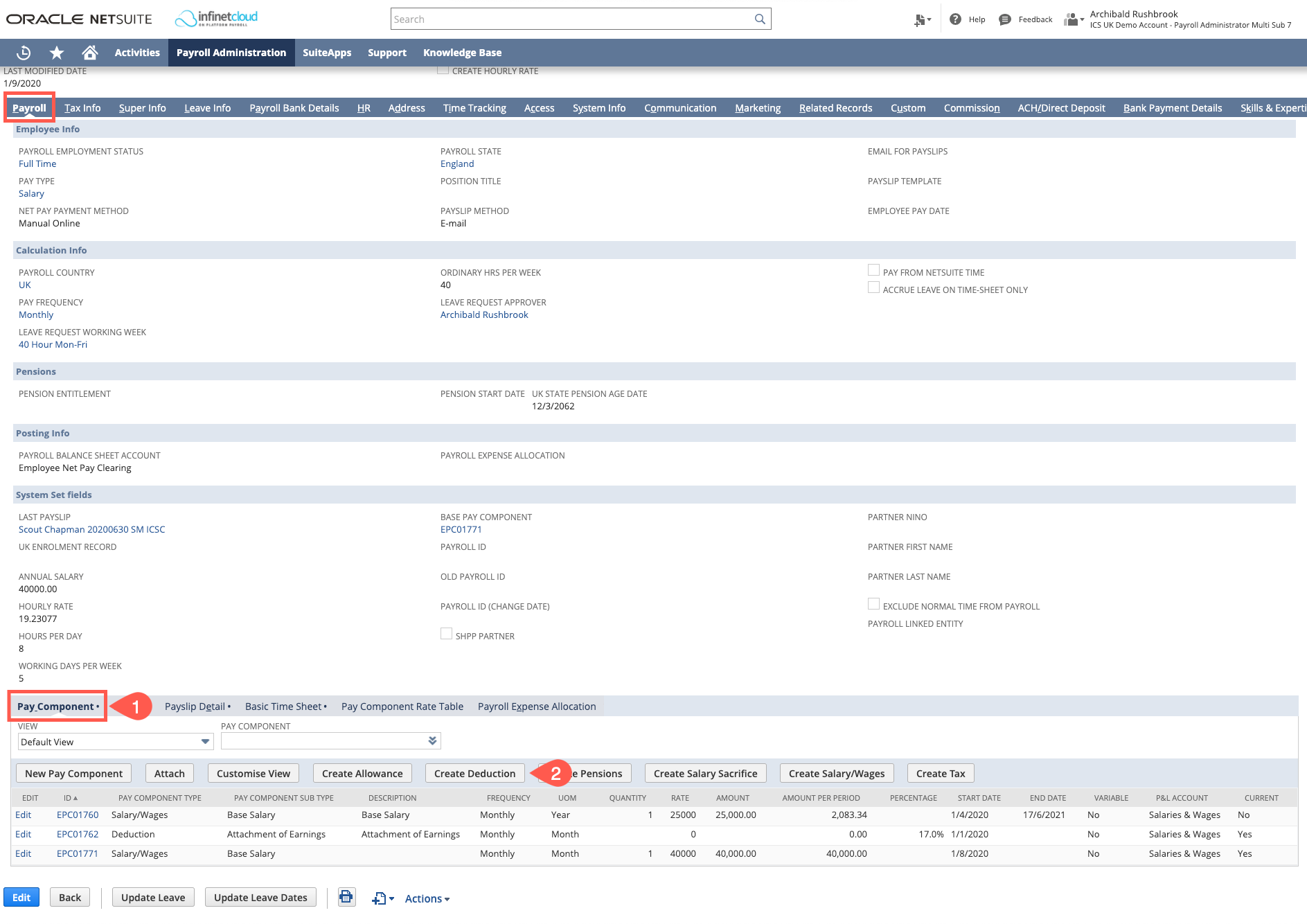

Navigate to the Employee Record > Payroll Tab > Pay Component Sub Tab

- Click on the "Create Deduction" button

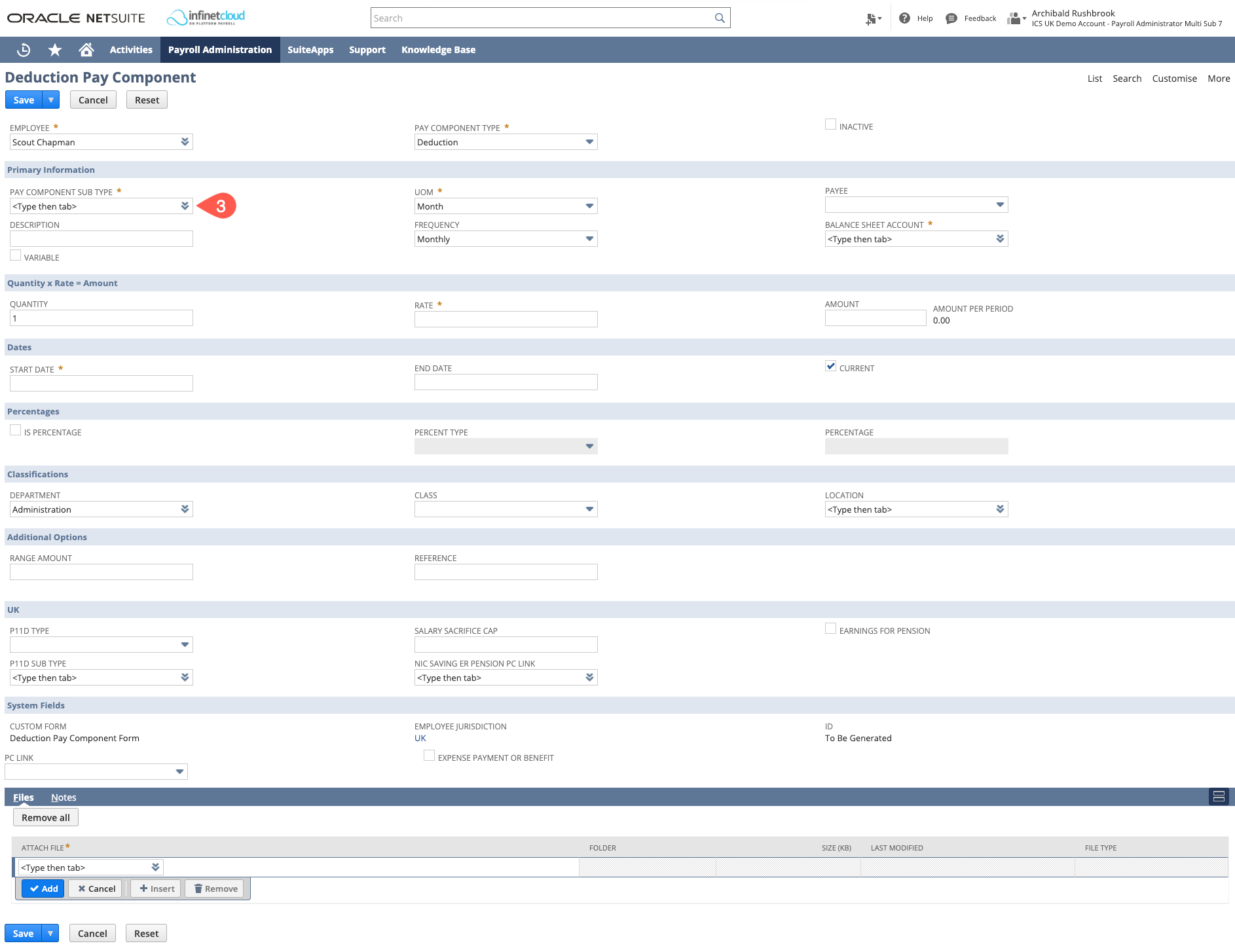

- Select the type of deduction you are wanting to create

Based on the Pay Component Sub Type that you choose, certain fields (such as Description, P&L, Balance Sheet) will default, certain fields (such as Class, Location, Department and Frequency) will default from the Employee Record. Fill the remaining fields as below:

Field

Allowance e.g.

UOM Depends on the Pay Frequency of Employee/payment you are making Frequency Depends on the Pay Frequency of Employee Quantity

The quantity of the deduction per frequency e.g. 1 Rate The amount to be deducted Amount Quantity x amount Start Date The start date of the deduction pay component Current Ticked

Is Percentage If the deduction is a percentage of earnings tick this (this overrides the quantity, rate and amount) Percent Type What you want the percentage to be based on Percentage The percentage to be deducted Range Amount If the deduction has a set total amount enter it here, the - Click "Save"

General

Content

Integrations