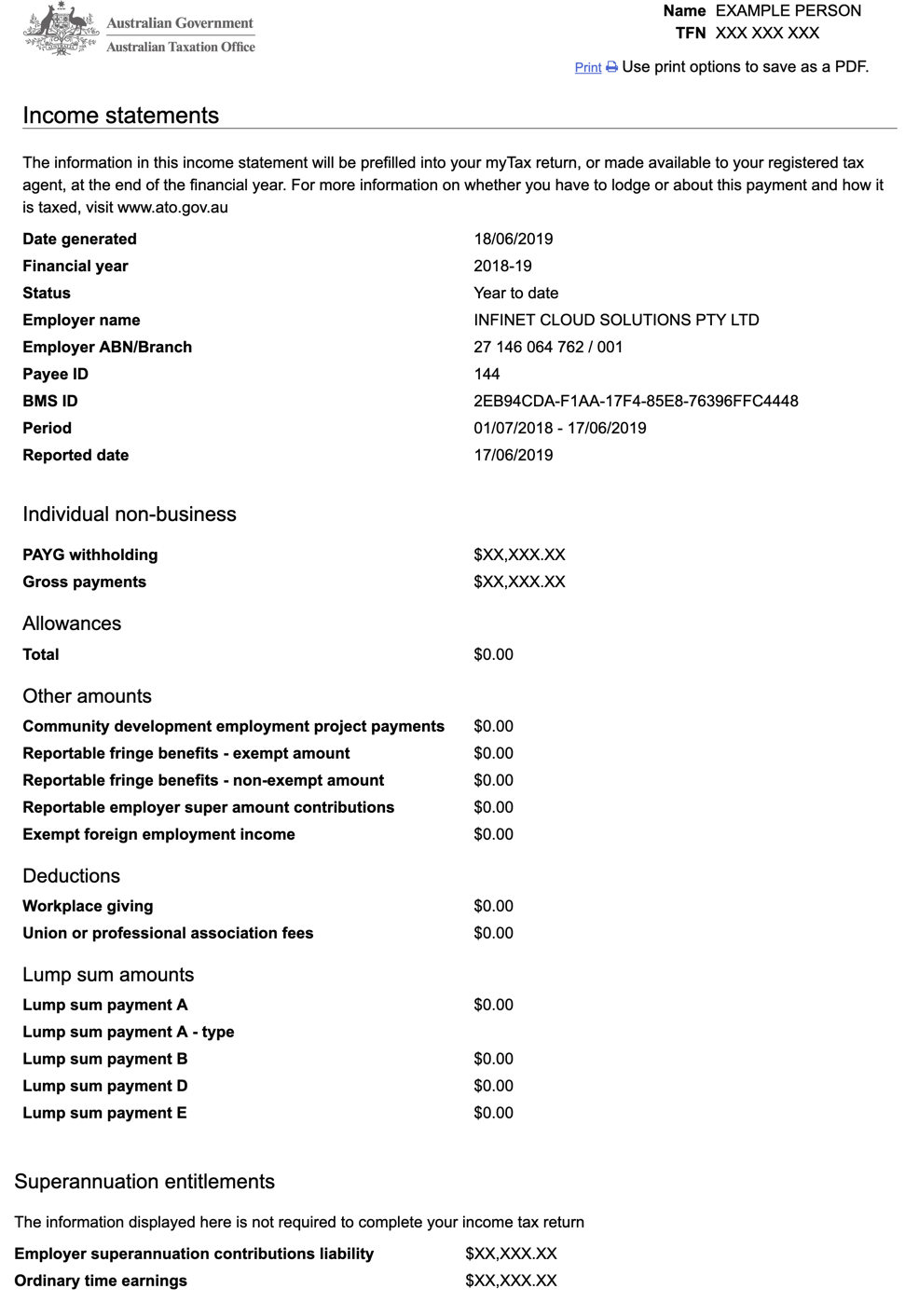

Income Statement is the new Payment Summary

The Income Statement looks a little different from the the Payment Summary (or Group Certificate) but it provides all the information needed to complete a tax return. The information is updated electronically every time an employee is paid and becomes tax ready when your employer marks the STP report as finalised.

