Troubleshooting Pay Events (STP)

Authentication Error Codes

Error code | Description | Recommended action |

|---|---|---|

CMN.ATO.AUTH.007 | You do not have the correct permission to submit this request or retrieve this file. Review your permissions in Access manager or contact your AUSkey Administrator. | Contact your AUSkey administrator to authorise your AUSkey for the relevant registered agent number. Check that the client identifiers on your client record in your software are correct:

If necessary, set up your permissions in Access Manager (see Access Manager). |

CMN.ATO.AUTH.001 | Requesting entity is not authorised to lodge on behalf of the customer. | Your registered agent number is not linked to the ABN of the selected AUSkey. Confirm the AUSkey selected to submit this lodgment is correctly linked to your registered agent number. Attempt to correct in Access Manager. If you still need help, phone the AUSkey help desk on 1300 287 539. |

CMN.ATO.AUTH.002 | You are not authorised to lodge on behalf of this client. | Link this client to your registered agent number (if you are authorised by the client to do so) using the client update service or the portal. In some instances, it may take overnight to process your request. If the link already exists, the client may be restricted in Access Manager. Contact your AUSkey Administrator to allow 'view all restricted clients' or to have the restriction for this client overridden. If the problem persists and the client is appearing on your client list and is not a restricted client, you may need to remove and re-add the client and try to lodge again. |

CMN.ATO.AUTH.004 | No ATO reports currently available. Please try again later. | If the problem persists, check your permissions in Access Manager as you may not be authorised for this report type. If you are using cloud-based software, you may need to contact your software provider. |

CMN.ATO.AUTH.005 | Your AUSkey is not linked to this registered agent number in Access Manager. | Your AUSkey Administrator may need to authorise your agent number for this AUSkey. Ensure your permissions are set up correctly in Access Manager. |

CMN.ATO.AUTH.006 | The requested report belongs to another intermediary. Review request details and try again. | Check that the client-to-agent relationship is correct; the client may be linked to another agent. If the client is linked to your registered agent number, remove and re-add the client and then try again. |

CMN.ATO.AUTH.008 | You are not authorised to lodge on behalf of this client. | Link this client to your registered agent number, using the client update service or the portal. In some instances, it may take overnight to process your request. If the link already exists, the client may be restricted in Access Manager. Contact your AUSkey Administrator to allow 'view all restricted clients' or to have the restriction for this client overridden. If the client is appearing on your client list and is not a restricted client, you may need to remove and re-add the client and try to lodge again. Your agent number must also be linked to the correct agent ABN in Access Manager. Ask your AUSkey Administrator to make any necessary changes. |

CMN.ATO.AUTH.009 | Length of the software ID must be 10 characters. | Check the software ID to ensure it is correct. |

SBR.GEN.AUTH.002 | Mandatory information provided in the transmission is invalid. | Check that you have correctly recorded client information in your practice management software. |

SBR.GEN.AUTH.003 | Reporting party identifier information is missing from the lodgment. | Check that you have included the reporting party identifier (TFN or ABN). |

SBR.GEN.AUTH.004 | Check AUSkey details match the details of the user submitting the information. | Check that the correct AUSkey has been selected for this lodgment. If necessary, contact your AUSkey Administrator. |

SBR.GEN.AUTH.005 | Misalignment of identifying information. | Check that the client identifiers (TFN or ABN) entered into the practice software match the client identifiers used for the lodgment. |

SBR.GEN.AUTH.006 | The software provider has not been nominated to secure your online (cloud) transmissions. | You must nominate your software provider before attempting to lodge. Phone us on 1300 852 232 or use Access Manager to notify us of a hosted SBR software service. |

SBR.GEN.AUTH.008 | Your nomination with the online (cloud) software provider does not contain the correct software ID. | Check and update your hosted SBR software ID through Access Manager or by phoning 1300 852 232. |

SBR.GEN.AUTH.009 | You do not have the correct permission to submit this lodgment. | Review your permissions in Access Manager or contact your AUSkey Administrator. |

