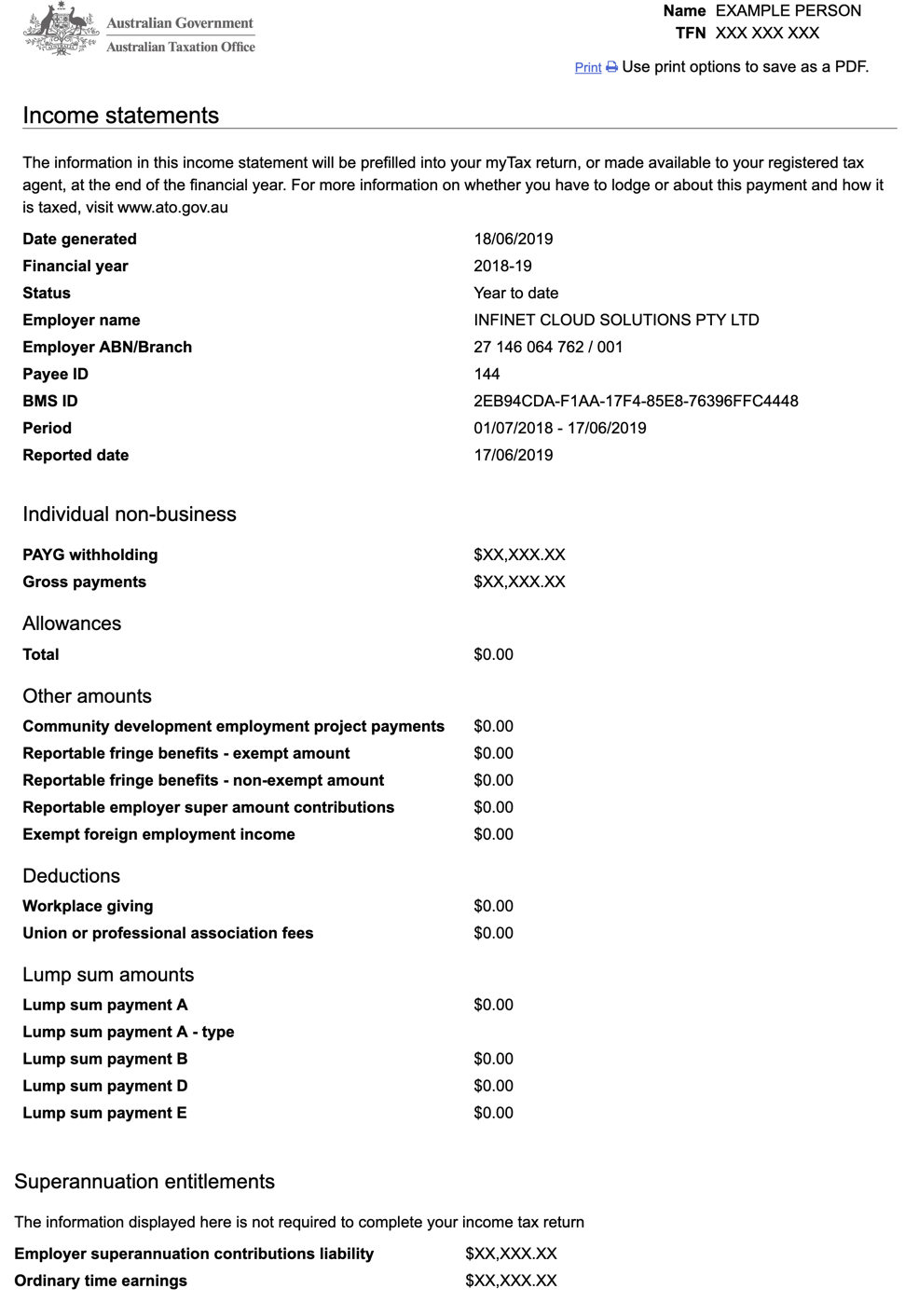

Income Statement is the new Payment Summary

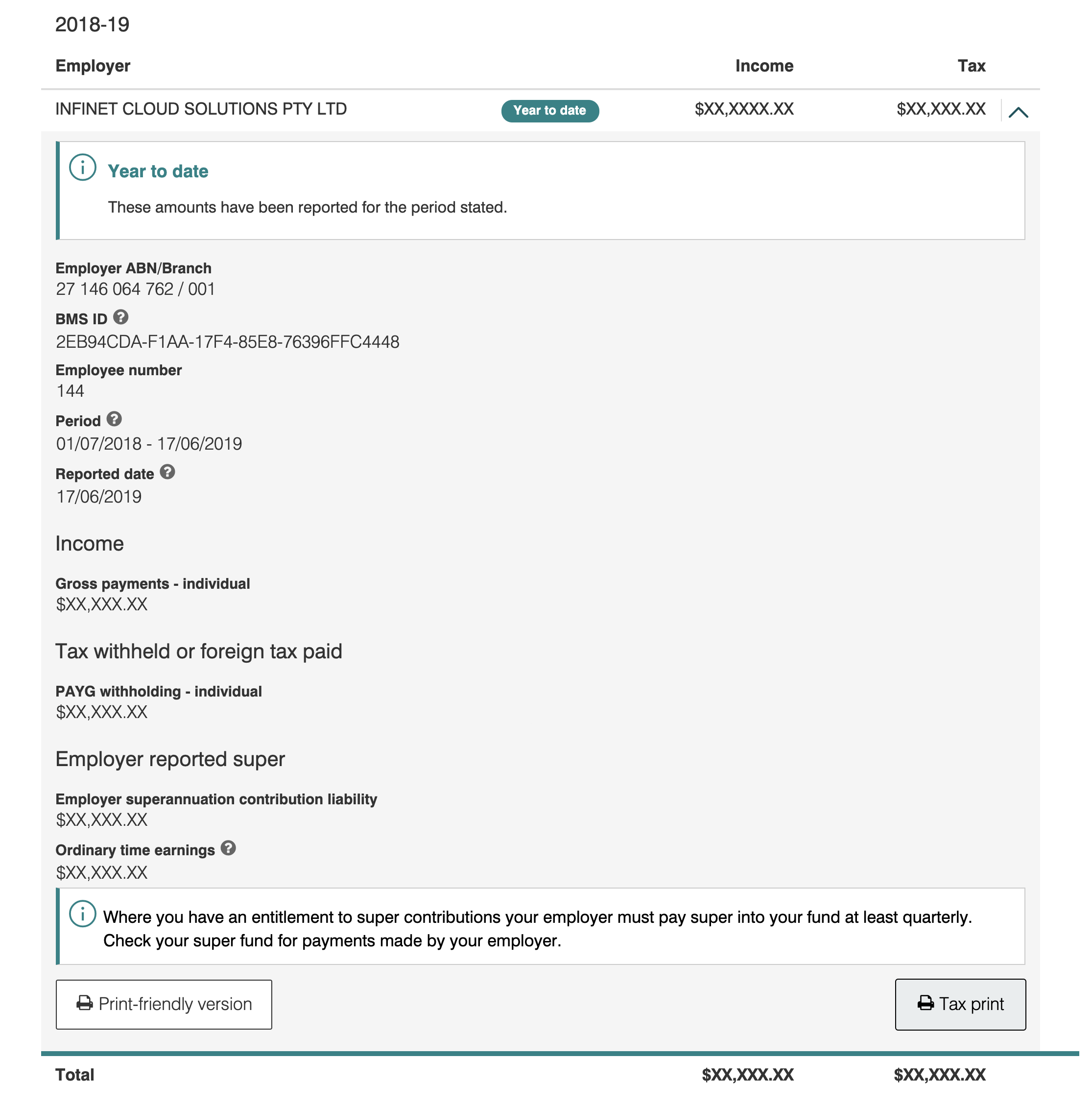

The income statement looks a little different from the the payment summary but it provides all the information needed to complete a tax return. The information is updated electronically every time an employee is paid and becomes tax ready when your employer marks the STP report as finalised.

