Process Overview

Eligible Infinet Cloud Payroll customers can manage employee nomination and quarterly lodgement of minimum hours test requirements directly from Infinet Cloud Payroll via STP.

This process requires the Customer to install a bundle containing specific pay component sub types and scripts that can then be used for processing 'One-off' pay details relevant to JobMaker reporting.

Setup

Once you have confirmed you are eligible for registration for the scheme, there are three simple steps to get started;

1. Install the JobMaker Bundle

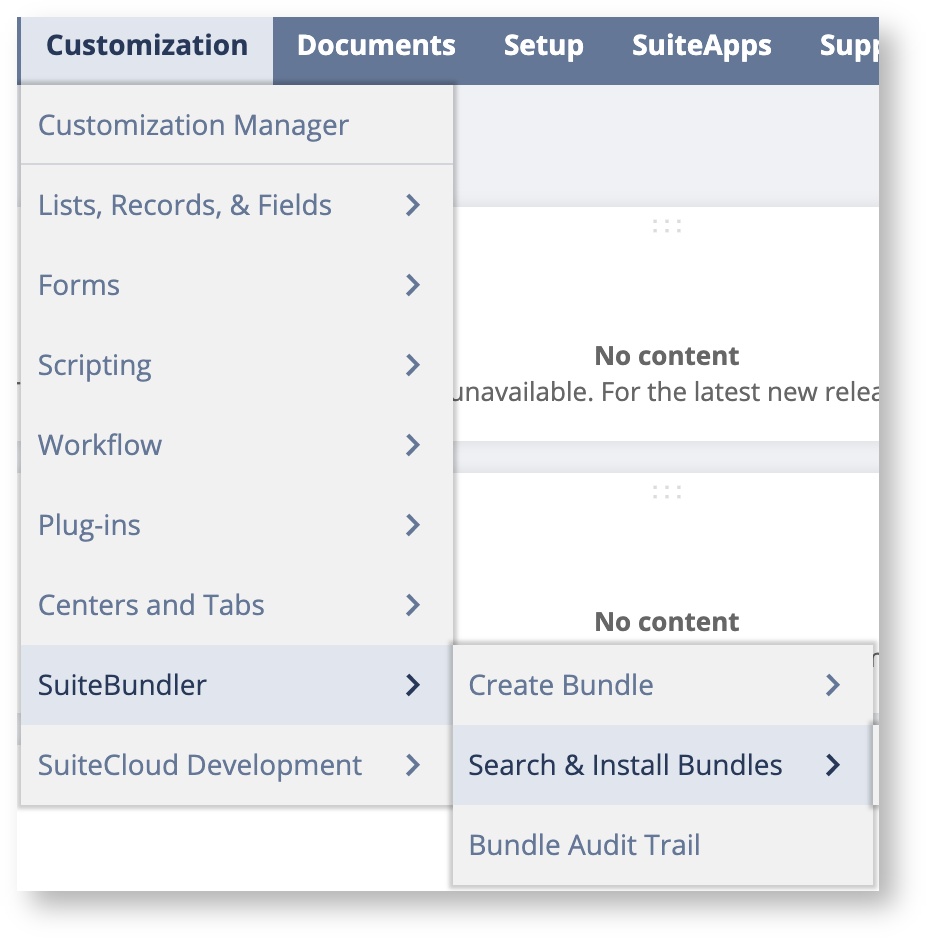

- As an Administrator, navigate to Customisation > SuiteBundler > Search & Install Bundles

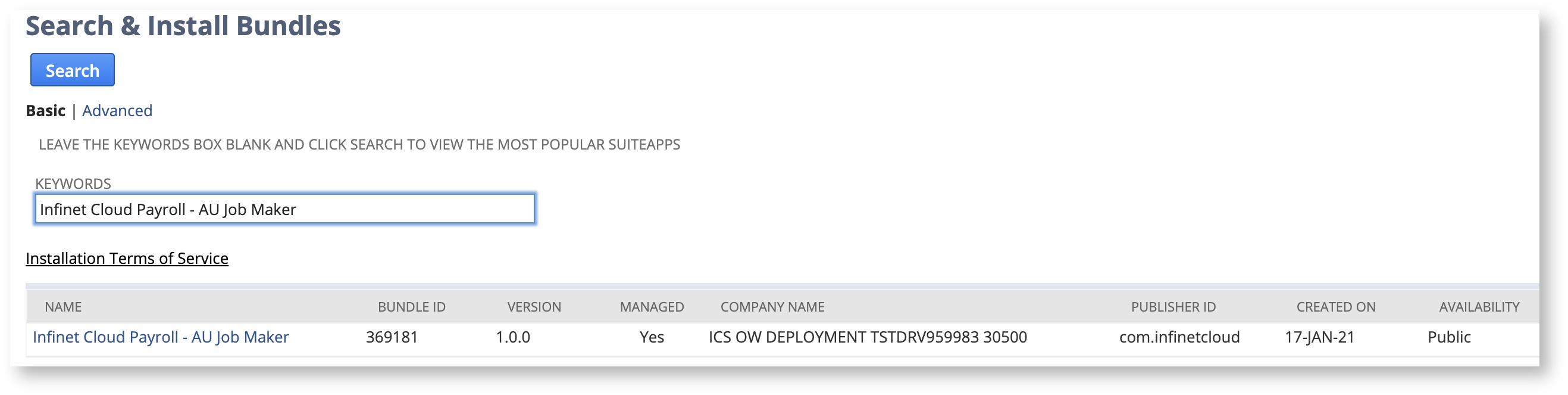

- Copy 'Infinet Cloud Payroll - AU Job Maker' and paste into in the Keywords field