SBR.GEN.AUTH.012 | Intermediary identifier information is missing from the lodgment. | Ensure that the TFN, ABN or ARN of the intermediary is in the appropriate field. |

SBR.GEN.AUTH.013 | The ABN of the business being acted on behalf of is required. | Attempt to correct the field. |

SBR.GEN.AUTH.014 | A client’s ABN, TFN, WPN or ARN is required for this request. | Attempt to correct the field. |

SBR.GEN.AUTH.015 | You are not authorised to submit this request. Review permissions in Access Manager and try again. | Check your permissions in Access Manager or contact your AUSkey Administrator. |

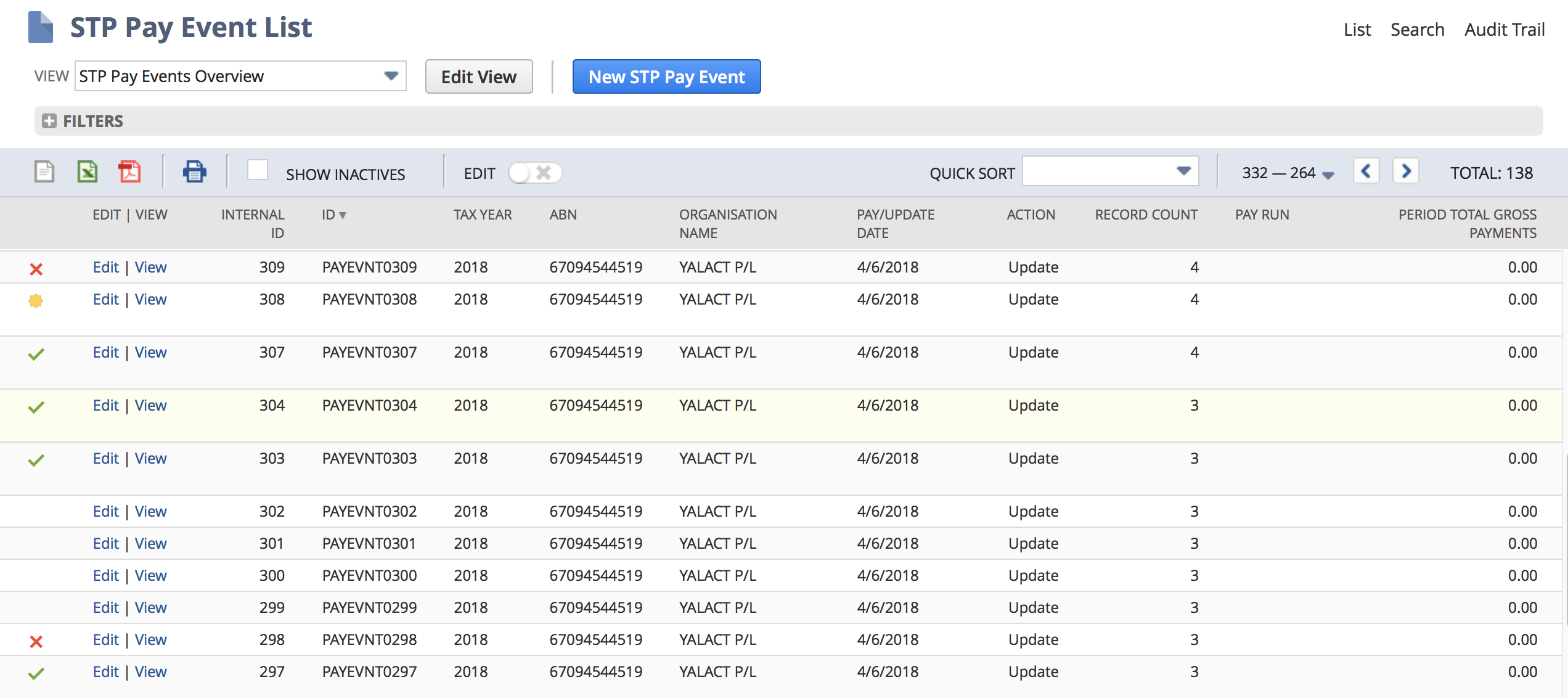

Review Pay Events

You can easily review all Pay Events by selecting the following menu option: Payroll Administration > Single Touch Payroll (AU) > Pay Events Overview

The status of each Pay Event is easily identifiable using the coloured icons on the left. For more information, refer to the following table.

