Understanding STP Reporting

User Interface

The following table illustrates the key differences between the two reporting variations of Submit and Update:

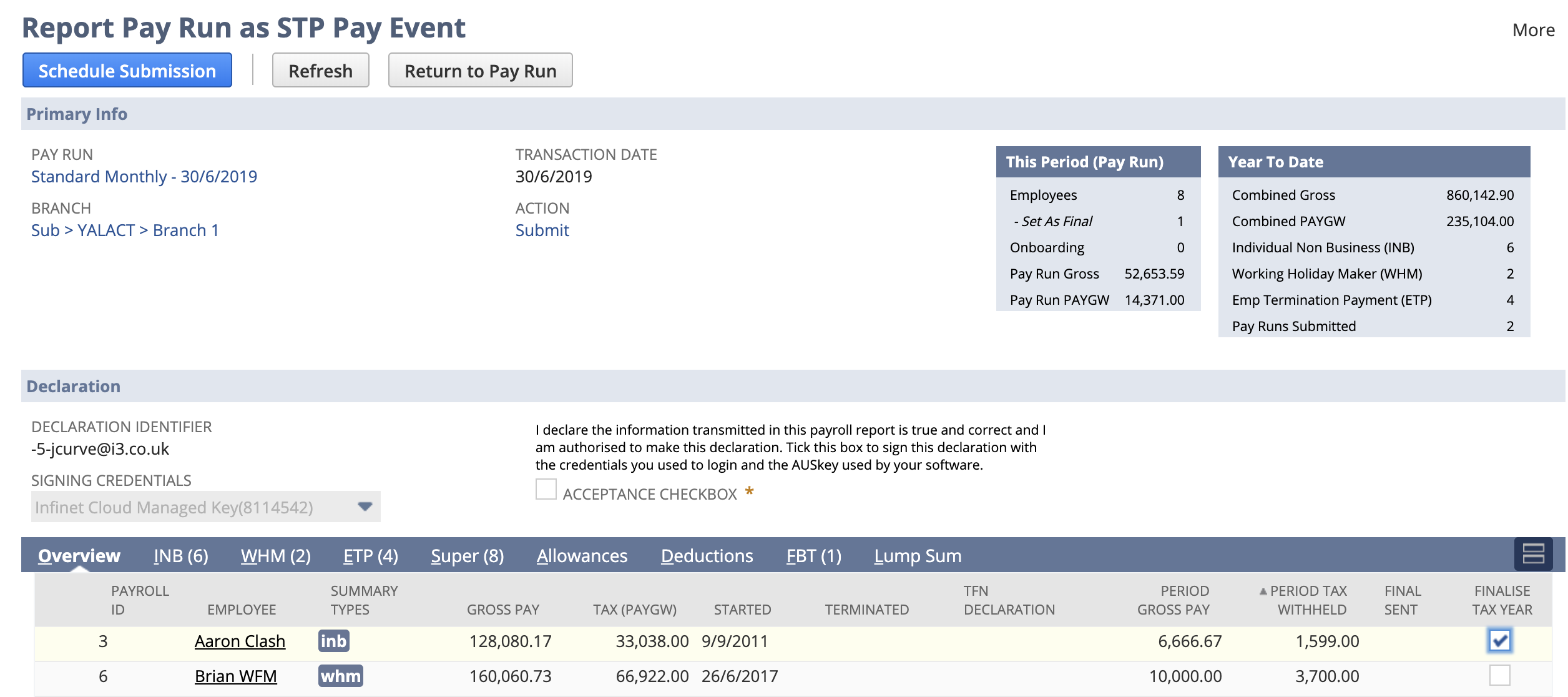

| Submit Event | Features |

|---|---|

The Submit Event is associated with a pay run and should be sent on or before the payment date, which displays as the transaction date. It displays all of the same information as an update, with the addition of "This Period" information that is used to pre-fill the Business Activity Statement W1 and W2.

