By default, ICS payroll creates the journals with the classifications (Department, Class and Location) set on the employee record. The timesheets that are entered/imported may have different classifications than on their employee record. To re-allocate the cost to the classifications on the timesheet we have a separate process that you need to run for each pay run.

Go to Payroll Administration > Payroll Setup > Payroll Expense Re-allocation Journal.

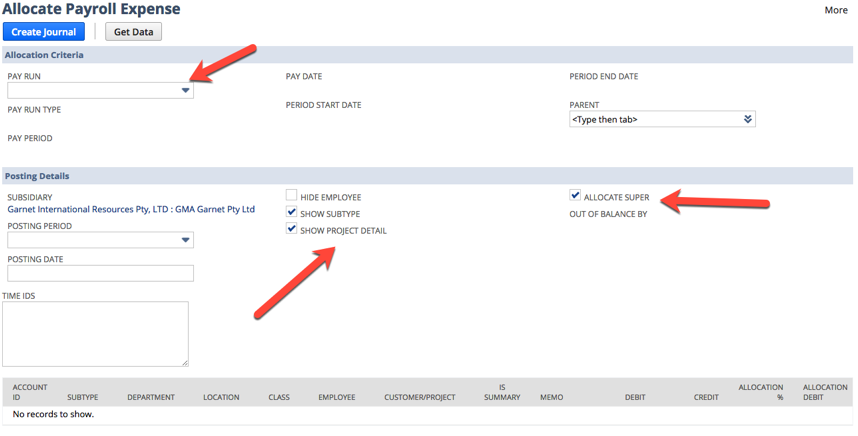

You will need to select the relevant pay run. Once you select the pay run you can check the amounts that will appear at the bottom part of the screen by unmarking the Hide Employee checkbox and marking the Show Subtype. You can also Allocate Super if you want to ensure the superannuation cost is allocated as well.

When the data appears at the bottom of the screen, it is recommended that you check the amounts per employee / sub type against the payslips in the pay run you have chosen.

You will see an entry similar to the one above. It shows the hours and subtype in the Memo field which you can reconcile against the timesheets for the employee and check that the amounts match back to your payslips.

If you are OK with the calculations above, then when you want to create the journal, you will want to remove the employee and sub type. You can do this by marking the Hide Employee checkbox and unmarking the Show Subtype checkboxes. If the screen does not refresh automatically, click on Get Data.

You can set the posting period and posting date to any period, but the journal will not post if the accounting period is closed.

This process can not be run more than once for the pay run. If you select the pay run again, you will get the following message:

The resulting journal will be linked to your pay run on the Transaction Tab