myGov Access

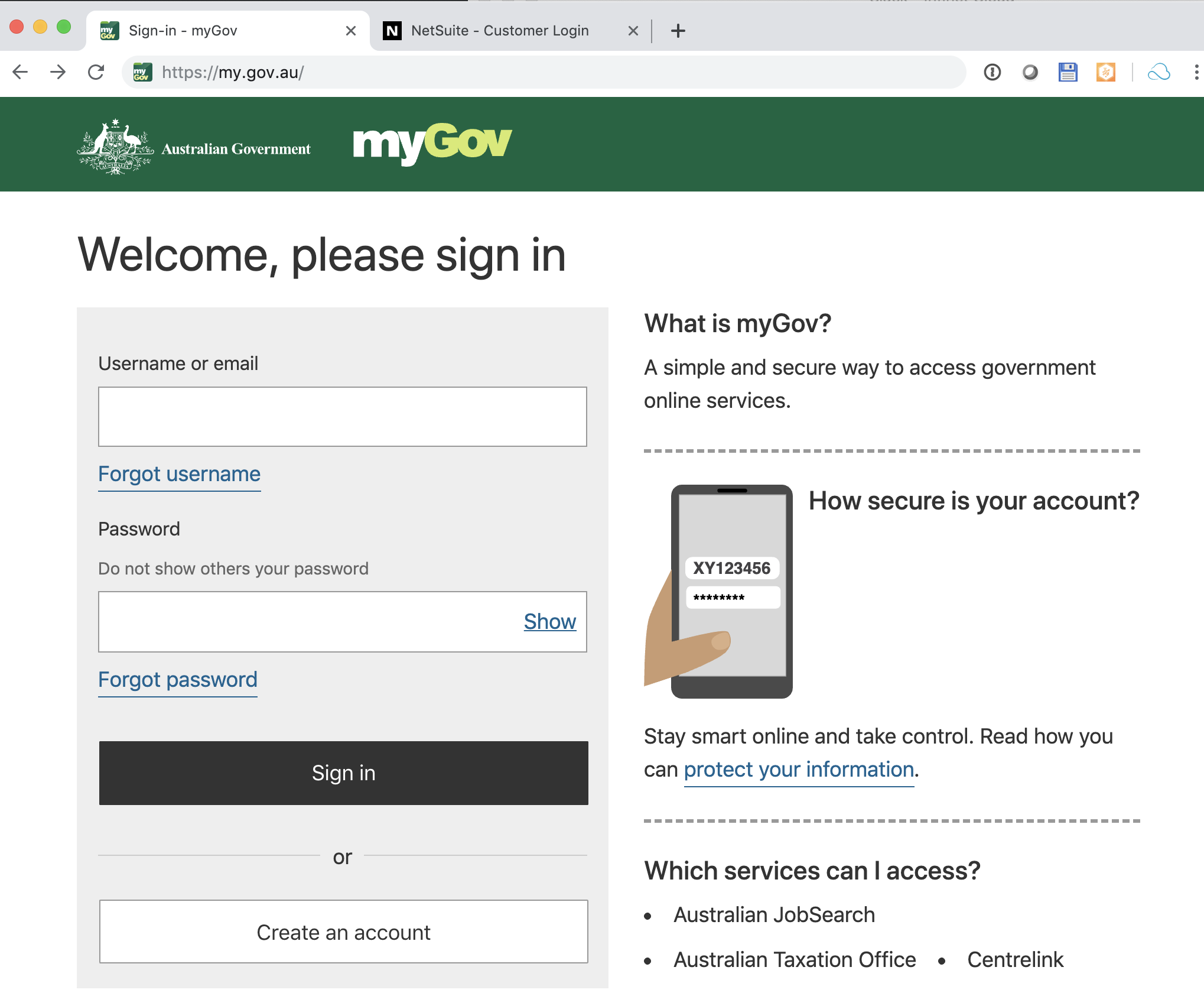

Navigate to https://my.gov.au and follow the instructions

Step 1: Register and Login

- If you haven't already, register for myGov

- Sign in using your myGov credentials

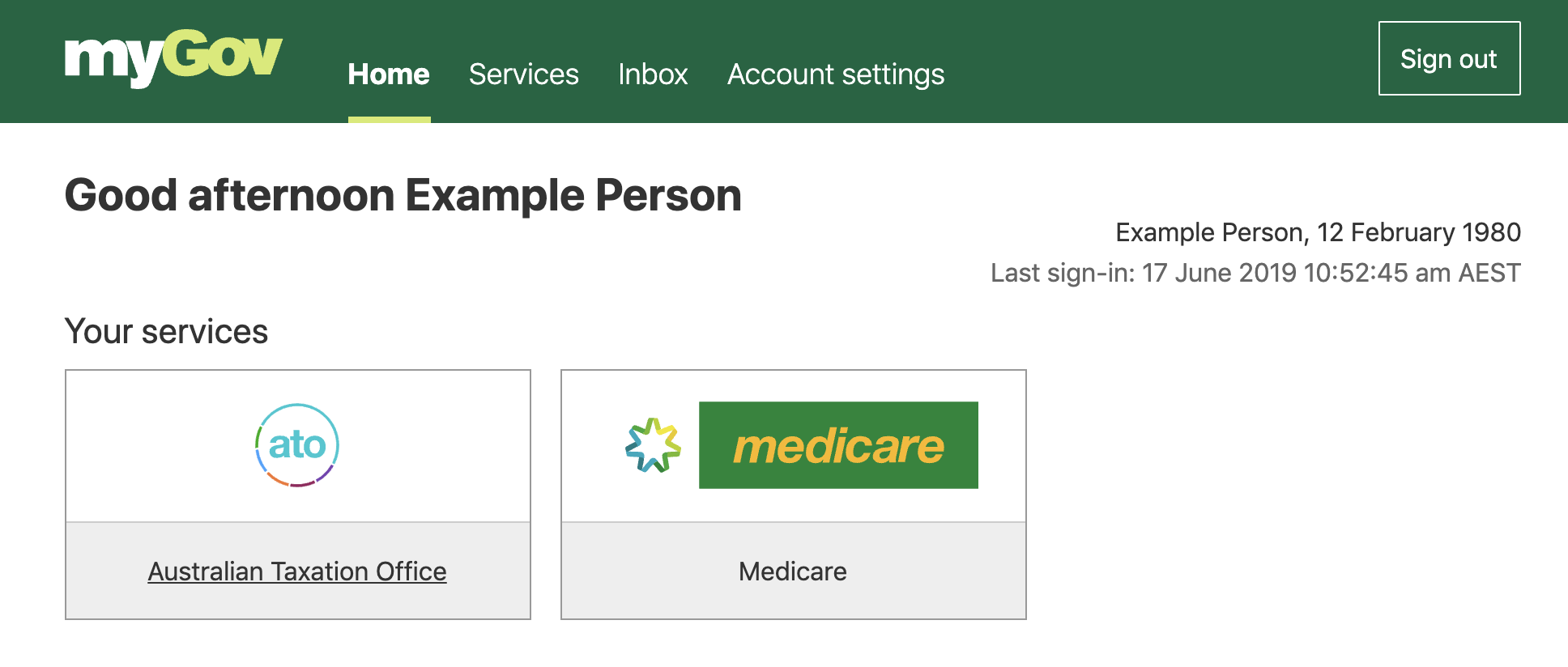

Step 2: Navigate to the ATO service

Once you have completed login you will be taken to the myGov home page that will provide links to the services you have setup in the portal.

- If you have not linked your myGov account to the Australian Taxation Office then do so

