Document Overview

This document outlines the functionality of the TFN declaration module used for Australian New Starters. The module provides functionality to record TFN declaration data as entered on TFN declaration forms, and provides a means to group declarations into a submission, generating an ECI file suitable for upload into the ATO portal. The module comprises of two record types:

- TFN Declaration

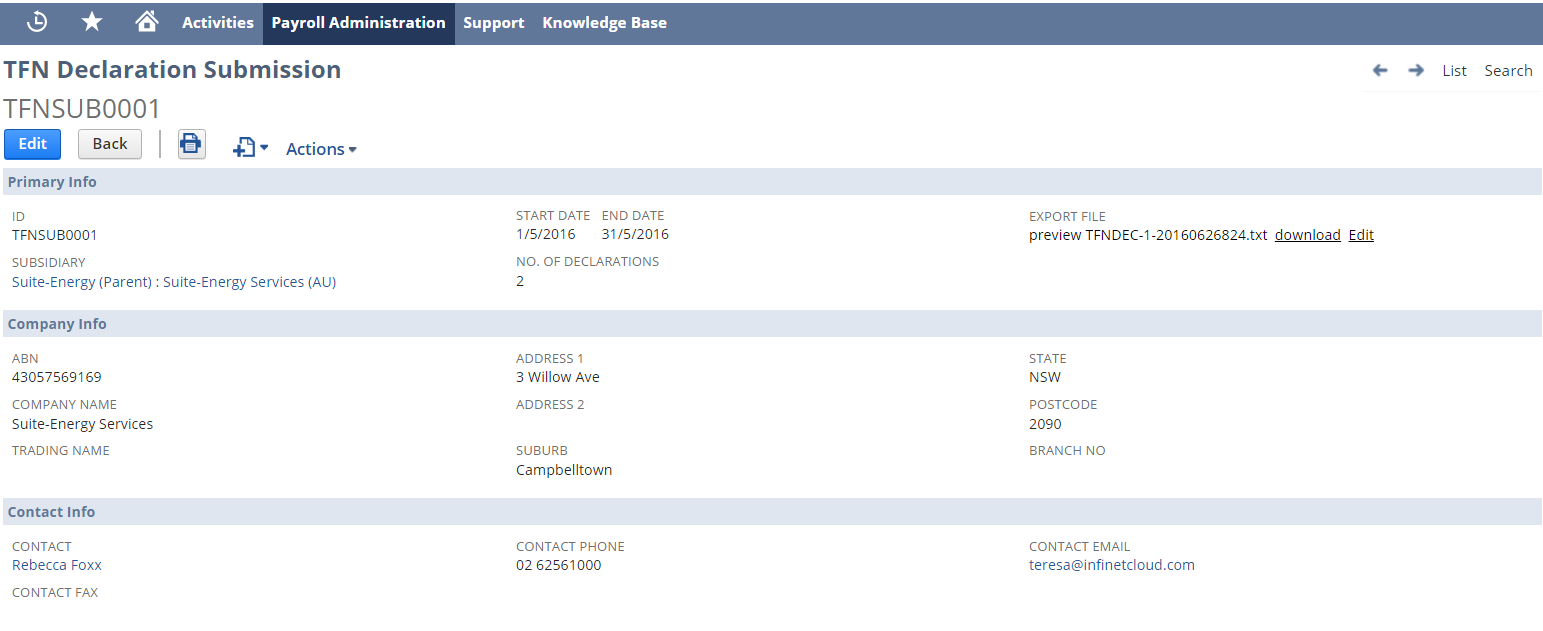

- TFN Declaration Submission

Completing Employee TFN Declarations

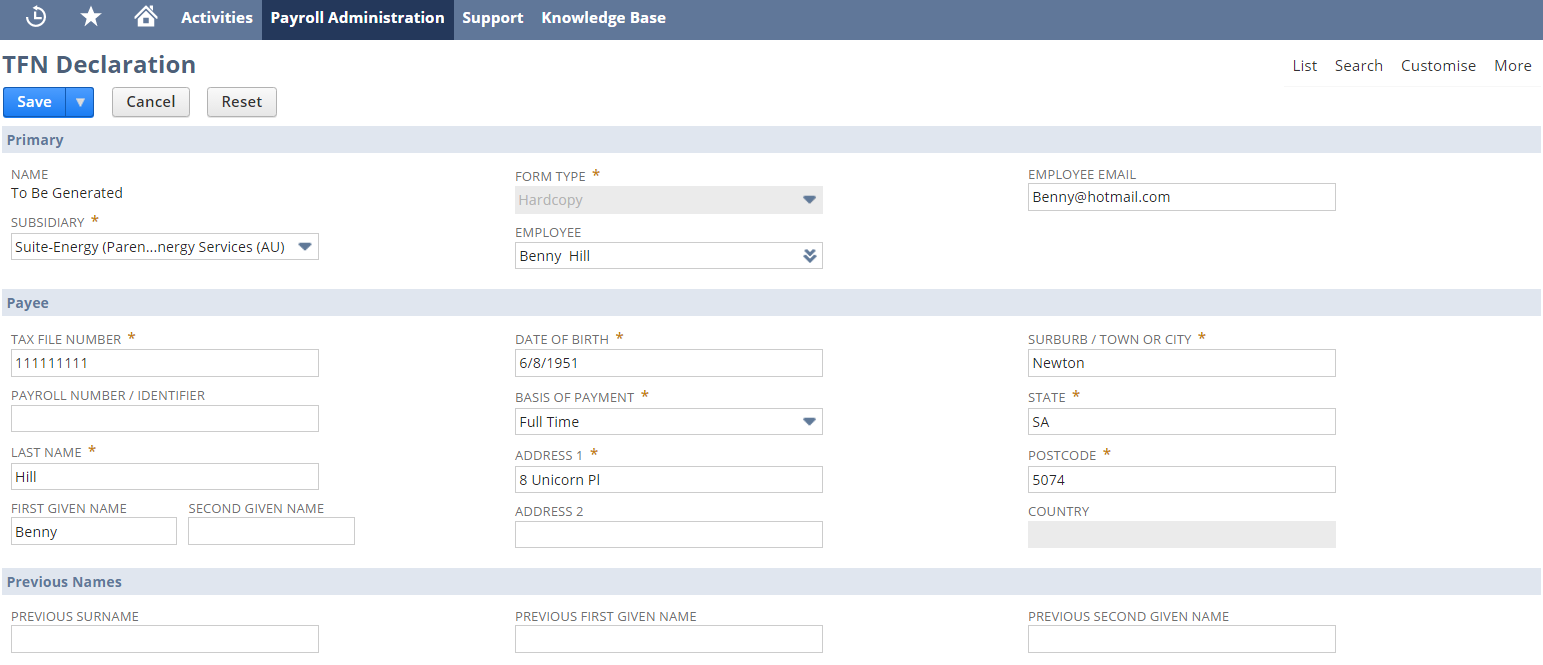

The TFN declaration record contains all of the details recorded on the hard copy TFN Declaration Form. The record allows for a TFN declaration for an existing employee record, or for the data to be collected prior to the creation of a NetSuite Employee record.

Creating a TFN Declaration record

If you are transcribing a TFN Declaration form received from an employee follow these steps:

- Payroll Administration Tab > Tax Reports > TFN Declaration.

- Click on New TFN Declaration button.

- In the Primary Section select a Subsidiary (One World Only) this is used to group submissions.

- If a NetSuite employee already exists select the Employee in the drop down, a message box will appear to auto populate fields from the employee record, click OK.

Populate the remaining fields from the TFN declaration form ensuring that the fields marked mandatory are complete. Note: State field must be one of ACT, NSW, NT, QLD, SA, TAS, VIC, WA, if employee address is outside of Australia enter OTH, this will default the Postcode field and the Country becomes mandatory.

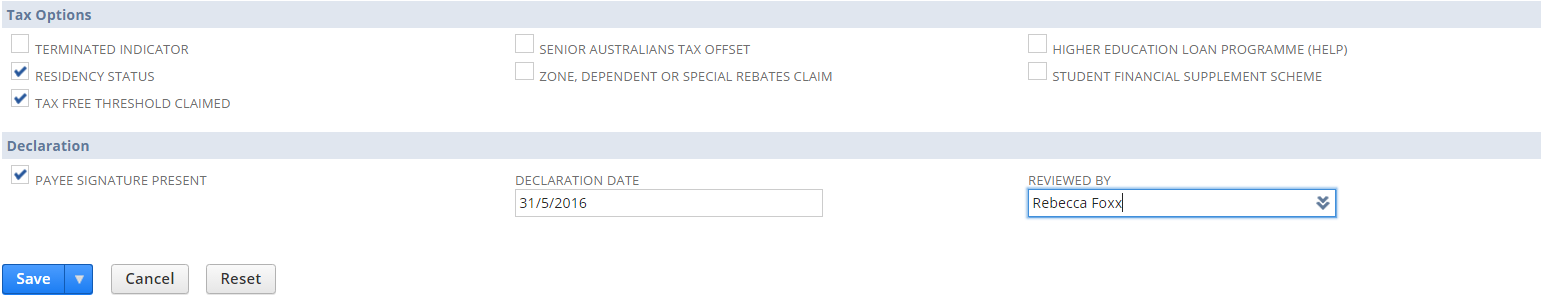

- Complete the Declaration section.

Once complete Save the record which will mark the TFN declaration ready to be included on a submission. Repeat this process for all other employee declarations.