| |

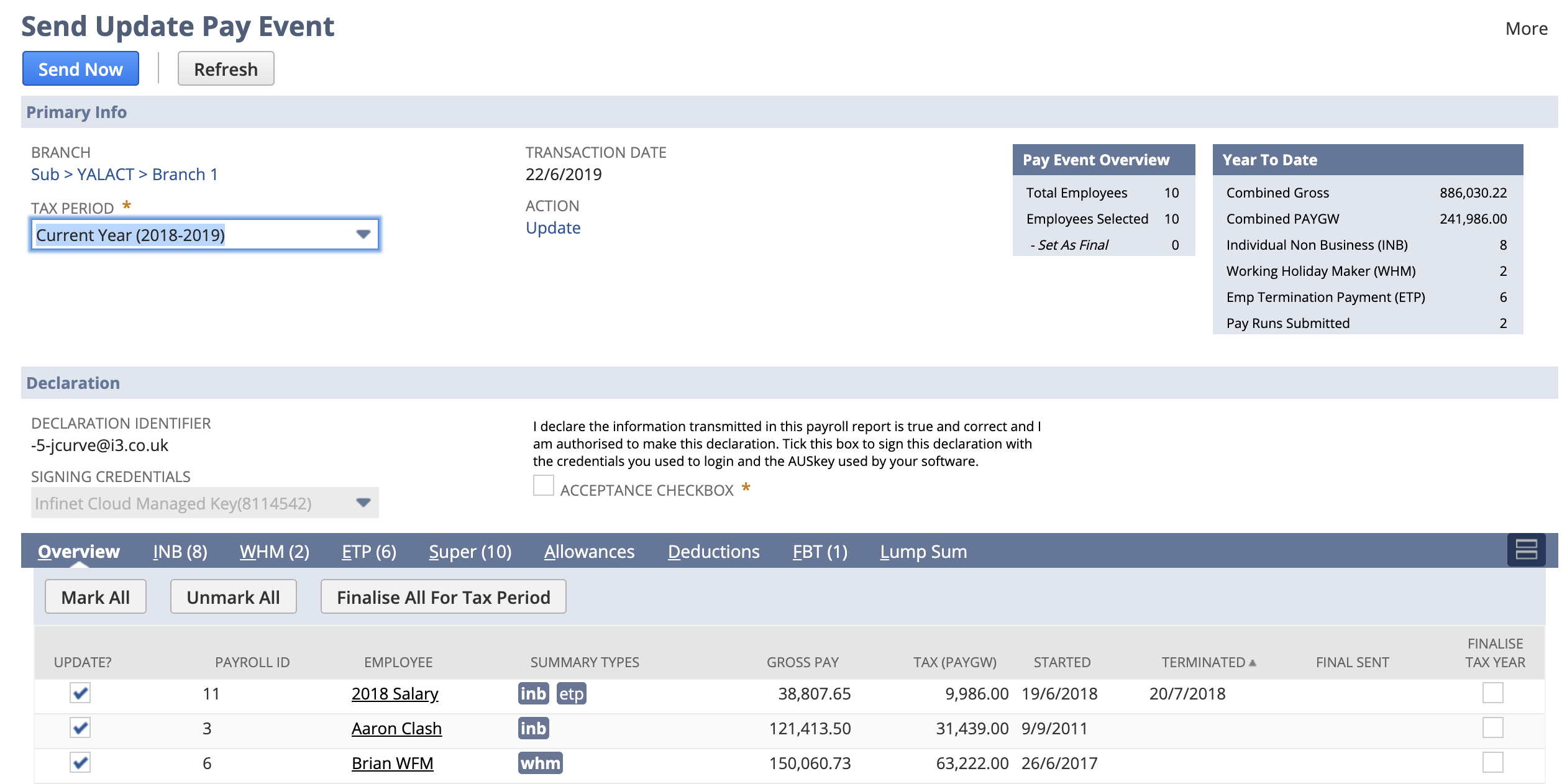

| Update Event | Features |

The Update Event can be sent at any time, and requires employees to be selected to send an update as of the transaction date (defaults to current date). If you need to send an update for the prior tax period select the period, which will refresh the page and the transaction will update. All prior tax period updates are sent with the transaction date set as the last day of the period. Overview Tab Displays

