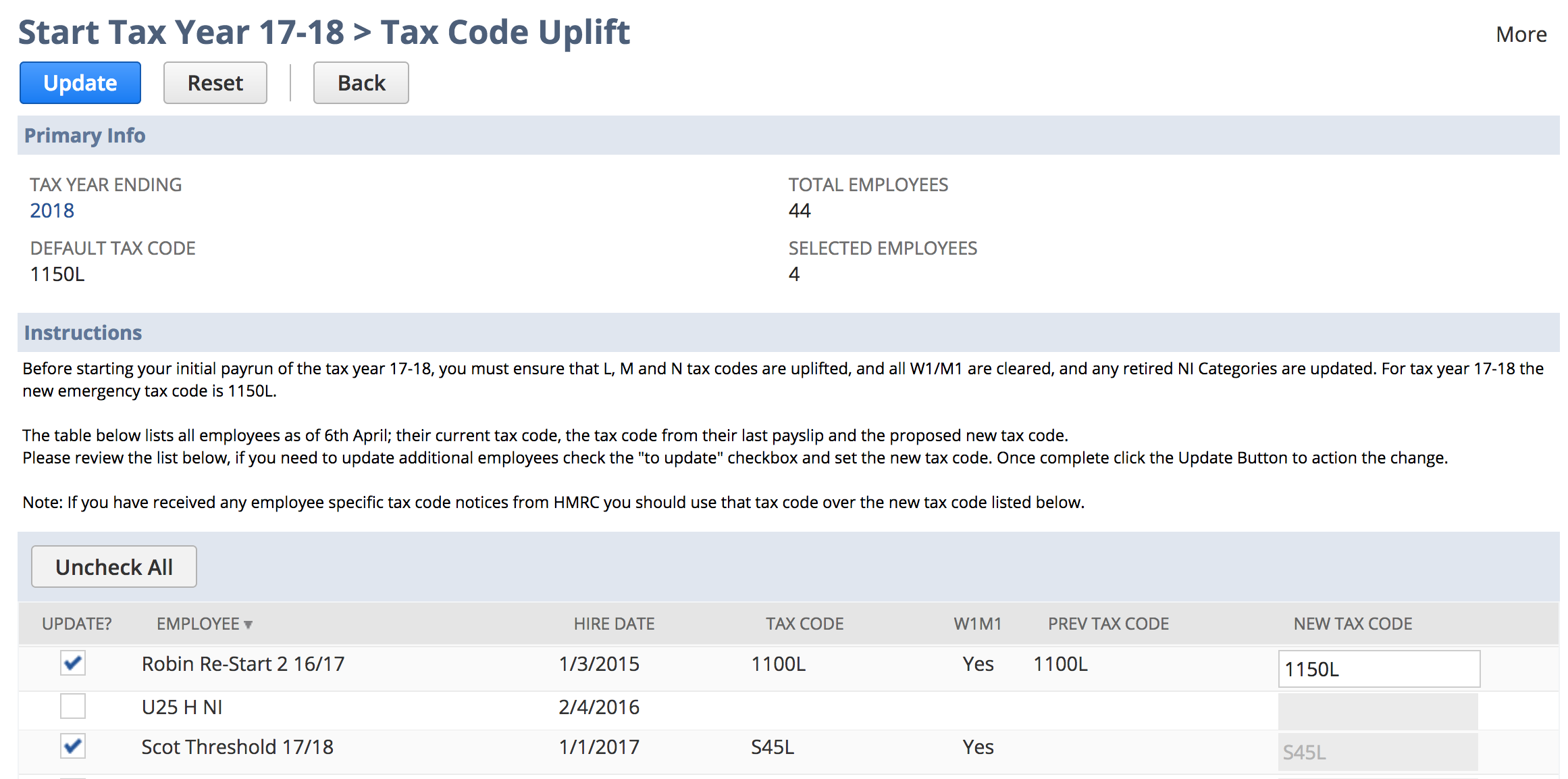

Tax Code Uplift

Tax codes that contain a personal allowance may be uplifted at the start of the new tax year to reflect changes in the new tax year personal allowance. For the 1721/18 22 Tax year the standard personal allowances has increased by 50 7 points to 1150L1257L, this means an employee on 1100L 1250L last year should be "uplifted" to 1150L1257L, an employee on 900L would become 950L907L.

| Info | ||

|---|---|---|

| ||

If you receive a P9 Notification from the HMRC this overrides any uplift change. |

Tax Code Uplift Tool

To simplify the uplift process ICS provides a user interface to allow employees to be updated in bulk. The tool displays a list of employees, auto selecting those eligible for uplift. For P9 Notifications employees can be manually selected and the new tax code set. Alternatively you will receive P9s through the HMRC DPS if you have this set up, you can apply these after running this process.

