Reporting New & Departing Employees (Employee Details)

Generating a New Report

To generate a new Employee Detail Payday report (CSV) file to upload to the IR, follow these steps:

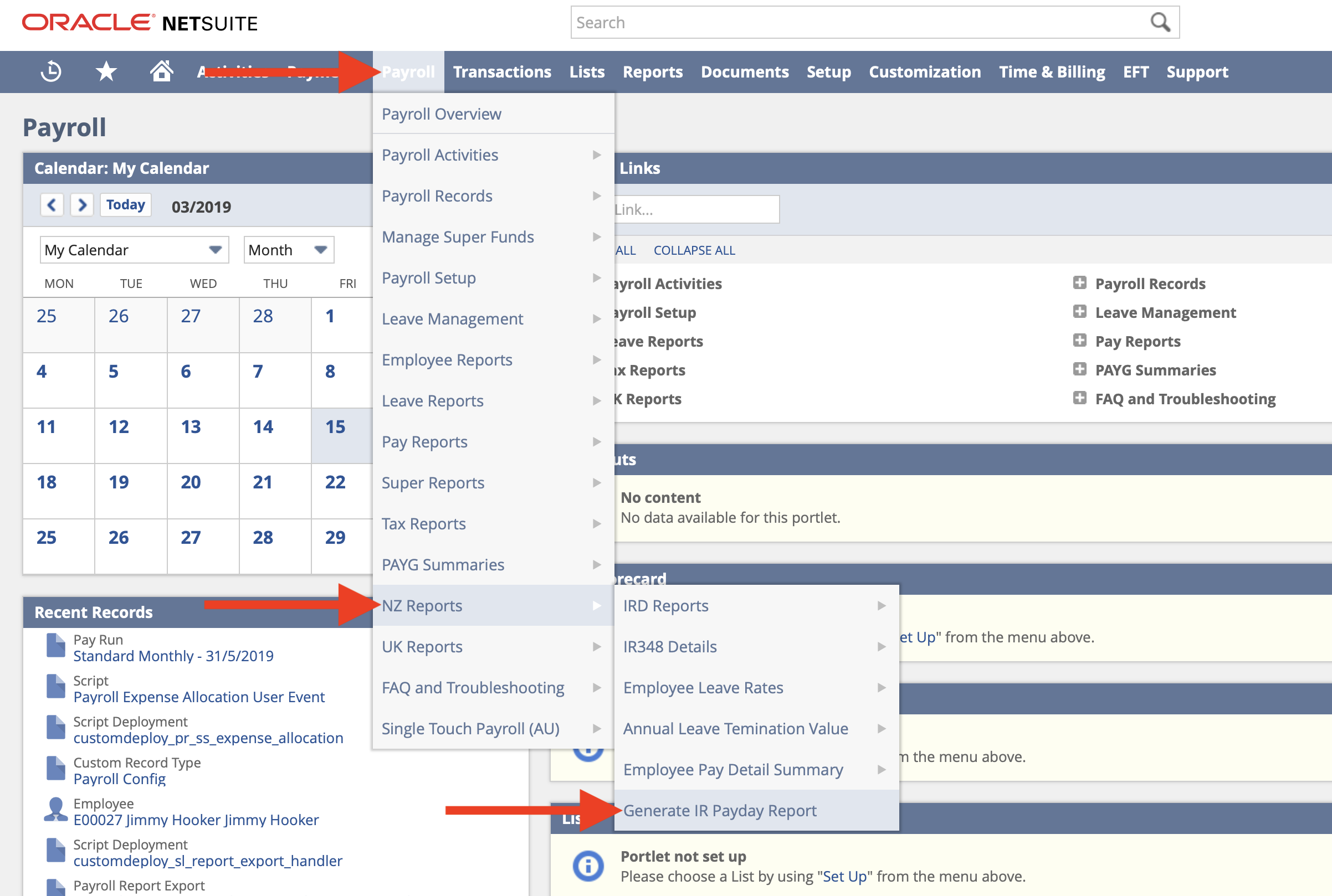

- From the menu, select Payroll Administration > NZ Reports > Generate IR Payday Report