|

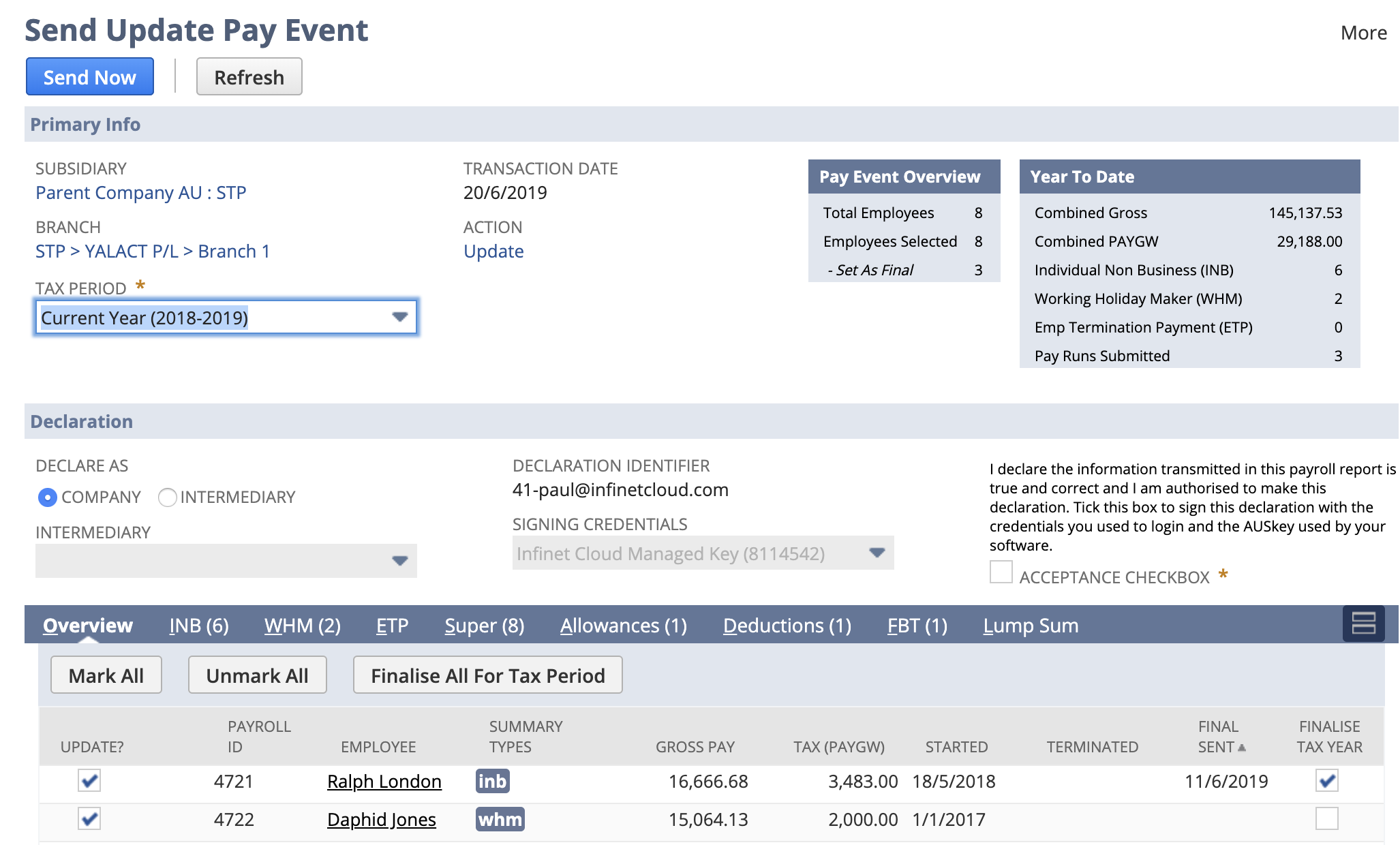

The page is split into 3 main groups:

- Primary Info: displays the criteria for the data collated in the tabs (branch, tax period, transaction date), and summary information for the data collated.

- Declaration: displays the acceptance declaration required for every STP submission.

- Tabs: Overview , the other tabs provide granular information for review.