- Click on the Australian Taxation Office service button

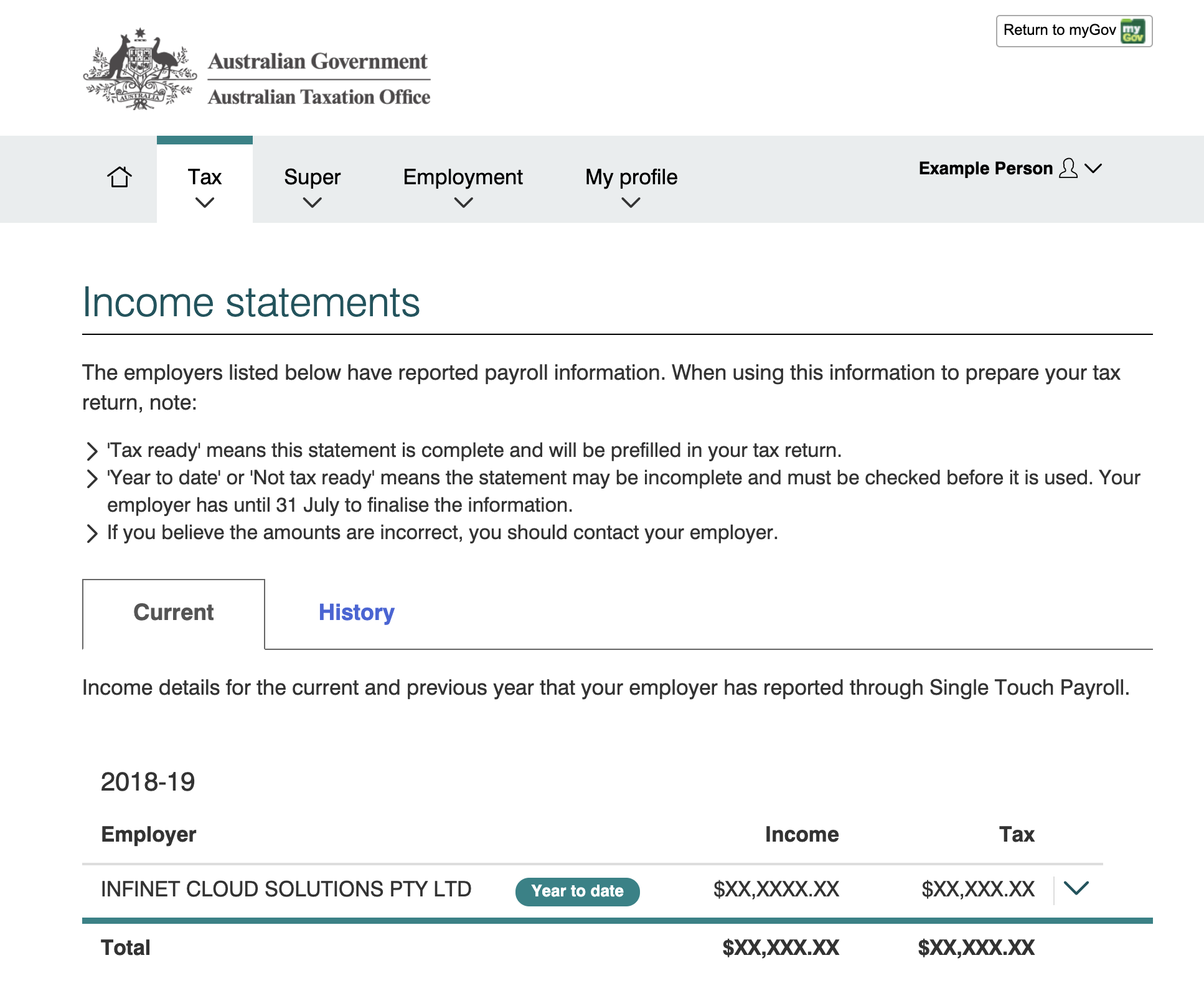

Step 3: View your Income Statement

Important

If you do not see Tax Ready next to your income statement you should NOT use this information for tax return purposes

The ATO service home page displays a number of options, and has information on any actions that are currently pending.

- Click on View my income statements link as highlighted in the screenshot below.

- Within the Income statements section you will see all of the Income Statements that have been reported by STP. They will display in summary form as shown in the screenshot below.

