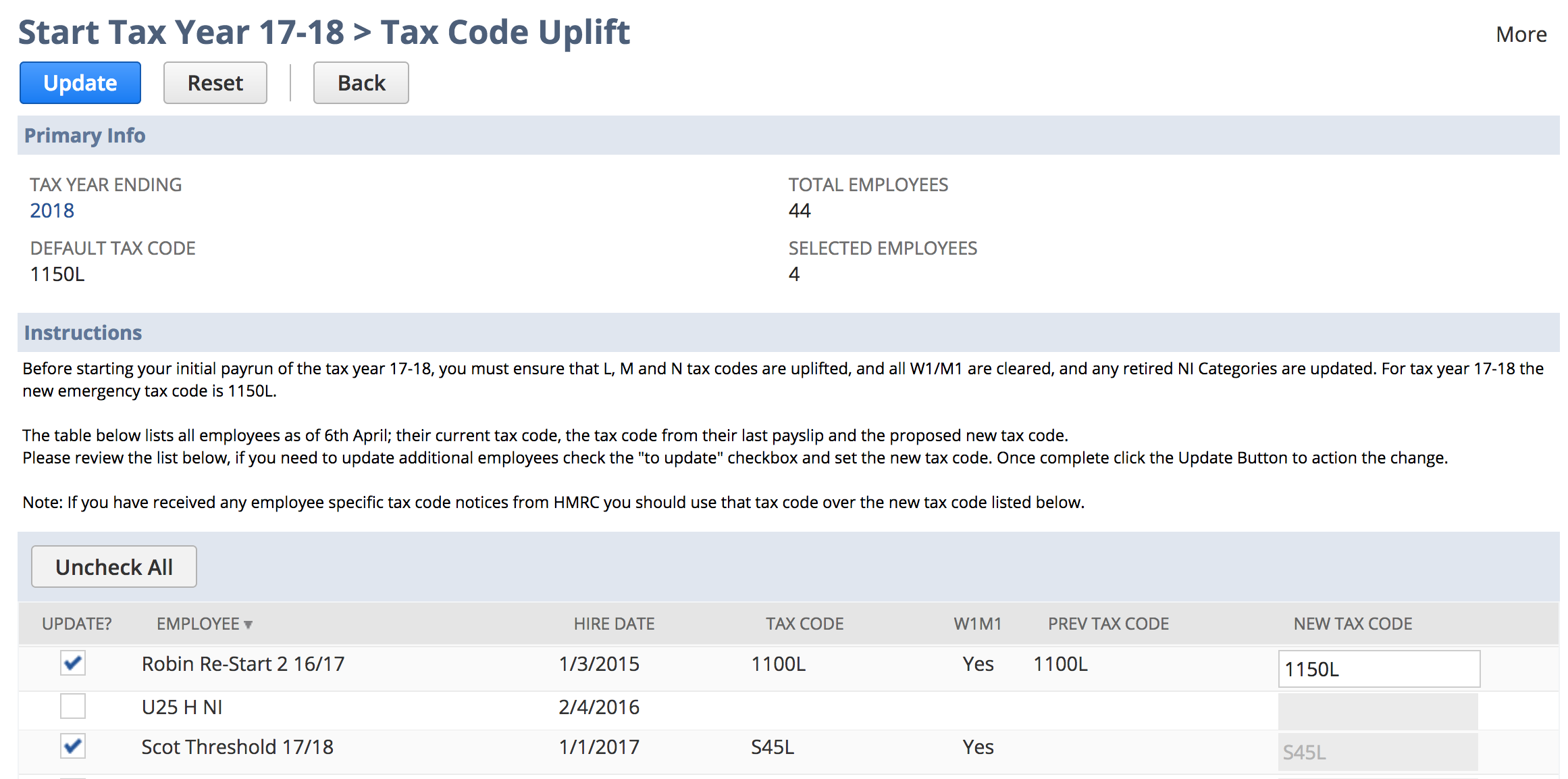

Tax Code Uplift

Tax codes that contain a personal allowance may be uplifted at the start of the new tax year to reflect changes in the new tax year personal allowance. For the 21/22 Tax year the standard personal allowances has increased by 7 points to 1257L, this means an employee on 1250L last year should be "uplifted" to 1257L, an employee on 900L would become 907L.