The overview tab provides

- highlights validation errors against the employee

- allows employees to be selected for update (update only)

- allows an employee to be marked as finalised and highlights the date when most recently finalised

In addition to the overview tab additional detail tabs that display more granular information:

- INB (Individual Non Business Summary)

WHM (Working Holiday Maker Summary)

ETP (Employee Termination Payment)

Super

Allowances

Deductions

FBT (Fringe Benefit Tax)

Lump Sum

For more details on how this data is collated and grouped see the Data Collation section.

If you hover over blue tags in the additional info column you will see a tool tip displaying quick information from the corresponding tab.

Update Pay Event: Finalise

The introduction of STP has significantly simplified the end of year process. Once you have completed your payroll activities for the tax year (and entered FBT information XXXXX fill in link), you then need to send an update event for all employees with the "Finalise Tax Year" checked.

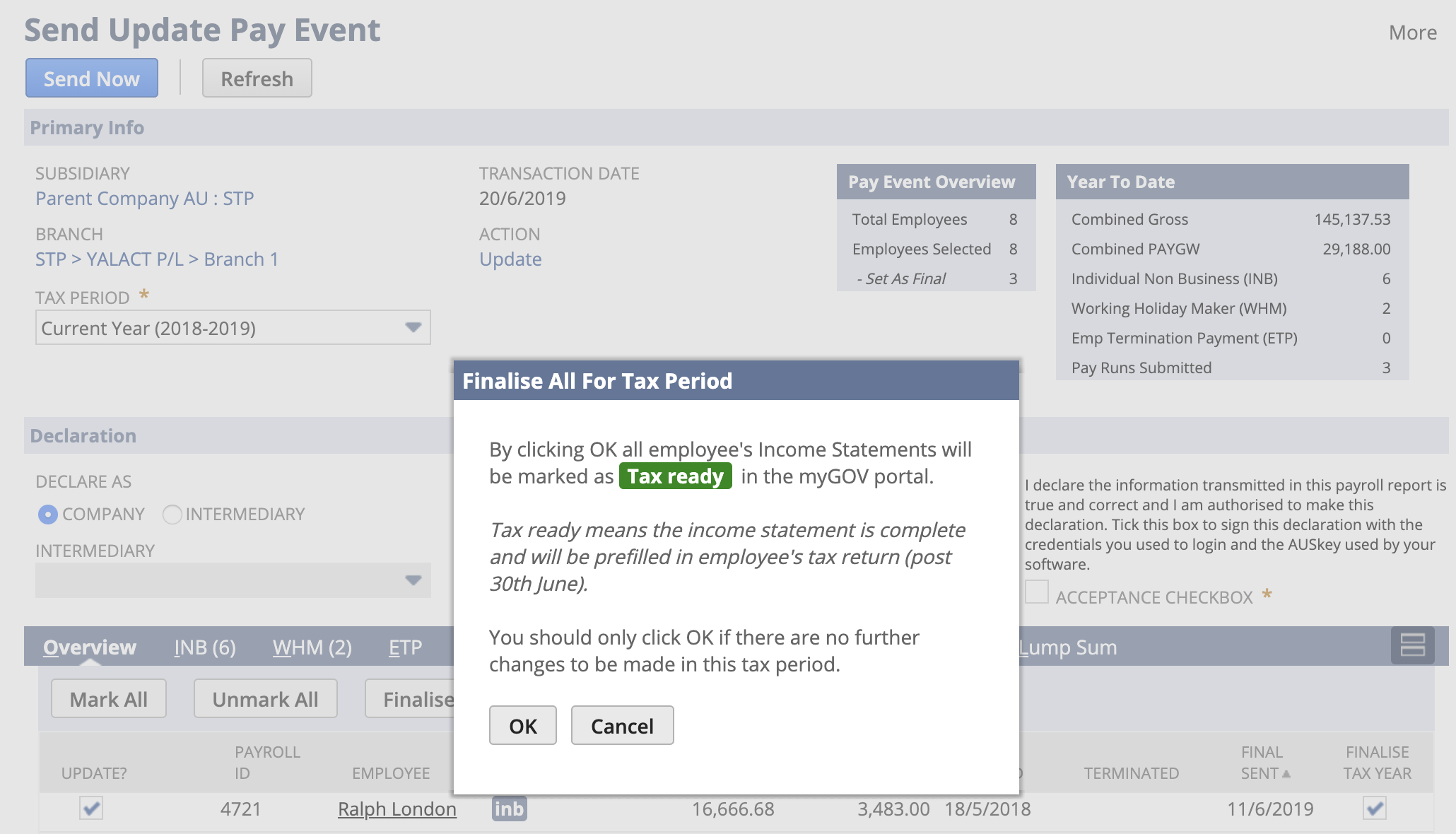

To simplify this we have added a new button "Finalise All For Tax Period", which when clicked ask for confirmation and then automatically select all employees, and check the "Finalise Tax Year" column.