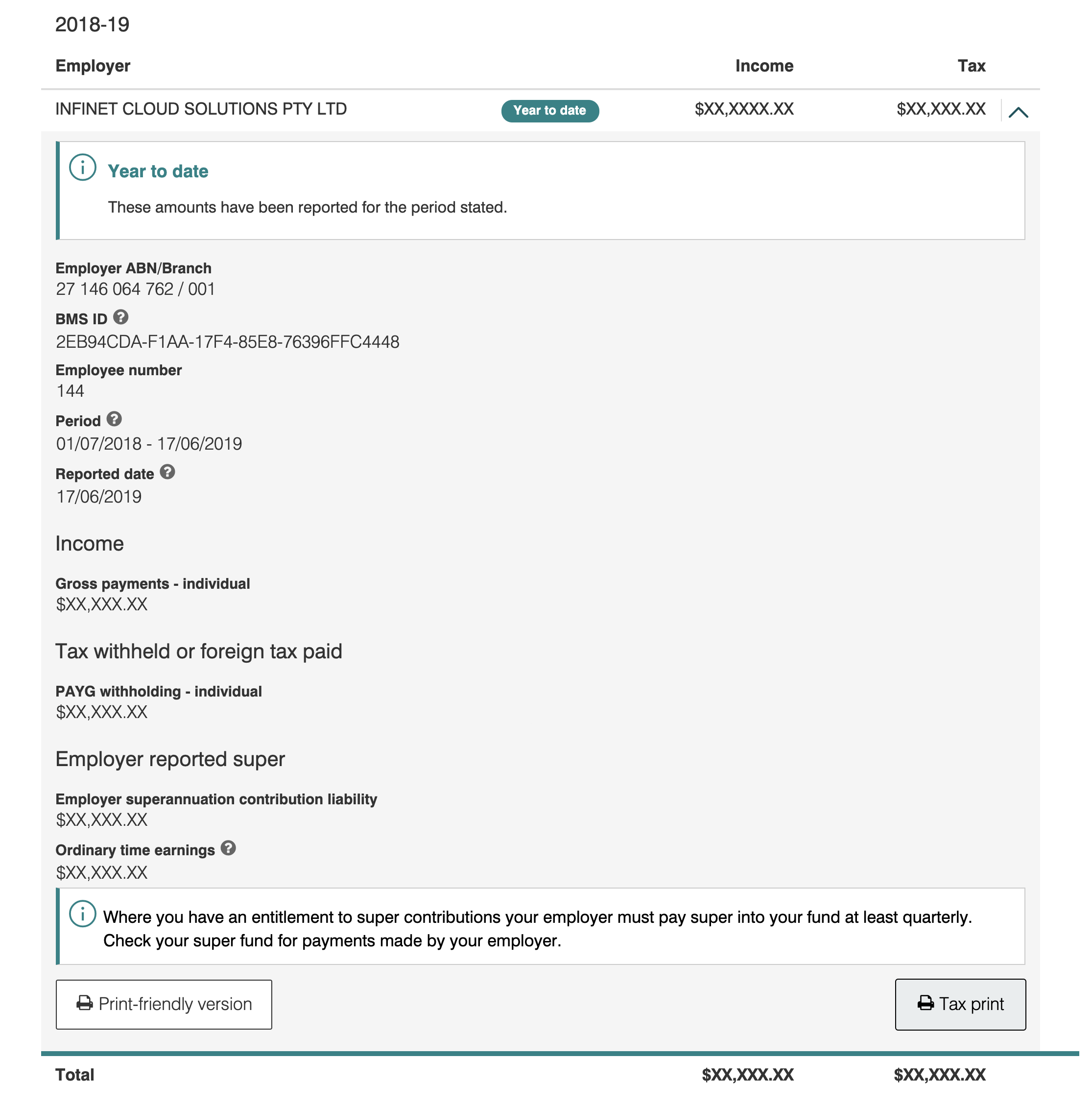

- By clicking on the down arrow (to the right of the Tax amount) you can see a break down of the details including when it was last reported and some high level totals.

- Click on the Tax print button to proceed to the Income Statement.

- The page will refresh and you will see the following that can be printed by simply clicking on the Print button, this action can also be used to save a copy as PDF using your browser print dialog.

Frequently Asked Questions

Q: Can I still request a Payment Summary or Income Statement in a physical form from my employer ?

A: It is your responsibility to retrieve your income statement from the myGov portal yourself. The ATO has mandated that payment summaries should no longer be issued in almost all cases.

Q: My Income Statement status is showing as Year to date or Not tax ready what should I do?

A: Your employer should send an STP update to make the Income Statement ready by the 14th of July (extended to the 30th for tax year 19-20). If your income statement is not complete please contact your HR or payroll officer who will be able to advise.