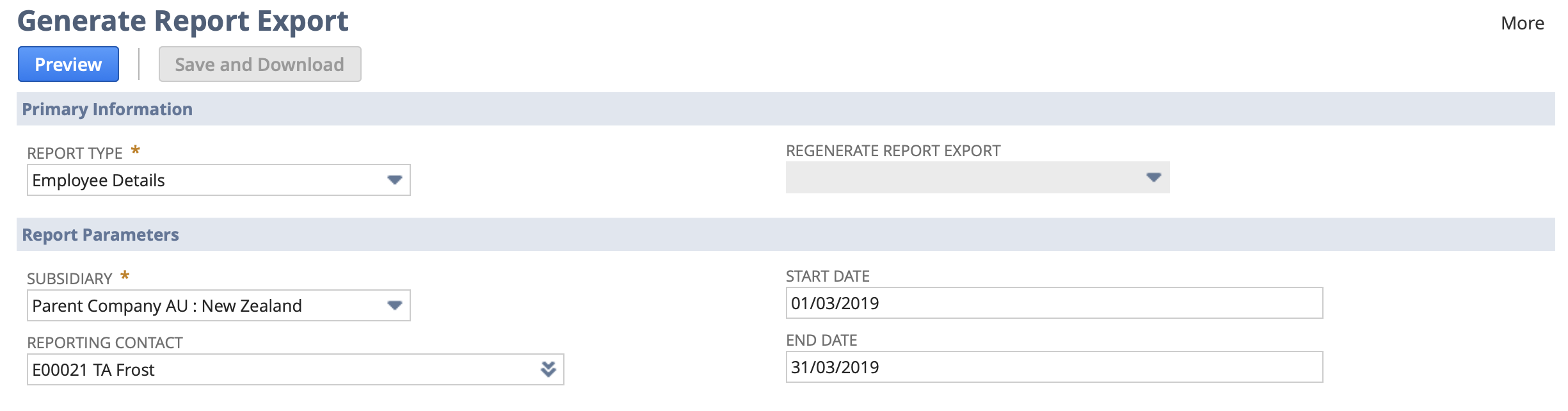

- If not selected, select Employee Details from the Report Type dropdown

- Set the following fields:

- Subsidiary - the subsidiary you want to include employees from

- Reporting Contact - the person who will be submitting this report to the IR

- Start Date - employees you have a Hire or Termination date after this date will be included

- End Date - employees who have a Hire or Termination date before this date will be included

