Employee Payroll IDs - UK

Entering a Payroll ID

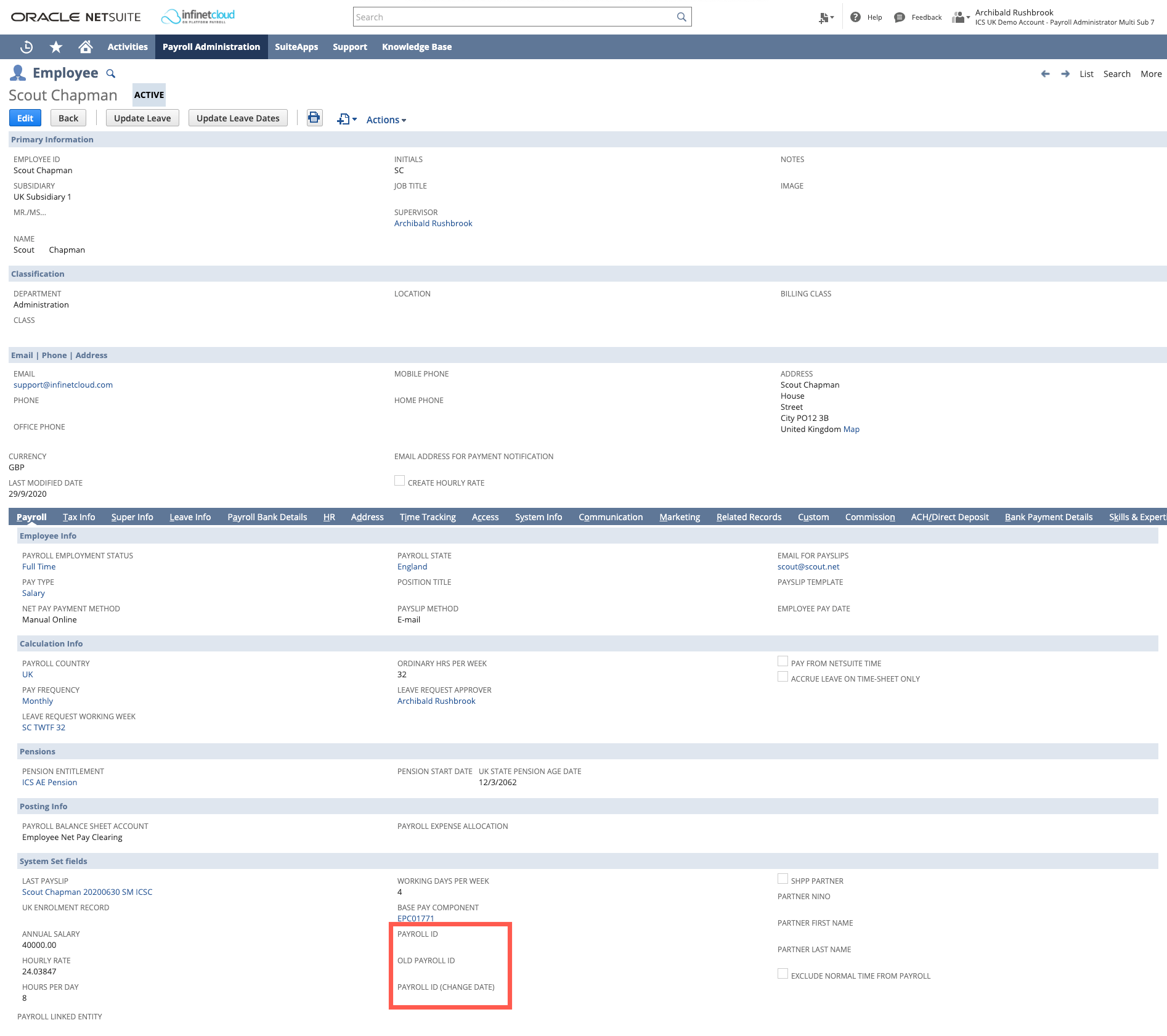

To enter a Payroll ID for a new starter you will need to navigate to the Employee Record (open in edit) > Payroll Tab > System Set Fields

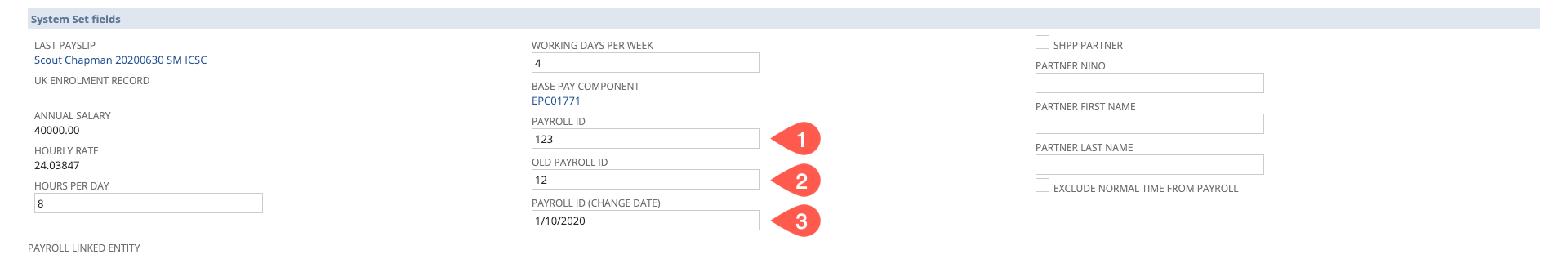

And enter in the required ID in the Payroll ID field.

Updating Payroll IDs

If the employee has no Payroll ID and you want to start submitting one fore them, or if you need to change the employee's Payroll ID for any reason, you would need to do the below so that HMRC is aware, in order to keep the identifiers linked.:

You must not complete this if you are re-employing someone, if you are re-employing someone you must create a new employee record and treat them as any other new starter. If you re-employe someone within the same tax year you must restart their year-to-date information from ‘£0.00’. If you reuse a previous Payroll ID you’ll create a duplicate record with the HMRC and report payroll data incorrectly

- Enter the Payroll ID - this is the new Payroll ID that you would like to use as the unique identifier for this employee

- Enter the Old Payroll ID - the old Payroll ID that you used for this employee, you only enter the old ID if it’s changed since the last FPS the employee was included on, this may be blank if they previously didn't have an ID

- Payroll ID (Change Date) - the date that the employee ID changed (not the employee's start date)