Versions Compared

compared with

Key

- This line was added.

- This line was removed.

- Formatting was changed.

| hidden | true |

|---|

| Status | ||||

|---|---|---|---|---|

|

Image Removed

Image Removed

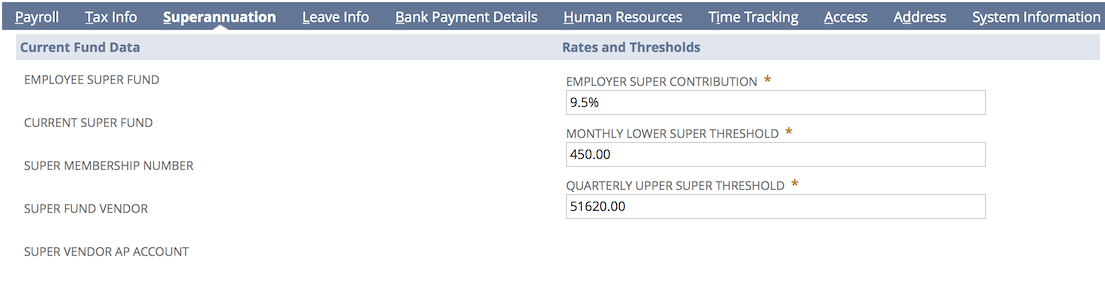

Other Superannuation tab details

Current Fund Data

| Note |

|---|

You cannot change this information whilst in Edit mode. This information defaults from the Employee Super Fund |

details that you |

add later during step 10. Add Super/Pension Funds |

Image Added

Image Added

Rates and Thresholds

Use these fields to set your (the employer's) super obligations for the employee.

- Employer Super Contribution - 9.5% ( defaults from configuration).the configuration, enter the amount of Employer Super Contribution as a percentage. For example: 9.5%

- Monthly Lower Super Threshold - if monthly salary/wage is less than this amount ($450) then the employee is not obligated to pay superannuation. lower threshold that your (the employer's) obligation to pay superannuation starts. If you want to calculate and pay super to the employee regardless of their monthly earnings then set this to 0.00

- Quarterly Upper Super Threshold - if quarterly salary/wage is higher than this amount ($50,810) then the employee is not obliged upper threshold that your (the employer's) obligation to pay any additional superannuation stops. If you want to continue calculating and paying super to the employee - regardless of their earnings - then set this to a high amount, for example: 999999.99

Go to step 7. Leave Info tab

| Panel | ||||

|---|---|---|---|---|

| ||||

|