In this screen shot the first employee has already been finalised as a date is shown in the final sent column.

when Finalise All For Tax Period is clicked the following confirmation is displayed.

For more information on finalising the tax year, see our guide. XXXXXXXX replace ME XXXXXXX

Data Collation

The data presented

the data reporting comes from 4 different sources within NetSuite:

- employee record (for the personal information)

- summarise of information in payslip detail records

- fbt records

- tfn declaration (if submit)

Employee Reporting

An employee is included for reporting if they meet one of the following criteria:

- they have a payslip detail record for the specified branch, in the current tax year on or before the transaction date

- they have an FBT summary record for the specified branch, and tax year

An employee must have either a payslip detail or FBT summary record to be included for reporting; setting just the branch on an employee record does not add them.

Pay Data Summarising

The STP reporting format requires the pay data to be summarised into groups, the first groups correspond to payment summary types and are determined as follows:

| INB (Individual Non Business) | WHM (Working Holiday Maker) | Employee Termination Payment |

|---|---|---|

Payment Summary Location:

| Income Type Code = H Payment Summary Location:

| Payment Summary Location:

|

ETP Note: An employee can have multiple ETP termination payment summaries they are grouped by pay date and ETP code. Any adjustment to an ETP needs to have the same code and payment date.

| Payment Summary Location | Column |

|---|---|

| Allowances | |

| Allowances Box | Car, Laundry, Meals, Transport, Travel, Other |

| Deductions | |

| Union / Professional Association Fees | Fees |

| Workplace Giving | Work Place Giving |

| Lump Sum | |

| Lump Sum Payments A: | A |

| - | A Type (defaults to R if A is set) |

| Lump Sum Payments B: | B |

| Lump Sum Payments D: | D |

| Lump Sum Payments E: | E |

| Sub Type | Column |

|---|---|

Super | |

| Sum of PSD is OTE checked | OTE Amount |

| Employer Super | SGC |

| RESC | RESC (Reportable Employer Super Contribution) - xsc |

| Additional Employer Super, Salary Sacrifice-Superannuation | |

FBT

Fringe Benefit Tax information is sourced from the Employee FBT Summary record directly mapping the field

| FBT Summary Field | Column |

|---|---|

| REPORTABLE FBT FOR PAYG SUMMARY (custrecord_pr_reportable_fbt) | Taxable Amount |

| PAYEE RFB EXEMPT AMOUNT (custrecord_pr_fbts_exempt_amount) | Exempt Amount |

only displayed if the taxable amount exceeds the FBT threshold (currently $3,773.00 in 18/19)

Summary Information

We now display additional year to date summary information with both Update and Submit Events.

- Submit information is based on only the employees included on the pay run you are reporting.

- Update information is based on all employees listed in the overview (irrespective of whether they are checked for update)

| Year To Date | |

|---|---|

| Label | Source Information |

| Combined Gross | Sum of the Total Row Gross Pay Column from the INB / WHM / ETP Sub Tabs. The Gross Pay for each Sub Tab is calculated based on

|

| Combined PAYGW | Sum of the Total Row Tax(PAYGW) Column from INB/ WHM / ETP Sub Tabs. The Tax PAYGW for each Sub Tab is calculated based on

|

| Individual Non Business (INB) | Total employees with an INB Summary |

| Working Holiday Maker (WHM) | Total employees with a WHM Summary |

| Emp Termination Payment (ETP) | Total employees with an ETP Summary (an employee can have more than 1) |

| Pay Runs Submitted | Total payruns that have been reported as Submit Pay Events with a response status of Success or Partial Success |

Frequently Asked Questions

Can I export this data to excel ?

Yes click the 'Export To Excel' button at the top of the page.