Icon | Meaning | Possible Action |

|---|---|---|

| Data for the Pay Event is being calculated | None. Wait till the process completes. | |

| The Pay Event was rejected by the ATO | Open the Pay Event, review the error details including the Submission Errors sublist, and take appropriate action. | |

| The Pay Event was partially accepted by the ATO | Open the Pay Event and review the Submission Errors sublist. If required, take appropriate action. | |

| The Pay Event was accepted in full by the ATO | None. | |

| <NO ICON> | The Pay Event is pending submission or is currently being submitted to the ATO | None. Wait, or open the Pay Event for more detail. |

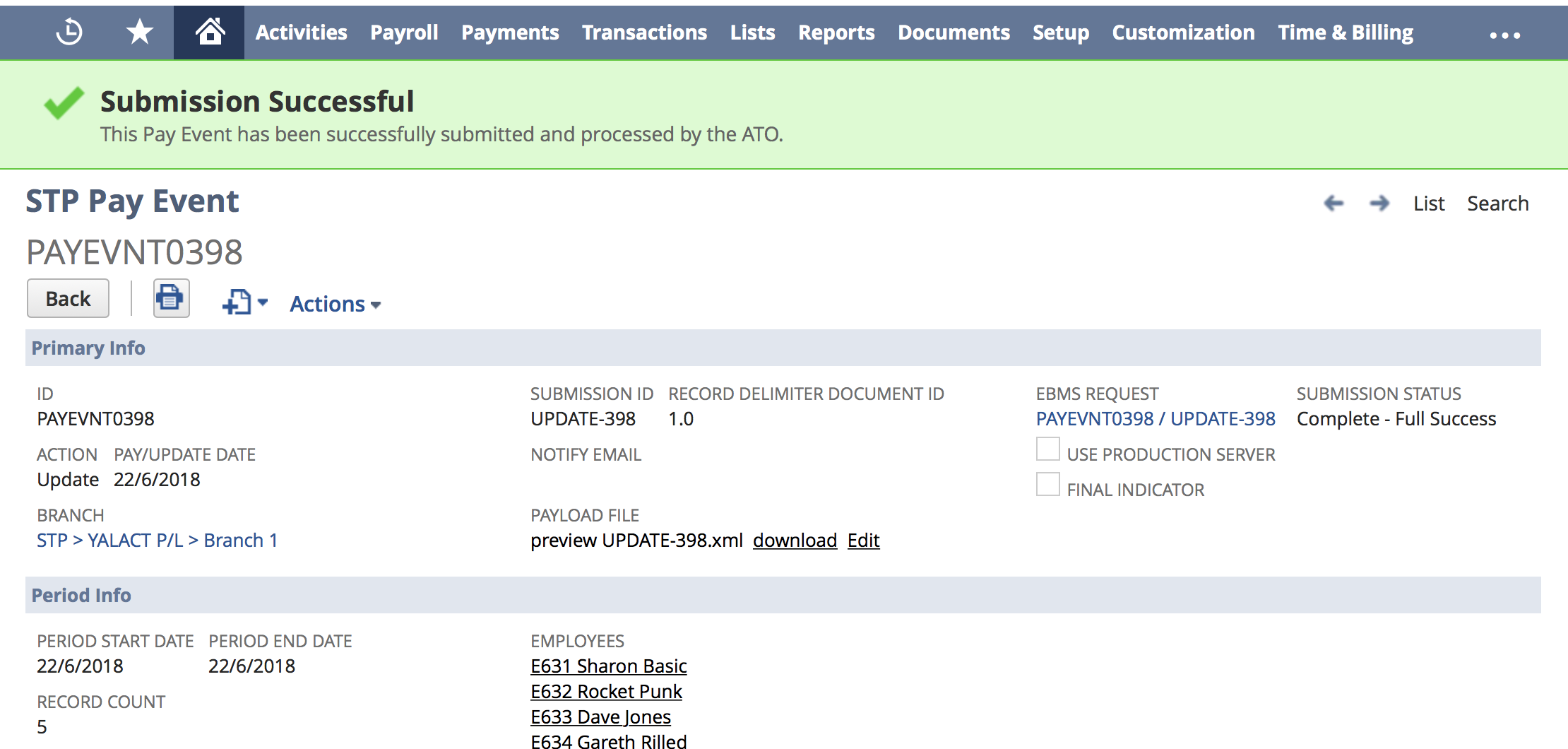

Identify Successful Submissions

A successful STP Pay Event can be easily identified by the green banner visible when opening the Pay Event record.