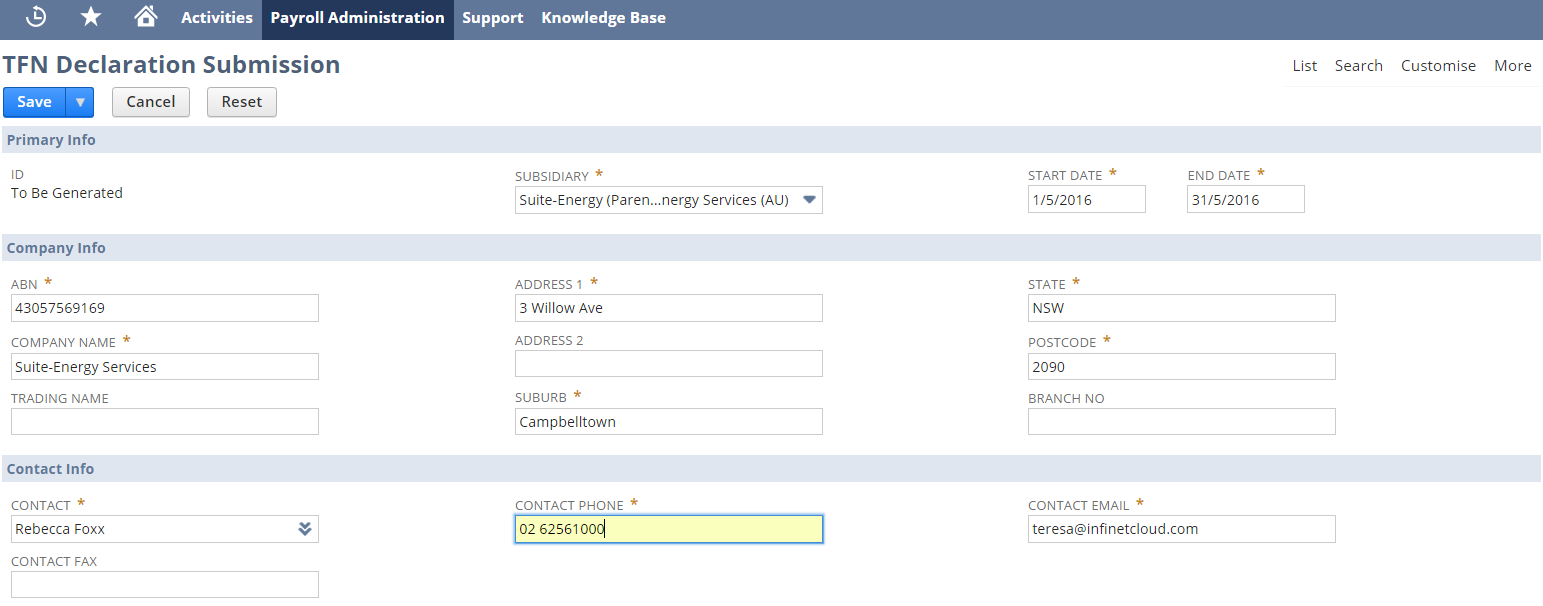

Submitting Employee TFN Declarations

To prepare one or more declarations for submission you can either:

- View a pending TFN declaration and click the Submit button, OR create a new TFN submission via Payroll Administration Tab > Tax Reports > TFN Declaration Submission > New.

In the Primary Info section select the Subsidiary. Note: If One World, the subsidiary field will default if submitted from the TFN declaration.

- Enter the Start and End Date for the submission.

- Company Info (ABN and Company name will populate from payroll configuration).

- State (must be one of ACT, NSW, NT, QLD, SA, TAS, VIC, WA).

- Branch No - should be left empty or set to a number.

- Contact Info (will default from the current user), ensure that the fields marked mandatory are complete.

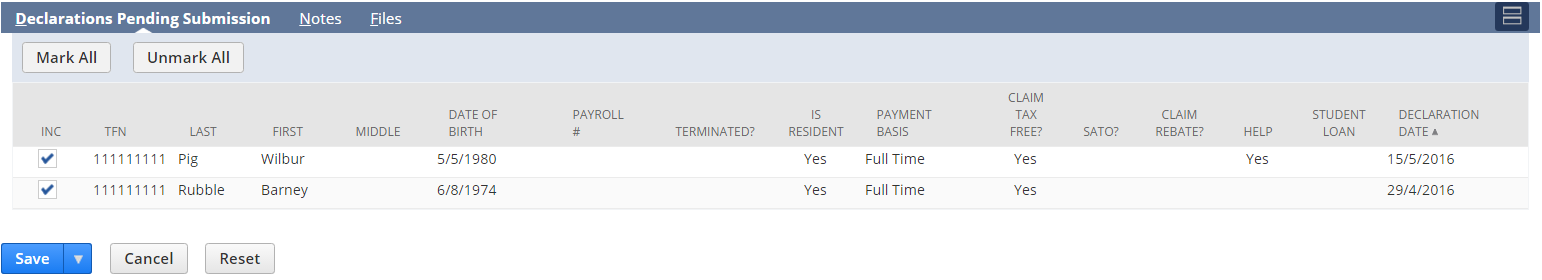

- Select one or more declarations from the Declarations Pending Submission tab, click Save.

On Save of the record a new export file will be generated which can be downloaded, saved and manually uploaded to the ATO.

Uploading To ATO

needs completing haven't done this yet

Troubleshooting Rejected Files