Single Touch Payroll (STP) Guide

Accessing STP functionality

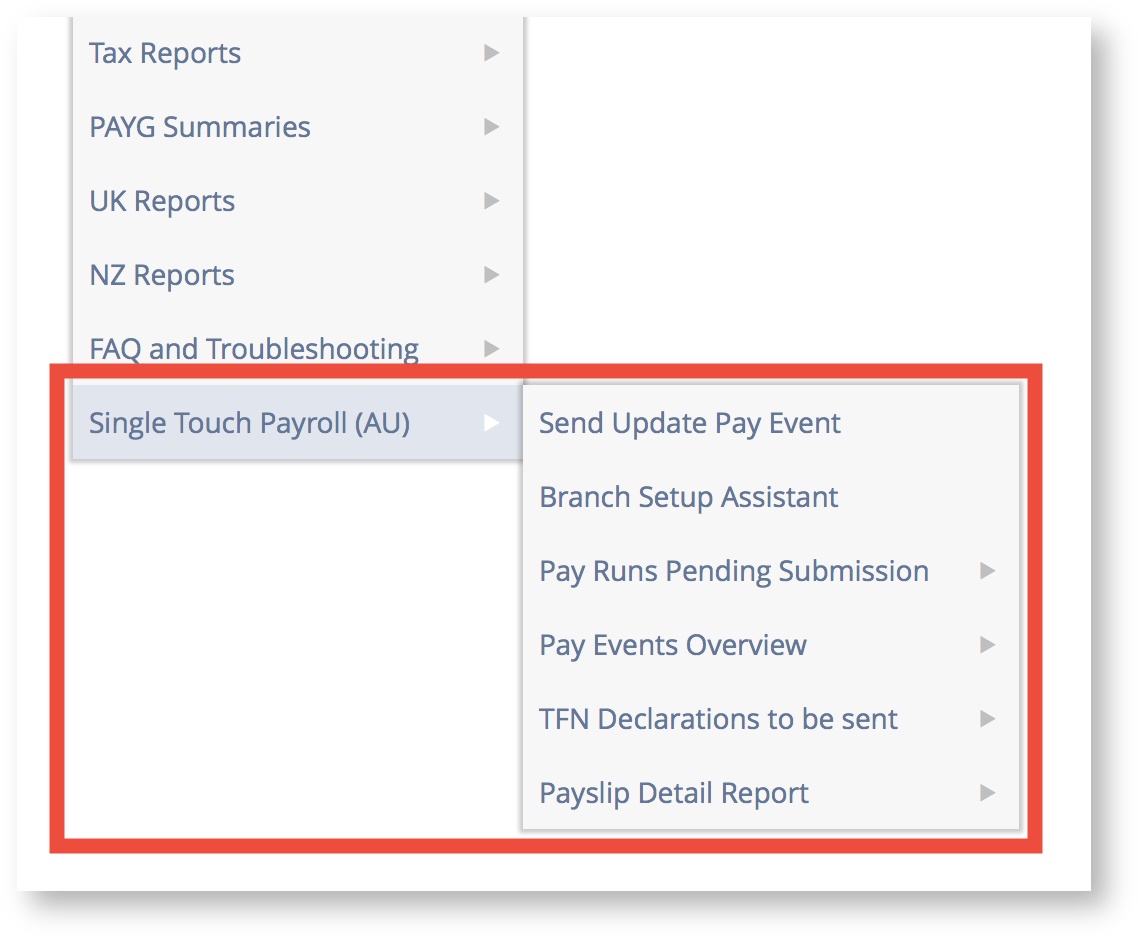

You should use the Payroll Administrator - Unlocked or similar role when using STP functionality. If you have a NetSuite One World account, then Subsidiary permissions and restrictions are respected throughout the solution. All functionality can be easily accessed from the Payroll or Payroll Administration menu, Single Touch Payroll (AU) sub-menu.