- Click the Search button

- Click on Name link

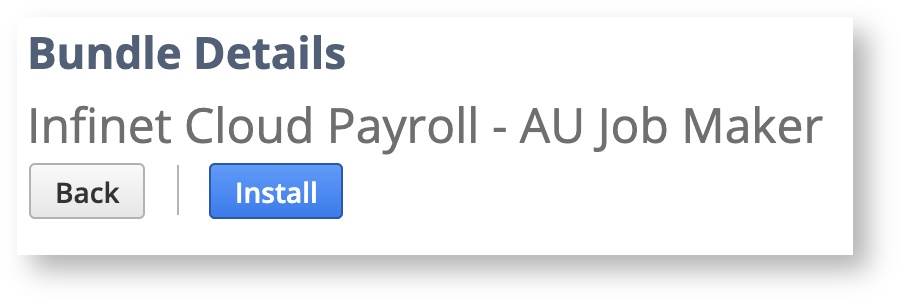

- Click the Install button

2. JobMaker Hiring Credit Nomination

Employers must use an STP payroll event to nominate employees eligible for the JobMaker Hiring Credit to the ATO.

Employee nomination for the JobMaker Hiring Credit Scheme is expected to occur at the point of hiring during the JobMaker period dates, and prior to making a claim.

NB

It may take up to 72 hours for this information to be processed and made available on the ATO portal.

Report Employee Nomination

Enter Payslip Details

- Enter the information at the One Off stage during the pay run or to enter in advance (navigate to Payroll Administration > Payroll Activities > Enter One Off Pay Details)

- Select Tax Year

- Select Subsidiary

- Enter Date - this will be the Claim Period Date (see table above)

- Select Paid for Period - Quarterly

- Select Employee

- Select Sub Type

- Click Submit

Send Update Pay Event

- From the menu, select: Payroll Administration > Single Touch Payroll (AU) > Send Update Pay Event

The following STP Elements will be sent via STP

STP Element ID | STP Element name |

|---|---|

PAYEVNTEMP13 | Payee TFN |

PAYEVNTEMP92 | Payee Commencement Date |

PAYEVNTEMP205 | Payee Day of Birth |

PAYEVNTEMP203 | Payee Month of Birth |

PAYEVNTEMP204 | Payee Year of Birth |

| STP Element | Pay Component Sub Type |

|---|---|

Other Allowance Description | JMHC_NOM |

3. JobMaker Hiring Credit Minimum Hours Declaration

Using the codes from the table below, select one of the following codes in the sub Type field to declare the Minimum Hours test was met.

Report Minimum Hours Test Declaration

Enter Payslip Details

- Navigate to Payroll Administration > Payroll Activities > Enter One Off Pay Details

- Select Tax Year

- Select Subsidiary

- Enter Date - this will be the Claim Period Date (see table above)

- Select Paid for Period - Quarterly

- Select Employee

- Select Sub Type

- Click Submit

JobMaker Period | Pay Component Sub Type |

|---|---|

Period 1 | JMHC_P01 |

Period 2 | JMHC_P02 |

Period 3 | JMHC_P03 |

Period 4 | JMHC_P04 |

Period 5 | JMHC_P05 |

Period 6 | JMHC_P06 |

Period 7 | JMHC_P07 |

Period 8 | JMHC_P08 |

Send Update Pay Event

- Navigate to: Payroll Administration>Single Touch Payroll (AU) > Send Update Pay Event

JobMaker Hiring Credit Corrections

The ATO will treat JobMaker Hiring Credit code reporting in chronological order of when the STP Event was sent.

Use the following codes to correct STP reporting for Nomination, Rehiring and/or Minimum Hours Test Declarations.

Enter Payslip Details

- Navigate to Payroll Administration > Payroll Activities > Enter One Off Pay Details

- Select Tax Year

- Select Subsidiary

- Enter Date - this will be the Claim Period Date (see table above)

- Select Paid for Period - Quarterly

- Select Employee

- Select Sub Type

- Submit

| Sub Type | Reporting Purpose |

|---|---|

| JMHC_NOMX | Reporting JMHC_NOMX will remove the nomination for the employee, and they will not be part of any claim. This sub type should only be used to indicate that the original nomination should not have been provided. **This code should not be used to report the cessation of an employee** |

| JMHC_RENOMX | Reporting JMHC_RENOMX will remove the rehire nomination for the employee, and they will not be part of any claim. This sub type should only be used to indicate that the rehire nomination should not have been provided. **This code should not be used to report the cessation of an employee** |

JMHC_P01X JMHC_P02X JMHC_P03X JMHC_P04X JMHC_P05X JMHC_P06X JMHC_P07X JMHC_P08X JMHC_P09X | Reporting JMHC_PXXX will remove the declaration that an employee met the minimum hours test for the specific JobMaker period. |

Send Update Pay Event

- Navigate to: Payroll Administration>Single Touch Payroll (AU) > Send Update Pay Event

JobMaker Hiring Credit Cessation

If an employee nominated for JobMaker Hire Credit ceases employment within 12 months of being hired the employer must report a 'Payee Cessation Date'. When you terminate an employee the termination date that is entered in your termination pay run will in turn be reported to the ATO to confirm employment has ended. There is nothing additional that is required other than following the standard ICS Termination Process.