If you receive a P9 Notification from the HMRC this overrides any uplift change.

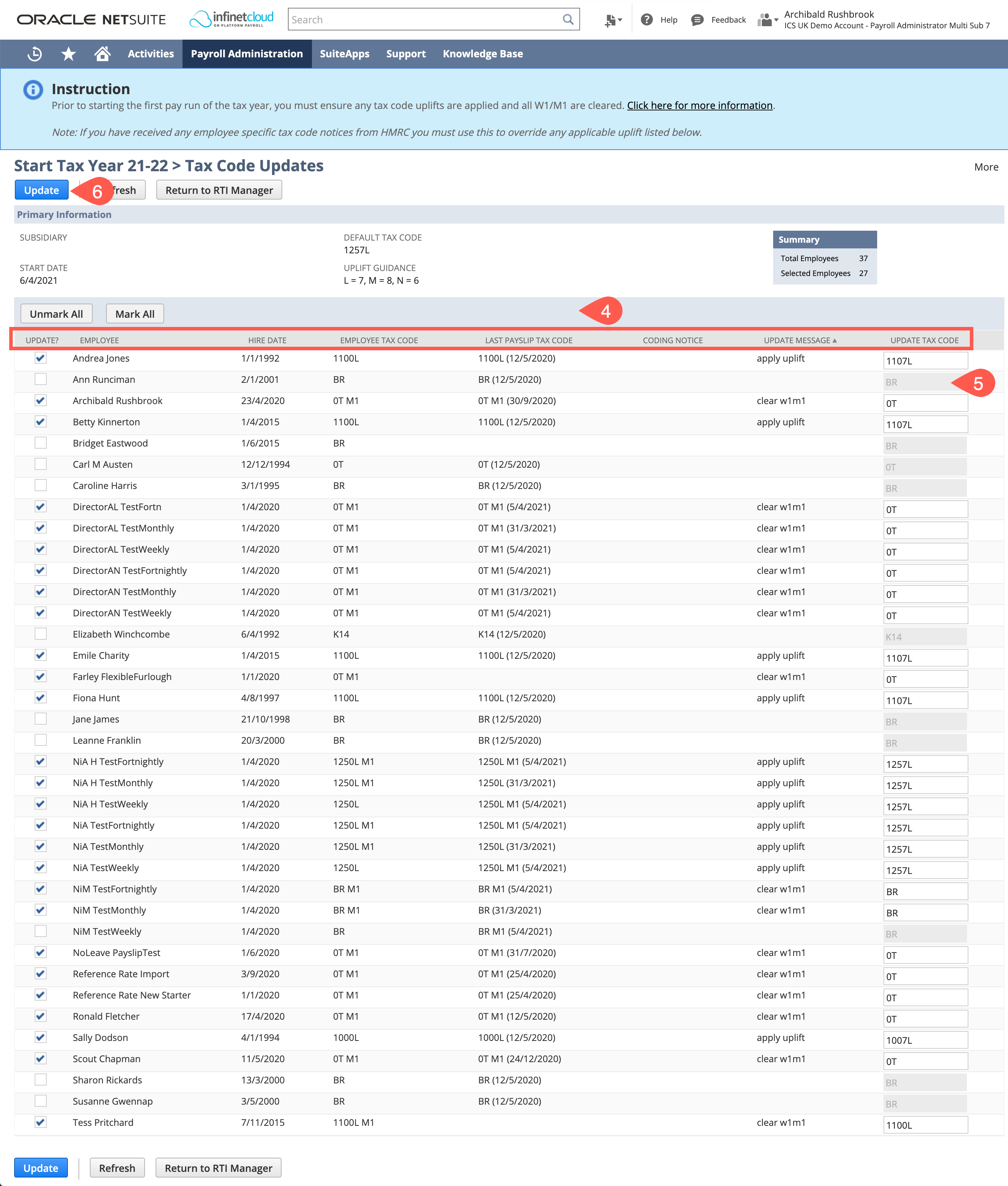

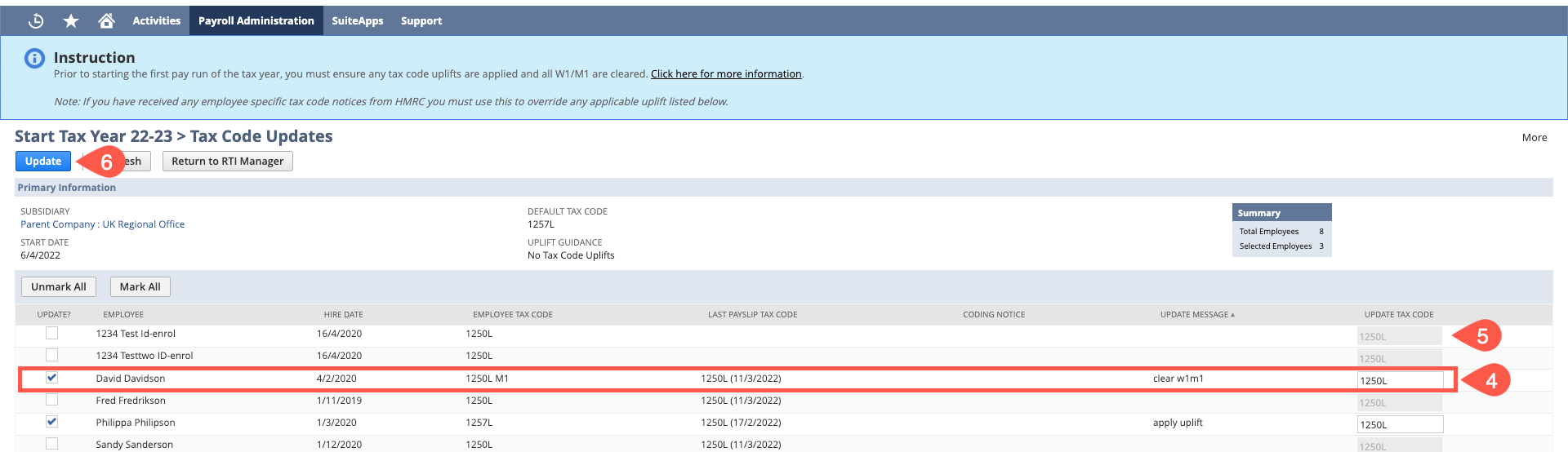

To simplify the uplift process ICS provides a user interface to allow employees to be updated in bulk. The tool displays a list of employees, auto selecting those eligible for uplift.

| Warning |

|---|

If you have configured HMRC DPS, any P9 Notifications for employees will now be picked up by the Tax Code Uplift Tool, . Once you have run this process you will need to check these after running this process to ensure all have been picked up correctly. If you have not got the HMRC DPS configured please follow these instructions to do this prior to running this process. |

The uplift logic works by comparing the tax code from the last payslip (linked on the employee) from the prior tax year, and the tax code on the employee record. The uplift will automatically check the employee for update if:

- W1/M1 is set - it will be cleared for the new tax year

- If the tax code from the prior payslip is eligible for uplift and applying uplift to the tax code is different to the employee record tax code