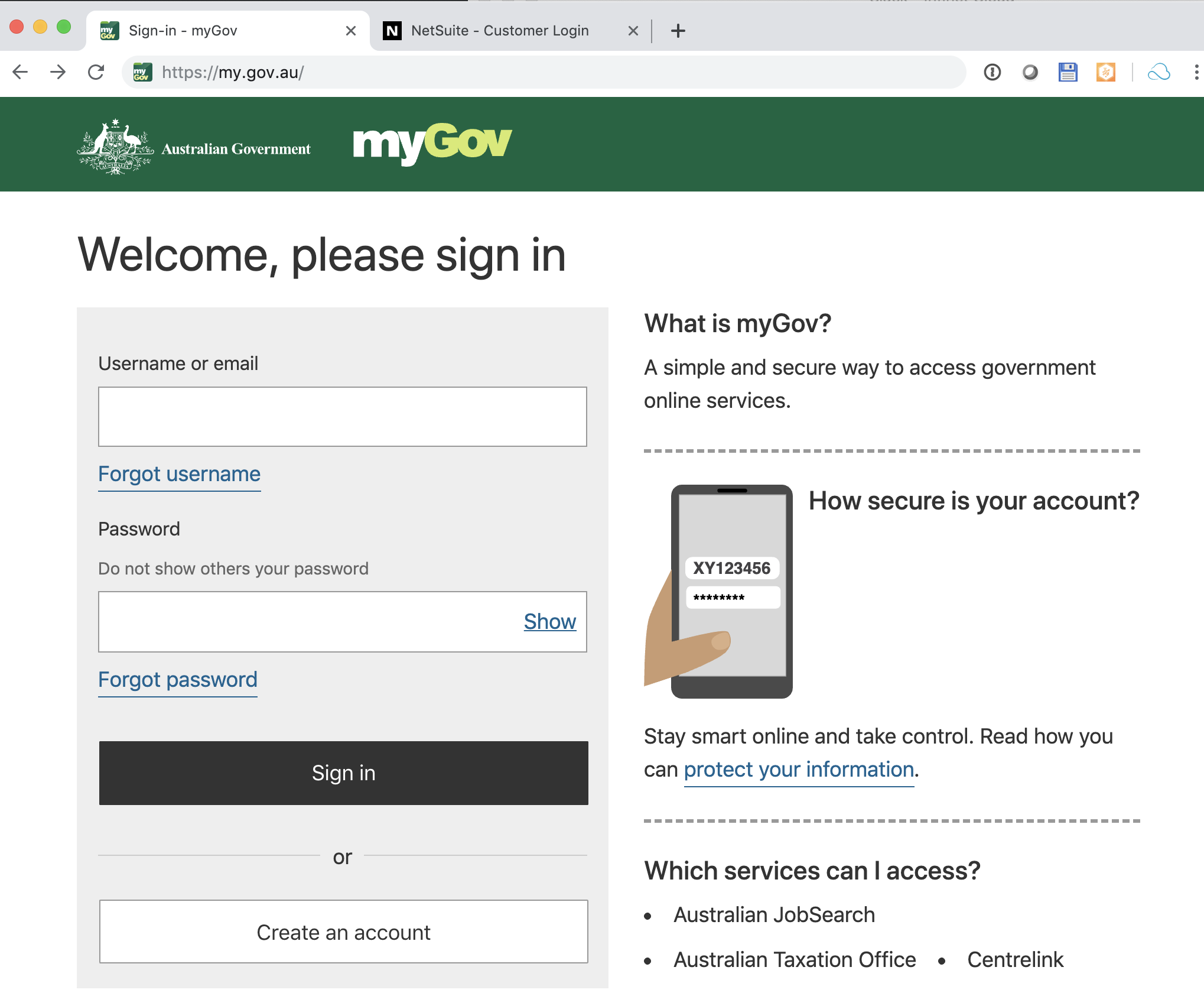

myGov Access

Navigate to https://my.gov.au and follow the instructions

1.Register and Login

- Register for myGOV (if you haven't already)

