/

6. Superannuation tab

6. Superannuation tab

Feb 23, 2023

You cannot change this information whilst in Edit mode. This information defaults from the Employee Super Fund details that you add later during step 10. Add Super/Pension Funds

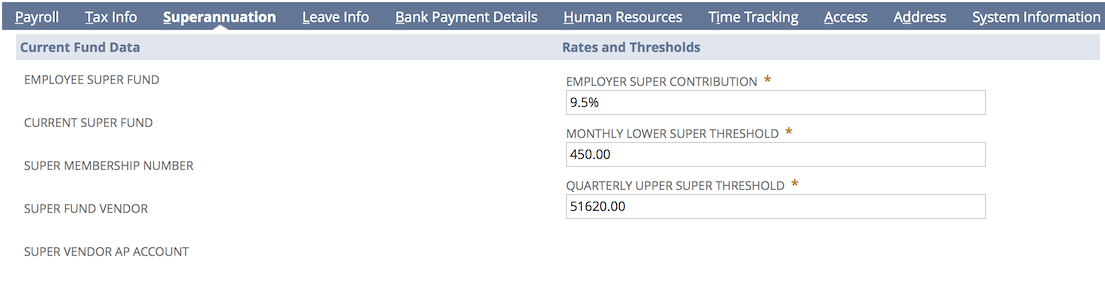

Rates and Thresholds

Use these fields to set your (the employer's) super obligations for the employee.

- Employer Super Contribution - defaults from the configuration, enter the amount of Employer Super Contribution as a percentage. For example: 9.5%

- Monthly Lower Super Threshold - lower threshold that your (the employer's) obligation to pay superannuation starts. If you want to calculate and pay super to the employee regardless of their monthly earnings then set this to 0.00

- Quarterly Upper Super Threshold - upper threshold that your (the employer's) obligation to pay any additional superannuation stops. If you want to continue calculating and paying super to the employee - regardless of their earnings - then set this to a high amount, for example: 999999.99

Go to step 7. Leave Info tab

Employee Setup Guide

, multiple selections available, Use left or right arrow keys to navigate selected items