- If there is a P9 Notification received in the DPS for the employee

Running Tax Code Uplift Tool

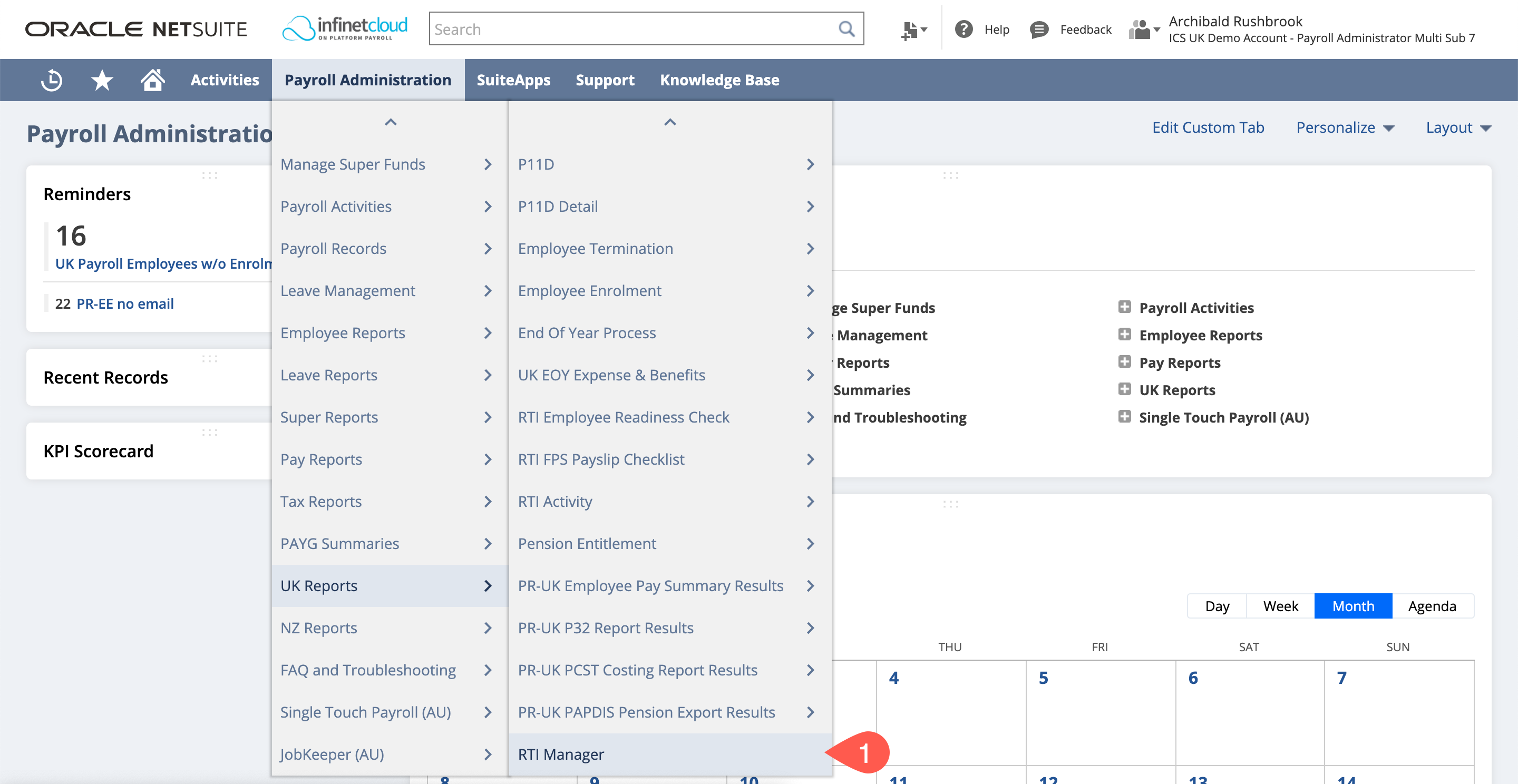

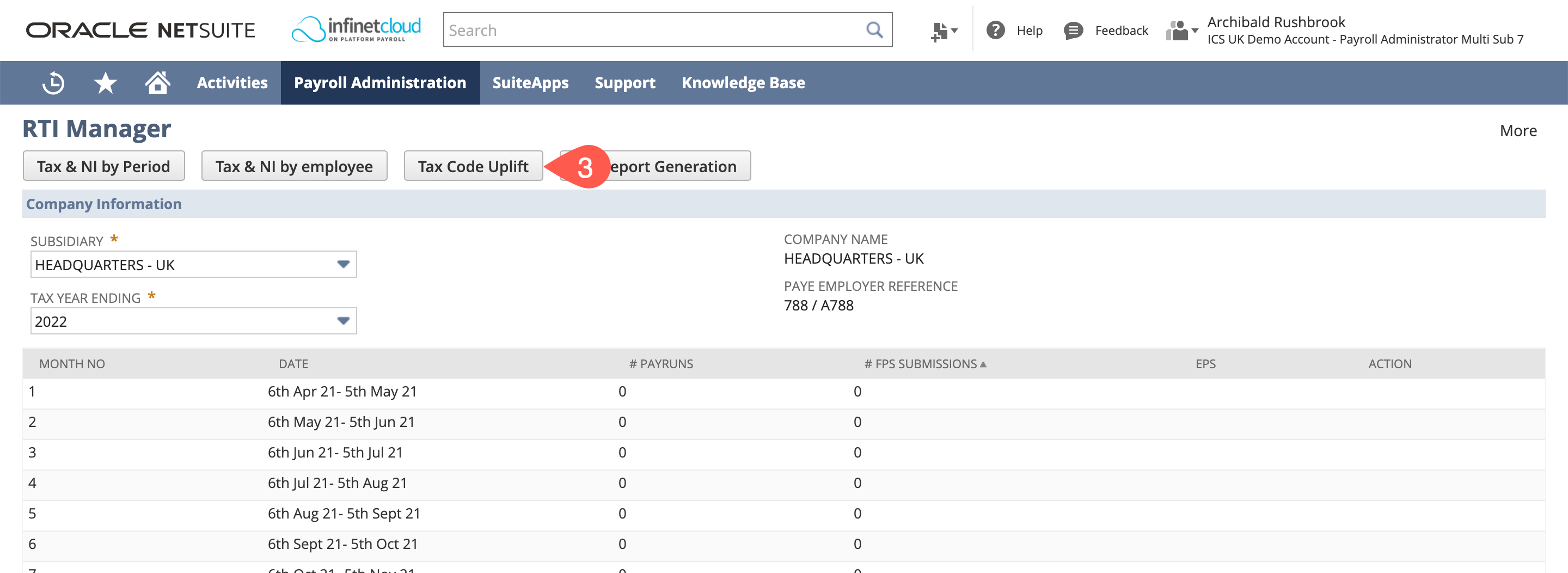

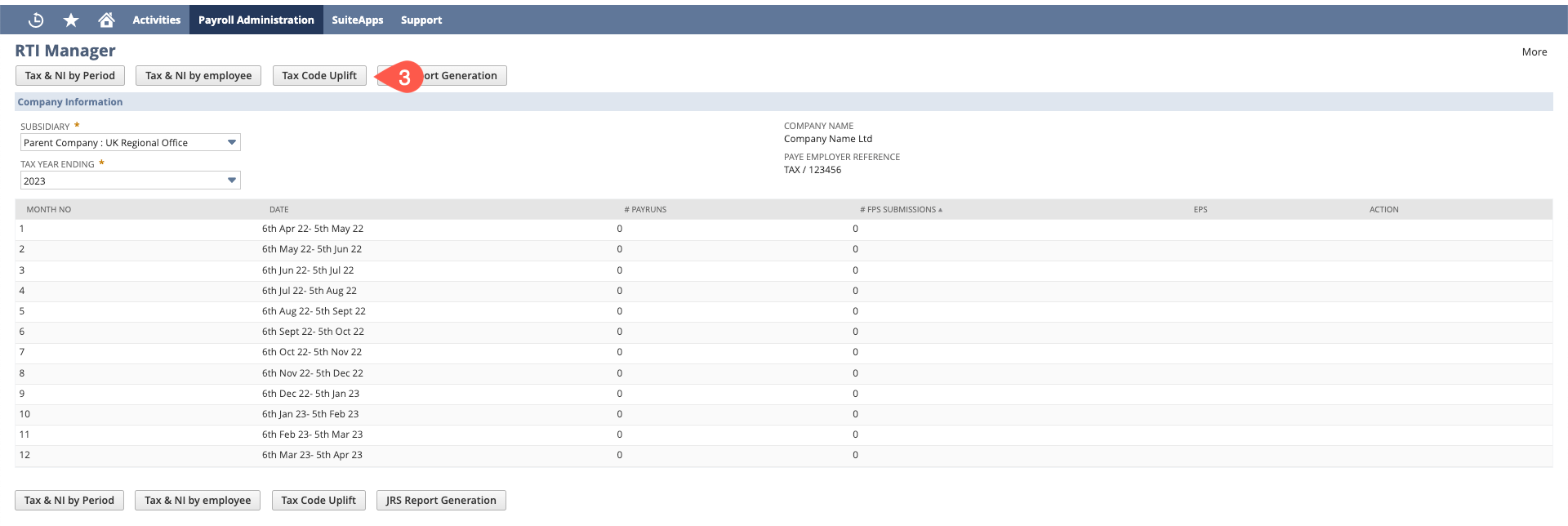

- Navigate to Payroll Administration > UK Reports > RTI Manager

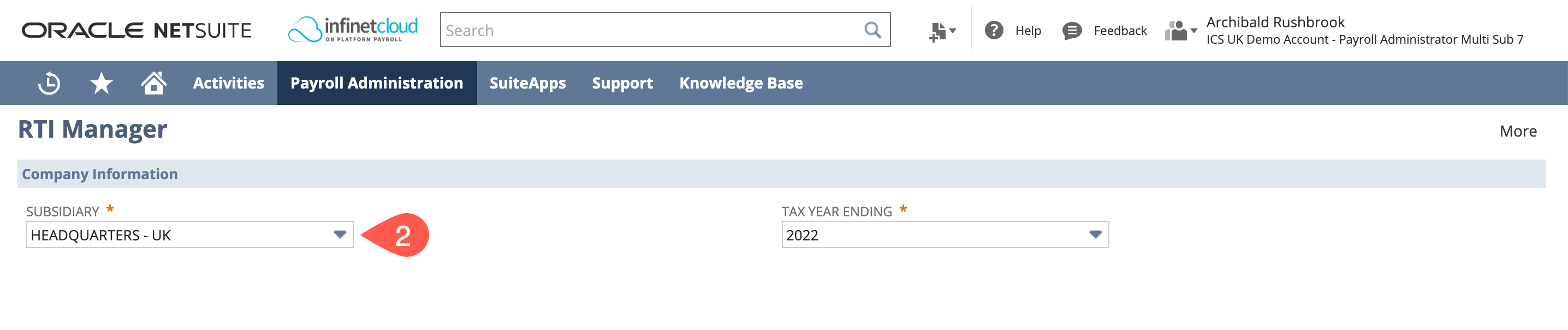

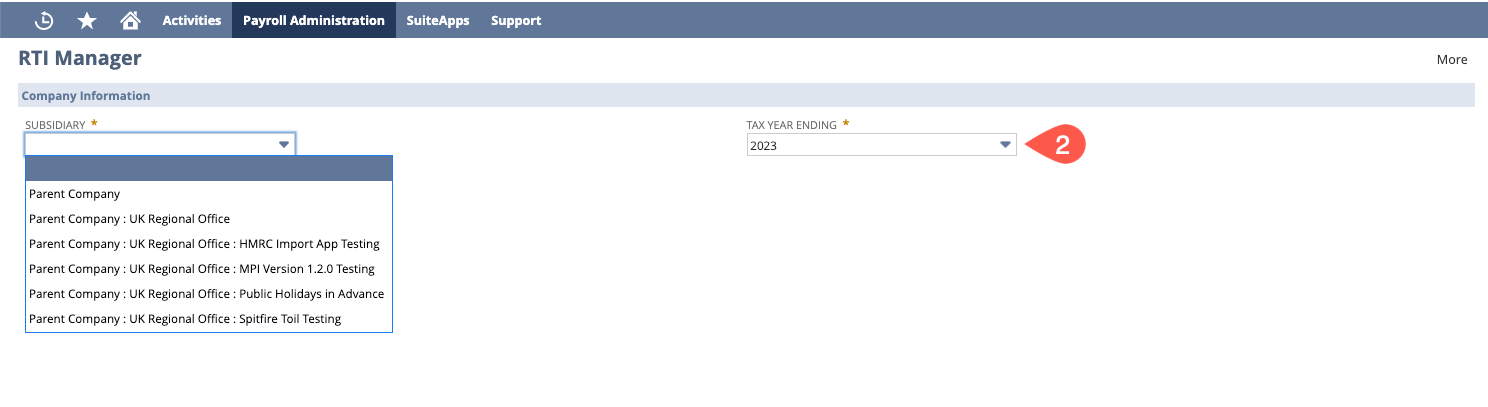

- Select the Subsidiary you need to run the uplift on and the tax year ending in question.

- Click "Tax Code Uplift"

- On the uplift page you will see that the system will automatically assign whether or not someone needs an uplift or a W1/M1 flag removed and only tick those to be uplifted. The page will show you their current tax code, the last tax code used, if there is a coding notice that overrides uplift, the message (the action that is occurring) and what the tax code will be.

You can override this if you believe necessary by

tickingentering a tick in the checkbox for "Update?" next to the employee and entering a tax code into the "Update Tax Code" field.

- Click "Update"

| Warning | ||

|---|---|---|

| ||

You should run a secondary check in the DPS to ensure that the most recent P9 notification was the one that was picked up - this will only effect employees who have had multiple P9 notifications. To do this you will need to navigate to Payroll Administration > United Kingdom > HMRC DPS Notifications |