- Click the Preview button

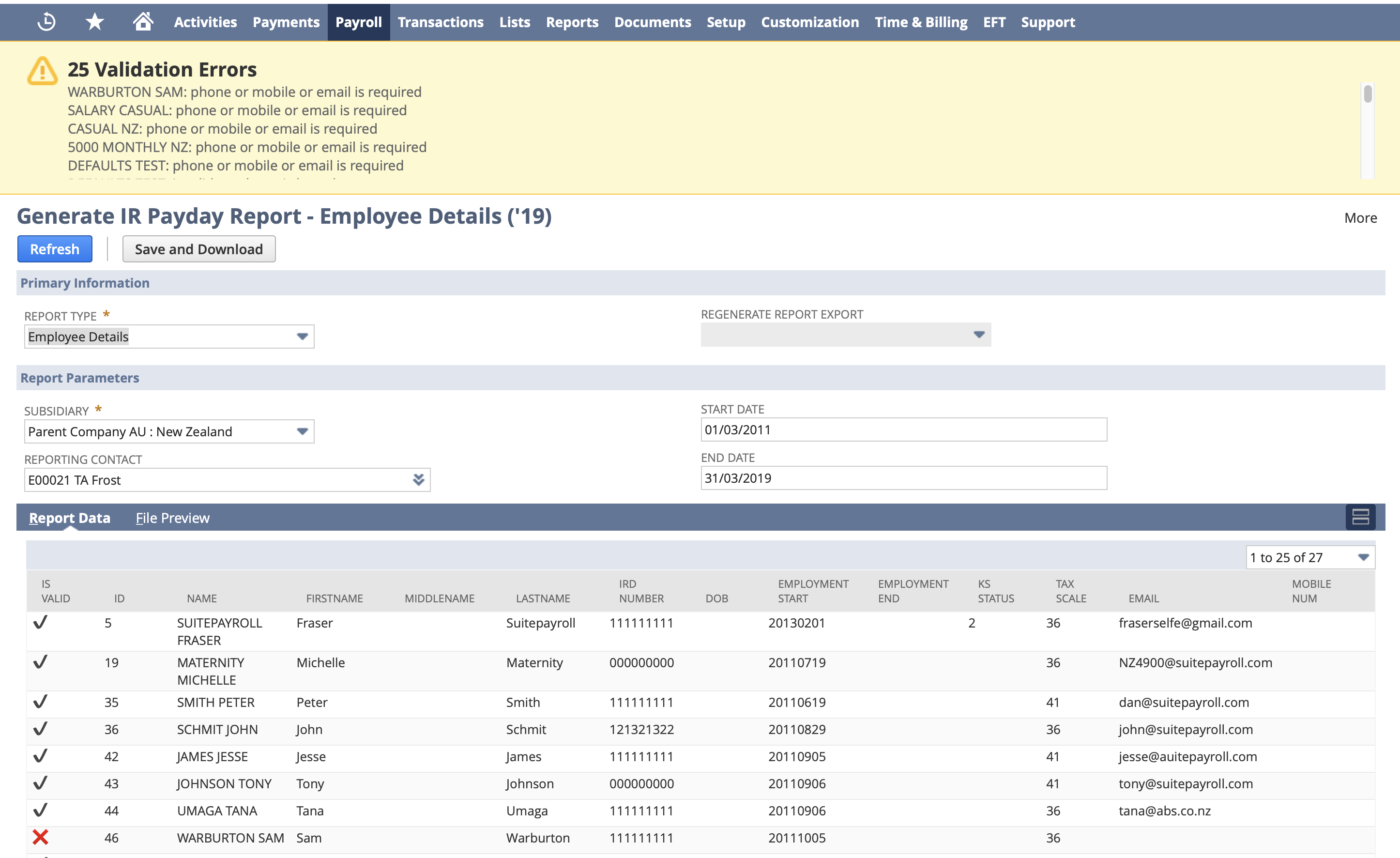

- A few notes regarding this screen:

- Any validation errors will be displayed in the top, you should review these and (if applicable) fix them.

- If more than 25 results are returned, the results will "paginate". To switch between pages, use the 1 to 25 of X dropdown on the right.

- To see a preview of the CSV file that will be created switch to the File Preview tab.

- If you need to make any changes (e.g. update an employee's details, or change the Start Date) then make sure you click the Refresh button so that the changes are reflected.

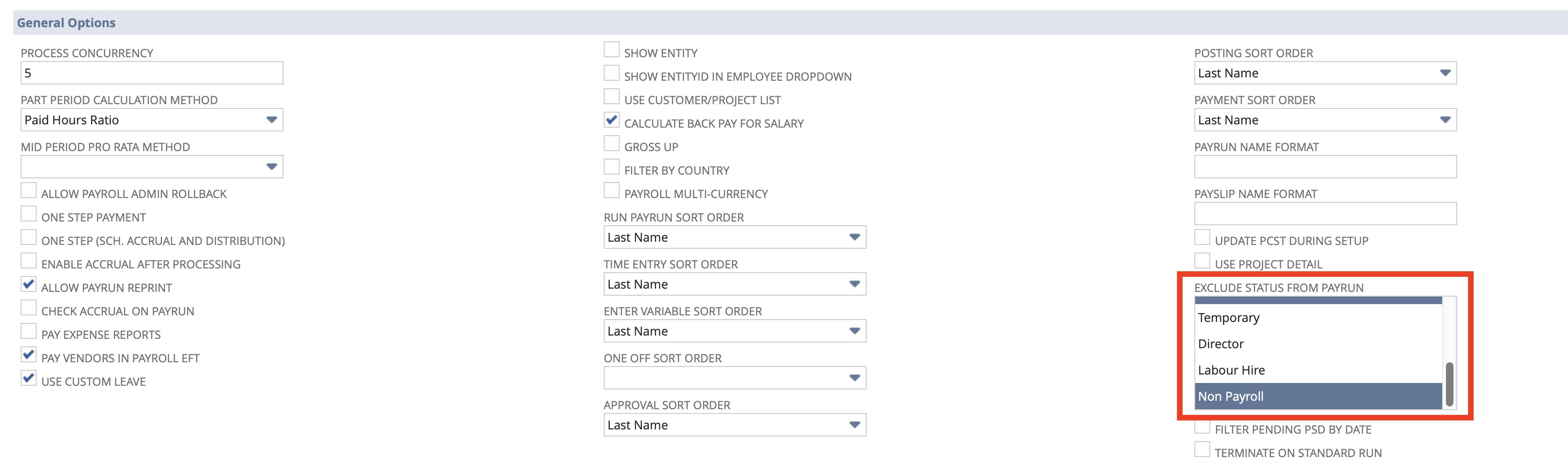

- If you have individuals who are set-up as employees that are Non Payroll and do not need to reported to the IRD you should edit their employee record and set their Payroll Employment Status to Non Payroll and refresh this page.