Alternatively, you should also receive an email notification when the server receives a response from the ATO. Finally, you may also like to Review Pay Events.

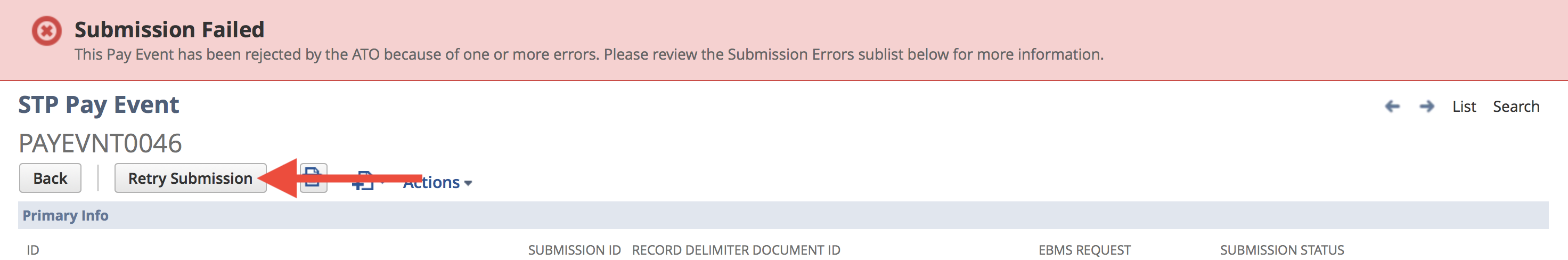

Deal with Failed/Rejected Submissions

If a Pay Event is rejected by the ATO (I.e. submission has failed), then you will need to address any error(s) identified and re-submit immediately. Pay Events can fail for a number of reasons, all will be displayed with a red banner as per the screenshot below.

Once you have fixed the error(s), click the Retry Submission button.

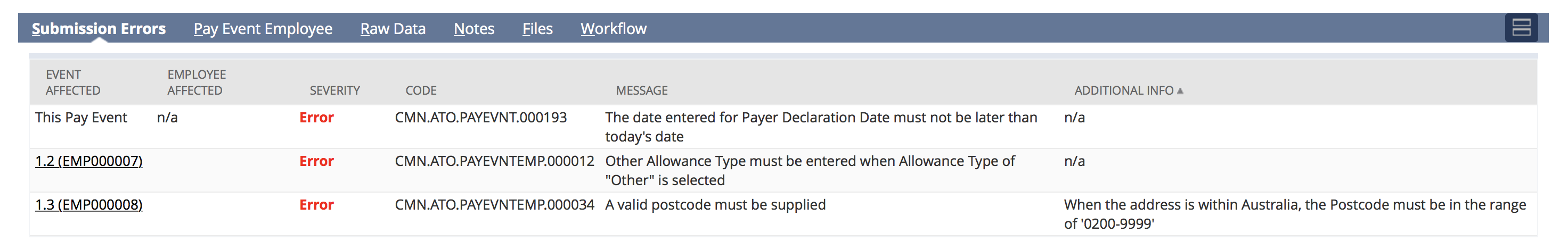

Transmission type errors will be displayed in the red banner. Most errors, will however be detailed in the Submission Errors sublist.

