Tax Code Uplift

To simplify the uplift process ICS provides a user interface to allow employees to be updated in bulk. The tool displays a list of employees, auto selecting those eligible for uplift.

There is no uplift to tax codes for TYE 2023.

If you have configured HMRC DPS, any P9 Notifications for employees will now be picked up by the Tax Code Uplift Tool. Once you have run this process you will need to check these to ensure all have been picked up correctly. If you have not got the HMRC DPS configured please follow these instructions to do this prior to running this process.

The uplift logic works by comparing the tax code from the last payslip (linked on the employee) from the prior tax year, and the tax code on the employee record. The uplift will automatically check the employee for update if:

- W1/M1 is set - it will be cleared for the new tax year

- If the tax code from the prior payslip is eligible for uplift and applying uplift to the tax code is different to the employee record tax code

- If there is a P9 Notification received in the DPS for the employee

Running Tax Code Uplift Tool

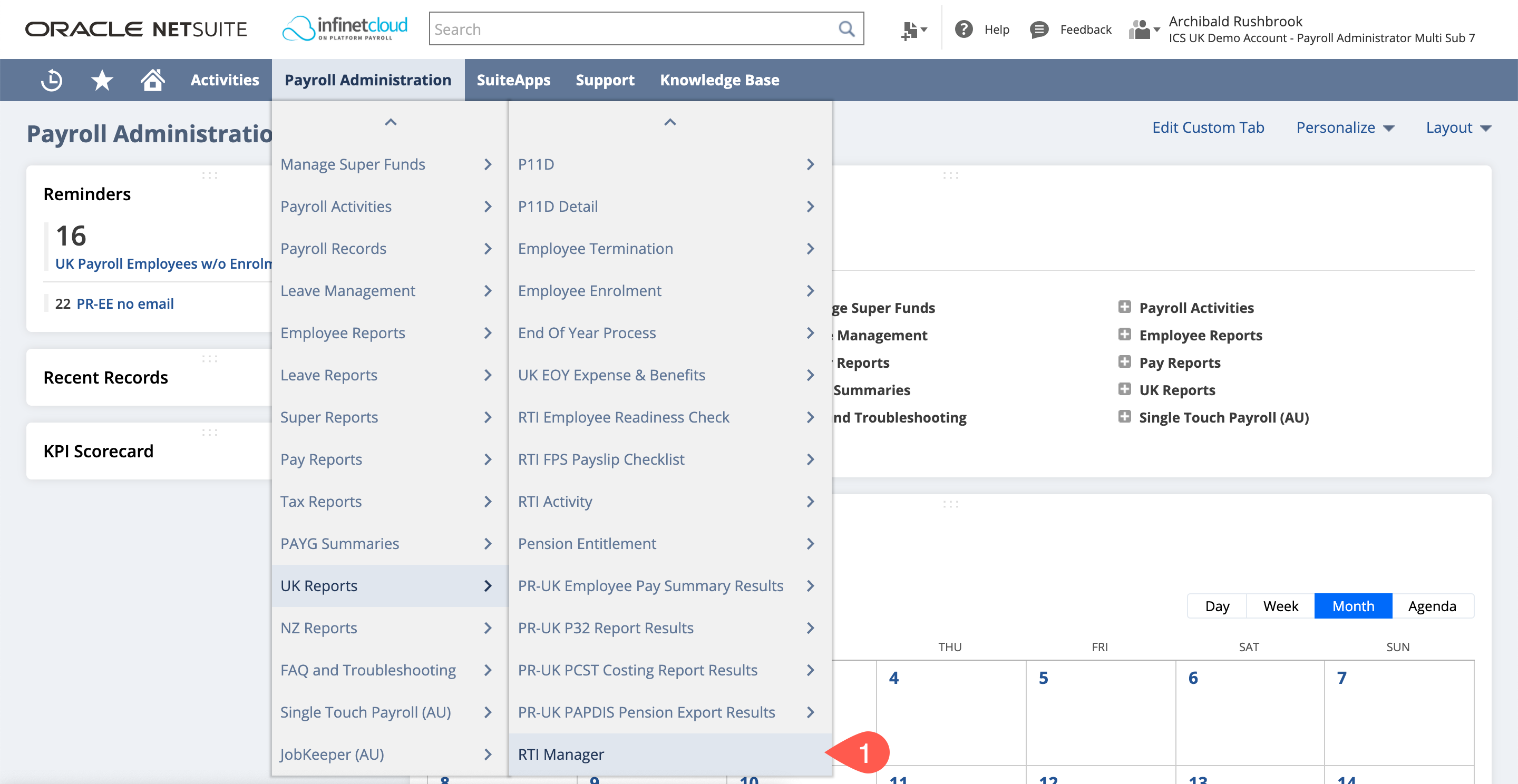

- Navigate to Payroll Administration > UK Reports > RTI Manager

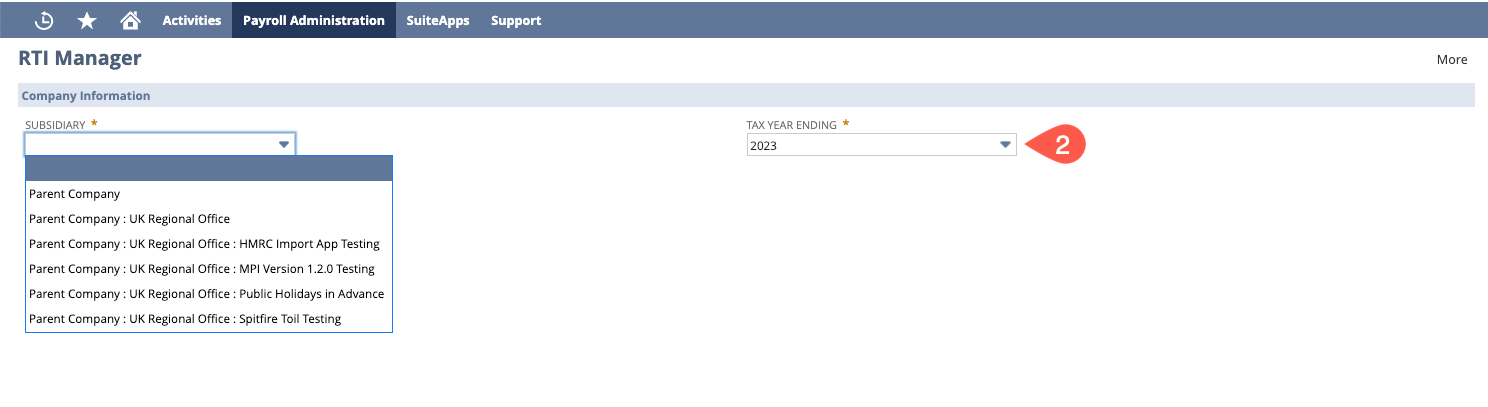

- Select the Subsidiary you need to run the uplift on and the tax year ending in question.