- Once you are happy with the report, click the Save and Download button

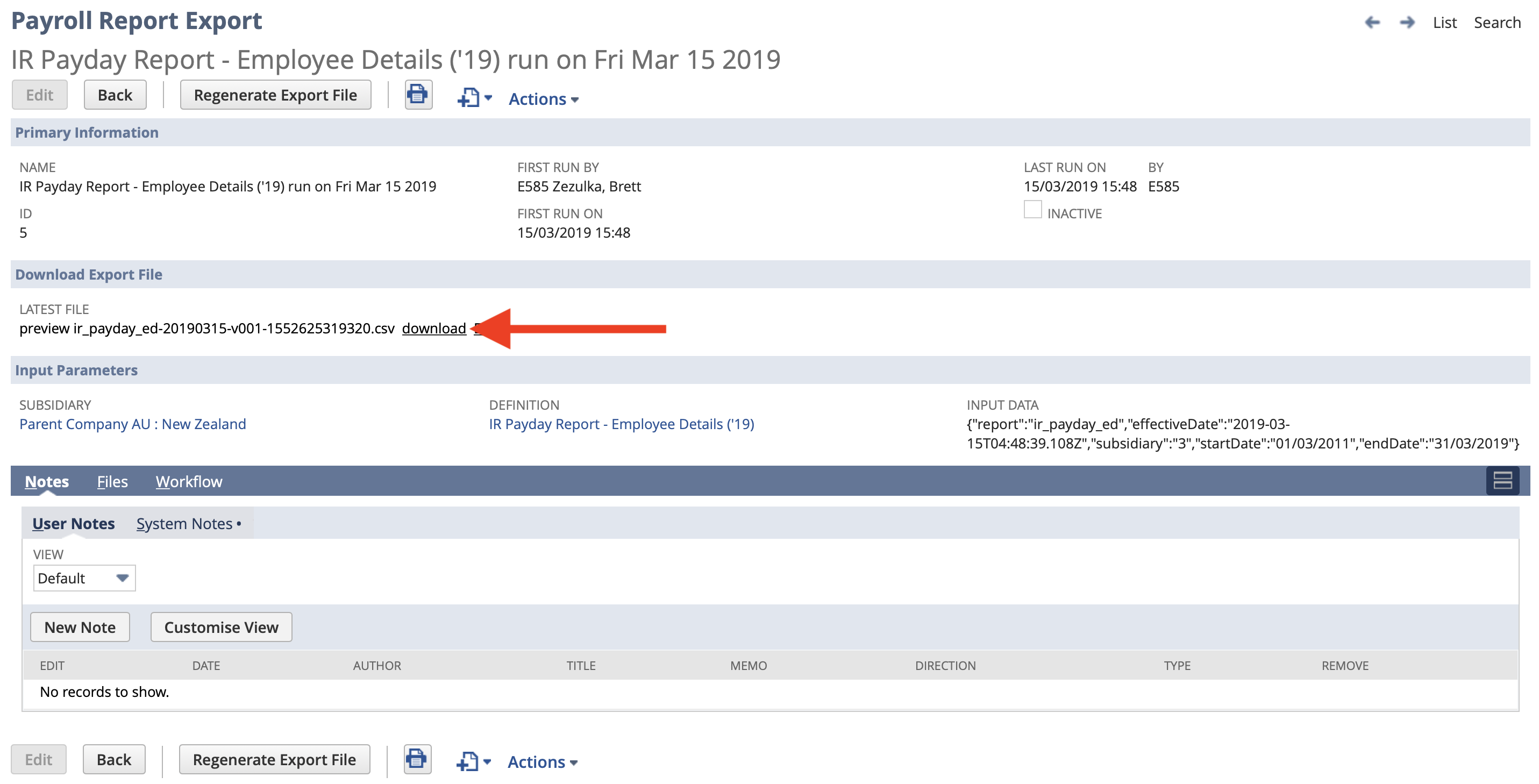

- You will be redirected to a new Payroll Report Export record.