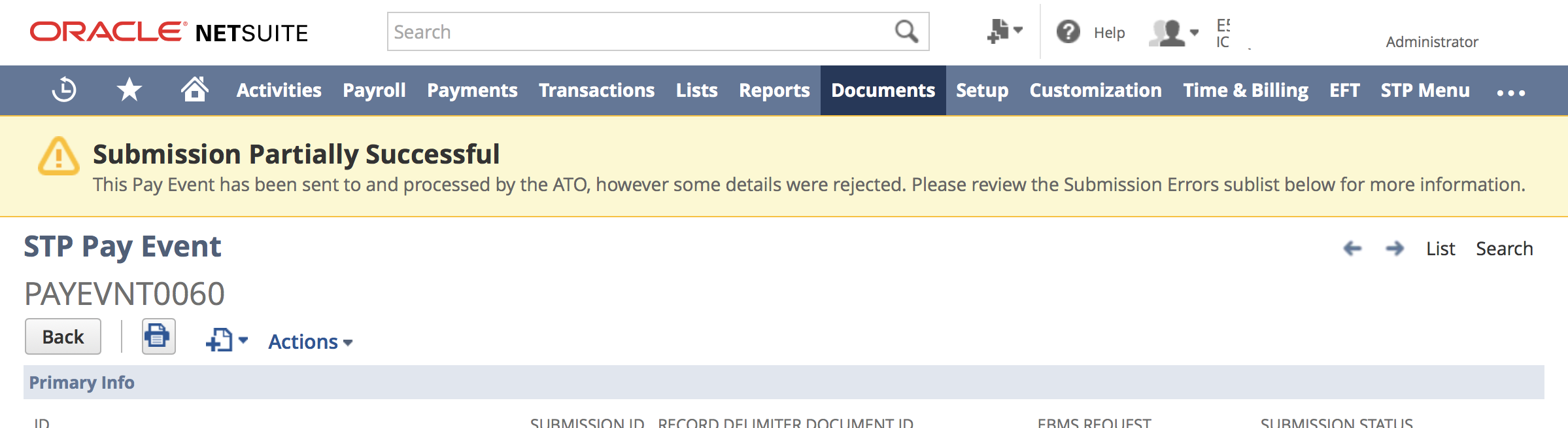

Deal with Partially Successful Submissions

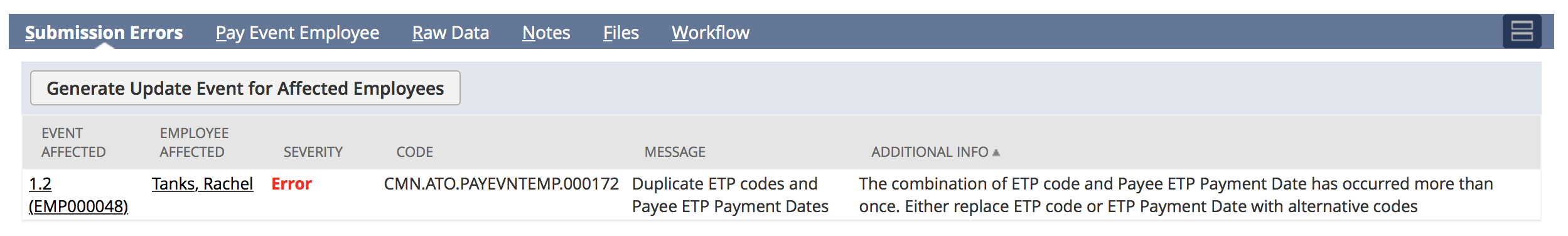

If a Pay Event is partially accepted by the ATO, a yellow banner will appear on the Pay Event and details of the error(s) will be available in the Submission Errors sublist.

