- Make amendments to the system by the data cut off date. For example:

- Salary increases

- Maternity/Paternity leave

- New starters

- Entering One Off Pay Details

- Terminate leavers (setting the termination date, annual leave payout and one off pay details)

- HMRC Updates (DPS Actions) - Tax/Student loan updates

- Ensure that when you make an amendment you also use the “Payroll Notes”

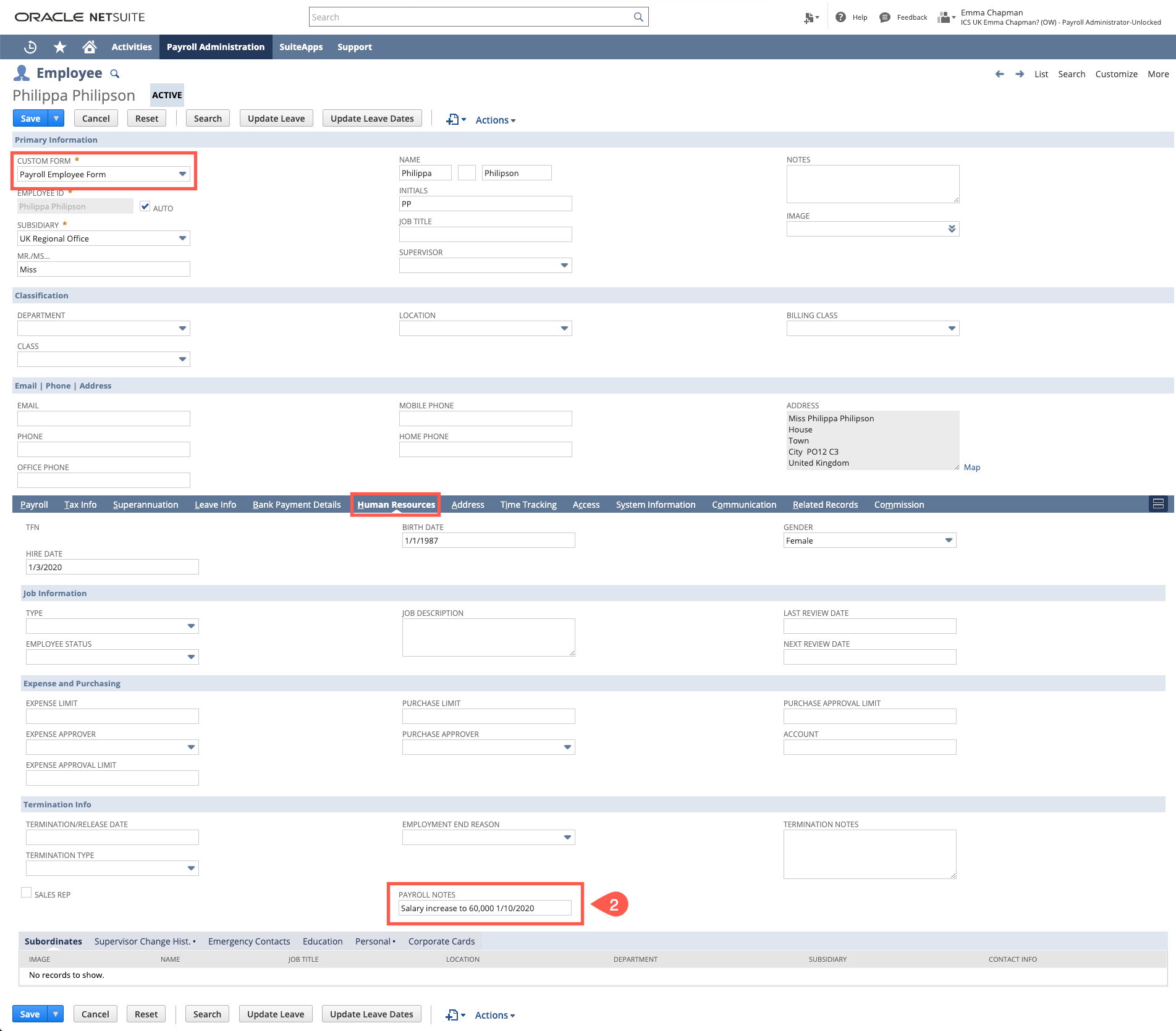

If you are using SuitePeople this needs to be on the employee’s record - to do this, open the employee record in edit mode, ensure you are using the "Payroll Employee Form" navigate to the HR/Human Rescources tab and enter notes in the "Payroll Notes" field

