Sending an Update Pay Event (STP)

How to Initiate and Send

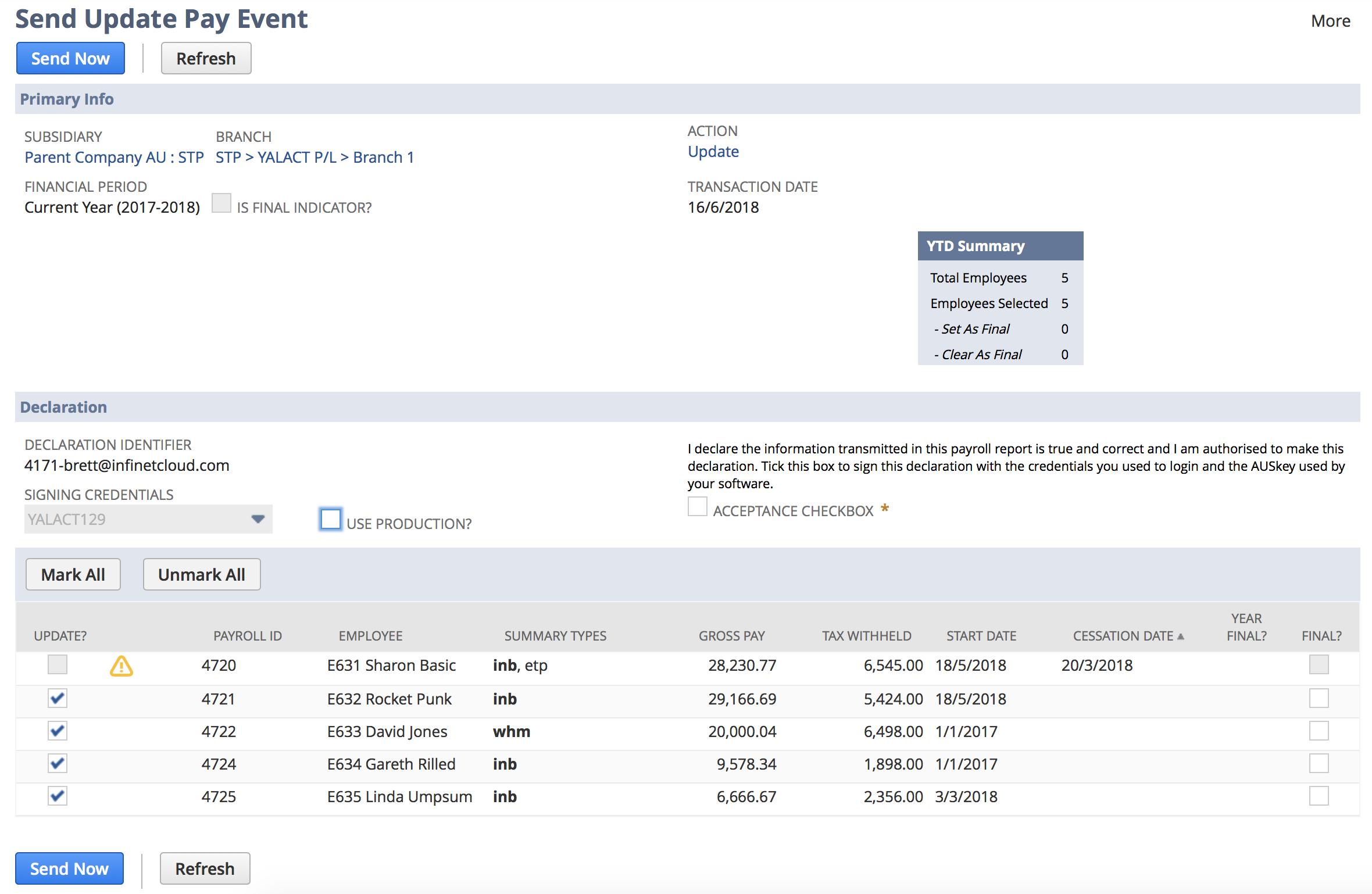

To send an Update Pay Event:

- From the menu, select Payroll Administration > Single Touch Payroll (AU) > Send Update Pay Event

- If you have multiple Branches setup, select a Branch

- The page will refresh with Employees and their YTD data

- Select the Employees you would like to send an Update Pay Event for

- You will not be able to select any employees that are identified as having invalid data. By hovering your mouse over the symbol, a message with what's been identified as invalid will show. You should fix all invalid data identified and then refresh the page.

- If this is the final Pay Event for any Employee, then mark the relevant checkbox in the Final? column

- Once you have reviewed the data presented, read and accept the declaration by marking the Acceptance Checkbox

- Click the Submit Now button to send the Update Pay Event to the ATO.

Submit Now

Clicking the Submit Now button will not actually result in the Update Pay Event being sent to the ATO immediately. The system first needs to calculate the data and create the appropriate records, and then it will schedule its submission. All this will run in the background, allowing you to continue on with other work. You will receive email alerts as this process progresses.