Scroll down to to see the Submission Errors sublist and review the information available. As per the ATO's guidelines, fixes for most errors may be deferred till the next regular pay cycle for any affected employee(s). Regardless, you should address any error(s) in the system immediately to ensure they're fixed for the next submission.

If you'd like to create an Update Pay Event to fix errors for any employees with the ATO now, then click the Generate Update Pay Event for Affected Employees button.

Only Employees with Error(s) will be displayed in the Submissions Errors sublist. Employees that do not appear here were accepted (successful) by the ATO. To see the full list of Employees and the data included with a Pay Event, select the Pay Event Employee tab/sublist.

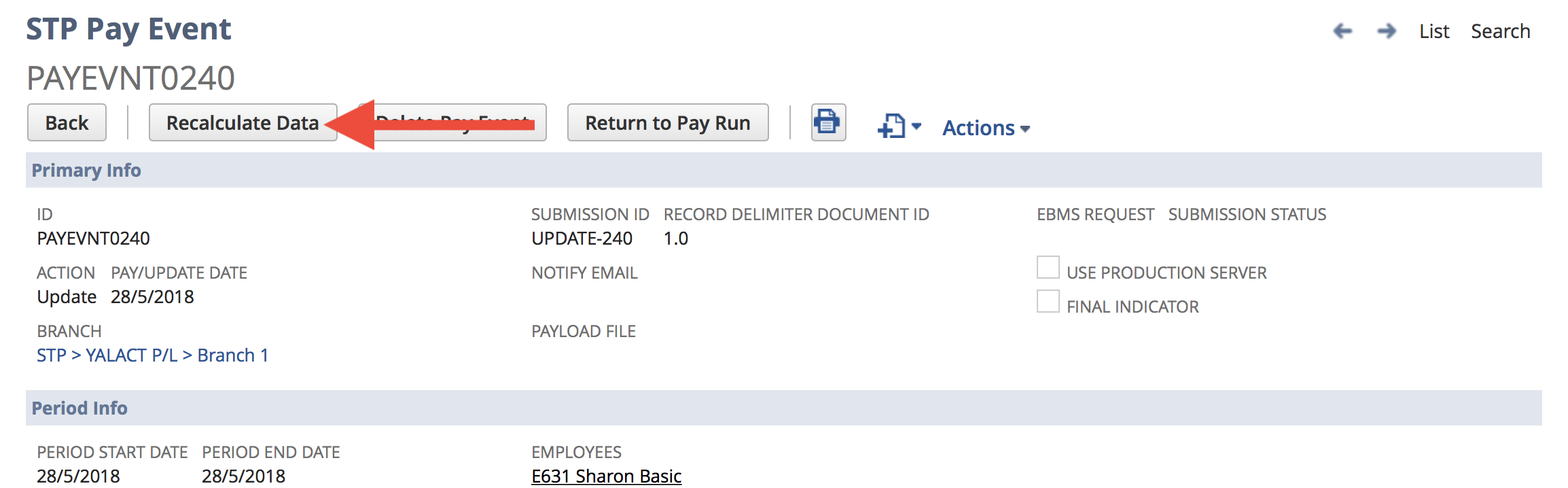

Recalculate a Pay Event

The two most common scenarios for recalculating a Pay Event are:

- If a previous data calculation process has failed

- If you've made changes to a Pay Run or Employee data and would like the (un-submitted) Pay Event to reflect the changes.

To recalculate the data, open the and click the Recalculate Data button.

Delete a Pay Event

A Pay Event can ONLY be deleted if it hasn't been submitted to the ATO. If you've noticed issues with the data included on a Pay Event that hasn't been submitted yet, or have made changes (e.g. in a Pay Run) and you'd like the Pay Event to reflect the changes, then you should Recalculate the Pay Event instead of deleting it.

To delete a Pay Event that hasn't been submitted yet, open the record and click the Delete Pay Event button. If you've