- Click the download link to download the Payday Employee Details report you just generated.

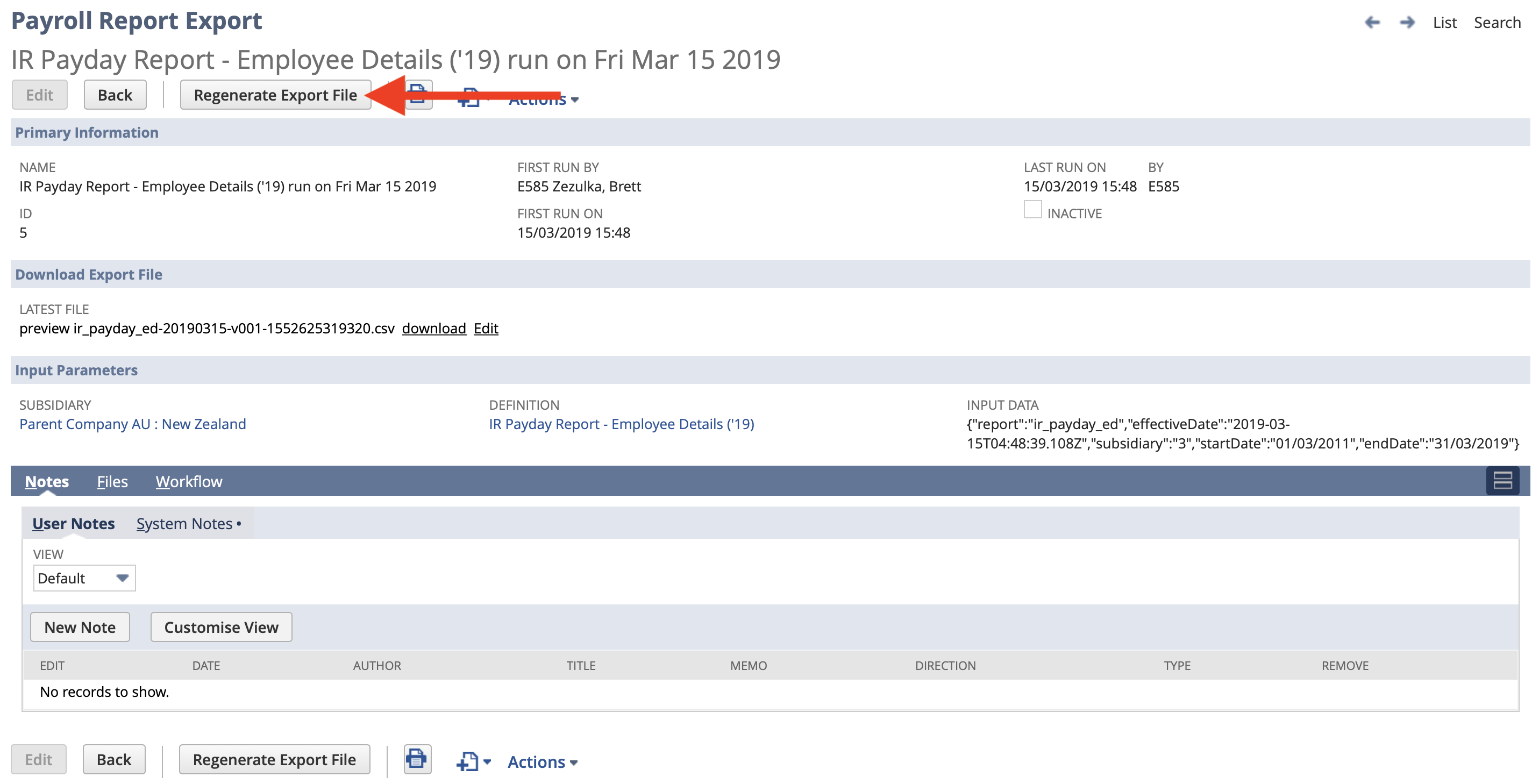

Regenerating a Payday Report

To regenerate a previously created Payday Report:

- Locate the relevant Payday Report (see section below)

- Click the Regenerate Export File button

- Review the data / preview.

- Click the Save and Download button.