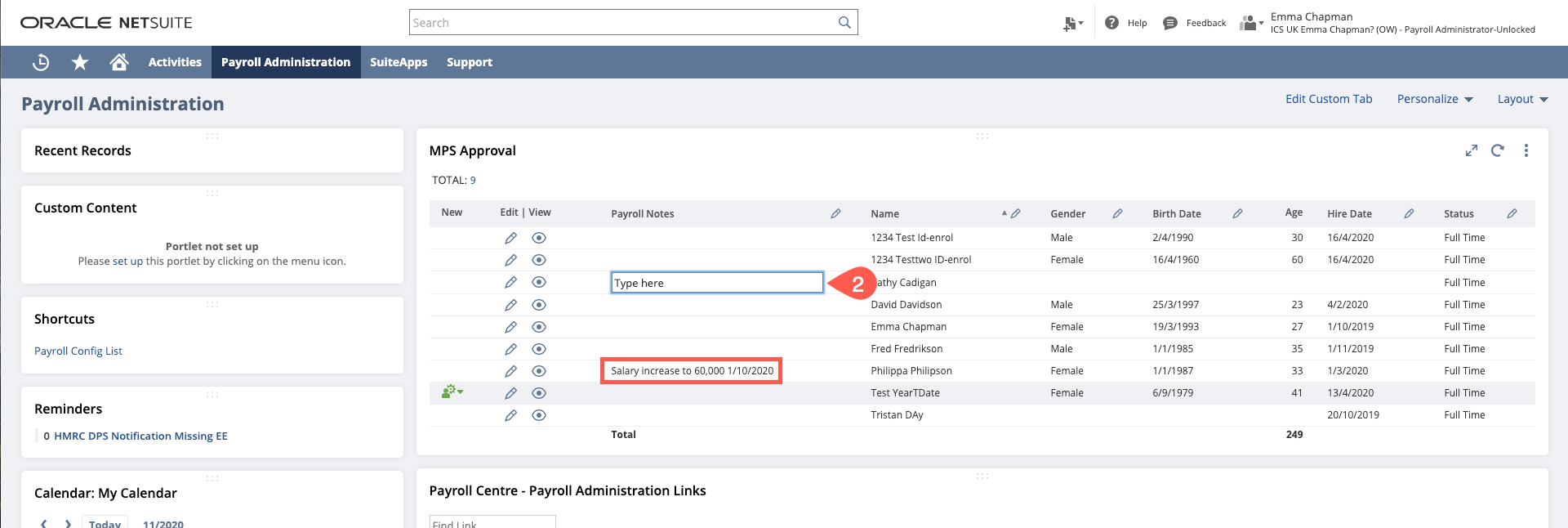

These notes will then show on your dashboard - if you are not using SuitePeople you are able to enter the notes directly onto the Payroll Notes section of the search on your dashboard. - Once you have completed this - email ICS to say all amendments have been made.

Please use the Subject of [Company Name MPS] YYYYMM - M(Period No.) Payroll - Pay Date (Date) e.g. [ICS MPS] 202010 - M7 Payroll - Pay Date 27th October 2020 - Once you have confirmed that you have completed your amendments, or on the data cut off day ICS will send an email to state that they are initiating the pay run processing - at this point you cannot make any further amendments.

ICS will:- Check new starters are properly set up

- Check previous payroll's leavers are excluded

- Check all leave for the month is set to "Approved"

- Run additional logic

- If there are no queries to be resolved, ICS will then initiate the Payrun, during this process we will:

- Check and reconcile the “Payroll Notes”

- Review the One-Off Details

- Process the payslips adding “Approval Notes”

- ICS will send an email with the payrun link at the "Approve Payslips" stage for your approval

- You will then approve this payrun and the system will create the EFT for you to upload to the bank and email ICS confirming the payrun is approved

- You will email the payslips out to the employees

- ICS initiate and review the FPS, we will submit a test FPS to check that there are no issues with submission and then email a link to approve and submit the live FPS submission

- You will submit this to the HMRC and poll for a successful submission

- ICS initiate and review the EPS, if an EPS submission is required ICS will submit a test EPS to check that there are no issues with submission and then email a link to approve and submit the live EPS submission

- You will submit this to the HMRC and poll for a successful submission

- You will then be able to download the Pensions export and upload to your pension provider

- ICS will email you the link to the "PR-UK P32 Report" for you to reconcile with the values in the HMRC gateway. Follow these instructions if you believe there are any discrepancies between the P32 Report and the figures in HMRC Gateway.

- Remove any “Payroll Notes” from the employee's record that are not required for the following month

Page Comparison

Manage space

Manage content

Integrations