...

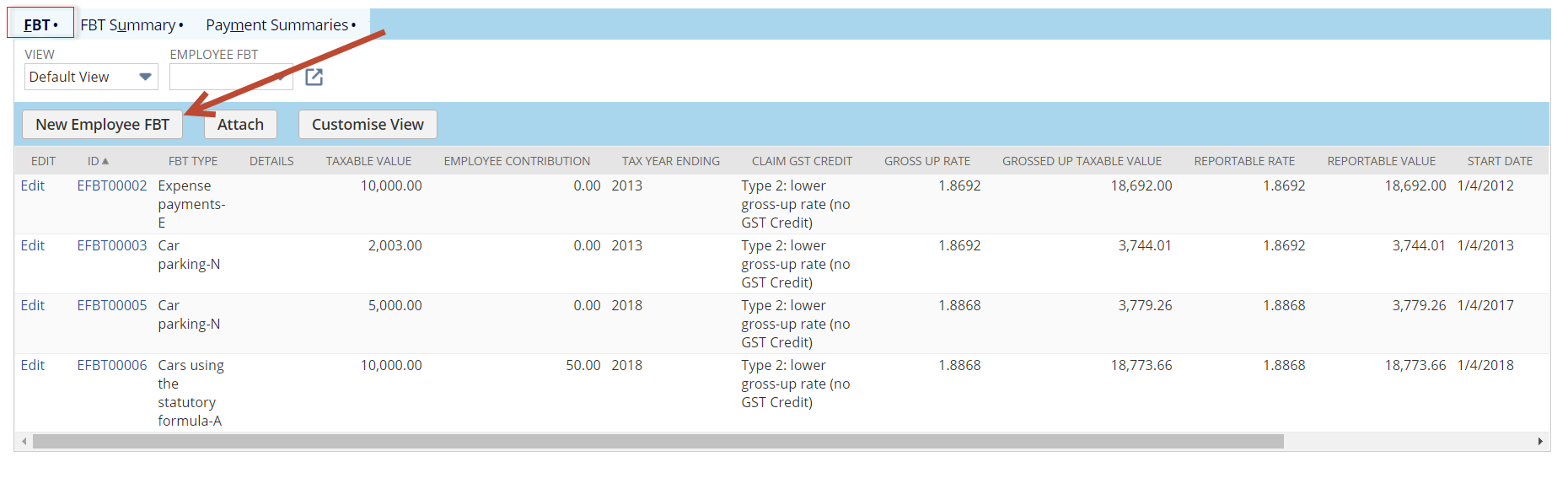

- While in view mode navigate to Employee record > Tax info tab > FBT sub list

2.

