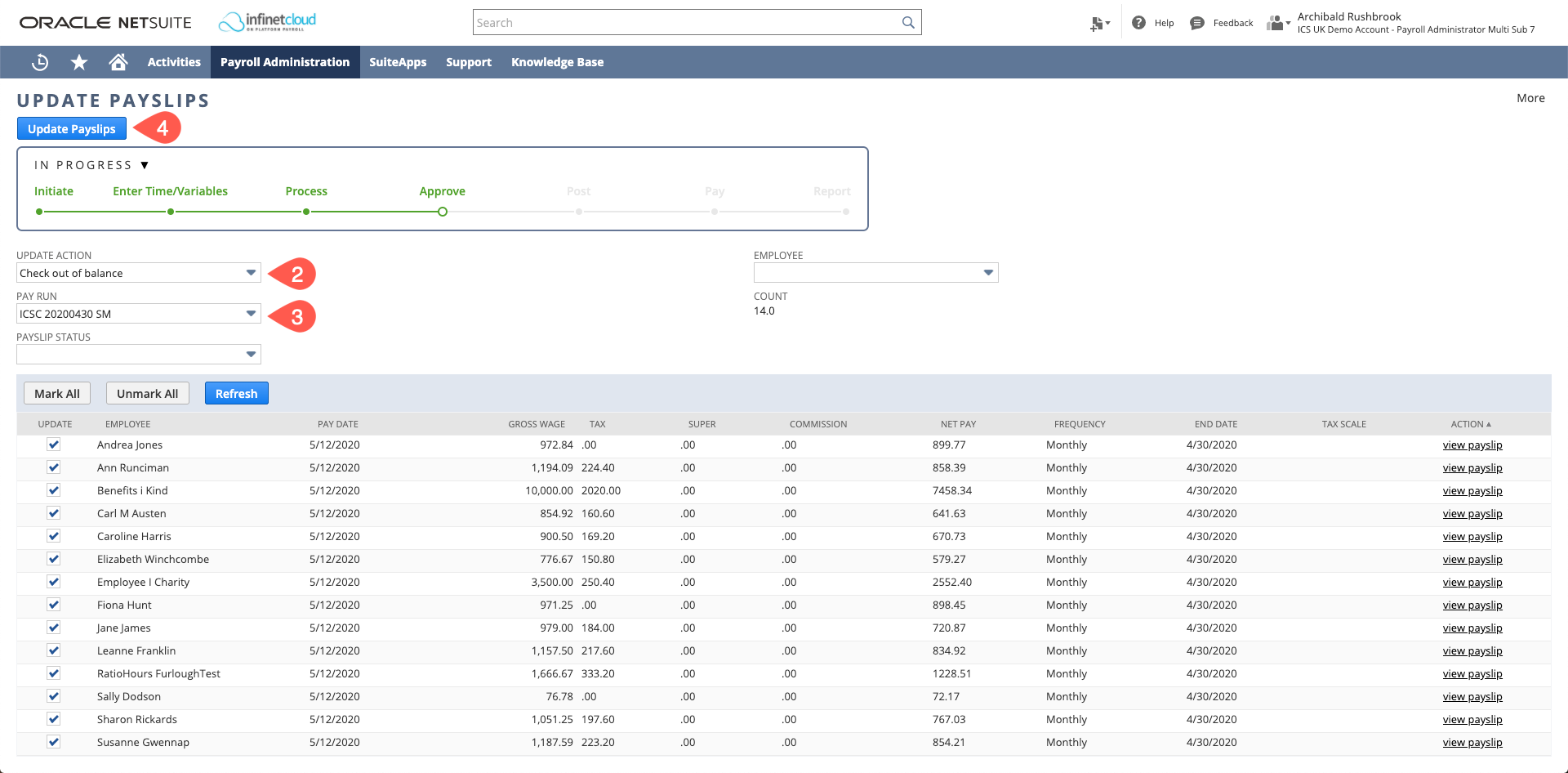

- Select the action “Check out of balance”

- Select the pay run that is out of balance

Click “Update Payslips”

This will bring you back to the Pay Run page - this does not mean that the process has completed. You should navigate to the Scheduled Script Status page and wait until this has completed before moving on to the next step

- Go back to the pay run and check the Out of Balance column as above

- To fix this issue - go into the payslip/s in question and recalculate

If you are still not able to locate the out of balance payslip and therefore cannot recalculate to balance the payslips:

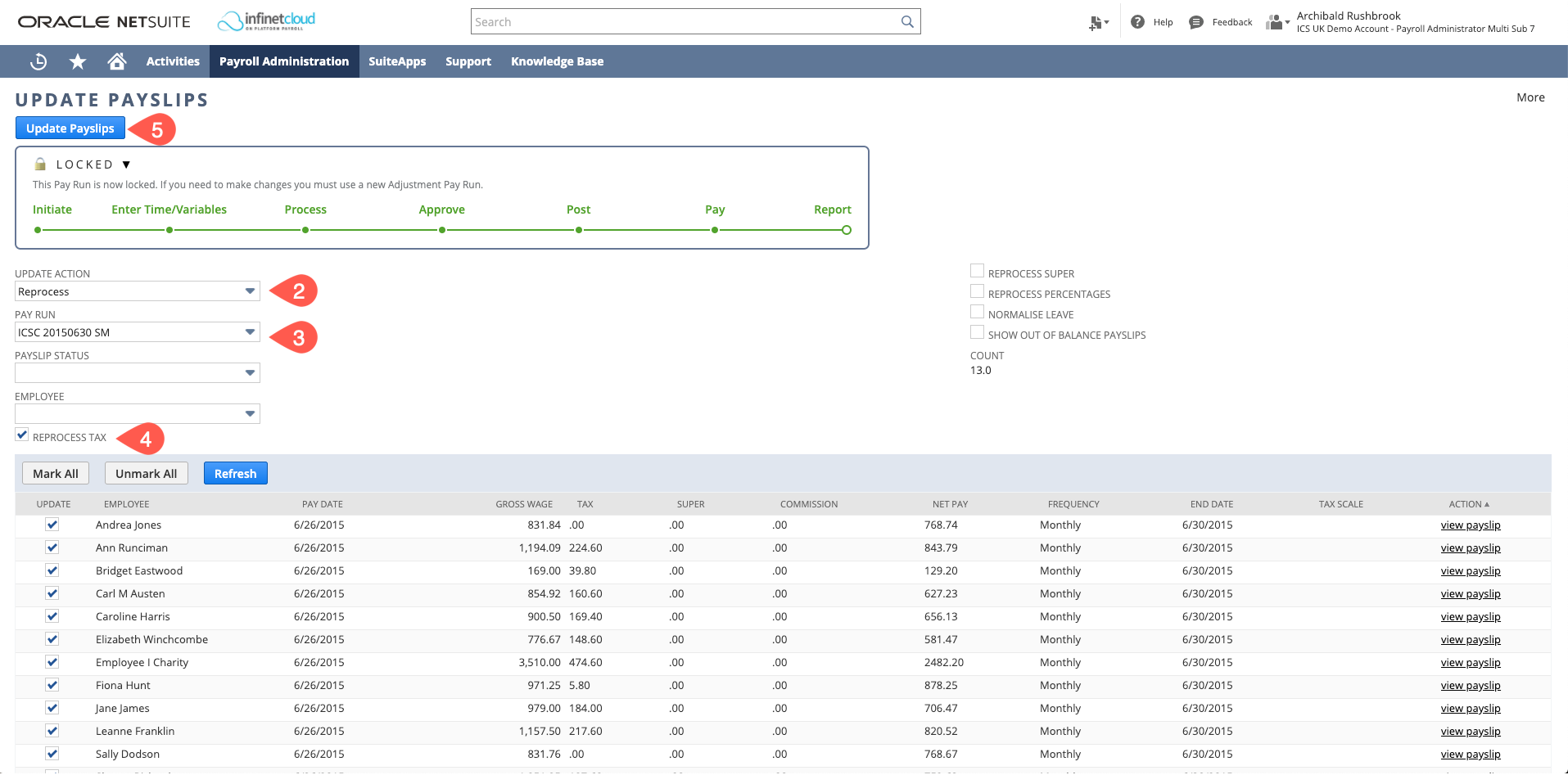

- Navigate to Payroll Administration > Payroll Setup > Update Payslips (Deployment)

- Select the update action "Reprocess"

- Select the payrun in question

- Tick reprocess tax, pensions and percentages as required

Click "Update Payslips"

This will bring you back to the Pay Run page - this does not mean that the process has completed. You should navigate to the Scheduled Script Status page and wait until this has completed before moving on to the next step