Ensure TFN Declarations get sent

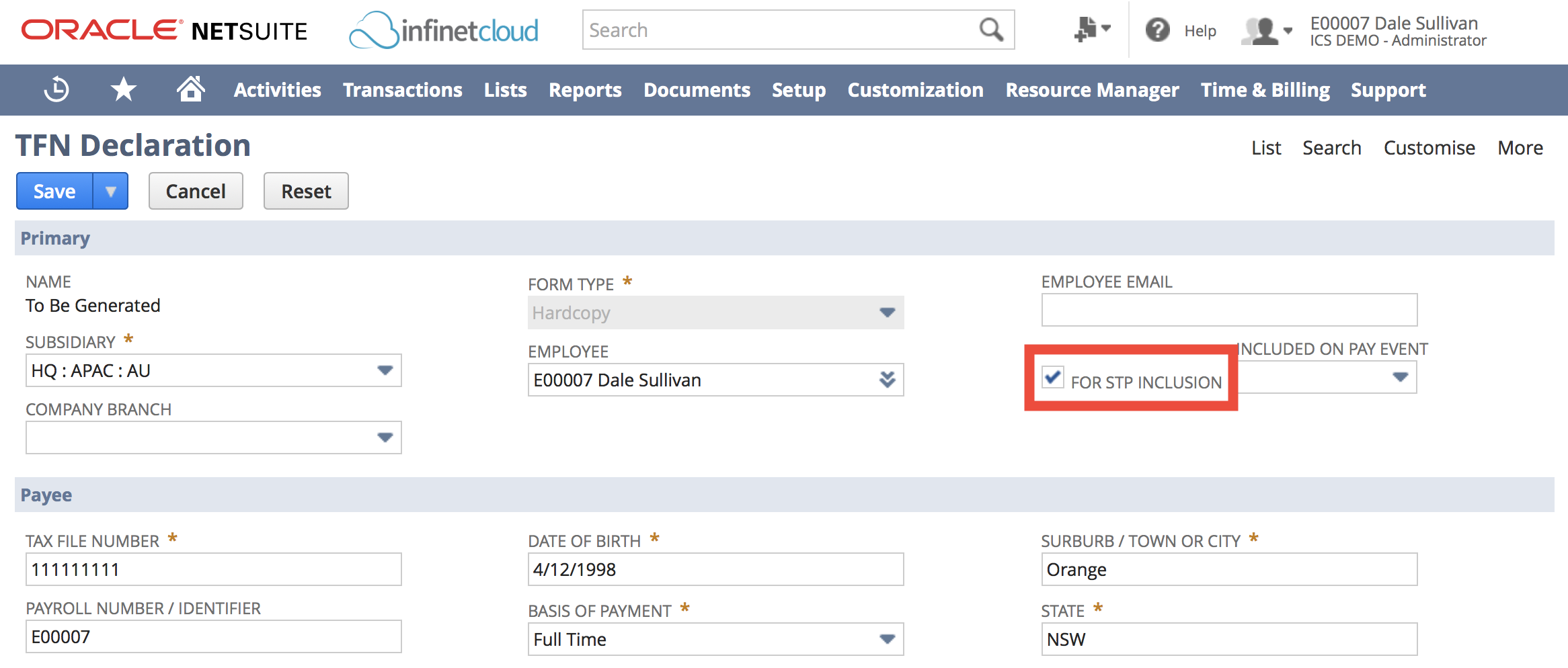

When creating the TFN Declaration record:

- If you are running OneWorld, select a Subsidiary

- If you have multiple Branches setup, select the appropriate Branch

- Ensure that the For STP Inclusion checkbox is marked. It will automatically be marked if the Branch has been setup for STP (see Branch Setup Assistant (Configure STP).

- Ensure that Included On Pay Event is blank. This will be automatically populated once it has been sent.