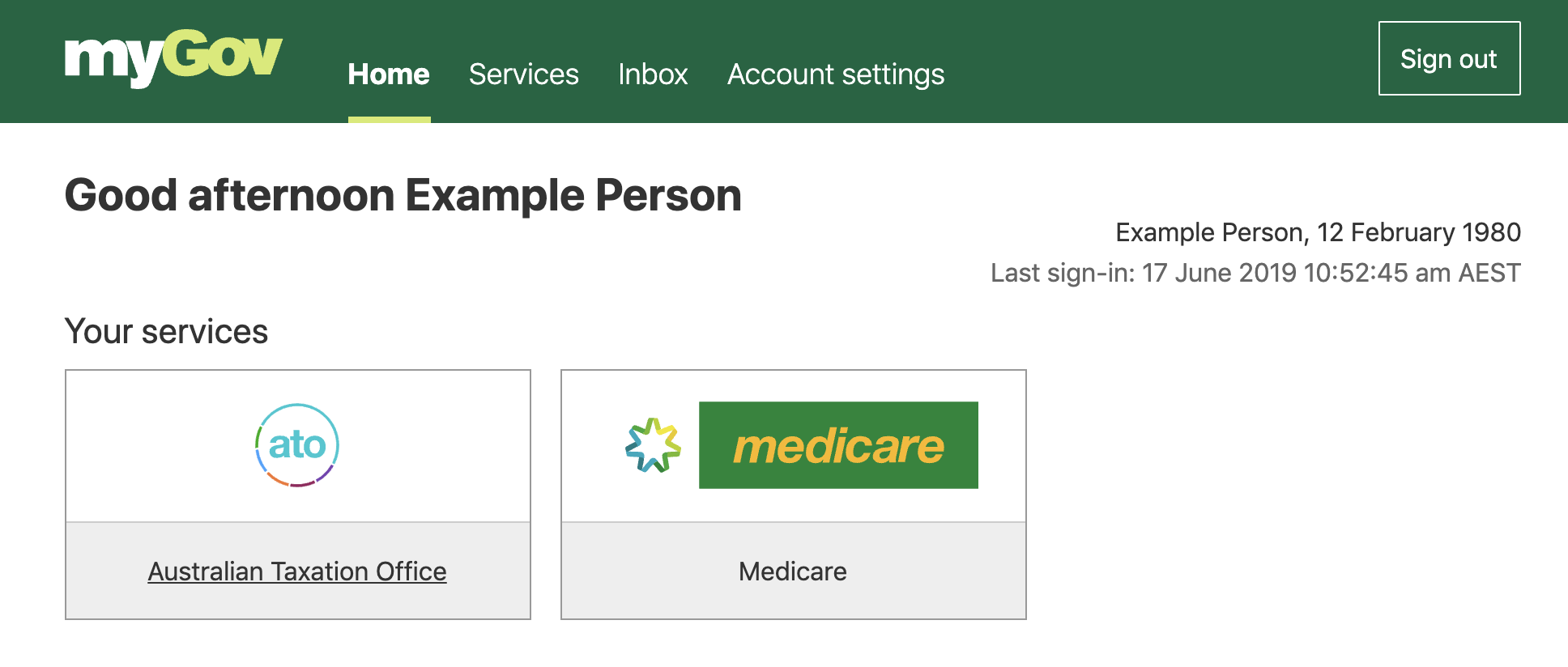

- Login and navigate to the ATO service

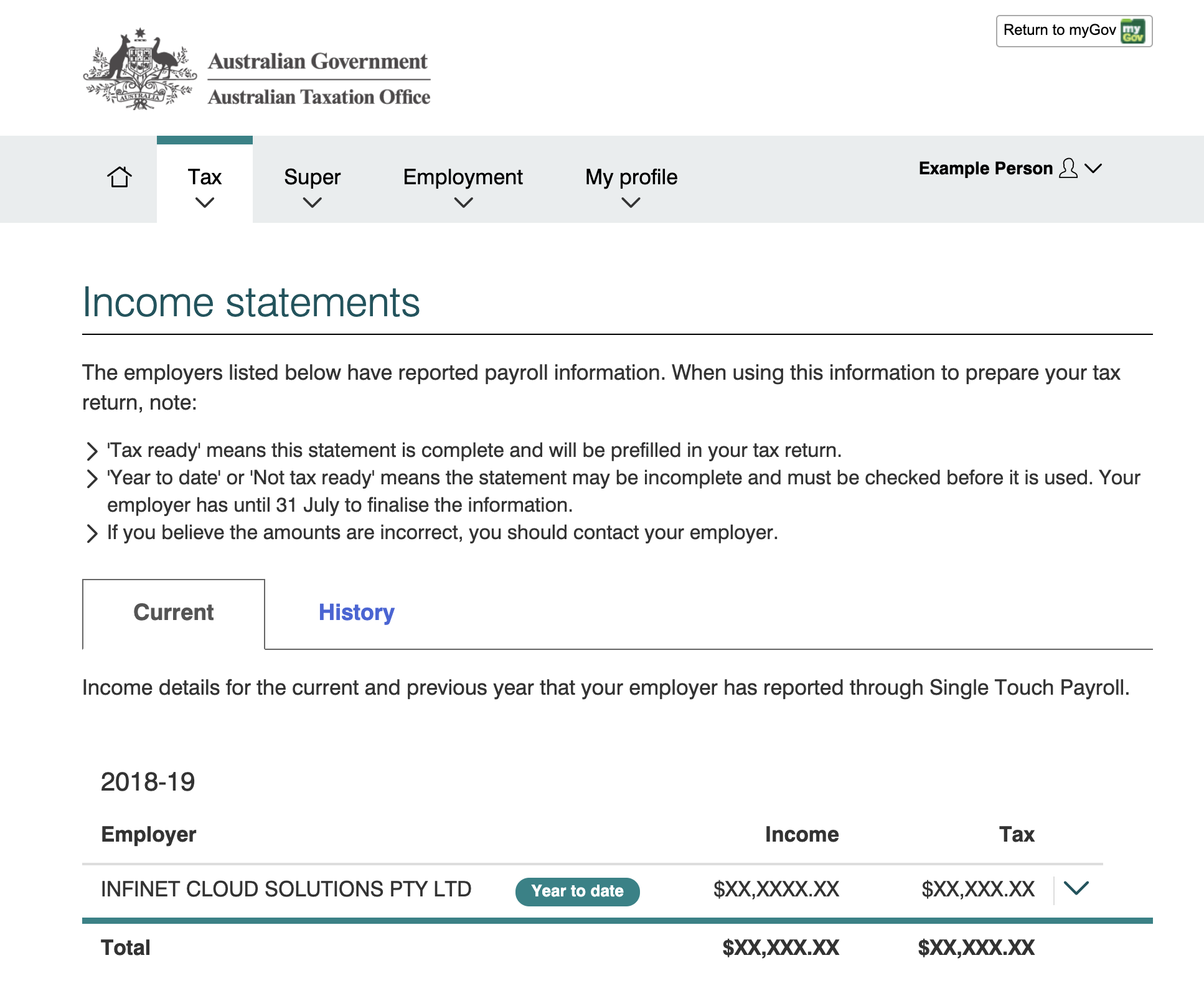

- Review the Tax Year Status and if "Tax Ready" view the detail and download

2.Navigate to ATO Service

3.Navigate to Income Statement

Important Tax Ready

If you do not see Tax Ready next to your income statement you should not use this information for tax return purposes.

Frequently Asked Questions

Q: Can I still request a payment summary or income statement in a physical form from my employer ?

A: It is your responsibility to retrieve your income statement from the myGOV portal yourself. The ATO has mandated that payment summaries should no longer be issued in almost all cases.

Q: My income statement status is showing as Year To Date or Not tax ready what should I do?

A: Your employer should send an STP update to make the Income Statement ready by the 14th of July (extended to the 30th for tax year 19-20). If your income statement is not complete please contact your HR or payroll officer who will be able to advise.