- Click the download link to download the latest file to your computer

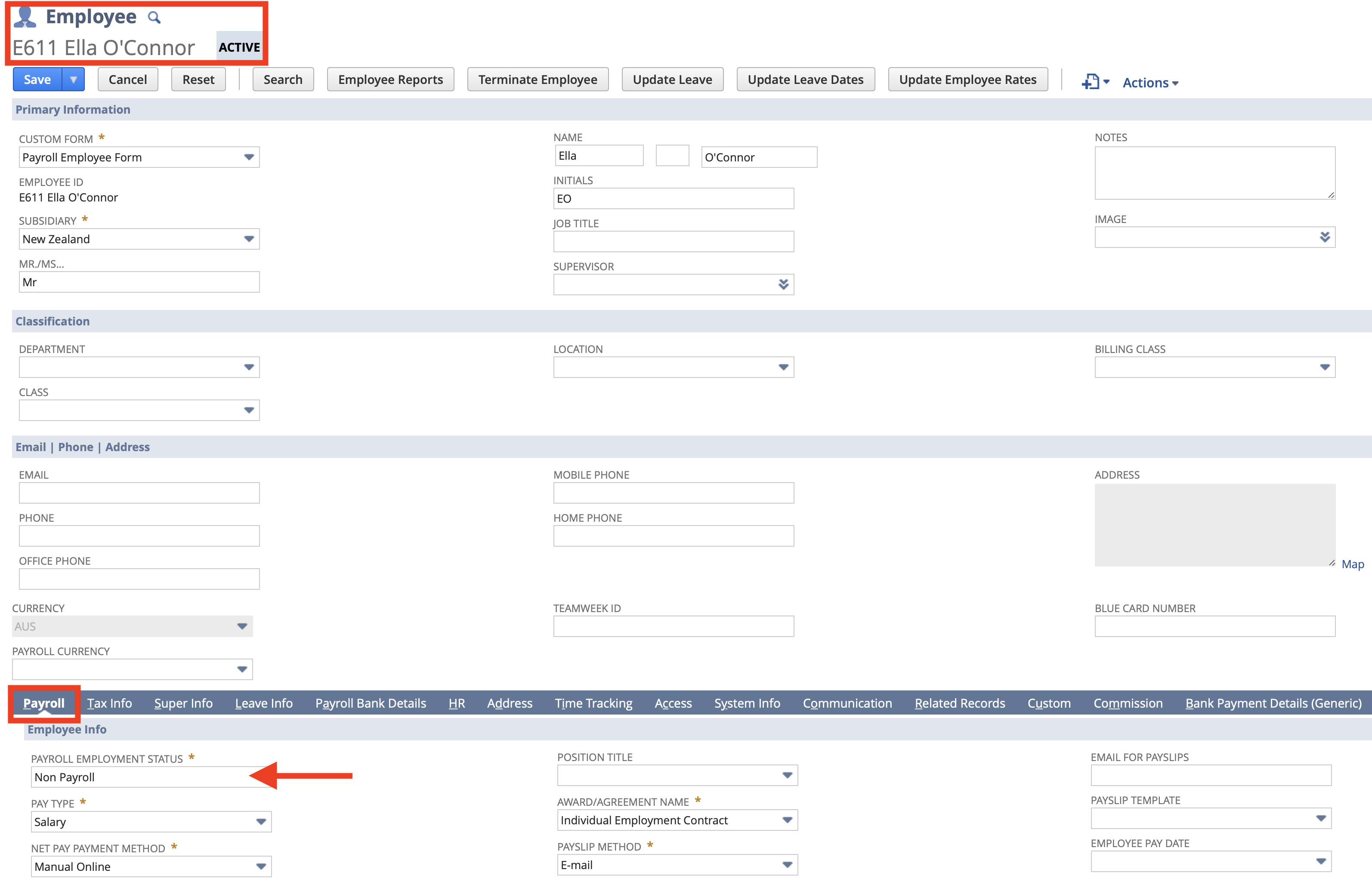

Excluding an Employee

If employees are being included in an Employee Details Report that shouldn't, the please check the Employment Status of those employees. To do this:

- Open the Employee record

- Under the Payroll tab, check the Payroll Employment Status field

- The value of this field should correspond to relevant advanced Payroll Configuration.

Duplicate/Resubmit of Employee Details

There are no issues with submitting details of an employee that has previously been submitted via Payday Filing. Doing so merely updates the details the IR has stored for any previously submitted employees.