Identify TFN Decs Pending Submission

From the Payroll Administration menu, select Single Touch Payroll (AU) > TFN Declarations to be Sent

Identify TFN Decs in a Pay Event

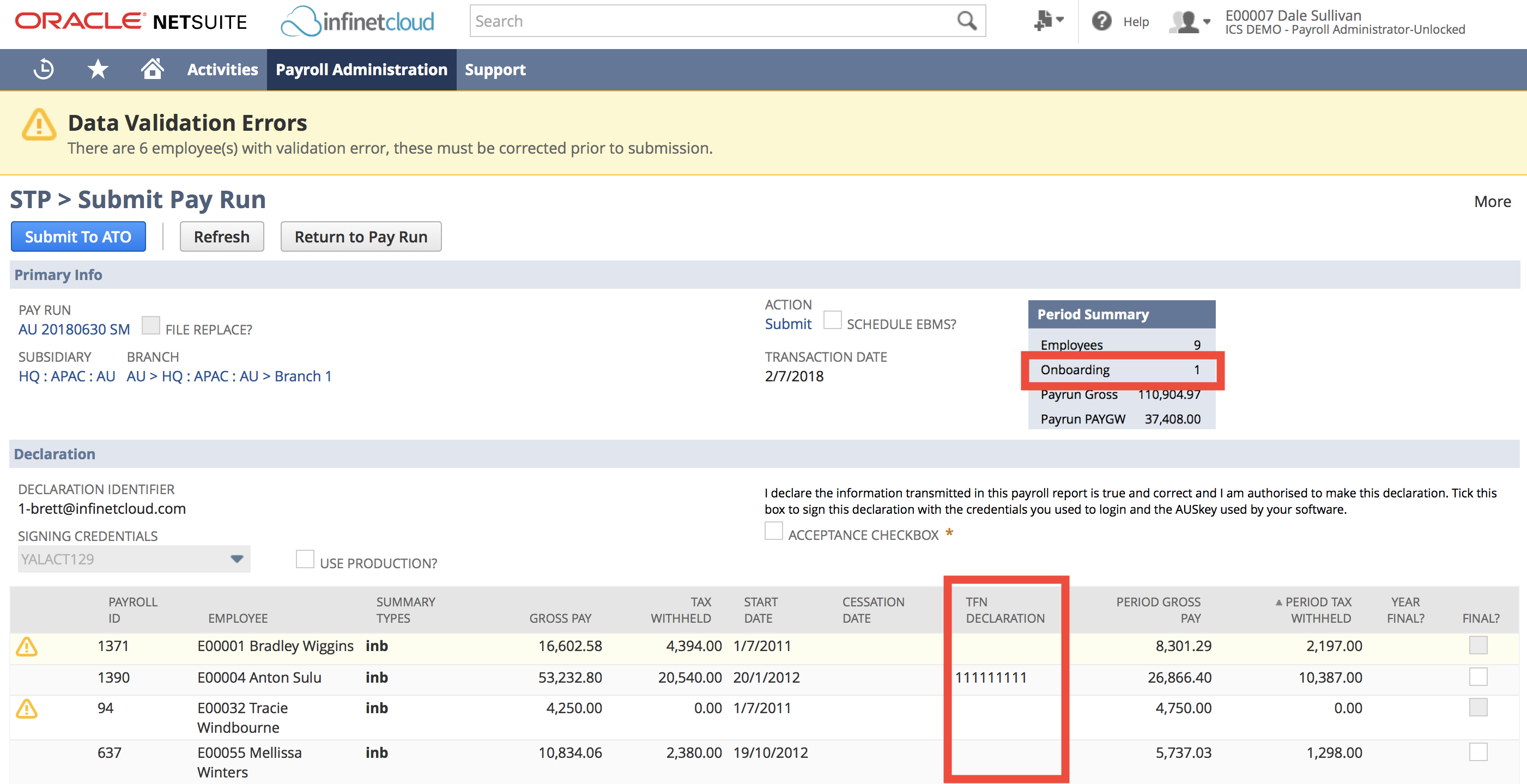

Before you Schedule Submission of a Submit Pay Event (initiated from a Pay Run), you will be presented with a screen that allows you to review the information that will be included. As per the below, TFN Declarations that will be sent can be identified by:

- The count of Onboarding

- The employee's TFN visible in the TFN Declaration column