/

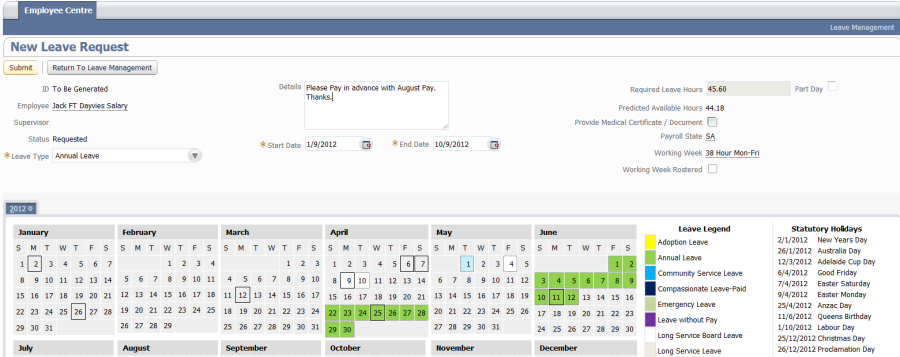

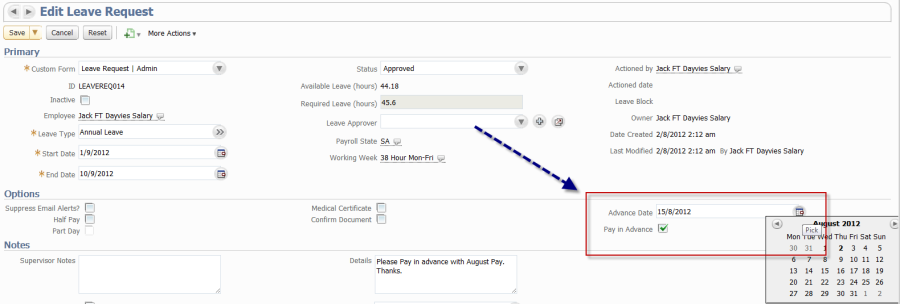

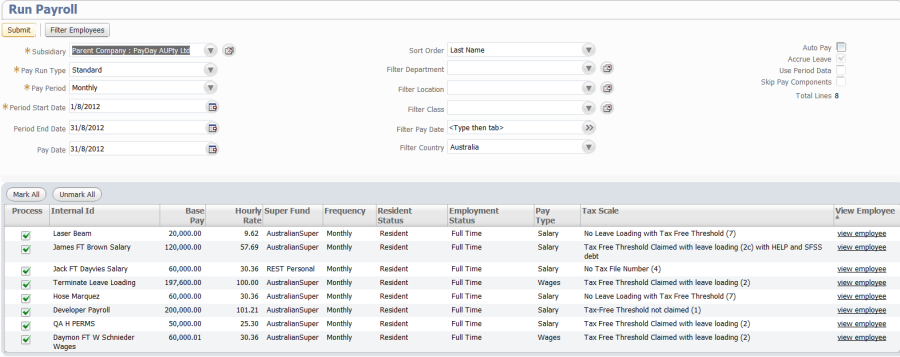

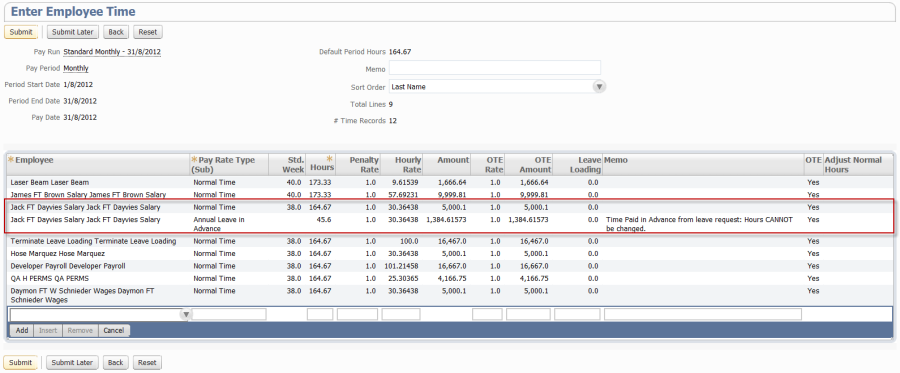

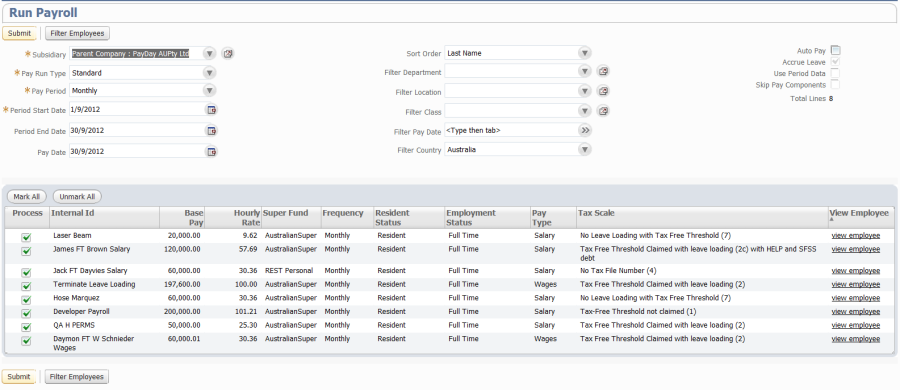

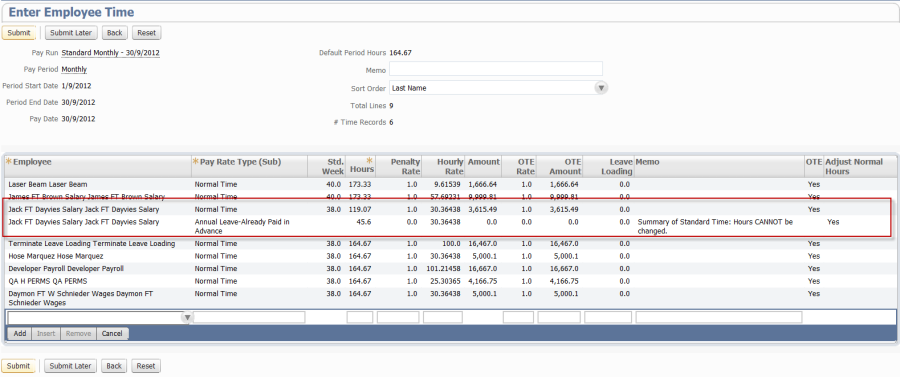

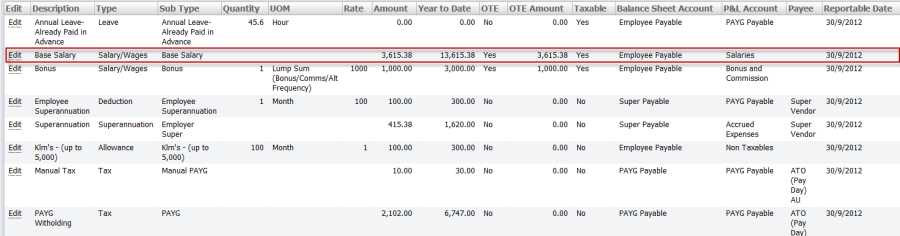

Paying Leave in Advance

Paying Leave in Advance

Related content

Payroll Support

Payroll Support

More like this

Statutory Sick Pay (SSP)

Statutory Sick Pay (SSP)

More like this

Payrolled Benefits in Kind (PBiK)

Payrolled Benefits in Kind (PBiK)

More like this

Leave Configuration

Leave Configuration

Read with this

3. UK EOY Expenses & Benefits P11d(b)

3. UK EOY Expenses & Benefits P11d(b)

More like this

Finalising a Financial Year (STP)

Finalising a Financial Year (STP)

More like this