The KiwiSaver employment details (KED) form allows employers to electronically notify Inland Revenue of:

- New employees, who meet KiwiSaver automatic enrolment eligibility criteria (KS1);

- Existing employees, who are not subject to the automatic enrolment rules but decide to join KiwiSaver without actively choosing a KiwiSaver provider (also treated as a „default enrolment‟); and

- Employees who have been automatically enrolled, but have opted out of KiwiSaver (KS10).

To generate the KED report file follow these steps:

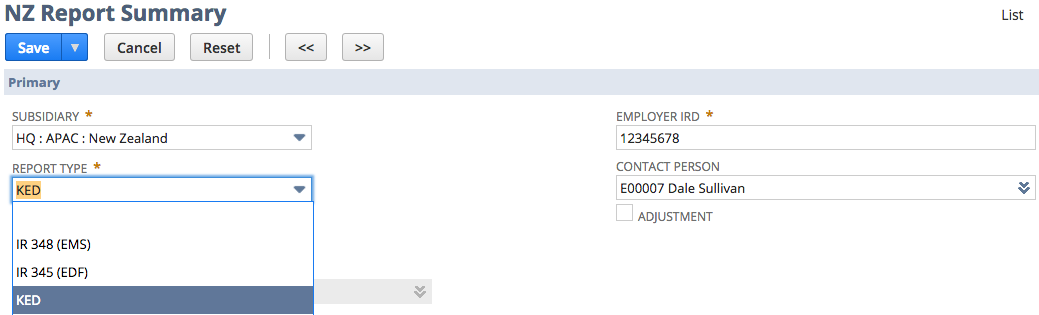

- From the menu, navigate to Payroll Administration > NZ Reports > IRD Reports > New

- Select the correct Subsidiary then select Report Type of KED. The page will refresh once the report type is selected so selecting the subsidiary first ensures the data returned is filtered properly.

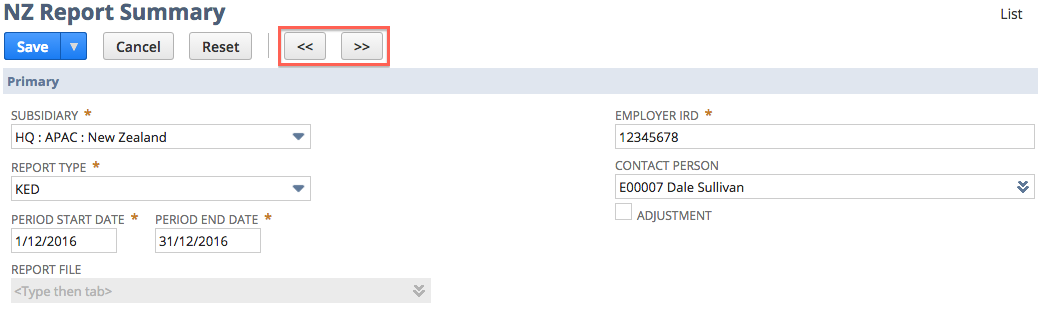

- A preview of the employee data will be shown and dates defaulted for Reporting Period Start Date and Period End Date. As reporting is generally done for last month the dates default to the month prior to the current date. To change the date ranges click on the arrows at the top of the page.

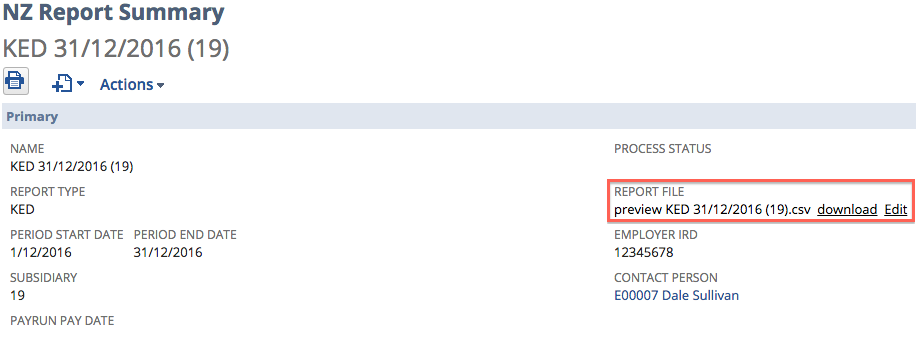

- To create the IR file click the Save button. Depending on the number of employees that are included on the submission the process will generate the file immediately or schedule. If the process schedules click the refresh button periodically until the process is complete. It should not take more than 5 minutes. Any error messages will appear in user notes section and you should Contact Support for assistance.

- The Report File will be available inline. Review the IR file and upload via the IRD portal.