It is therefore also okay to regenerate and resubmit an Employee Details report for a number of employees.

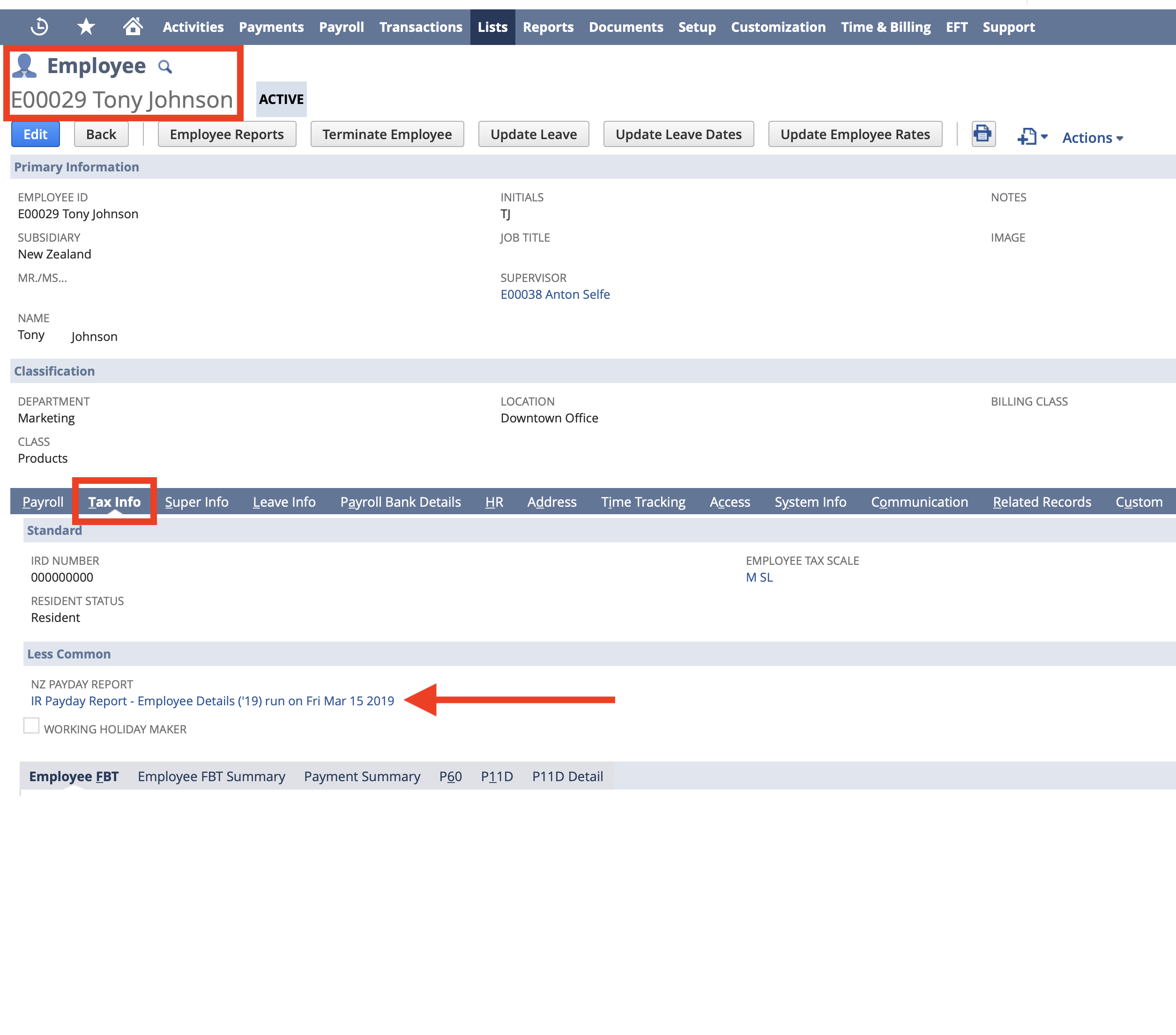

Locating a Previous Payday Report

Sometimes, you may need to locate the Employee Details Payday Report where an employee was last included. The easiest way to do this is:

- Locate the Employee in question

- Under the Tax Info tab, find the NZ Payday Report field and click through to the linked record.

- If the field is empty then the employee has not been included in a Employee Details Payday Report.

- If the field is empty then the employee has not been included in a Employee Details Payday Report.