...

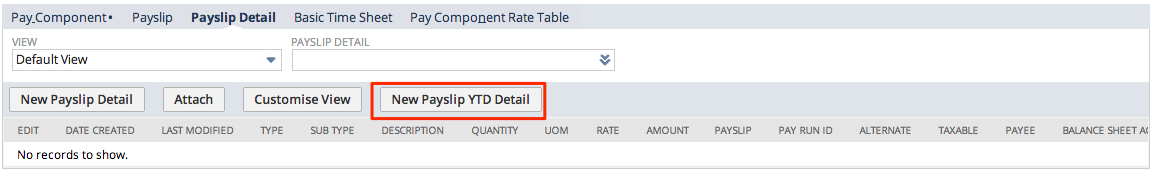

- While in View mode, navigate to the Employee record > Payroll tab > Payslip Detail sub tab

- Click on New Payslip YTD Detail and populate the fields accordingly:

- Type - select the pay component type. E.g. Salary or Wages, Superannuation, Tax etc

- Sub Type - select the pay component sub type. E.g. Base Salary or Normal Time, Employer Super or PAYG

- Description - Defaults from the sub type - NB for Superannuation you should change this to read as Superannuation rather than Employer Super so that your YTD's are grouped on the PDF of payslips

- Amount - enter the amount

- Tax Year Ending - select the correct tax year, e.g. 2019 = July 2018-June 2019

- OTE & OTE Amount - will default if applicable on subtype

- Payee - Will be mandatory for PAYG & Super and will then also prompt you to enter Balance Sheet Account

- Payslip Group - will default from sub type

- YTD import - tick this box if this YTD is part of an import of YTD data and is not connected to a payslip or a Pay Run

- Payment Summary Location - will default from sub type however this should be changed if it is not correct for your purposes

- Reportable Date - select reportable date - NB if you have been reporting via STP in a previous system then this date should be the pay date of the last pay run you ran in your old system

- Tax Rate - leave blank

- Memo - enter a memo if desired

- Start Date - select start date (of last pay run in old system if applicable)

- End Date - select end date (of last pay run in old system if applicable)

- ETP Code - leave blank unless this is an ETP payslip detail

- Type - select the pay component type. E.g. Salary or Wages, Superannuation, Tax etc

...