The uplift logic works by comparing the tax code from the last payslip (linked on the employee) from the prior tax year, and the tax code on the employee record. The uplift will automatically check the employee for update if:

- W1/M1 is set - it will be cleared for the new tax year

- If the tax code from the prior payslip is eligible for uplift and applying uplift to the tax code is different to the employee record tax code

Running Tax Code Uplift Tool

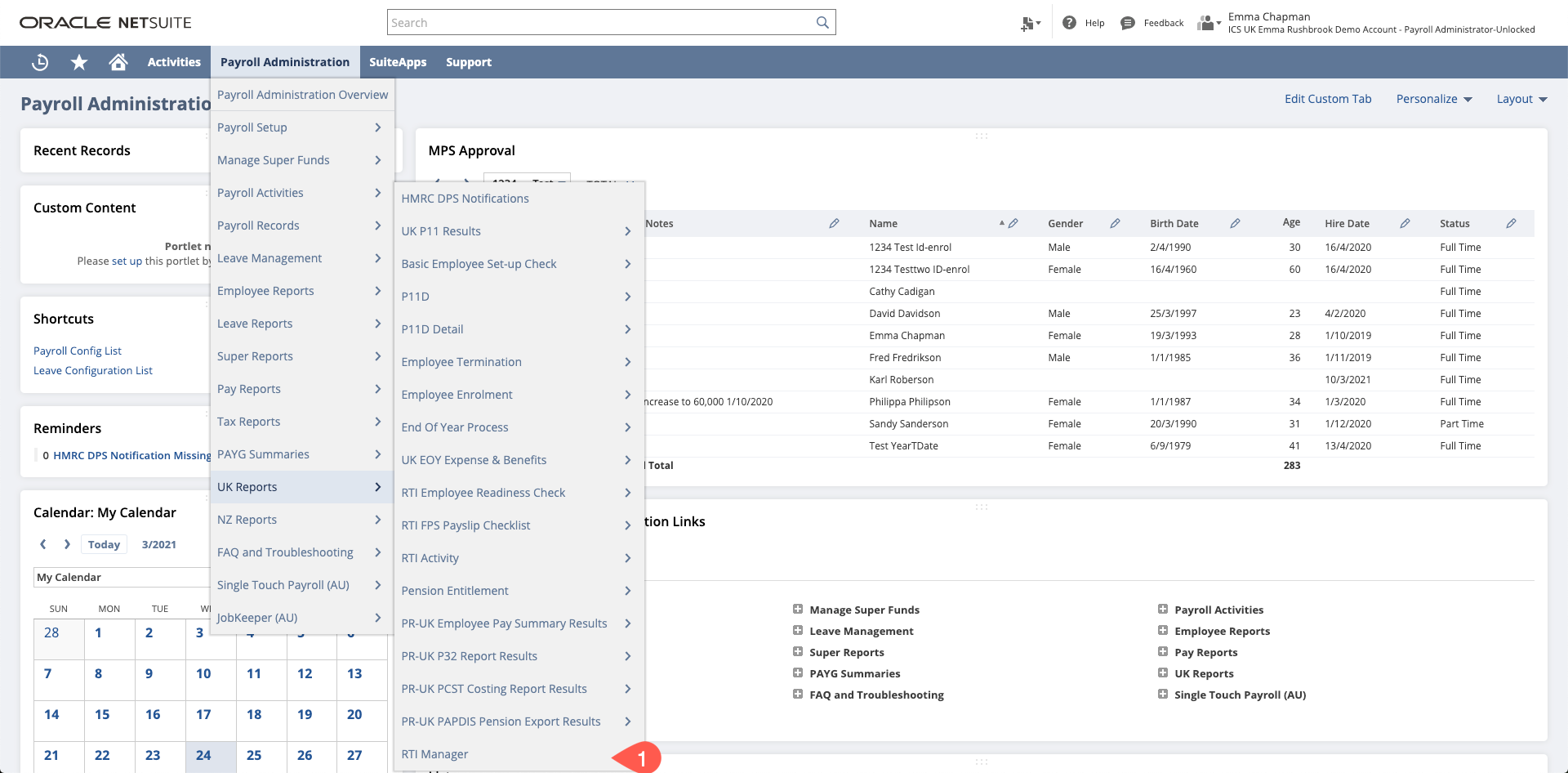

- Navigate to Payroll Administration > UK Reports > RTI Manager

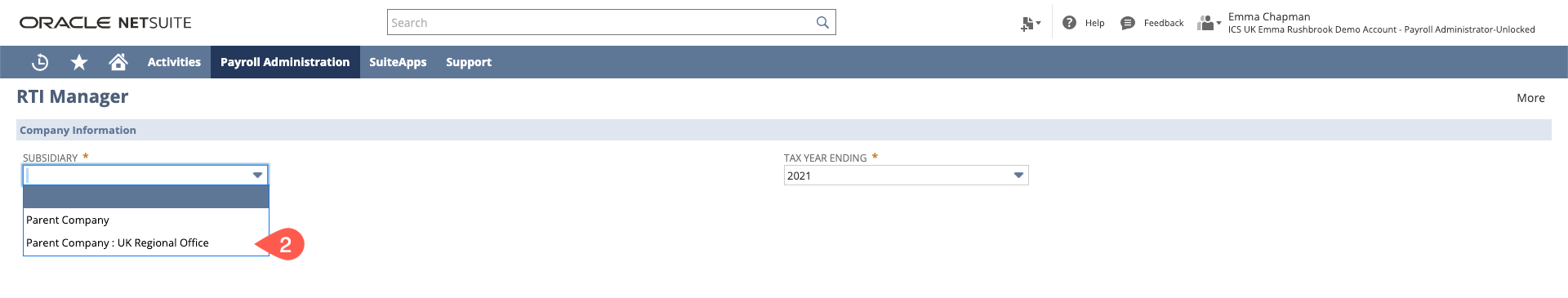

- Select the Subsidiary you need to run the uplift on.

- Click "Tax Code Uplift"