Employer Deductions form

The IR345 is used to record and pay the deductions made from employees pay. This form should correspond to a payment made to Inland Revenue (either directly, electronically or via a Westpac Branch).

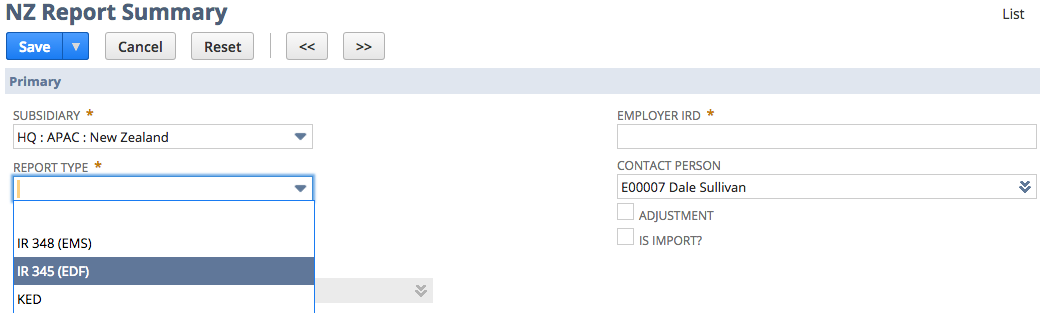

From the menu, navigate to Payroll Administration > NZ Reports > IRD Reports > New

- Select the correct Subsidiary, then select Report Type of IR 345 (EDF). The page will refresh once the report type is selected so selecting the subsidiary first ensures the data returned is filtered properly.

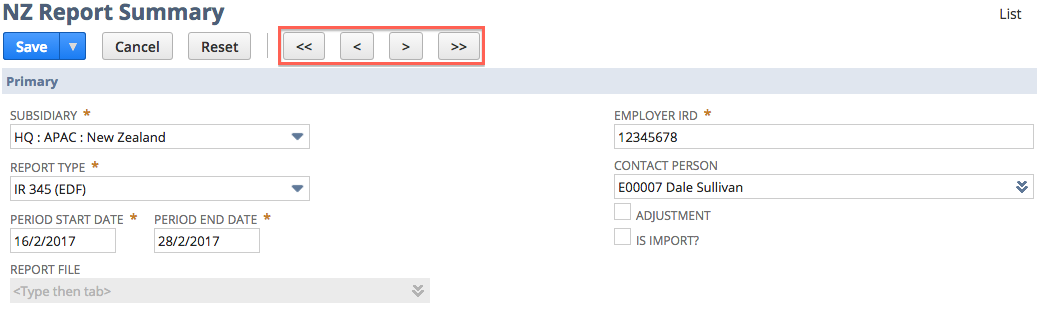

- There is no preview for IR345, dates are defaulted for Reporting Period Start Date and Period End Date. For larger employees the IR345 is submitted twice a month so the dates will default based on 15 days prior to the current period. Dates can be adjusted up and down using the arrow buttons:

- Double arrows move the dates forward or back one month;

- Single arrows move the dates forward or back 15 days.

- To create the IR file click the Save button.

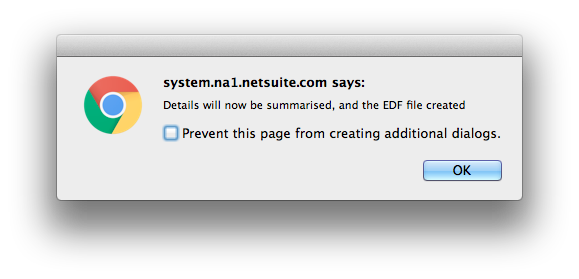

- The following message should appear - click OK.

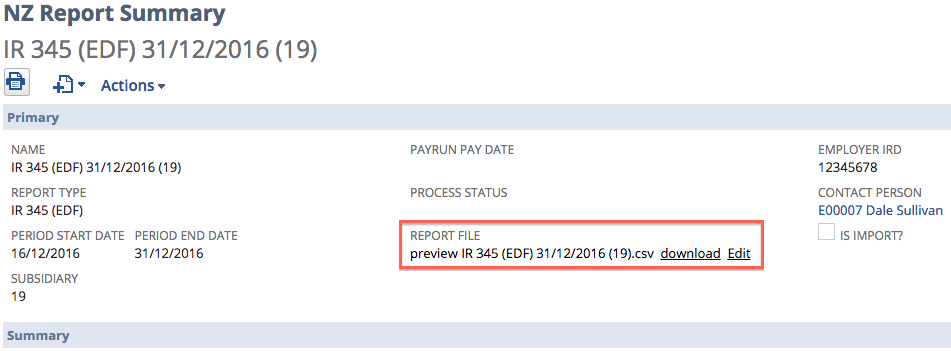

- The file and summary should be generated immediately. Review the IR file and upload via the IRD portal.

- You should see the download and Edit links for the file.

- You should see the download and Edit links for the file.