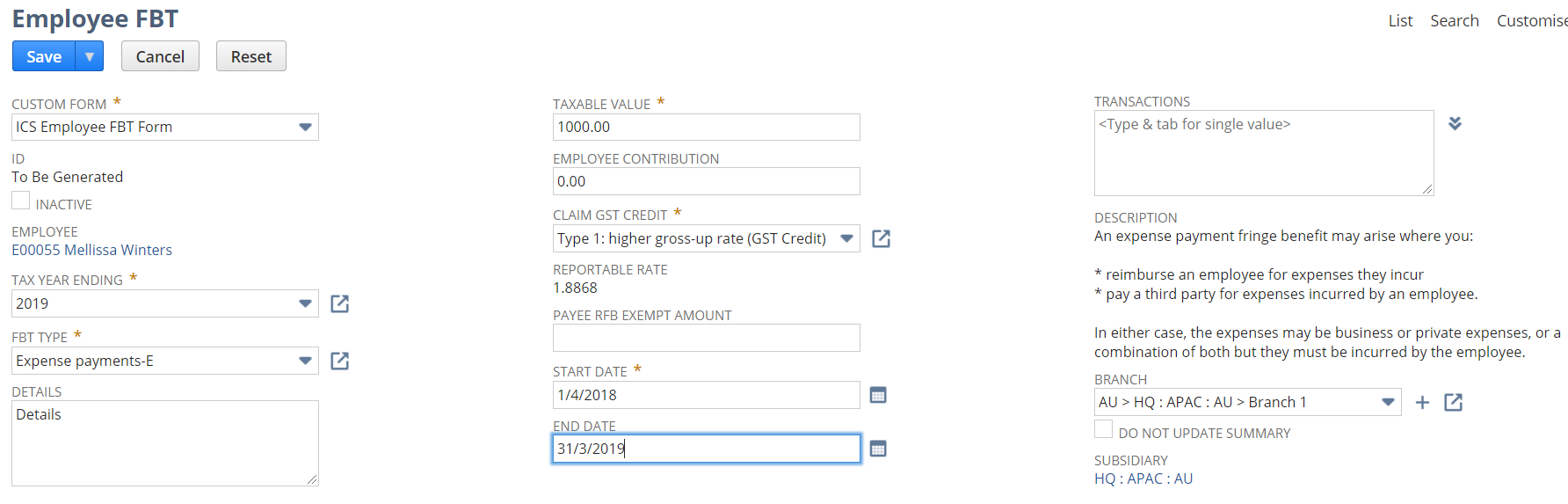

2. Click on New Employee FBT and populate the fields:

- Tax Year Ending - Select the

...

- relevant Tax Year Ending

- FBT Type -

...

- Select the appropriate FBT Type

- Details - enter

...

- any details for your reference

- Taxable Value - enter

...

- the taxable value

- Claim GST Credit - select the Type for gross up.

- Employee Conrtribution -

...

- Any contribution by the employee to reduce the reportable value.

- Payee RFB Exempt Amount -

...

- Any amount that is Exempt

- Start Date -

...

- The start date of the FBT instance. Ensure this matches the Tax year Ending

- End Date -

...

...

- The end date of the FBT instance. Ensure this matches the Tax year Ending

3. Click on Save . The FBT Instance with create an FBT Summary for reporting. You can see this on the Employee>Tax Info tab.

Option 2.

To add an Employee FBT Summary record.

...

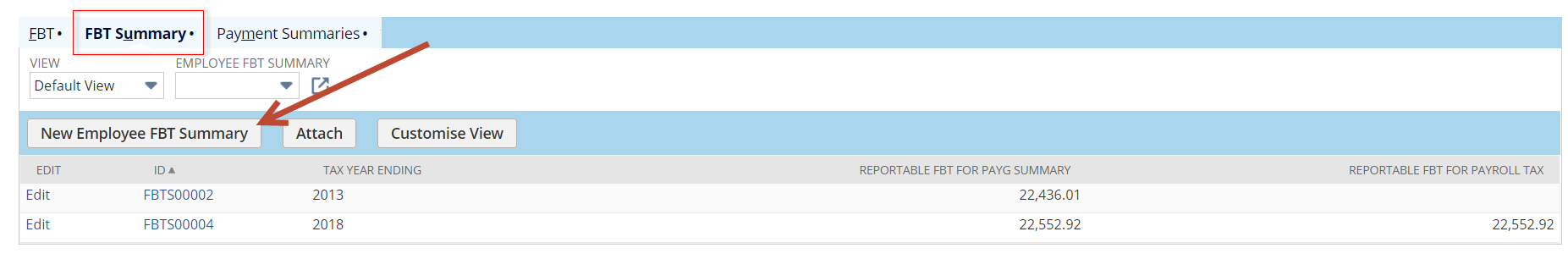

- While in view mode navigate to Employee record > Leave Tax info tab > Leave History Record FBT Summary sub list

2. Click on New

...

Employee FBT Summary and populate the fields:

...

- Tax Year Ending -

...

- Select the relevant Tax Year Ending

- Reportable FBT for PAYG Summary - Enter the reportable value for STP/PAYG Summary

- Reportable FBT for Payroll Tax - Enter the reportable value for PRT

3. Click on Save . The FBT Summary will be created for reporting. You can see this on the Employee>Tax Info tab.