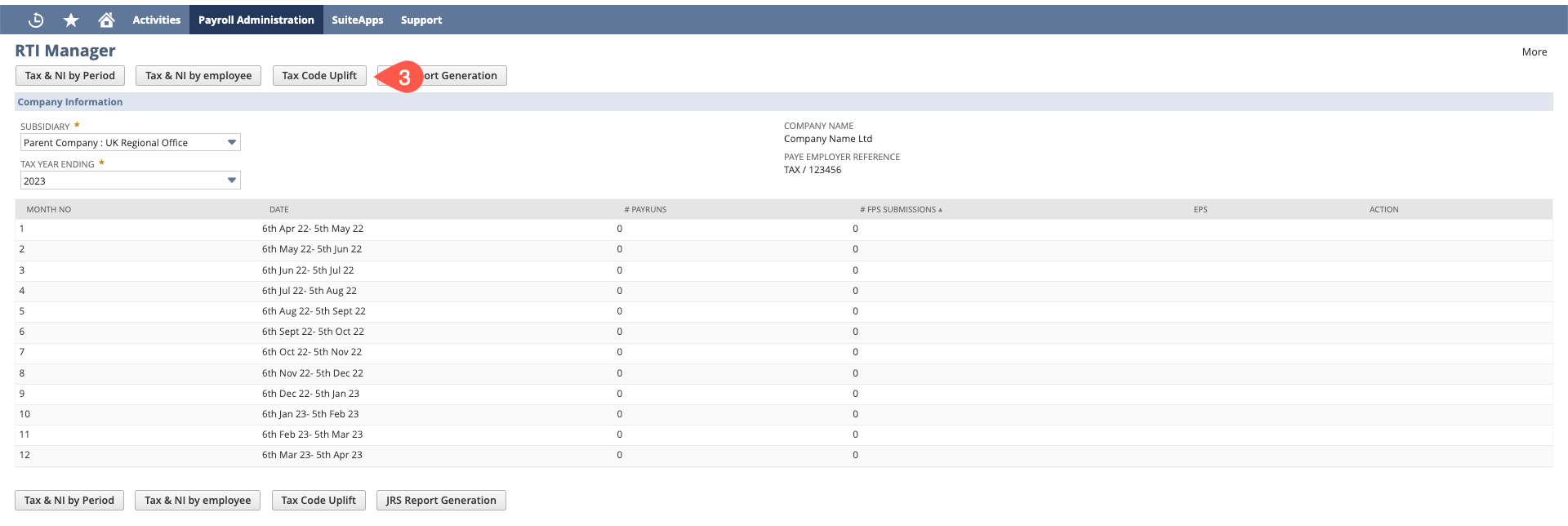

- Click "Tax Code Uplift"

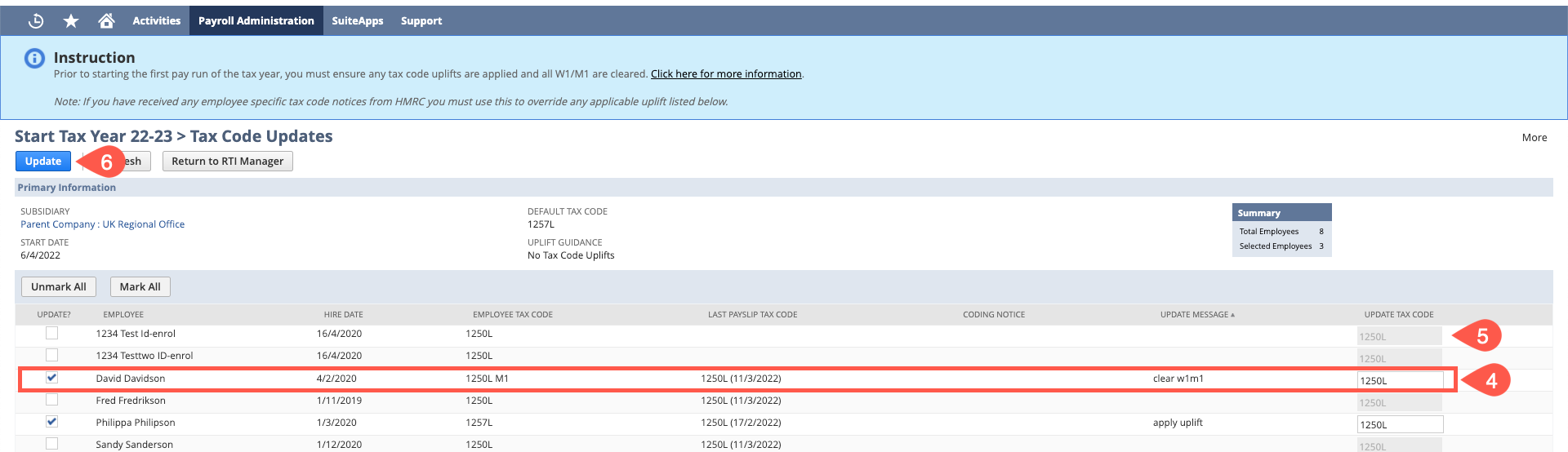

- On the uplift page you will see that the system will automatically assign whether or not someone needs an uplift or a W1/M1 flag removed and only tick those to be uplifted. The page will show you their current tax code, the last tax code used, if there is a coding notice that overrides uplift, the message (the action that is occurring) and what the tax code will be.

You can override this if you believe necessary by entering a tick in the checkbox for "Update?" next to the employee and entering a tax code into the "Update Tax Code" field.

- Click "Update"