...

...

...

...

| Info |

|---|

An Adjustment Pay Run is a pay run in its own right. It does not change anything on a previously paid/posted pay run. If you need to make changes to a pay run that has not been paid/posted then you should Roll it back and make changes at the Approval screen stage instead of processing a new Adjustment Pay Run. |

...

| Tip | ||

|---|---|---|

| ||

This page provides generic instructions and specific steps for a number of common scenarios. All of the steps and fields are also covered in the Process a Pay run Guide. Depending on your scenario, you may need to set/unset some fields and enter different information at various stages to what is described. Jump to: |

...

- From the menu, select Payroll Administration > Payroll Activities > Start New Pay Run

- From the Pay Run Type dropdown select Adjustment

- Unmark the Accrue Leave checkbox

- Mark the Skip Pay Components checkbox

- Mark the Use Period Data checkbox

- Set the Pay Period and Period Start Date to match the existing pay run

- Select the Employee(s) you want make payment(s) to and click Submit

- At the Enter Employee Time stage, click the Skip button

- At the Process Payslips stage, click the Enter One Off button enter them

- For each employee that you need to adjust tax for:

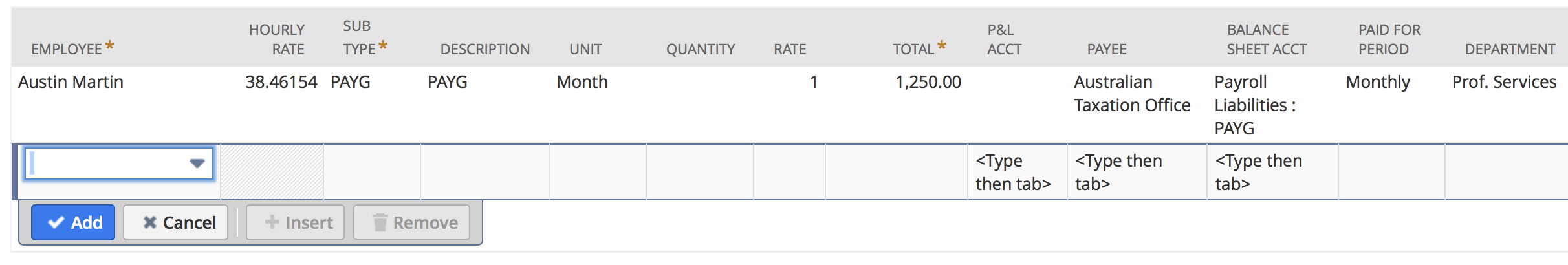

- Select the employee's name from the Employee dropdown

- Set the correct Tax Subtype for the payment (e.g. PAYG)

- Enter 1 as the Quantity

- Set the Rate to the correct amount - NB if it is an payment back to the employee you need to enter the amount as a NEGATIVE

- Set the Paid for Period dropdown to be as close to the period the adjustment is for

- E.g. If it covers 3 months worth then set to Quarterly

- Check that the Total field is correctIf not set automatically, set the P&L Acct field

- Set the PAYEE field to the correct Vendor (e.g. ATO). You must do this otherwise the amount will not be associated with that Vendor (e.g. ATO) for payment

- If not set automatically, set the Balance Sheet Acct field

- Once you've entered all of the payments, click Submit to return to the Process Payslips screen

- Click Submit to complete processing of the payslips and move onto the Approve Payslips stage

- Review each payslip, paying special attention to the figures including the relevant tax (e.g. PAYG/PAYE) lines.

- If you make any changes to a payslip then you will need to recalculate it - for more information see Recalculating a Payslip

- You may also want review the Approve Payslips page of the Pay Run Processing Guide

- Once you're finished reviewing the payslips, click the Submit button to move onto posting and paying the pay run

...